Published on January 10th, 2023 by Josh Arnold

Industries such as apparel retail tend to be somewhat challenging for dividend growth candidates, given the inherent cyclicality in the industry. There are examples of great dividend stocks in footwear and apparel, but more often than not, companies in consumer-facing sectors tend to struggle when it comes to recessions. Earnings decline, and dividend cuts are often the result.

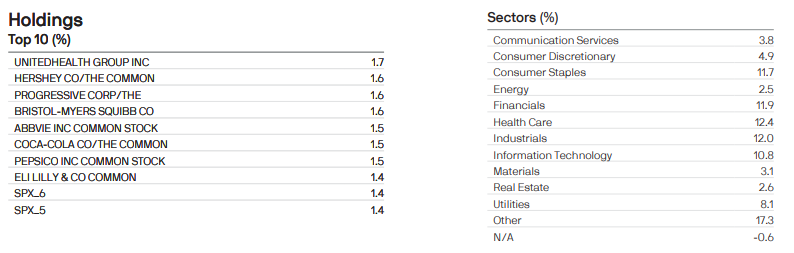

However, that doesn’t mean dividend investors need to ignore the sector altogether. Indeed, there are some terrific dividends to be had in apparel, so long as dividend growth is not a priority. One such stock is Kohl’s Corporation (KSS), which had a respectable dividend increase streak until COVID struck, and it slashed its payout. Still, the company’s $2 annualized dividend is worth a current yield of 7.6%, a staggering number compared to other apparel and retail names, and especially the S&P 500. That 7.6% yield is good enough for Kohl’s to land a spot on our list of high-yield stocks.

This list contains about 200 stocks with yields of at least 5%, meaning that, like Kohl’s, they all have yields vastly superior to that of the broader market.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we’ll take a look at Kohl’s prospects as a potential investment today, including some of the significant risks it is facing.

