Editor’s word: Searching for Alpha is proud to welcome Hindsight Investor as a brand new contributor. It is easy to turn into a Searching for Alpha contributor and earn cash to your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to seek out out extra »

Justin Sullivan/Getty Photos Information

Funding Thesis

Hibbett, Inc. (NASDAQ:HIBB) is a small-scale sporting items retailer catering to rural, underserved communities. Their inventory is down 38% YTD after peaking at $101.65 in November 2021. Along with macro headwinds, buyers have been involved about Hibbett’s relationship with its wholesale companions. Administration eased these considerations through the This autumn 2022 earnings name, however the market has didn’t take discover. With this concern behind them, Hibbett could also be poised to rally as soon as the macro atmosphere begins to enhance. At its present valuation, I imagine Hibbett provides a suitable margin of security in relation to its intrinsic worth.

Area of interest Market, A Pure Deterrent To Competitors

Hibbett is like Dick’s Sporting Items (DKS) besides their retailer footprint might be 1 / 4 of the dimensions. Over time, Hibbett has been profitable in rising income and profitability as a result of they cater to a distinct segment market – I can attest to this personally. I reside within the Cincinnati space now, however I’m from a small city in West Virginia the place Hibbett is the one recreation on the town for sporting items, other than the very restricted, off-brand choice accessible at Walmart (WMT).

Initially, I assumed Hibbett could be run out of enterprise by Amazon (AMZN) or Dick’s, however I failed to contemplate the communities during which they serve. Hibbett’s area of interest market of underserved, low to median-income communities is a deterrent to big-box retailers.

Not sufficient site visitors or inhabitants to warrant large field enlargement

That is very true for bodily shops. Consider the place you would possibly discover a Greenback Common (DG) – there’s prone to be a Hibbett close by. It simply doesn’t make sense to position a Dick’s Sporting Items in small-town America, but that’s precisely the place you discover Hibbett.

Supply to those communities is costlier and may take too lengthy

Not too long ago, I attempted ordering an merchandise from Amazon to have it delivered to my former hometown. I ended up not putting the order as a result of it was going to take 3 days to ship. In Cincinnati, I’m spoiled by subsequent day and even same-day supply from Amazon. In rural America, supply delay is a matter irrespective of the retailer – Amazon, Nike, Dick’s… you title it.

I’m not suggesting Amazon or others can’t steal share from Hibbett. I’m suggesting there’s little incentive for them to take action. Nike, Dick’s, and Amazon will not be going to develop their EPS sufficient to fulfill shareholders by focusing on Hibbett’s lower than $2 billion in annual gross sales.

Hibbett’s Model Partnerships Intact And Sturdy

Nike has been dropping retail companions like flies the previous few years to deal with the D2C channel. Notable names embody Dillard’s (DDS), City Outfitters (URBN), and Macy’s (M). On February 25, information broke that Nike added Foot Locker (FL) to the checklist. Foot Locker shares tumbled 30% in a single day. Nike later confirmed the rumor to not be true, however the injury had been executed.

Because it does, the market utilized Foot Locker’s dangerous information to each firm having a relationship with Nike – Hibbett included. Though Hibbett shares had been down 55% from their excessive at that time, the information didn’t assist sentiment; it has been buying and selling sideways ever since.

Chart courtesy of Searching for Alpha

Luckily, throughout Hibbett’s This autumn 2022 earnings name, administration reiterated a powerful and mutually useful relationship remained intact with its model companions. Although administration didn’t point out them by title, it was implied Nike was the companion in query (Nike’s headquarters is in Beaverton, OR). Here is what Jared Briskin, EVP Merchandising at Hibbett, mentioned in response to an analyst query on the name:

After which lastly, the — are you able to speak about your relationship along with your largest distributors, particularly the one from Beaverton, and the way assured you’re in what’s occurring there, how they’re supporting your new retailer opening plans and so forth and so forth? ... Samuel Poser (Williams Buying and selling)

Sure, certain, Sam. And as we have mentioned on earlier calls, we’re very assured in our positioning with our strategic vendor companions. Clearly, COVID’s had a fairly dramatic affect on the provision chain. That is led to plenty of short-term issues with regard to order administration points, order modifications and cancellation play, so on and so forth.

However on the identical time, we have been in a position to ship a major quantity of receipts over and above historic norms, which I believe displays the extent of help and precedence that we’re getting from our strategic companions.

