Published on January 7th, 2022 by Nikolaos Sismanis

Healthcare facilities can range in size and complexity. They need numerous operating components in order to function well. And as a result, managers in control of those facilities occasionally turn to outside assistance in order to meet their special needs. Healthcare Services Group is one business committed to providing such useful and much-needed solutions.

The company’s most distinct attribute is its dividend growth track record, including 19 years of annual dividend increases. That said, the company has been struggling lately, with shares now trading near their 14-year lows.

Accordingly, the stock currently trades with a sizable yield of 7.2%, which is significantly higher than its historical average. An above-average dividend yield can be a sign that shares are currently underpriced.

However, given the company’s low-margin business model and high payout ratio, the lofty yield could also indicate a potential dividend cut in the near future.

Healthcare Services Group is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (closely related REITs and MLPs, etc.) with 5% or more dividend yields.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we’ll take a look at today’s investment case of Healthcare Services Group.

Business Overview

Healthcare Services Group, a Pennsylvania company established in 1976, offers management, administrative, and operating skills and services to healthcare facilities all over the country’s housekeeping, laundry, linen, facility maintenance, and dietary service departments.

Servicing about 3,000 facilities, Healthcare Services is the most prominent player in the housekeeping and laundry management field of the healthcare sector in the country.

The $946 million company generates about $1.6 billion in annual revenues.

Healthcare Services Group’s third-quarter results reflected the ongoing and expected choppiness that was referenced in the second-quarter call, with the company essentially breaking even. Earnings-per-share came in at $0.00 compared to $0.13 in the prior-year period, while revenues continued their declining trend, dropping by $1 million to $415 against last year’s results.

The company’s management team has conviction in its ability to manage the controllable components of the business. However, they are also realistic about the ongoing challenges in the industry and the broader economy.

Despite management’s efforts to stabilize the business, Healthcare Services Group is expected to generate earnings-per-share of about $0.32 for fiscal 2022, which implies a decline of about 56% compared to last year.