Business Overview

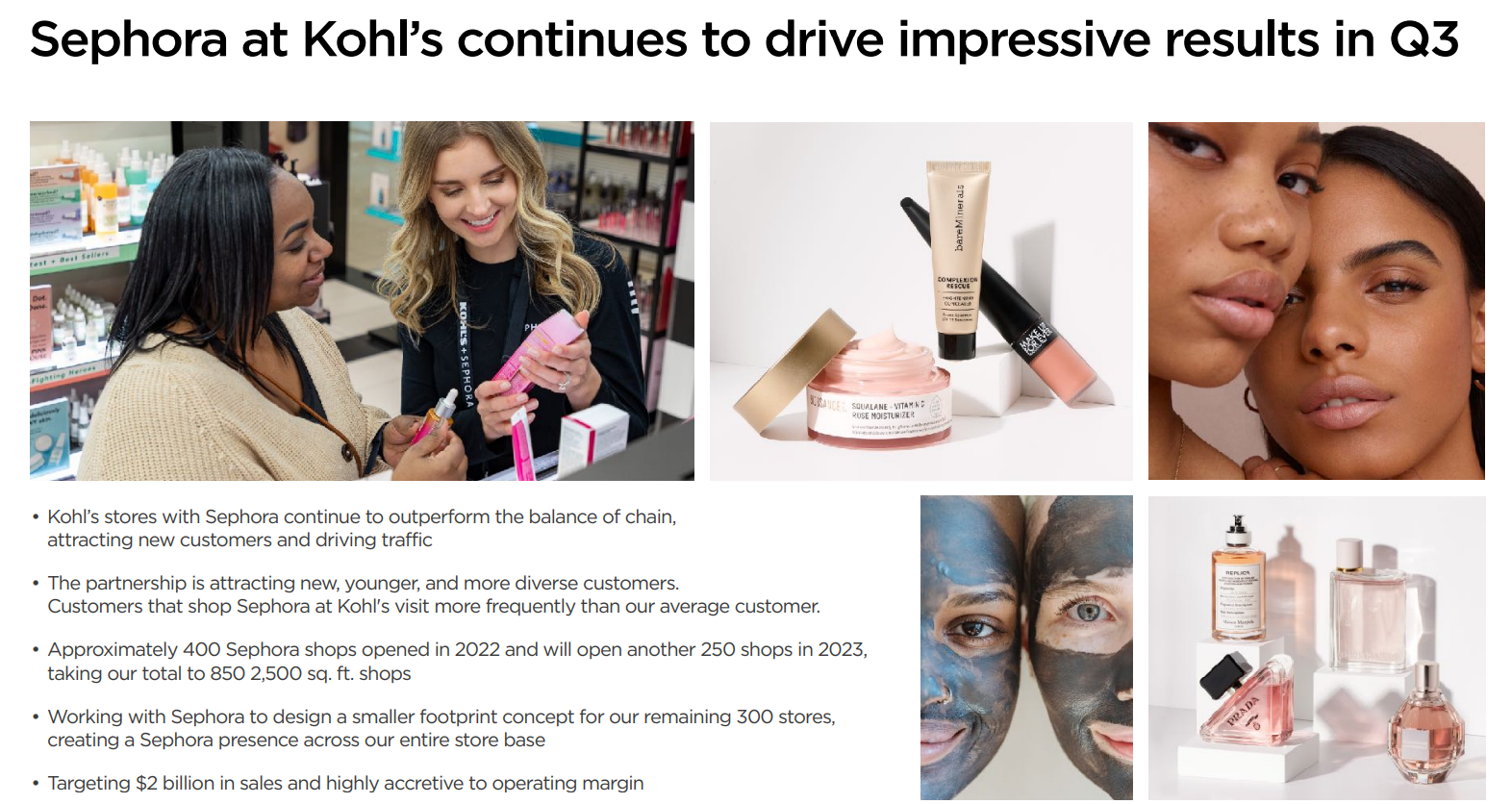

Kohl’s operates as a department store-style retailer that covers a wide variety of categories. Its primary offerings are apparel, footwear, accessories, beauty, home goods, electronics, toys, and more. The company sells a long slate of brands, but much of its apparel offerings are private label, developed in-house to drive better margins. The company also has numerous partnerships with celebrities and other brands. More recently, Kohl’s has rolled out a collaboration with beauty brand Sephora, and Kohl’s is well on its way to having a Sephora shop-in-shop in all of its stores.

Kohl’s has gone through some tumultuous times in recent years, and that resulted in a slight shrinking of the store base, which now stands at just over 1,000. The company was founded in 1988, it generates more than $17 billion in annual sales, and trades with a market cap of under $3 billion.

Kohl’s most recent earnings report was released on November 17th, 2022, for the period ending October 29th, 2022. The company posted better than expected results for both revenue and profits in Q3, despite the challenging environment for retailers. Adjusted earnings-per-share were 82 cents, which was seven cents ahead of estimates. Revenue was off 7% year-over-year to $4.38 billion, but was still $220 million better than expectations from analysts. Comparable sales declined 6.9% year-over-year, however, driving the revenue reduction.

Merchandise inventories were up by a staggering 33% year-over-year, partly because of the revenue decline, but mostly because the company simply bought too much inventory. Kohl’s warned the process of working through that excess inventory would see promotions and discounts elevate, which has a negative impact on profit margins.

While that wasn’t entirely unexpected, one thing that was unexpected was that the company’s CEO, Michelle Gass, suddenly resigned to take the CEO spot at Levi Strauss (LEVI). Kohl’s noted it had a transition plan in place and that the company was looking for a permanent replacement, but this helped to spook investors along with the inventory build.

Kohl’s revoked guidance for the fourth quarter and full year, citing significant economic headwinds, and the CEO departure. After Q3 results, we believe Kohl’s will be somewhere around $3.00 in earnings-per-share for all of 2022.

