Phiromya Intawongpan

In the search for a great value idea, I found Heritage Insurance Holdings (NYSE:HRTG) as an undervalued Property & Casualty insurance company. Heritage Insurance is priced significantly below the industry and below book value, leaving plenty of upside potential for the stock. The company has a solid strategy for growth and cost efficiencies which has a good chance of driving strong increases in net income going forward.

Company Background

Heritage Insurance provides property and casualty insurance as a holding company. Heritage offers policies to residential and commercial customers. The company covers multiple states including: personal residential insurance in Alabama, California, Connecticut, Delaware, Florida, Georgia, Hawaii, Maryland, Massachusetts, Mississippi, New Jersey, New York, North Carolina, Rhode Island, South Carolina, and Virginia; and commercial residential insurance in Florida, New Jersey, and New York.

Heritage is vertically integrated as the company manages all aspects of the insurance process including: risk management, underwriting, claims processing/adjusting, actuarial rate making/reserving, customer service and distribution.

Improving Financials

Heritage is bouncing back from having two full years of negative net income in 2021 and 2022. The company achieved positive net income for the past three quarters and is on track to achieve positive net income for the full fiscal year of 2023. The operating income margin increased from negative 10% in 2022 to a positive 0.70% for the trailing 12 months.

Heritage Insurance Holdings (HRTG) Operating Income (in millions) (Seeking Alpha)

The net income margin also turned positive over the past three quarters going from a negative 29% in Q3 2022 to positive margins of 7.5% for Q4 2022, 7.9% for Q1 2023, and 4.2% for Q2 2023. The dip in net income margin from Q1 to Q2 was a result of higher policy benefit payouts and slightly higher underwriting and SG&A costs in Q2.

Heritage Insurance Holdings (HRTG) Net Income (in millions) (Seeking Alpha)

Positive Q2 2023 Results

Heritage’s improved performance was highlighted during Q2 2023. Heritage achieved an increase in premiums & annuity revenues of 18.5% in Q2 2023 over Q2 2022. This was achieved while decreasing policy count by 11.1%.

This success was largely attributed to gains in the Florida market where the company’s commercial residential in-force premiums increased 75.5% while total insured value for that market increased by 75.5% in Q2 2023 over Q2 2022.

Heritage is expected to build on this success through a set of key strategies which I’ll discuss later in the article. Heritage is also benefitting from Florida’s new insurance law known as Bill 2A. This law, which began on March 1, 2023, has some stricter regulations that Heritage is adjusting to. However, the company should see net benefits as it provides cost savings from not having to pay attorney fees when insured policyholders win a lawsuit. Heritage can also benefit from less fraud since assignment benefits have been eliminated. Another plus for Heritage as part of the law is a reduction in claims-related litigation due to revisions in the ‘bad faith statute’.

Significantly Undervalued

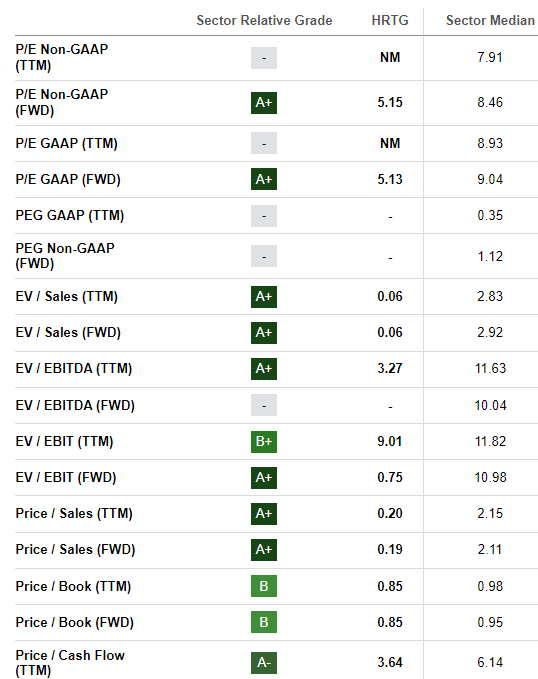

Heritage Insurance Holdings (HRTG) Valuation (Seeking Alpha)

We can see from the table above that Heritage is undervalued based on all metrics as compared to the sector median. There aren’t a lot of profitable companies in today’s market with PE ratios at 5x and Price/Sales ratios at 0.20. However, the most important valuation metric that I’d like to highlight for Heritage is the Price/Book ratio.

The Price/Book ratio is important for an insurance firm because the book value or shareholders’ equity is a good representation of an insurance company’s value. Strong book value shows that a company has a good ratio of total assets to total liabilities. This is a good measure of the balance sheet and financial strength. Heritage has 1.07x more total assets than total liabilities for total equity of $160.6 million. This shows that Heritage is not weighed down by too much debt in relation to assets.

Heritage has $154.5 million in total debt with $92.6 million in net debt. The company has $247.1 million in total cash and $685.4 million in total investments (which is 98% debt securities). The liabilities include $817.9 million in unpaid claims and $793.3 million in unearned premiums. Heritage should benefit from higher interest rates on its debt security investments.

