Published on January 15th, 2023 by Felix Martinez

Canadian Imperial Bank of Commerce (CM) has paid a rising dividend for 12 years. The stock price of CM had decreased by 40% since its high in January 2022. At the current price, the company stock looks to be attractive.

This significant markdown in the share price and the consistent dividend raises have resulted in a significant increase in CM’s dividend yield. The company now boasts a high dividend yield of 5.8%. One must delve into the company’s financials to determine whether the bank can sustain this dividend.

We have created a spreadsheet of high-dividend stocks with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze the Canadian Imperial Bank of Commerce (CM).

Business Overview

Canadian Imperial Bank of Commerce is a global financial institution that provides banking and other financial services to individuals, small businesses, corporations, and institutional clients. CIBC is focused on the Canadian market. The bank was founded in 1961 and is headquartered in Toronto, Canada. The bank reports its earnings in the Canadian dollar.

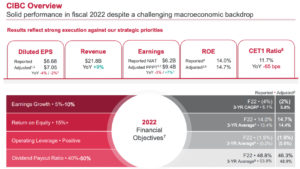

CIBC reported its fiscal Q4 2022 earnings results on December 1st, 2022. Its revenue climbed 6% to C$5,388 million against fiscal Q4 2021. Unfortunately, higher provision for credit losses (PCL) (up C$358 million) and higher non-interest expenses (up 11%) weighed on earnings.

Adjusted net income declined 17% to C$1,308 million. Adjusted earnings-per-share (“EPS”) also fell 17% to C$1.39. PCL increased due to an unfavorable economic outlook. Investors don’t need to be too alarmed, though, as the loan loss ratio was still very low at 0.16%. The bank’s adjusted return on equity (“ROE”) was 11.2%, down from 14.7% a year ago.

The bank’s capital position remains stable, with a Common Equity Tier 1 ratio of 11.7% versus 12.4% a year ago. CIBC’s results were mixed across its businesses for the full fiscal year. The Canadian Personal and Business Banking segment saw adjusted net income falling 4% to C$2,396 million, the Canadian Commercial Banking and Wealth Management segment increased adjusted net income by 14% to C$1,895 million, but smaller U.S. Commercial Banking and Wealth Management segment saw adjusted net income falling 17% to C$810 million, and Capital Markets segment’s adjusted net income rose 3% to C$1,908 million.

Altogether, in fiscal 2022, adjusted EPS fell 2% to C$7.05, which translated to US$5.25. It also increased its quarterly dividend by 2.4% to C$0.85 per share. We initiate our 2023 EPS estimate at US$5.20.

Source: Investor Presentation

Growth Prospects

In May 2022, the bank stock had a two-for-one stock split, which is why its EPS and dividend-per-share appear much lower in 2022. Stock splits do not change the valuation of the stock.

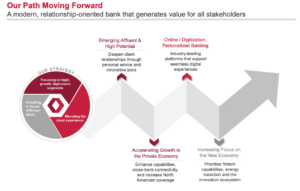

The Canadian bank’s medium-term goal is to grow adjusted EPS by 5-10% per year. However, its earnings and dividends have been bumpy due to the foreign exchange fluctuations between the U.S. and Canadian dollar.

From 2013 to 2022, the bank increased its EPS and DPS by 2.7% and 3.4% per year in US dollars. Also, from 2017-2022, its EPS and DPS growth rates were 4.0% and 5.4%, respectively.

As rate hikes occur in Canada and the U.S., we see loan growth of 4% in 2022 and in 2023, much lower than in 2022, as we forecast a slowdown in economic growth. We see a normalization in credit costs, with net charge-offs increasing in 2023 and 2024, as we forecast a minor recession toward the end of 2023.

Source: Investor Presentation

Competitive Advantages

CIBC is not the largest bank in its primary market of Canada, as it is the 5th largest, nor in the U.S. This is not necessarily a headwind, as both banking markets are large enough for different players.

Due to a focus on consumer banking, especially mortgages, which are usually insured in Canada, CIBC has a relatively low-risk portfolio relative to other banks. Its performance in the last financial crisis was not good, but not as disastrous as that of many of its North American peers.

The company does not have a leading market share in its domestic operations, limiting some of its cost advantages. It has a history of higher credit costs related to poor investment and lending decisions.

Dividend Analysis

The company pays a $0.63 quarterly dividend, which has been increasing over 12 years. The company has a 5-year dividend growth rate of 4.8%. At the current share price, CM has a high dividend yield of 5.6%, which is above its five-year average of 2.4%.

Based on our EPS estimate of $5.09 for 2023, the company is forecasted to pay out about 50.6% of earnings in dividends. While this isn’t a high payout ratio, it is much more than the company has paid out in the past. In the past, the company typically had a low 40% dividend payout ratio. Currently, the dividend does not appear to be in danger.

We currently anticipate decent earnings growth over the next five years of about 4% annually, which should continue to help the company grow its dividend.

Final Thoughts

Canadian Imperial Bank of Commerce is a high-quality bank that has proven to be an outstanding dividend growth stock throughout the years. The current dividend yield and valuation are attractive, and we expect the company to deliver over a 12% annual rate of return over the next five years.

The 12% annual return will come from the 5.8% dividend, the five-year earnings growth rate of 4%, and a PE expansion of about 3.7%.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].