Published on January 6th, 2023 by Quinn Mohammed

Emera Inc. has a track record of increasing its dividend for the last sixteen years. Today, the stock offers a high dividend yield of 5.3%, which is well more than its historical average yield. An above-average dividend yield could indicate that shares are currently undervalued.

Emera is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (closely related REITs and MLPs, etc.) with 5% or more dividend yields.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the electric utility company Emera Inc.

Business Overview

Emera Inc. generates, transmits, and distributes electricity to customers through its subsidiaries. The company was incorporated in 1998 and is headquartered in Halifax, Canada.

Emera’s segments include Florida Electric Utility, Canadian Electric Utilities, Other Electric Utilities, Gas Utilities and Infrastructure, and Other segments.

The corporation generates electricity through coal, natural gas and oil, hydro, wind, solar, petroleum coke, and biomass fuel.

Emera owns C$36 billion in assets and serves 2.5 million customers in Canada, the US, and the Caribbean. The company generated revenue of $5.7 billion in 2021.

Emera trades on the TSX under the ticker symbol EMA and on the OTC market under the ticker EMRAF. Also, Emera is listed on the Barbados Stock Exchange under the symbol EMABDR and on the Bahamas International Securities Exchange under EMAB.

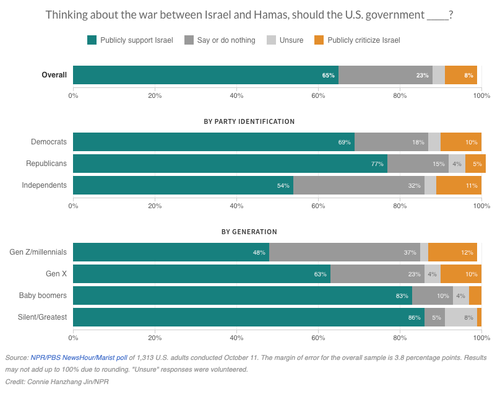

The company reported its third quarter 2022 results on November 11th, 2022. Emera reported quarterly adjusted EPS of C$0.76, a nearly 12% increase from C$0.68 in Q3 2021.

Source: Investor Presentation

Following Emera’s capital plan, the company is on track to deploy nearly C$3 billion of capital investments in 2022 to advance its strategy, including its clean energy transition.

Growth Prospects

Emera’s earnings per share have been volatile in the last decade, especially when accounting for currency changes. Earnings hit a floor in 2016 and 2017 while the share count began to expand significantly. Still, Emera has grown earnings by 9.9% on average over the last nine years.

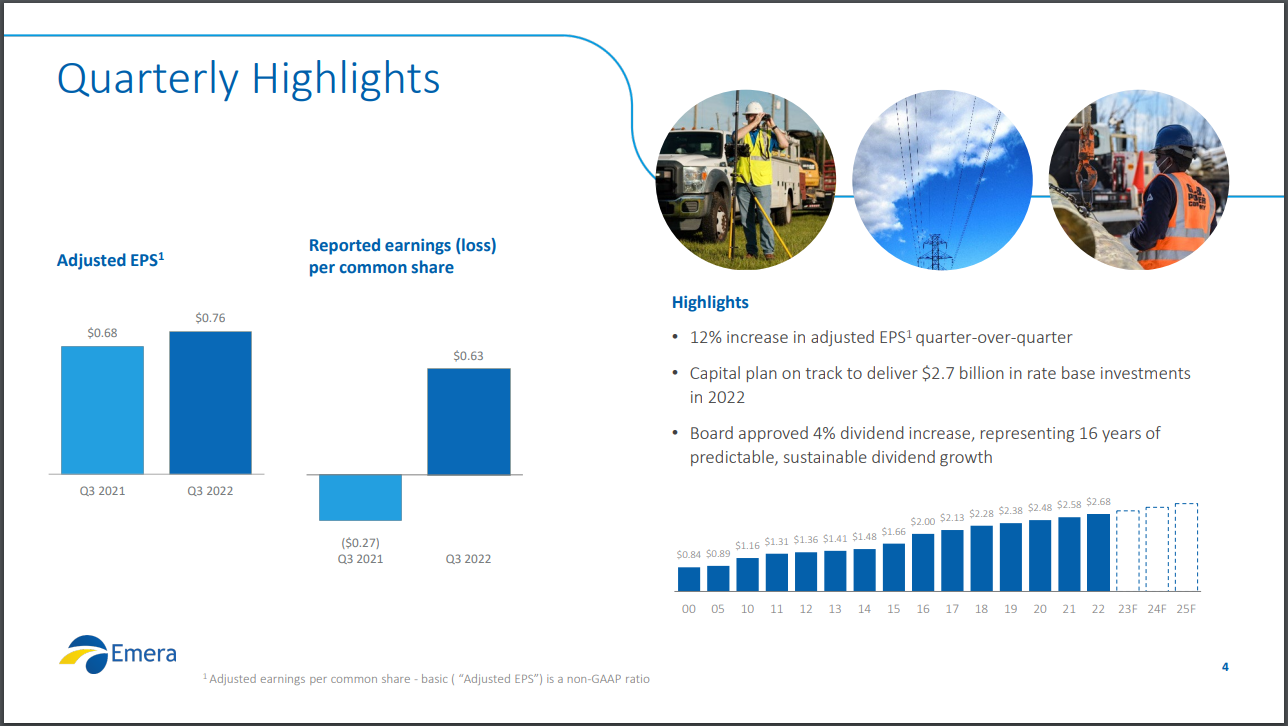

The corporation is expected to grow its earnings primarily through rate increases, which it expects to be from 7.0% to 8.0% through 2025.