I would also like to point out that Heritage has a BBB- credit rating from Fitch which is considered stable. This rating means that there is a low expectation of default for Heritage. However, it also means that certain business or economic factors could negatively affect the company. For Heritage that could mean higher than average claim payouts.

With a Price/Book of 0.85, Heritage is valued below the sector median of 0.98 and the Property & Casualty Insurance industry’s Price/Book of 2.06. Typically, insurance firms are considered attractive to buy when the Price/Book is at one or below. Therefore, Heritage is attractively valued with a Price/Book below one. This leaves plenty of room to the upside for HRTG as the company continues to grow.

HRTG’s peer with a similar market cap, Root, Inc. (ROOT), is trading with a Price/Book of 0.64. However, ROOT has consensus expectations for continued net losses in 2023 and 2024. Therefore, I see ROOT as a value trap, while HRTG is really the better buy with expectations of positive net income growth for 2023 and 2024.

Attractive Forward-Looking ROE

Another good measure for insurance firms is the return on equity [ROE]. Heritage could be overlooked because the stock currently has a trailing ROE of -8.2% for the past 12 months. This was a result of having negative net income of $14 million for the trailing 12-month period.

Heritage Insurance (HRTG) Stock Price vs. ROE (YCharts.com)

The main reason for HRTG’s low valuation can be seen in the chart above. The ROE tends to correlate well with the stock price. We can see that Heritage experienced a decline in ROE from 2016 to 2022. The stock price dropped significantly as a result, thus lowering the valuation to below book value. The rising ROE and the gap between it and the current price indicate that the stock price has plenty of room to increase.

The good news for Heritage is that the company is expected to achieve earnings per share growth of about 18% to $1.25 for 2024. Heritage tends to have net income gains approximately in line with EPS growth. So, I estimate that net income will also rise by about 18% in 2024. This would be on top of the expected 118% growth from 2022 to 2023 (from a negative EPS of $5.86 in to a positive $1.06). This would take net income from a negative $154.4 million in 2022 to a positive $27.8 million in 2023 and then to $32.8 million in 2024.

To estimate the ROE by the end of 2023, I’ll take the expected net income of $27.8 million divided by the trailing 12-month total equity of $160.6 million to get an ROE of 17.3%. Keep in mind that this is just an estimate since we don’t know the exact figure for the end-of-year equity or the exact amount of net income.

The estimated forward ROE of 17.3% is higher than the sector median of 11.22%. I would consider ROEs above 15% to be strong for this sector. This strong return on net assets demonstrates the company’s ability to improve its performance. Those strong improvements from negative net income to positive have the potential to drive the stock higher from the attractive valuation level.

Strategies Behind the Improved Performance

Heritage has a number of initiatives in place to improve profitability. This includes selective underwriting which ensures that risk is minimized among policyholders. Strategies are also in place for rate adequacy to strive for optimal premium pricing to drive revenue and profit growth.

Another strategy is optimizing capital allocation to effectively manage risk. Effective capital allocation can ensure that Heritage can handle large claims that can come with significant events such as hurricanes and other disasters.

Providing the appropriate coverage for the market and having a diverse portfolio are some other strategies that Heritage is employing to maximize the top and bottom lines. Regarding a diverse portfolio: no state in Heritage’s coverage represents more than 26.2% of the company’s total insurable value [TIV]. These spreads risk out among numerous regions so that a significant natural disaster in one area is not catastrophic for Heritage.

These strategies are beginning to show success as the company is close to returning to profitability with an improving ROE. If this success continues, Heritage has a good chance to grow net income while minimizing downside risk. Of course, this depends on the magnitude and frequency of catastrophic events among the insured regions. That is the main risk for the company in my opinion. The good news is that Heritage has strategies in place to manage and minimize risk so that significant events wouldn’t likely bankrupt the company.

Heritage is rolling out a new billing/policy system which is expected to launch in early 2024. The company expects that the new system will improve process efficiencies. The system provides efficient data collection & analytics with the ability to scale up. Another positive for this system is that it is designed to improve customer service for a better policyholder experience. This new system can help drive down costs to help expand margins and grow net income.

Final Thoughts on Heritage Insurance Holdings

Overall, the company is attractively undervalued as it trades below its book value. This undervaluation is magnified due to Heritage’s improvements in returning to profitability and increasing ROE over the long term.

Heritage is expected to report earnings for Q3 2023 on November 2, 2023. The company is expected to experience a slight EPS loss of $0.21 for Q3 most likely due to a spike in claims. However, this would be an 82% improvement in normalized EPS of negative $1.17 from Q3 2022. I expect Heritage to report positively about future quarters and the company’s long-term outlook due to its strategies.

Heritage has effective strategies in place to grow net income while effectively minimizing risk. The growth is likely to drive the stock higher from the low valuation. Given this scenario, I believe that the stock should be trading at least at Book Value. This puts the stock at $6.28 or 15% higher than the current price. Of course, with profitability returning and growing, even larger gains are not out of the question. If overall claims remain average or below average over the next year, then I would expect the stock to increase by 20% to 30% by approximately this time next year.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!