These not dwelling underneath a rock for the previous 12 months may skip these opening paragraphs as they’re nicely conscious the true property market has been on hearth. They’re additionally conscious that inflation is uncontrolled (and more likely to keep that manner), having hit 9.1% in June, the very best for the reason that early 80s. On prime of that, GDP shrank 0.9% within the second quarter of 2022, that means we now have had two adverse quarters in a row, i.e., the US is in a recession.

Add the inventory market being down nearly 20% year-to-date, the crypto collapse, close to document low client confidence and labor pressure participation, together with sturdy indicators that the Fed will proceed to lift rates of interest.

But, as famous, actual property costs have skyrocketed in the course of all this financial turmoil. In June of 2022, the median listing worth was up 16.9% year-over-year and up 31.4% as in comparison with June 2020! This chart actually drives that time house:

So, are we about to see the true property market collapse prefer it did in 2008?

Properly, for many who skipped the primary few paragraphs, the quick reply as to if 2008 is about to repeat itself is sort of actually not.

Why This Time is Completely different (Though Nonetheless Unhealthy)

There’s a cautionary saying amongst army strategists that goes one thing like “armies put together to struggle their final warfare, somewhat than the subsequent warfare.” Certainly, there have been calvary costs originally of World Battle I. Then the French tried to construct an impenetrable tremendous trench referred to as the Maginot Line to stop a German advance if a second world warfare broke out. When it did, the Germans have been in a position to merely blitzkrieg their manner round it by way of the Netherlands and Belgium, marching their manner into Paris inside six weeks.

An identical impact goes on when occupied with economics. Having lived by way of the true property bubble of the late 2000s and subsequent Nice Recession, that is the financial calamity on the prime of everybody’s thoughts and thereby what many consider will see itself repeated in 2022.

However our present woes bear far more resemblance to the stagflation of the Nineteen Seventies and early Nineteen Eighties. That “misplaced decade” noticed low progress and excessive inflation all through. And it required a reasonably nasty recession in 1982 to get out of after Federal Reserve chairman Paul Volker jacked rates of interest up into the kids to “break the again of inflation.”

Excessive inflation and low progress (and even shallow recessions as we now have now) are most likely what we now have to look ahead to for the foreseeable future. However an all-out collapse, significantly in actual property, is unlikely.

For one, lots of the scary headlines on the market lack a whole lot of context. For instance, as you’ve actually seen within the information, mortgage defaults rose from 0.6% in April 2021 to 1% by the tip of the 12 months, however they’re nonetheless manner under what they’ve been over the past decade.

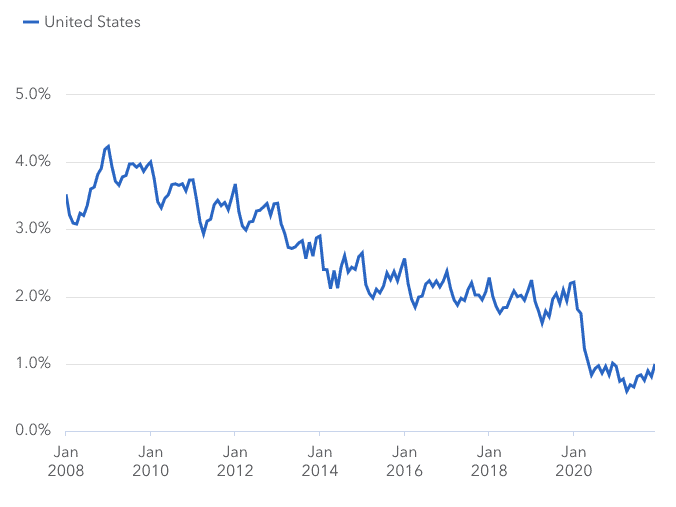

nationwide common (January 2008 – December 2021) – Shopper Finance Safety Bureau

Property gross sales have additionally fallen 14.2% year-over-year from June 2021. However as soon as once more, beginning at a date in such an excessive vendor’s market is deceptive. Gross sales are nonetheless above what they have been in 2020 and about equal to 2019. The market was scorching in 2019.

The true property market was so ridiculously scorching in 2021 that it had just one solution to go. It actually needed to cool off earlier than costs outpaced all semblance of affordability. Luckily, there are a number of main elements that ought to stop any form of collapse.

1. Common Inflation

Residing by way of the present bout of excessive inflation makes it pretty much as good a time as any to be taught the distinction between actual and nominal costs. Nominal costs are simply what they look like. Actual costs take inflation into consideration. So, if inflation is 9% and actual property costs go up 10%, in actual phrases, values have solely gone up 1%.

In different phrases, normal inflation makes nominally excessive actual property appreciation charges much less significant. Previous to the 2008 monetary disaster, inflation charges have been low. They most actually aren’t low immediately.

Certainly, nominal costs for actual property have been by no means adverse in the course of the 1973-1982 stagflation. They have been, nevertheless, adverse in actual phrases for a number of years and for the economically troubled decade. General they simply about stored tempo with inflation; not good by any means, however not a disaster both.

| Yr | Inflation Charge (YoY) | Residence Costs (YoY) |

|---|---|---|

| 1973 | 6% | 16% |

| 1974 | 11% | 9% |

| 1975 | 9% | 8% |

| 1976 | 6% | 11% |

| 1977 | 7% | 10% |

| 1978 | 8% | 12% |

| 1979 | 11% | 11% |

| 1980 | 14% | 3% |

| 1981 | 10% | 6% |

| 1982 | 6% | 1% |

| Common | 9% | 9% |

We’re more likely to see one thing like this once more.

And whereas it’s not good for house costs to develop slower than inflation, a fall in actual worth is best than a fall in nominal worth due to the best way debt works, as shall be elaborated on under.