Source: Investor Presentation

Emera has an extensive capital program with an expected spending of $5.9 billion USD to $6.7 billion from 2023 through 2025. About 63% of this capital program is related to decarbonization and reliability projects. And 75% of the capital plan is expected to be invested in Tampa Electric and Peoples Gas. The company is pushing to significantly increase its exposure to renewable energy.

One thing to note is that as of September 30th, 2022, Emera held C$15.3 billion in long-term debt. Additionally, interest expense has been increasing. Compared to the third quarter of 2021, interest expense rose by nearly 23% to C$184 million in the third quarter of 2022.

Leadership expects the company’s EPS and cash flow growth to track rate base growth over the long term.

Moving forward, we estimate Emera can grow earnings at a rate of 5.0% per annum.

Competitive Advantages & Recession Performance

We don’t see Emera as having any strong competitive advantage compared to its regulated electric utility peers. However, the company’s revenue should remain stable as there are steep barriers to entry for electric utilities, massive capital investment requirements, and heavy regulation.

Emera came out of the Great Recession unscathed, as its electric utility business is an essential service required by customers in all economic times. In fact, it was during this recession that the corporation resumed increasing its annual dividend after some years-long pause.

Dividend Analysis

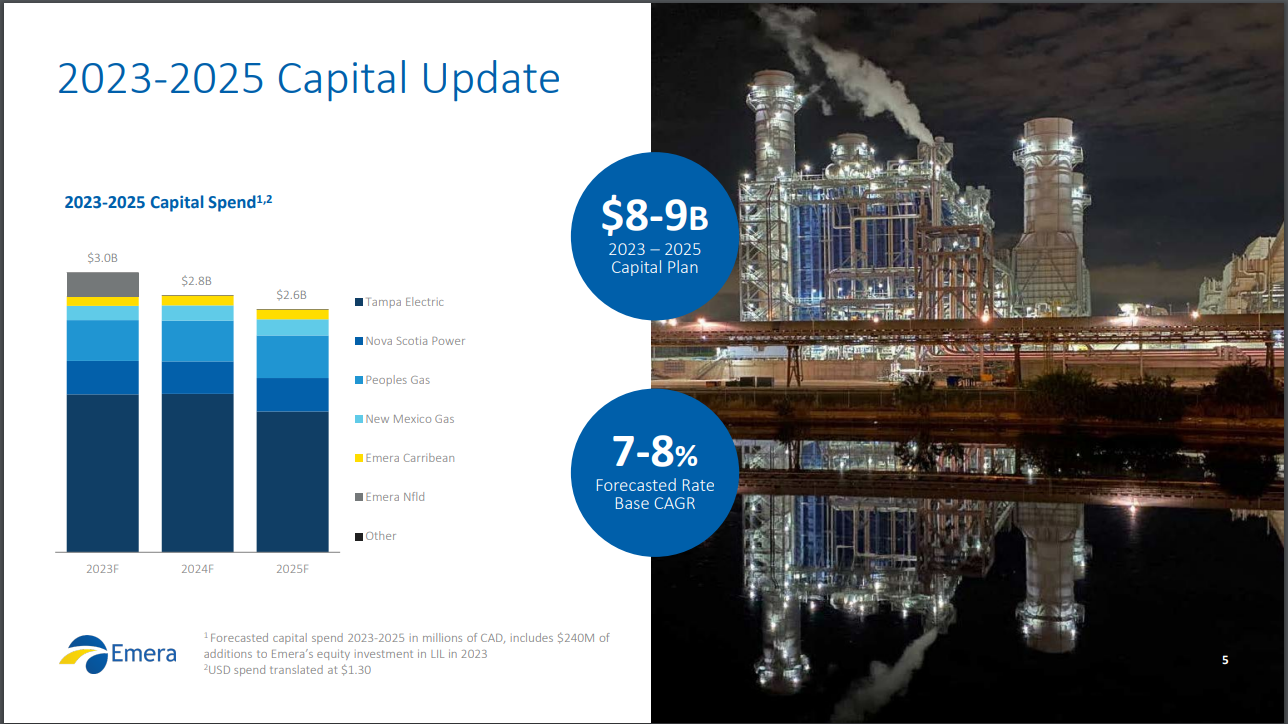

Emera Inc. pays its dividend in Canadian dollars, with a forward dividend per share of C$2.76. The dividend was last increased in September 2022 from C$2.65, which marked the company’s sixteenth consecutive annual increase.

Source: Investor Presentation

Emera sports a dividend yield of 5.3% at the current share price, which is 100 basis points above the company’s ten-year average dividend yield.

After accounting for exchange rates, Emera is set to pay out roughly 92% of its earnings in dividends for 2022. While utility companies are stable businesses with reliable income, this is still an elevated payout ratio.

The company’s dividend payout ratio has not been trouble-free in the past either, as it eclipsed the 100% mark in 2016, 2017, and 2021. Still, the company continues to guide for mid-single-digit dividend growth.

Final Thoughts

Emera is offering a high dividend yield of 5.3%, has paid a dividend every year since 1993, and has raised the dividend for the last sixteen consecutive years.

The company has a defined path to growth through its multi-billion-dollar capital program and rate increases. However, the dividend payout ratio is high and is forecasted to remain in this range. Thus, Emera is a company that may require extra attention to verify the company’s ability to pay the dividend remains intact.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].