Published on January 7th, 2023 by Josh Arnold

Utility stocks tend to be great sources of dividends for investors that seek income. The reason is because utilities have fixed pricing that all but ensures a certain level of profits, set by regulators in the localities where they operate. That level of profit is enough to reinvest in the company’s infrastructure, but also to provide ample returns to shareholders. In addition, the demand for power tends to be quite stable, with a gentle upward slope, meaning utility stocks also tend to land on the list of those with the longest dividend increase streaks. Rarely, we see a stock in the utility sector that also has an outstanding current yield.

One such stock is Algonquin Power & Utilities Corporation (AQN), a moderately sized power utility with a market cap of just under $5 billion, and a streak of dividend increases that stands at 10 years. Algonquin’s current yield is fractionally under 5%, landing it on our list of high-yield stocks.

This list contains about 200 stocks with yields of at least 5%, meaning they all yield at least three times that of the S&P 500.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In the article below, we’ll take a look at Algonquin’s investment prospects today.

Business Overview

Algonquin is a holding company for a portfolio of regulated and non-regulated power generation, distribution, and transmission utility assets. The company has two segments: Regulated Services, and Renewable Energy. The regulated business is a traditional utility that operates in the US, Canada, Chile, and Bermuda. It provides distribution services to 1.1 million connections in electric, natural gas, water, and wastewater. The renewable business is non-regulated, and generates and sells electrical energy, capacity, and related products and services in the US and Canada. The company generates renewable power through hydroelectric, wind, solar, and thermal facilities.

Algonquin was founded in 1988, is expected to produce about $3 billion in revenue in 2023, and trades with a market cap of $4.8 billion.

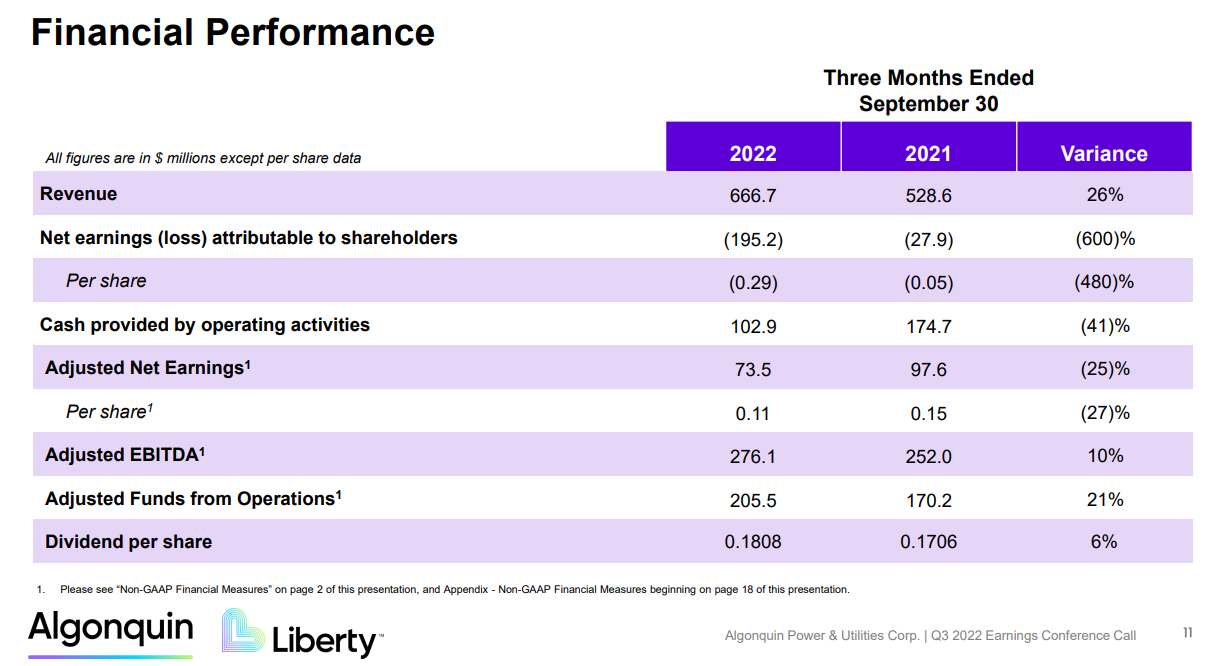

The company posted third quarter earnings on November 11th, 2022, the summary of which is below.