Growth Prospects

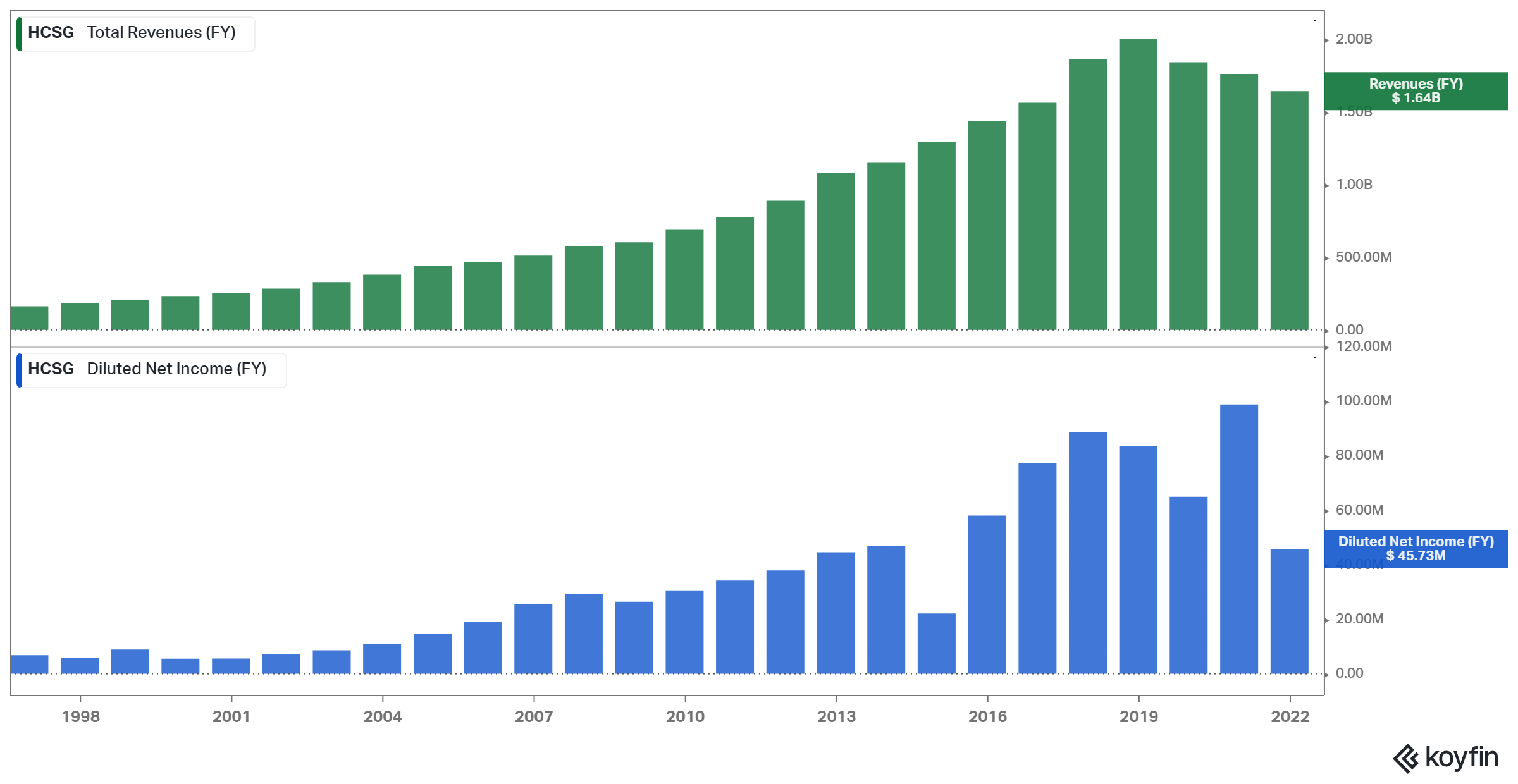

Healthcare Services Group’s earnings-per-share have consistently followed revenues, with a rather consistent rise up until 2018.

Since then, however, Healthcare Services’ financials have been on a steady decline, as some clients have not stuck with the company. Increasing costs amid elevated inflation levels and rising wages have also been pressuring the company’s profitability.

Source: Koyfin

Healthcare Services’ future growth drivers include the potential for a geographic expansion of regional and local clients and the possibility to cross-sell its housekeeping & laundry services to existing clients that don’t use all of its services.

A priority of the company is to continue to work on contract modifications that will result in more advantageous terms, which will begin to hopefully have a positive effect on the company’s financials this year onwards.

Contract modifications could match current and future inflation so that the company can mitigate the effects of the ongoing macroeconomic environment in its results. They could potentially lead to a recession in its margin compression trend and even help return to earnings-per-share growth if Healthcare Services doesn’t lose more clients along the way.

Competitive Advantages

The company operates a low-margin business model in a highly competitive market without having a major competitive edge over other organizations with a similar business model. Some of its clients even have their internal housekeeping divisions, which limits its market penetration as well.

One factor that differentiates Healthcare Services from its peers is the complete absence of any long-term debt from the balance sheet. The company can easily pay off all of its liabilities, and because it has no debt, the continued increase in interest rates shouldn’t have a direct negative impact on its net income. Healthcare Services may be able to outcompete its rivals while they deal with growing interest costs as a result.

