Published on January 7th, 2022 by Nikolaos Sismanis

Despite boasting 41 consecutive quarters of dividend increases and currently trading with a hefty yield of 6.4%, Cogent Communications is not making a splash with investors.

The $2.9 billion company is quite small to attract meaningful investor interest and overall coverage, resulting in the stock’s daily trading volumes averaging below $17 million in nominal value.

Nevertheless, Cogent Communications is included in our coverage universe. It is, in fact, one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (closely related REITs and MLPs, etc.) with 5% or more dividend yields.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze Cogent Communications Holdings (CCOI).

Business Overview

In 1999, Cogent Communications Holdings was established on the basis that bandwidth could be traded and sold like any other good or service (i.e., a commodity). The company provides small and medium-sized enterprises in 50 different countries with low-cost, high-speed internet access and private network services. Over 20% of all internet traffic was carried by Cogent’s global network last year.

Cogent provides high-speed internet connection to two different types of consumers: corporate or “on net” customers, who account for 59% of sales, and netcentric or high bandwidth users, who earn the remaining 41%.

With the company’s telecommunication services generating resilient and recurring cash flows, the company’s performance has remained robust over the past several quarters despite the tough market environment.

Powered by a rising customer count and robust ARPU, the company’s most recent Q3 results came in quite solid. The on-net customer base rose by 3.10% to 82,614, while off-net customers increased by 6.9% to 13,359.

Accordingly, on-net revenue came in at $113.2 million, up 1.1% from the previous year, while EBITDA rose 0.2% year-over-year to $57.9 million. Net income per share was negative, at ($0.17), but posting messy net income levels has been a common theme for the company due to the frequent change in the valuation of its Euro-notes.

Growth Prospects

Cogent’s earnings-per-share generation has been quite erratic over the last ten years. Earnings-per-share has hovered as low as $0.02 in 2014 and as high as $1.22 in 2013. Income tax expenses, unrealized FX gain on euro notes, and debt redemption losses have contributed to net income’s wild swings.

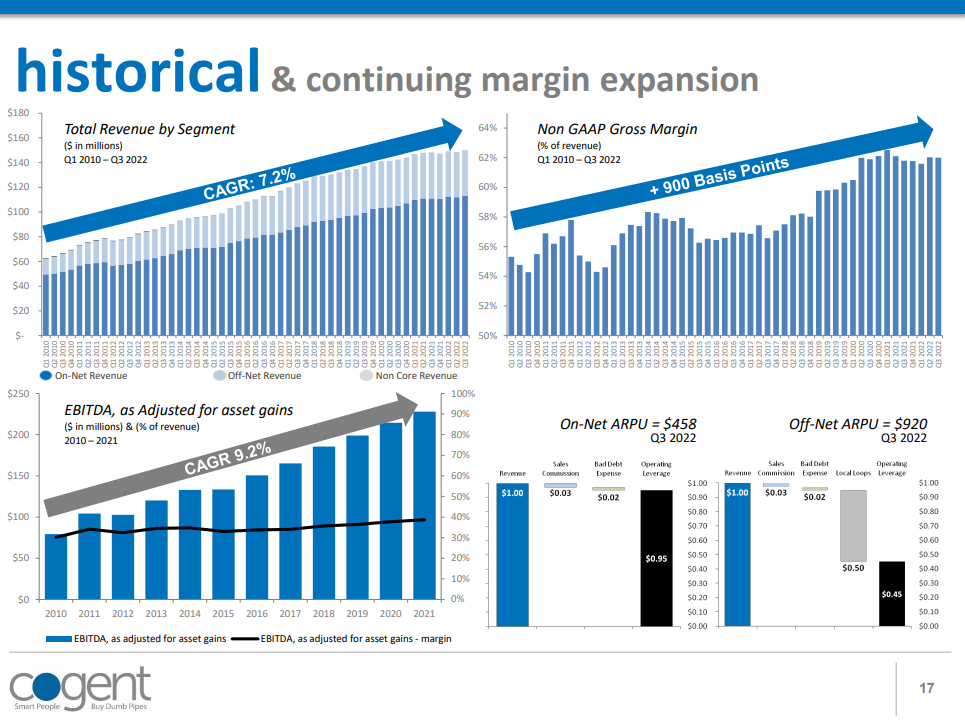

The company’s performance is thus better assessed through its adjusted EBITDA generation as the metric of these one-off items, along with the company’s capital expenditures. Cogent has increased adjusted EBITDA at a compounded annual growth rate of 9.2% since 2010.