Growth Prospects

Kohl’s has a very spotty history of earnings growth in the past decade. The company has experienced what amount to boom and bust cycles in earnings, which not only makes it very difficult to maintain a dividend payment, but also for investors to have some sort of reasonable expectation of what the company might earn at any particular time.

For instance, the company lost $1.21 per share in 2020, earned $7.33 in 2021, and is expected to earn less than half of that for 2022, which has yet to be reported. That sort of volatility in earnings is difficult to reconcile for investors, but we think Kohl’s can grow earnings at 5% annually, on average, from its 2022 base of $3.00 per share in the coming years.

Source: Investor presentation, page 6

One key initiative is the company’s partnership with Sephora, which is not only driving customers to stores, but is driving a new demographic of customers to the stores. The goal of the Sephora partnership was to drive people into stores, and it is working based upon the Q3 update. Kohl’s has about 600 Sephora shop-in-shops as of the end of the year, with another 250 planned for 2023.

The company believes it can achieve $2 billion in annual revenue with Sephora, which it says is “highly accretive” to profit margins. This is, in our view, the best chance Kohl’s has to achieve meaningful earnings growth in the years to come.

Outside of that, Kohl’s has struggled to maintain comparable sales in recent quarters, and as we mentioned above, it has far too much inventory at the moment. Still, it is using its ample cash flow to retire shares, which boosts earnings-per-share by reducing the number of shares over which earnings are divided. We think revenue is likely to grow slowly, but we also note the company’s management team seems confident in their ability to boost operating margins over time.

