Published on January 7th, 2023 by Quinn Mohammed

BCE Inc. pays a high dividend yield of 6.0%, and the company has increased its dividend for 13 consecutive years. The company’s payout ratio as a percent of earnings may be stretched, but BCE has recession-resistant qualities and competitive advantages that should protect the dividend.

Deep analysis should be completed to verify the safety of high-yield stocks, particularly when their payout ratios eclipse 100%, which could spell an oncoming dividend cut.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze the Canadian telecom giant BCE Inc. (BCE).

Business Overview

BCE Inc. is a telecommunications and media company that provides communications services in the following business units: Bell Wireless, Bell Wireline, and Bell Media.

The corporation addresses residential customers, small- and medium-sized businesses, and large enterprise customers.

BCE was founded in 1970 and is headquartered in Verdun, Canada. Shares are listed on both the New York Stock Exchange (NYSE) and on the Toronto Stock Exchange (TSX).

BCE reported third quarter 2022 results on November 3rd, 2022. Revenue rose by 3% year-over-year to C$6.0 billion, and adjusted net earnings rose 7% to C$801 million.

Adjusted EBITDA increased by 1.2% to C$2.6 billion, and adjusted earnings-per-share increased by 7.3% year-over-year to C$0.88. BCE also generated cash flows from operating activities of nearly C$2.0 billion and free cash flow of C$642 million, increases of 12.5% and 13.4%, respectively.

The Bell Wireless and Wireline segments saw revenue growth of 7% and 1%, respectively. On the other hand, the Bell Media segment experienced roughly flat revenue growth.

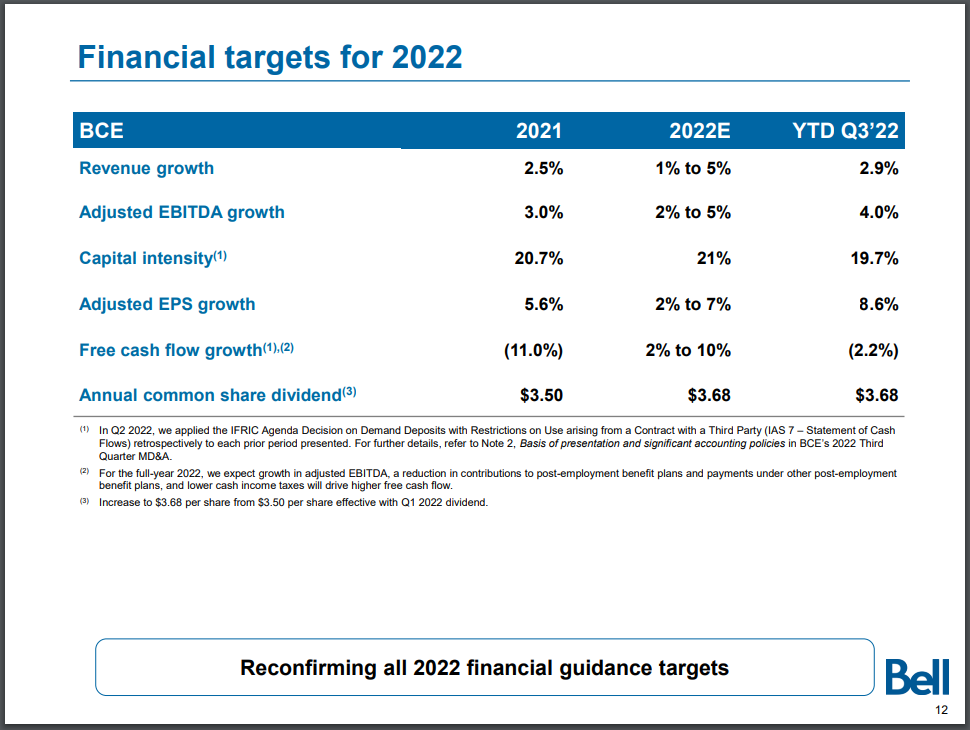

Source: Investor Presentation

BCE reiterated its 2022 outlook and expects revenue growth of 1% to 5%, adjusted EBITDA growth of 2% to 5%, adjusted EPS growth of 2% to 7%, and FCF growth of 2% to 10%.

Our 2022 EPS estimate for BCE stands at US$2.66.

Growth Prospects

BCE has seen declining earnings per share in U.S. dollars over the last decade. Earnings per share fell by about 3.2% annually from 2012 to 2021. In Canadian dollars, however, earnings per share were essentially flat across the same time period. Since BCE is focused on the Canadian market and reports its results in Canadian dollars when translated into US currency, results can fluctuate significantly.

BCE is focused on growing its subscriber base and has made several investments to facilitate this. Capital expenditures are on track to reach over $5 billion for the fiscal year 2022, the highest amount ever by a Canadian telecom in a single year.