Our technique continues to be to deal with the underserved client in underserved markets, as Ben talked about earlier, all bolstered with the premium client expertise, and that is extremely differentiated within the market and stays largely complementary to our companions.” … Jared Briskin (Hibbett – EVP Merchandising)

Moreover, I don’t imagine it is smart for Nike, who’s by far Hibbett’s largest merchandiser at +70% of gross sales, to chop ties with Hibbett. Doing so would probably trigger a loss in gross sales for Nike, albeit a small affect total, as a result of Hibbett prospects are prone to commerce down, settling for Walmart the place gadgets can be found identical day in retailer. Thus, it will seem Nike’s relationship with Hibbett actually is mutually useful. On the finish of the day, there are extra Nike merchandise in customers’ arms on account of Hibbett.

Aggressive Panorama

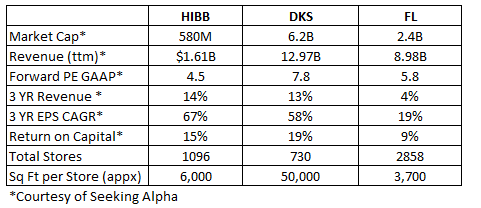

Hibbett’s closest competitor might be Dick’s Sporting Items, however Foot Locker additionally makes for comparability as a result of they work with the identical model companions. Right here is how Hibbett compares on key metrics:

Key metrics comparability (Creator’s private information)

HIBB Inventory – Engaging Valuation

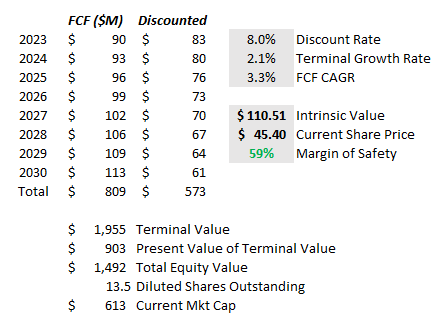

I carried out a DCF evaluation in addition to a market a number of valuation for Hibbett. Conclusion: Hibbett’s present share worth of $44.83 is reasonable, irrespective of how I slice it.

Utilizing the DCF, I arrive at an intrinsic worth of $110.51.

DCF Evaluation (Creator’s private valuation software)

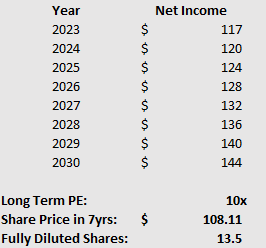

Utilizing the market a number of strategy, I arrive at a good worth of $108.11, which excludes dividends and share repurchases. I assumed income development of three%, internet margins of seven%, and a long-term P/E of 10, close to its 5YR common. I imagine these are extraordinarily conservative assumptions given Hibbett’s previous efficiency and long-term goals, that are $2 billion in gross sales by 2025 with 10% working margins.

Market A number of Valuation (Creator’s private valuation software)

At its present share worth, I imagine Hibbett can beat the S&P 500 over the subsequent a number of years, returning +13% yearly to achieve its intrinsic worth of roughly $110 by 2030.

Dangers

No funding is with out its dangers. Listed below are just a few to contemplate earlier than taking on a place in Hibbett.

Nike holds substantial affect

Whereas I imagine the chance to be low, Hibbett would take a considerable hit if Nike determined to chop ties or considerably reduce operations with the small-town retailer.

Current stock buildup, a priority

Of their Q1 2023 earnings launch, Hibbett reported stock of $314.9 million, a 72.6% improve over the identical interval final 12 months. The stock buildup was to offset provide chain points and guarantee in-store product availability. Nevertheless, within the present macro atmosphere, I fear this may increasingly have been too formidable. There’s a danger of elevated promotional exercise and merchandise write-downs if macro headwinds don’t ease quickly. This might hit gross margin considerably within the close to time period.

Firm might revert to its former self

Hibbett re-baselined key monetary targets, akin to working margin, post-pandemic. Certainly, working margin improved from 3-4% pre-pandemic to 13.5% in 2022. Hibbett believes it’s a completely different firm now – I are likely to imagine the identical – however there’s danger the corporate reverts to its former self with decrease margins and profitability.

Conclusion

Hibbett seems to be a beautiful worth alternative at its present share worth. The corporate operates in a distinct segment market that deters big-box competitors, has cleared the Nike headwind which was weighing on sentiment, and is reasonable by most measures. The chance-reward profile seems favorable and could also be attractive for growth-oriented worth buyers.