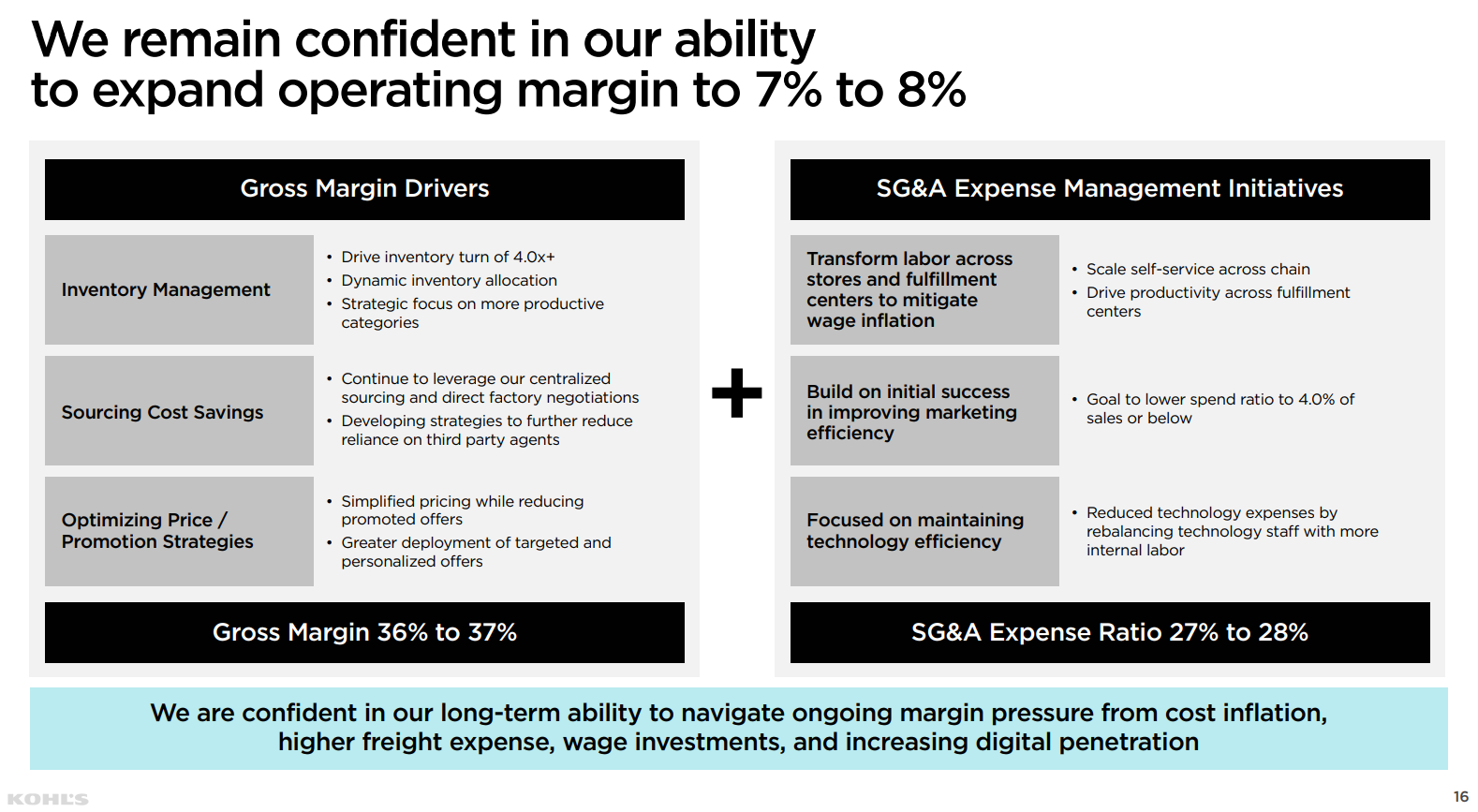

Source: Investor presentation, page 16

Kohl’s is taking a diversified approach to boosting margins, including managing its inventory more effectively, saving on sourcing costs, and optimizing its promotion-heavy pricing strategy.

In addition, it’s taking a hard look at SG&A costs, and has set target for both gross margins and SG&A that if achieved, would see operating margins much higher than they are today. We are cautious on Kohl’s ability to produce 8% operating margins given some mismanagement that has occurred to date, but we believe margin growth is essential to growing earnings-per-share in the years to come.

Competitive Advantages

Kohl’s operates in an extremely competitive field, as apparel is available to consumers globally from thousands of sources, most of which will ship clothing directly to their door. Kohl’s has attempted to combat this with its off-mall store footprint, as well as its large suite of private label brands.

In addition, it has been creative in driving traffic to stores with its Amazon return program, as well as the more recent Sephora partnership. Still, the company faces an uphill battle as the department store model continues to see numerous headwinds.

We believe the Sephora partnership gives Kohl’s its best shot at a sustainable competitive advantage, and early indications are that it is working as intended to drive traffic to stores.

Dividend Analysis

Kohl’s has raised its dividend for only two years, given it slashed the payout during 2020 as COVID set in. However, after cutting the dividend drastically in 2020, the company has rebuilt it quite quickly, and the current $2.00 per share dividend is equal to a nearly-8% yield.

Earnings are expected to be $3.00 per share this year, so the company should be able to cover the payout with earnings. However, we note that Kohl’s has competing priorities in terms of capex to build out the Sephora expansion and store remodels, in addition to share repurchases, and the cost of the dividend.

If earnings do not increase fairly substantially, it will need to make choices in terms of how to spend cash. We believe share repurchases would be the first to go, and that management is keen to defend the dividend. However, we also note that earnings volatility means that if Kohl’s has a down year, it may be forced to cut the payout again.

Final Thoughts

Kohl’s has an extremely attractive, REIT-like dividend yield today of nearly 8%. That’s a big draw for potential shareholders so long as the company can continue to pay it, and for now it looks sustainable. However, we note the company is in the midst of a transition in terms of driving revenue and profitability, and if there is a downturn in earnings, the dividend may be at risk again. We like the plan Kohl’s has in place to rebuild its earnings, but shareholders should be aware of the increased execution risk of any turnaround plan, particularly as a new CEO will be driving it.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].