The growth in adjusted EBITDA has been powered by growing revenues and expanding margins. Specifically, since 2010, revenues have grown at a CAGR of 7.2%, while Cogent’s adjusted gross margin has expanded by 900 basis points.

Source: Investor Presentation

Driven by Cogent’s superior proposition to customers, including the company winning about 40% of all On-Net proposals, we expect revenue and adjusted EBITDA to keep growing at about 8% per annum moving forward.

Competitive Advantages

Cogent offers narrow product sets, which can have significant cost advantages compared to telecommunication majors, whose offerings are generally broad.

The company’s transmission and network operations rely mainly on two sets of equipment, increasing control to give superior delivery. While they have over 25 thousand corporate connections, this only accounts for a 5% market share, compared to the 95% market share they own with netcentric customers. This gives them plenty of capacity to attract new customers.

The fact that the corporation increased its dividend every three months during the COVID-19 pandemic should illustrate the resilience of its business model, even though the company’s ability to weather recessions in terms of payouts has not been put to the test.

Still, due to the nature of telecommunications, we would expect relatively robust results during a potential recession.

Dividend Analysis

Since 2012, when Cogent initiated dividend payments, its growth rate has been quite impressive. Cogent’s dividend has, in fact, grown at a CAGR of 35.2% during the period, while the fact that payouts have been increased for 41 consecutive quarters demonstrated management’s commitment to rewarding shareholders progressively.

Note that despite Cogent’s depressed net income levels implying a lack of dividend coverage, the dividend is actually covered by the company’s adjusted EBITDA, which excluded extraordinary items. For context, last year, the company generated an adjusted EBITDA of $227.9 million and paid $150.3 million in dividends.

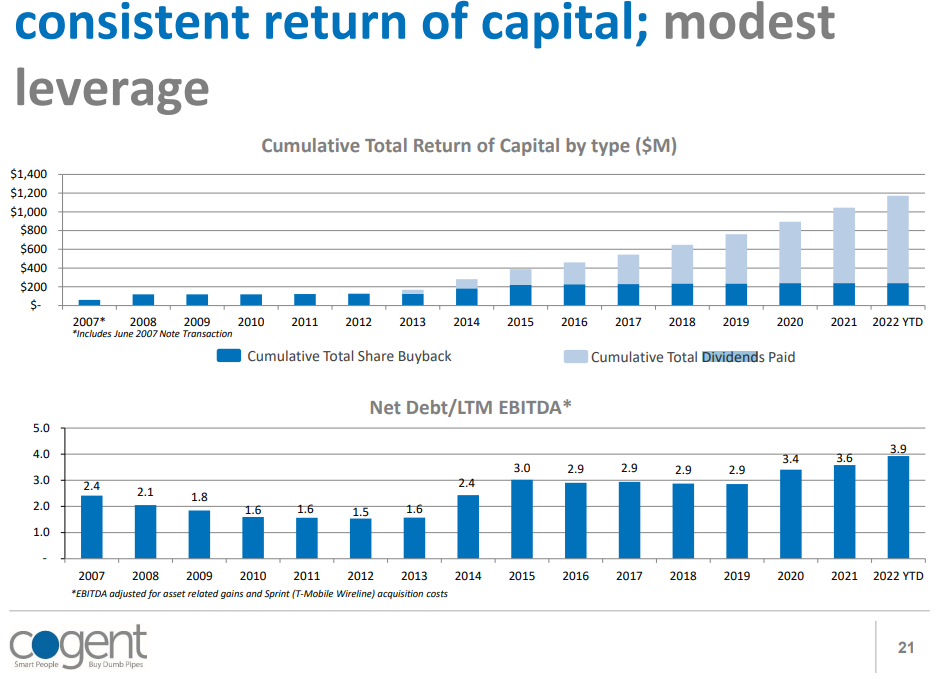

Cogent’s net debt to adjusted EBITDA is rather elevated, but the dividend is not threatened. High leverage ratios are common amongst telecom providers due to their rather resilient and recurring cash flows. That said, it would probably be smart for the company to deleverage amid rising interest rates.

Source: Investor Presentation

We believe there is further room for the company to continue growing the dividend, likely at a rate in line with its adjusted EBITDA growth, close to the mid-to-high single digits.

Final Thoughts

Income-oriented investors are likely to appreciate Cogent’s 6.4% dividend yield and frequent dividend increases. Payouts should keep growing as they are well-covered by the company’s adjusted EBITDA, even if rising interest rates could modestly pressure profitability due to its relatively high indebtedness.

With uncertainty in the markets still fuming, Cogent’s defensive business model and recurring cash flows should shield it against the ongoing headwinds, making it a solid pick in the current environment.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].