Revealed on October twenty eighth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which are considerably larger than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares will be significantly useful in supplementing revenue after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Cross Timbers Royalty Belief (CRT) is a part of our ‘Excessive Dividend 50’ sequence, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We have now created a spreadsheet of shares (and intently associated REITs, MLPs, and so on.) with dividend yields of 5% or extra.

You may obtain your free full checklist of all securities with 5%+ yields (together with essential monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our checklist of high-dividend shares to evaluation is Cross Timbers Royalty Belief (CRT).

Enterprise Overview

Cross Timbers Royalty Belief (CRT) is an oil and fuel belief established in 1991 by XTO Power, a subsidiary of ExxonMobil. The belief generates revenue by means of a 90% internet revenue curiosity in gas-producing properties in Texas, Oklahoma, and New Mexico, together with the San Juan Basin, and a 75% internet revenue curiosity in working curiosity oil properties in Texas and Oklahoma. Whereas the 90% curiosity shouldn’t be topic to improvement prices, the 75% curiosity requires CRT to share in manufacturing and improvement bills, that means distributions are delayed if prices exceed earnings.

CRT’s income is closely weighted towards oil, which accounted for 72% of whole income in 2024, with pure fuel making up the remaining 28%. Traditionally, the belief has produced steady royalty revenue, producing $12.5 million in 2022 and $12.3 million in 2023. Month-to-month distributions are paid to unitholders by XTO Power, and CRT has a market capitalization of roughly $52 million, providing buyers a royalty-based publicity to U.S. oil and fuel manufacturing with predictable money flows.

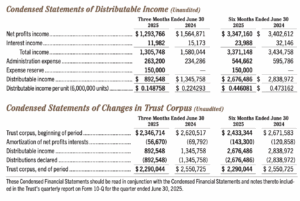

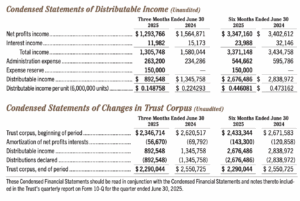

In mid‑August 2025, Cross Timbers Royalty Belief (CRT) reported its Q2 outcomes: oil volumes declined by ~18% 12 months‑over‑12 months, and pure fuel volumes fell by ~35%. On the similar time, the typical realized oil value dropped by ~14%. Because of this, CRT’s distributable money stream (DCF) per unit decreased by round 17%.

Distributions have dropped considerably over the previous 5 months amid decrease oil costs and the unwinding of OPEC manufacturing cuts. Based mostly on distributions over the primary eight months of 2025, CRT is providing an annualized yield of roughly 12.1%.

Supply: Investor Relations

Progress Prospects

A key driver for Cross Timbers Royalty Belief is the worth of oil and fuel. Between 2014 and 2020, falling commodity costs restricted the belief’s revenue, however the 2023 rally to 13-year highs allowed CRT to attain its highest distributable money stream (DCF) per unit in eight years. Sturdy commodity costs immediately increase distributable revenue and, in flip, the unit value. Nonetheless, as OPEC manufacturing cuts unwind, CRT’s inventory has pulled again from close to all-time highs.

As a royalty belief, CRT has minimal working bills, giving it important leverage when revenues rise. Its distributable revenue and progress are subsequently virtually solely depending on commodity costs. Over the previous decade, CRT has averaged $1.24 per unit in annual distributable and distributed money stream, although this declined over a lot of the final eight years till 2022. Manufacturing from its properties naturally declines by 6%-8% per 12 months, which presents a headwind to future returns. Coupled with the worldwide shift towards renewable vitality, we count on distributable money stream to say no by a median of 5% yearly over the following 5 years.

Aggressive Benefits & Recession Efficiency

Dividend Evaluation

Cross Timbers Royalty Belief (CRT) classifies its distributions as royalty revenue, which is taxed as bizarre revenue on the recipient’s marginal tax fee. Distributions are declared 10 calendar days earlier than the document date, sometimes the final enterprise day of every month.

Payouts have traditionally been risky, reflecting swings in oil and fuel costs. Between 2014 and 2020, distributions declined steadily resulting from weak commodity costs, falling from $1.43 per unit in 2018 to $0.78 in 2020, earlier than rebounding in 2021 and 2022 as vitality markets recovered. CRT provided $1.92 per unit in 2023, yielding a median annual distribution of 10.9%, and an eight-year excessive of $1.96 per unit in 2022. During the last 12 months, the present yield is roughly 12%.

Distributions are extremely depending on commodity costs, as CRT distributes primarily all of its revenue and has no management over manufacturing or pricing. Dividend progress is tied on to larger distributable revenue, making payouts unpredictable and extremely cyclical.

Whereas elevated oil and fuel costs can yield beneficiant distributions, the long-term threat of value declines—particularly amid the worldwide shift towards renewable vitality—introduces important volatility. Traders ought to perceive that CRT’s excessive yields include appreciable variability, and the belief’s payout sample is greatest seen as a mirrored image of commodity market efficiency reasonably than steady revenue.

Closing Ideas

Cross Timbers Royalty Belief (CRT) has fallen roughly 34% from its peak over the previous 5 months, primarily resulting from declining oil costs as OPEC restores manufacturing to regular ranges. The inventory’s excessive yield could seem enticing, however its efficiency stays intently tied to risky commodity markets.

Trying forward, CRT may ship a median annual return of about 6.8% over the following 5 years. This assumes a 12% beginning distribution yield, 4% progress in distributable revenue, and a projected 5.5% valuation headwind. The belief continues to face dangers from the cyclicality of oil and fuel costs, long-term manufacturing declines, and working prices, supporting a promote score for the inventory.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].