Source: Investor presentation, page 11

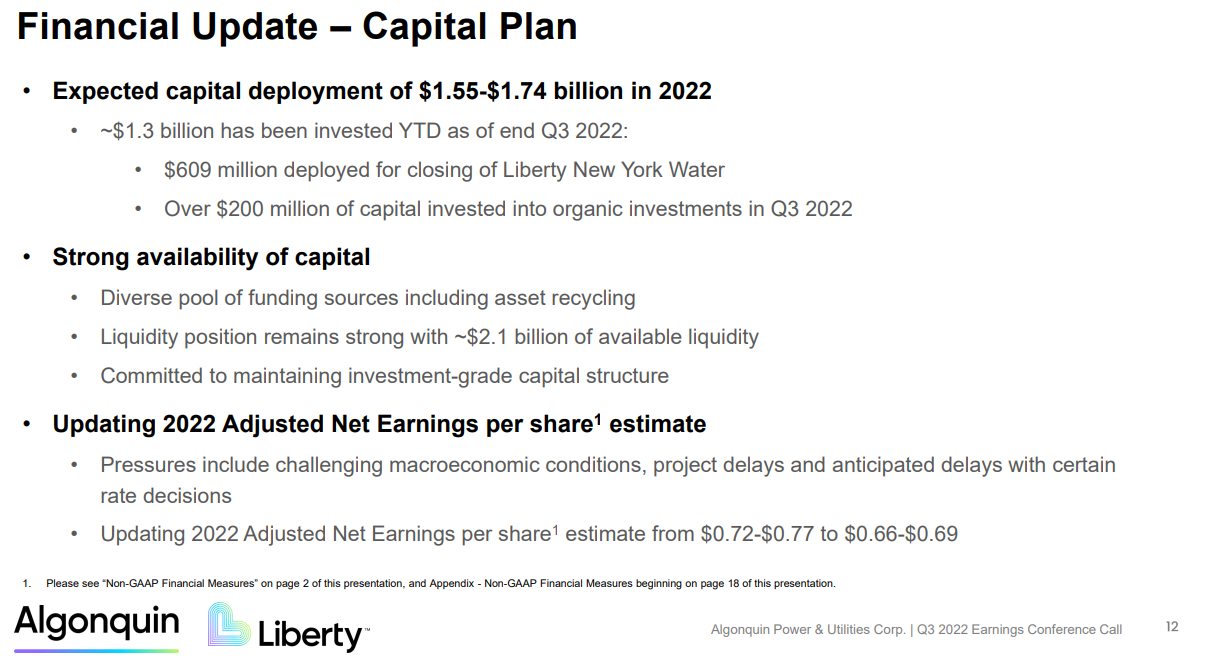

Adjusted earnings-per-share came to 11 cents in Q3, which missed estimates by a nickel. Revenue was $667 million, up 26% year-over-year, and beat estimates by a staggering $72 million. However, guidance for the year was slashed from a range of 72 cents to 77 cents in earnings-per-share, to a new range of 66 cents to 69 cents. The stock traded 30% lower in the immediate aftermath of the report as investors became concerned about its ability to finance the dividend. Algonquin cited “challenging” macroeconomic conditions, as well as construction delays that it believes will extend well into 2023. In addition, higher interest rates were cited as an earnings headwind, as well as the timing of tax incentives on certain renewable energy projects.

The planned acquisition of Kentucky Power was rejected by regulators in mid-December, meaning Algonquin must either prove the acquisition won’t harm customers – likely through price cuts – or it must abandon the acquisition. Either scenario will result in lower-than-planned long-term growth in the regulated utility business.

With all of that in mind, we updated our estimate of 2022 earnings-per-share to 68 cents, which would represent a modest decline against 2021’s earnings of 71 cents per share.

Growth Prospects

Algonquin, unlike most utilities, actually has a fairly strong earnings growth history. However, that was due in no small part to the company’s lackluster earnings in past years, which made the base from which to grow quite small. As an example, the company earned just 14 cents per share in 2012, but nearly doubled that total in 2013. We project the potential for 6.5% earnings growth in the years to come, as Algonquin is making aggressive investments in its infrastructure, as well as planned acquisitions, to help grow its regulated and non-regulated bases. We note the rejection of the Kentucky Power business as a potential headwind to this growth rate.

We reiterate that unlike many utilities, Algonquin’s earnings growth over the past decade has been erratic rather than smooth. The company has diversified its asset base with its renewable business, but we note that business is more volatile given it is unregulated.

Source: Investor presentation, page 12

One headwind to note is that the company prefers using equity to finance acquisitions, so if Kentucky Power ends up being consummated, or any other deal, shareholder dilution is a likely outcome. The company is targeting about 70% of its investment capital into the regulated business, and about 30% into the renewable business.

Competitive Advantages

Algonquin operates in much the same way as every other power utility, and while that doesn’t make it different, it does mean it has what amounts to a monopoly in its service areas. That creates built-in demand and recession resistance, at least in the regulated business. The renewables business is more of a wildcard, in that it offers better long-term growth prospects, at the expense of predictability and built-in pricing power. As a utility, there isn’t anything the company can do to boost its competitive advantage given the industry’s enormous amount of regulation.

Dividend Analysis

Algonquin has boosted its dividend for 10 consecutive years, but it has routinely paid more in dividends than it produced in earnings. This has required the company to fill the gap with other sources of funding, including equity and balance sheet sources, which is unsustainable. Indeed, earnings for 2022 are projected to be slightly under the dividend by about four cents. That sort of shortfall can be filled temporarily, but we believe the company may at least need to pause increases, or potentially put in a dividend cut to save cash.

The company has a staggering $7.3 billion in long-term debt, which makes additional borrowing either very expensive, or impossible. That exacerbates the need to save capital with the dividend, particularly if earnings are at risk.

The yield is currently 4.9%, which is quite good for any stock, but in particular, for a utility. However, we believe this is in no small part due to the risk that the dividend may need to be cut in 2023, or at the very least, that the increase streak is at high risk of not continuing.

Final Thoughts

Algonquin shares have an attractive yield, but we caution that is likely due to the market pricing in the odds of a potential dividend cut. The 4.9% yield is much higher than the company’s historical average yields, so if Algonquin can manage to continue paying the dividend, it offers significant value today. However, we believe the risks at the moment are elevated that a cut will become necessary.

The stock was down about 50% in 2022, and while 2023 likely won’t be as harsh, we cannot recommend Algonquin as a secure dividend stock today.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].