Revealed on April 1st, 2022, by Quinn Mohammed

Huntington Bancshares (HBAN) has raised it’s dividend for eleven years following the Nice Recession. Nevertheless, the dividend was solely a penny 1 / 4 on the time, making it a conservative base to work off.

Nonetheless, these will increase have led the corporate to boast a excessive dividend yield of 4.3% as we speak. This can be a good bit larger than the corporate’s ten yr trailing common yield. The corporate could also be a dangerous one beneath sure circumstances although, because it has little recession resistance. Correct due diligence is paramount in circumstances like these.

We now have created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with essential monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink under:

On this article, we’ll analyze financial institution holding firm, Huntington Bancshares.

Enterprise Overview

Huntington Bancshares is a regional financial institution holding firm with $174 billion in property, headquartered in Columbus, Ohio. The corporate was based in 1866 and as we speak operates greater than 1,000 branches throughout 11 states.

The corporate offers a complete suite of banking, funds, wealth administration and threat administration services and products to shoppers, small and middle-market companies, companies, municipalities, and different organizations.

Huntington reported This autumn and FY 2021 outcomes for the interval ending December 31st, 2021, on January 21st. The corporate generated whole income of $1.65 billion in This autumn, a 33% enhance in comparison with $1.24 billion a yr in the past. The income enhance may be defined primarily on account of the TCF acquisition accomplished on June 9th, 2021.

Reported web earnings equaled $401 million, a rise over the $315 million earned within the yr in the past interval. Nevertheless, reported web earnings per share fell from $0.27 to $0.26, on account of a rise within the excellent share depend. Adjusted earnings-per-share was $0.36.

For the total yr, whole income rose 24% to $6.0 billion in comparison with $4.8 billion, pushed by the TCF acquisition and natural development. Web earnings grew 61% to $1.15 billion or $0.90 per share in comparison with $717 million or $0.69 per share in 2020.

Lastly, tangible guide worth per share was 5% decrease in comparison with the yr in the past interval, all the way down to $8.06 from $8.51.

Development Prospects

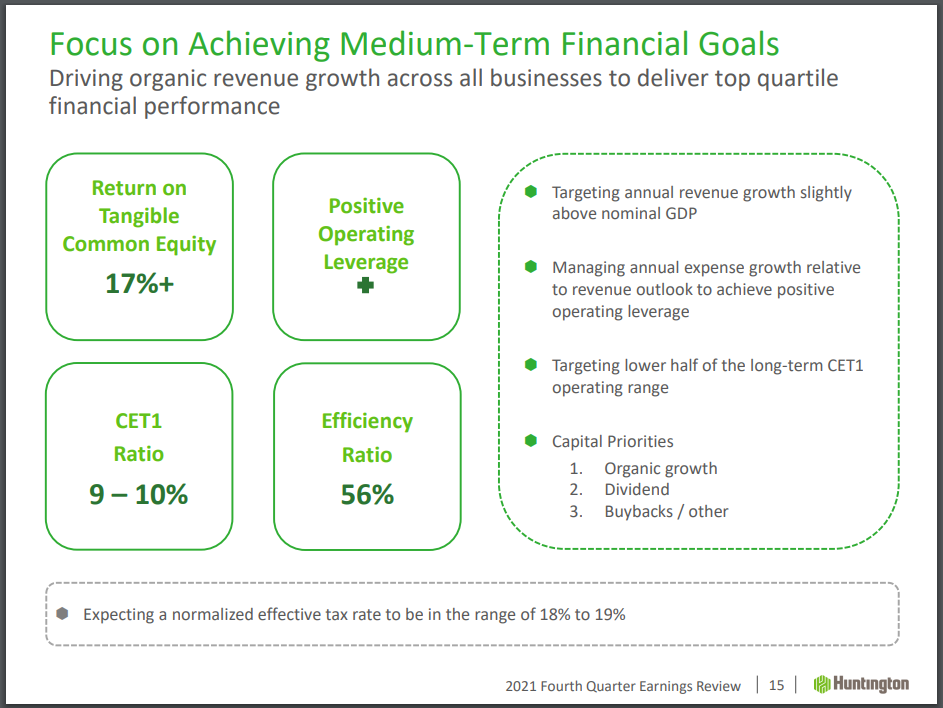

Within the medium-term, Huntington is aiming for annual income development to be simply barely larger than nominal GDP.

Supply: Investor Relations

Within the present yr, common loans are anticipated to develop by excessive single digits, pushed primarily by industrial loans, and mortgage, auto and RV/marine loans.

Web curiosity earnings will develop within the excessive single to low double digits as the corporate ticks up their web curiosity margin and enhance their incomes property.

Lastly, noninterest earnings will develop by single digits with development in capital markets, funds, and wealth administration, offset by mortgage banking normalization.

Additionally, the corporate’s value financial savings program is paying off, and by the second quarter, Huntington anticipates a quarterly run-rate of about $1 billion in bills.

Nonetheless but, there are business tailwinds which Huntington ought to profit from, akin to long-term financial enhancements and an surroundings which can bolster a sequence of rate of interest will increase.

Aggressive Benefits & Recession Efficiency

Huntington doesn’t possess any main aggressive benefit within the regional Midwest banking scene. Moreover, the corporate is hardly recession resistant.

Within the Nice Recession, the corporate acquired clobbered. So badly that shares went as little as $1. The corporate struggled so severely in 2008 and 2009, that they slashed the dividend to a penny per quarter and virtually doubled the share depend.

Despite the fact that the corporate has change into much more worthwhile for the reason that Nice Recession, the numerous shareholder dilution has precipitated earnings-per-share to nonetheless are available in under the pre-recession peak. Following the pandemic, shareholder dilution continues to be ongoing at a reasonably fast tempo.

Dividend Evaluation

Huntington has elevated their annual dividend for eleven years, following the penny 1 / 4 cost in 2009 and 2010. And the corporate paid the identical $0.15 quarterly cost for 9 quarter straight earlier than the newest 3.3% enhance in 2021. Nonetheless, the corporate paid the dividend in a approach that it was larger for the total yr since 2011.

Huntington’s at present quarterly dividend payout of $0.155 equates to an annual dividend of $0.52 in 2022. On the present HBAN share value, the corporate has a excessive dividend yield of 4.3%. The present dividend yield is an entire proportion level above the trailing decade common.

With anticipated earnings per share of about $1.10 for the yr, the corporate has a good payout ratio of 56%. The corporate could proceed to develop the dividend very slowly, in order that one other scenario like through the Nice Recession doesn’t happen. It’s extra prudent to develop the dividend at a gradual tempo than to develop it immensely and crash and burn.

And whereas an above common dividend yield can typically point out shares are overvalued, that is one identify the place we don’t imagine that to be the case. Even on an anticipated earnings foundation, shares supply little to no margin of security as we speak.

Ultimate Ideas

Huntington Bancshares Inc. just isn’t a recession resistant firm. Actually, it acquired decimated through the Nice Recession, which noticed shares commerce as little as $1, a large enhance in shares excellent, and a dividend of a penny 1 / 4.

The pandemic additionally hit the corporate’s earnings, simply as the corporate was doing pretty properly and decreasing its share depend. However following the pandemic, the share depend has elevated as soon as once more.

Consequently, the corporate has considerably slowed its dividend enhance charges. However nonetheless, Huntington has paid the next annual dividend for the final eleven years straight. The payout ratio just isn’t in any imminent hazard at present ranges, which ought to assist continued gradual dividend development. At as we speak’s value, shares aren’t too enticing, however they do have a excessive yield of 4.3%.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].