Printed on October twenty second, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably greater than the market common. For instance, the S&P 500’s present yield is simply ~1.2%.

Excessive-yield shares will be notably useful in supplementing retirement revenue. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Blue Owl Capital Company (OBDC) is a part of our ‘Excessive Dividend 50’ sequence, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We’ve created a spreadsheet of shares (and intently associated REITs, MLPs, and so forth.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full record of all securities with 5%+ yields (together with necessary monetary metrics reminiscent of dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our record of high-dividend shares to evaluate is Blue Owl Capital Company (OBDC).

Enterprise Overview

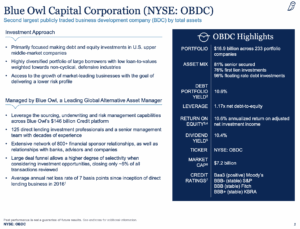

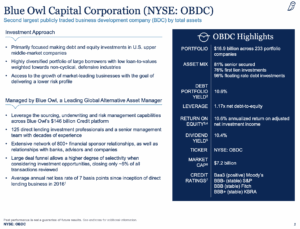

Blue Owl Capital Company is a publicly traded enterprise improvement firm (BDC) headquartered in New York, New York. Based in October 2015, the agency accomplished its preliminary public providing in July 2019. Blue Owl primarily invests in and offers financing to U.S. middle-market firms, focusing on these with annual EBITDA between $10 million and $250 million or revenues starting from $50 million to $2.5 billion on the time of funding.

The corporate generates roughly $1.6 billion in annual gross funding revenue and holds a market capitalization of $6.6 billion, making it the third-largest publicly traded BDC. Blue Owl focuses on supporting growth-oriented firms by means of strategic investments and lending options.

On July 6, 2023, the agency rebranded from Owl Rock Capital Company to Blue Owl Capital Company, updating its Nasdaq ticker from ORCC to OBDC to replicate its new identification.

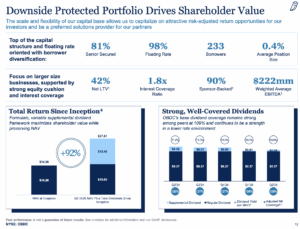

Blue Owl Capital Company (OBDC) reported sturdy monetary outcomes for the second quarter ended June 30, 2025. GAAP web funding revenue (NII) per share was $0.42, exceeding expectations by $0.03, whereas income elevated 22.5% year-over-year to $485.8 million. Adjusted NII per share rose barely to $0.40 from $0.39 in Q1 2025. The Board of Administrators declared a complete dividend of $0.39 per share for the quarter, together with a $0.02 supplemental dividend, reflecting an annualized yield of 10.4%. Web asset worth per share was $15.03, modestly down from $15.14 within the prior quarter on account of choose write-downs, partially offset by earnings exceeding dividends.

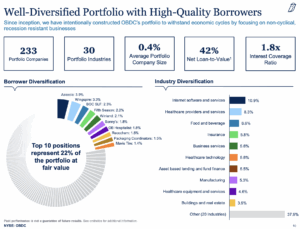

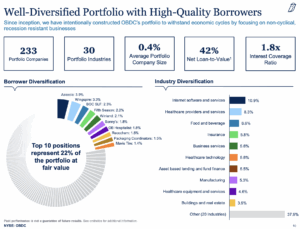

Throughout the quarter, Blue Owl dedicated $1.1 billion to new investments whereas receiving $1.9 billion in repayments and gross sales, leading to a web discount of invested capital. The corporate’s portfolio consisted of 233 firms throughout 30 industries, with whole investments valued at $16.9 billion. First-lien senior secured debt represented 75.8% of the portfolio, and solely 0.7% of the investments have been on non-accrual standing, demonstrating sturdy credit score high quality and portfolio stability. Weighted common yields on debt investments remained engaging at roughly 10.6% at truthful worth.

OBDC ended the quarter with $360 million in money, $9.3 billion in whole debt, and $3.7 billion in undrawn credit score capability, sustaining compliance with all monetary covenants. Working bills elevated barely to $266.8 million, primarily from curiosity, administration, and incentive charges associated to the current merger. CEO Craig Packer emphasised that the portfolio’s efficiency helps constant earnings and engaging risk-adjusted returns, positioning Blue Owl to capitalize on alternatives within the middle-market lending sector whereas sustaining sturdy liquidity and capital flexibility.

Supply: Investor Relations

Progress Prospects

The corporate’s web funding revenue (NII) per share is very depending on the unfold between the yields on its investments and its personal funding prices. On the finish of Q2 2025, the weighted common whole yield on debt and income-producing securities was 10.6%, down 130 foundation factors year-over-year, whereas the common unfold declined 50 foundation factors to five.8%.

Excessive rates of interest can profit Blue Owl, however provided that the corporate maintains management over its funding prices. Given the already elevated FY2025 NII per share, additional development is unlikely within the close to time period as market dynamics evolve.

Relating to distributions, Blue Owl presently pays a quarterly base dividend of $0.37 per share. Particular dividends have been frequent in current intervals on account of extra features, however the base dividend is predicted to develop modestly at round 2% yearly, a tempo thought-about sustainable given the corporate’s earnings profile.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Blue Owl Capital has sturdy benefits as a result of it focuses on lending to U.S. middle-market firms with steady money flows. The corporate’s expertise in structuring loans and investments, mixed with its stable relationships with its portfolio firms, allows it to determine engaging alternatives and make knowledgeable funding selections. Most of its loans are floating-rate, which may also help earn extra when rates of interest rise.

The corporate additionally performs nicely in downturns. Its portfolio is generally senior secured debt, which is safer, and only a few investments are on non-accrual. This conservative strategy and give attention to cash-generating companies assist Blue Owl keep steady revenue and dividends, even throughout recessions, whereas persevering with to offer regular returns to buyers.

Supply: Investor Relations

Dividend Evaluation

Blue Owl Capital’s annual dividend is $1.48 per share. At its current share value, the inventory has a excessive yield of 11.4%.

Given the corporate’s earnings outlook for 2025, NII/share is predicted to be $1.65. In consequence, the corporate is predicted to pay out 90% of its web revenue per share to shareholders. This doesn’t embody some small particular dividends which can be typically declared.

Closing Ideas

Blue Owl Capital is without doubt one of the largest BDCs, with a diversified portfolio throughout totally different firms and industries. Though it has a comparatively quick historical past as a publicly traded firm, it has proven sturdy fundamentals.

We anticipate annualized returns of about 9.9% over the medium time period, principally pushed by its dividend, and charge the inventory as a maintain.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].