The company’s significant investments in its infrastructure have led to it owning the fastest-ranked and largest wireless network in Canada. Additionally, its LTE and 5G coverage envelop more than 90% and 75% of Canadians, respectively. Lastly, the company’s industry-leading speeds will also draw customers in and aid in growing the subscriber base.

While BCE has seen its earnings per share decline in the last decade on a U.S. dollar basis, for the next five years, we estimate that the company can grow earnings per share by roughly 4.5% annually.

Competitive Advantages & Recession Performance

BCE Inc., being the largest Canadian telecom company, enjoys its entrenched position in the lucrative space. The Canadian telecom industry is not threatened by new entrants, as massive barriers to entry protect the current telecom companies. BCE Inc. also has the best network due to its significant capital spending, which would be extremely difficult to replicate today.

The company also has high recession resiliency, as the company’s products and services are practically necessities in today’s day and age, through all economic cycles. While the company saw results fall during COVID-19, they still held up reasonably well and have increased since.

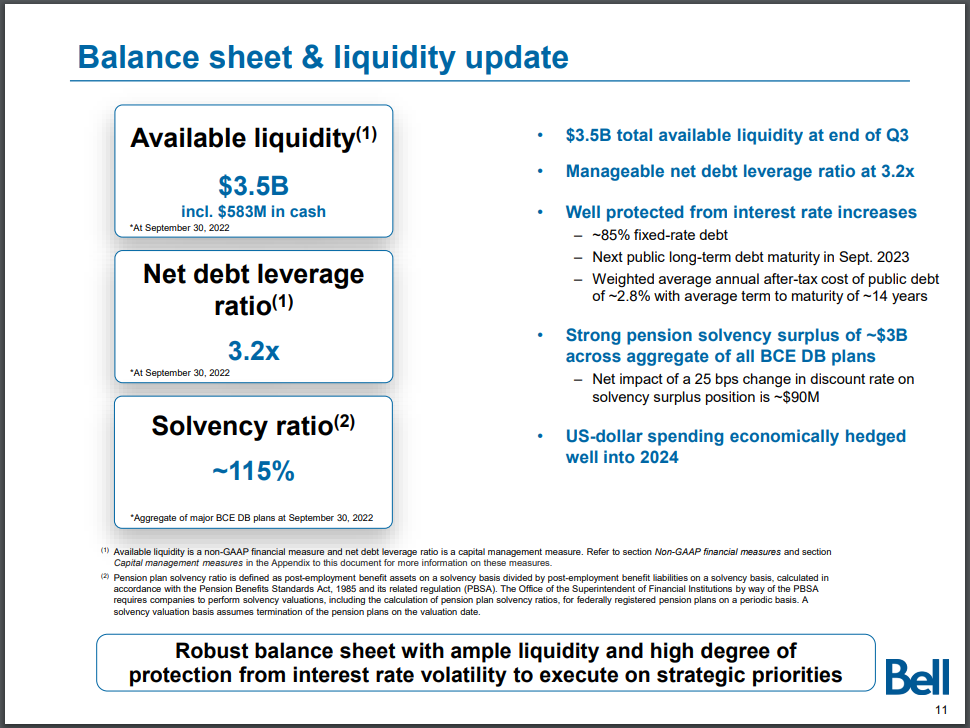

Source: Investor Presentation

At the end of the third quarter, BCE had C$3.5 billion of available liquidity, which included $583 million in cash. Additionally, its net debt to adjusted EBITDA ratio was 3.2x.

Dividend Analysis

BCE Inc. pays a C$3.68 annual dividend. The company last increased its dividend by 5% in February 2022, representing its thirteenth consecutive annual dividend increase. At the current share price, BCE has a high dividend yield of 6.0%, which is 80 basis points above its ten-year average yield of 5.2%.

Based on our EPS estimate of US$2.66 for 2022, the company is forecasted to pay out about 102% of earnings in dividends. This is a risky payout ratio, which indicates that the dividend could be in danger.

However, BCE invests heavily in its infrastructure and also experiences high levels of depreciation and amortization, which negatively skews earnings. As a result, calculating the company’s payout ratio as a percent of free cash flow could be more insightful. However, BCE’s FCF has been reduced in the short term from intensive capital investments and is set to rebound in 2023 and beyond.

Given our earnings growth estimate, which outstrips the dividend growth estimate, we believe that the company’s dividend payout ratio will moderate in the years to come.

Final Thoughts

BCE Inc. has not seen much growth in the last decade on a U.S. currency basis. However, going forward, we expect the company to grow by mid-single digits. Today, BCE has a high dividend yield of 6.0%.

The company has increased its dividend for thirteen consecutive years. While the payout ratio was favorable in the first half of the last decade, the payout ratio as a percentage of earnings has eclipsed 100% since the COVID-19 crisis. If the company can grow its earnings faster than its dividends going forward, the payout ratio should moderate.

BCE should be tapering off its capital investments in the coming years, which should see a significant increase in free cash flow, from which the company could safely pay its dividend.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].