Dividend Analysis

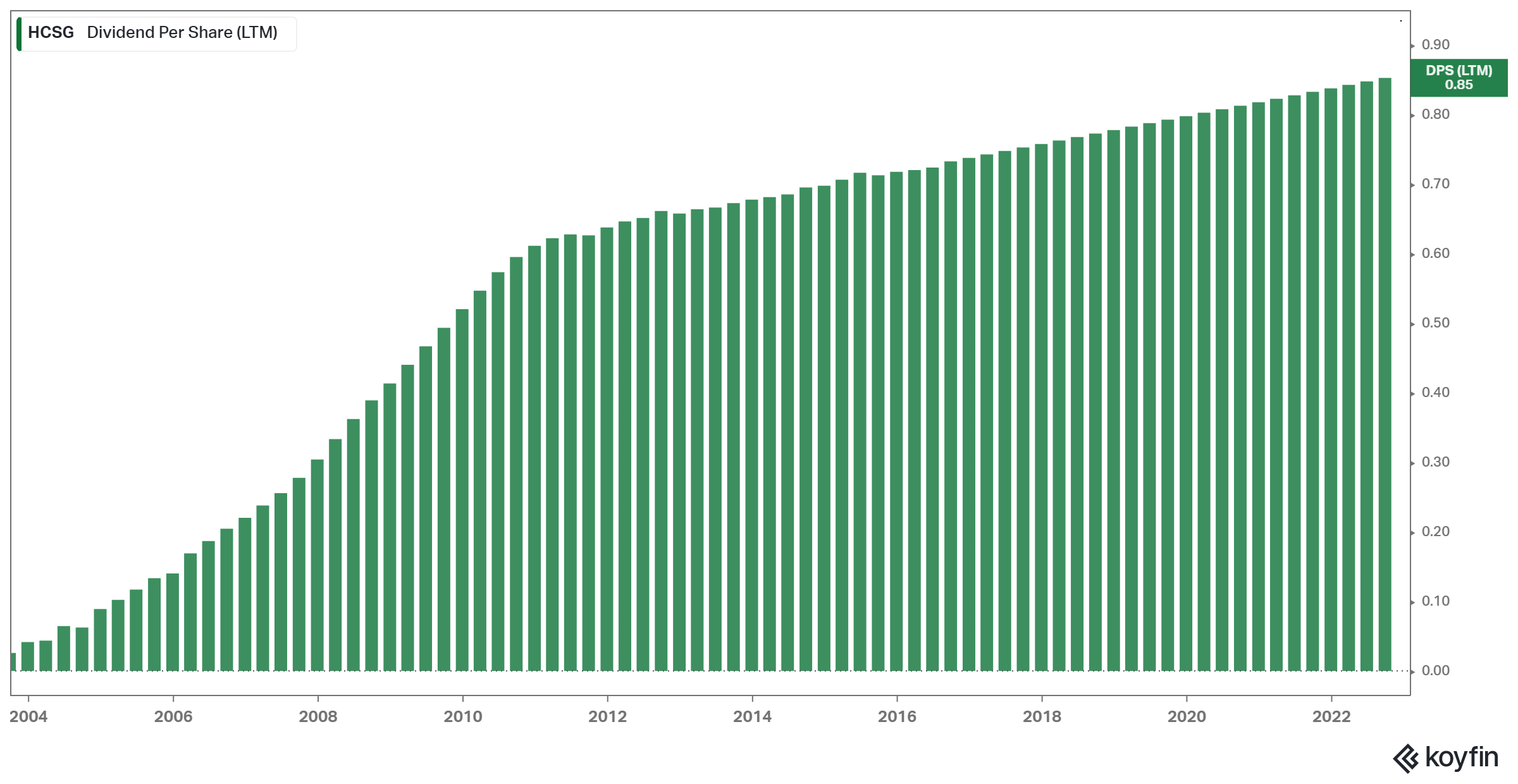

Healthcare Services Group has increased its dividend for 19 consecutive years. Notably, the company has been actually raising its dividend on a quarterly basis. Its most recent dividend increase this past October marked the 77th consecutive increase since 2003.

Source: Koyfin

The combination of a rising dividend against a declining share price has resulted in the stock’s yield currently hovering near all-time-high levels at 7.2%. With the dividend set to outweigh net income this year, we are concerned regarding the dividend’s prosperity moving forward.

The stock’s payout ratio has frequently matched or exceeded earnings, and unless the decline in revenues and net income is reversed somewhat soon, a dividend cut would not surprise us despite the company’s admirable dividend growth track record thus far.

Final Thoughts

Healthcare Services may appeal to dividend growth investors at first, given its impressive dividend growth track record, as well as the frequency of its underlying dividend hikes.

That said, the recent decline in revenues and profits could threaten the viability of the dividend going forward. In fact, the massive 7.2% dividend yield hints at the case of a potential dividend cut in the near term.

Healthcare Services’ growth drivers and possible renegotiations of its contracts could help expand margins and resume dividend coverage, while the lack of debt should assist the company in this effort during the current rising-rates environment. Still, risk-averse investors should not rely on the stock’s dividend.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].