2. The Lending Surroundings is Completely different (and Higher) than 2008

Everybody remembers the madness that preceded the 2008 collapse. When you had a pulse, banks would lend to you. It was not unusual to get 100% of the property financed with an 80/20 mortgage (80% LTV on the primary mortgage and 20% second). Said earnings loans (the place you merely said your earnings, verification elective) have been all the fad, and the notorious NINJA loans (No Earnings, No Job, No Property) have been being handed out like sweet.

I imply, why not? Housing at all times goes up, doesn’t it?

Then there have been the teaser charges. Many unscrupulous lenders would provide very low starter charges for a number of months or a 12 months, after which they’d rocket up 4 or 5 share factors after that. On prime of this, many loans began as curiosity solely or have been even negatively amortized, the place the principal stability grew with every fee. These householders relied strictly on appreciation to have any fairness within the house.

So, when the music stopped, that they had nothing to lose.

Luckily, except for excessive LTV loans, most of this nonsense has stopped. The teaser charges are principally gone and Investopedia notes, “NINJA loans largely disappeared.”

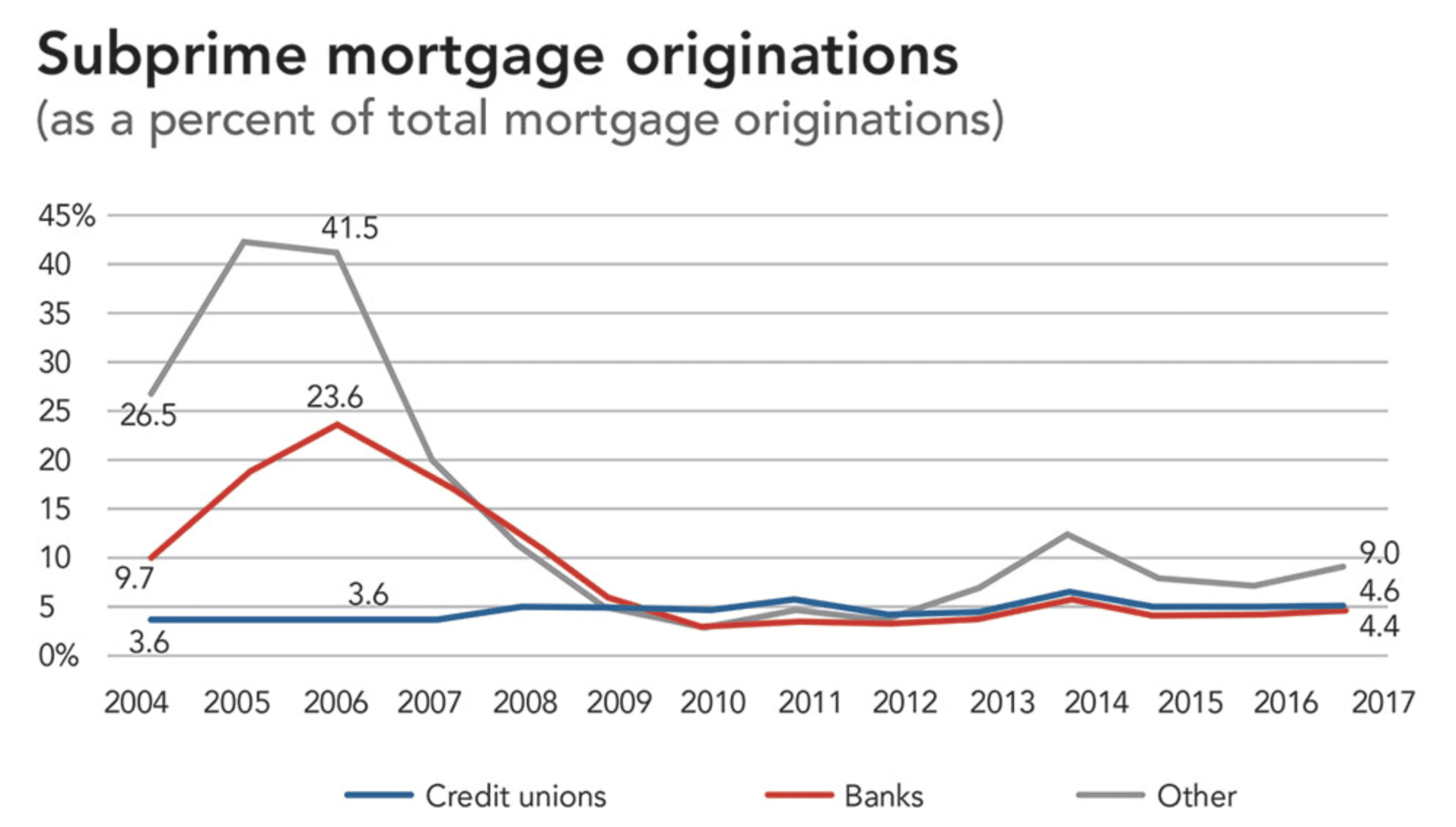

The standard of debtors has additionally indisputably gotten higher. Earlier than 2008, subprime loans have been being made en masse. The Credit score Union Nationwide Affiliation states, “Whereas ‘subprime’ isn’t simply outlined, it’s typically understood as characterizing significantly dangerous loans with rates of interest which might be nicely above market charges.”

The Credit score Union Nationwide Affiliation makes use of the Residence Mortgage Disclosure Act information to find out what number of subprime mortgages are taken out annually, and the variety of such loans being made has plummeted for the reason that crash:

Even the loan-to-value ratios aren’t as dangerous as earlier than for 2 causes. One, nearly probably the most you may get is 96.5% with an FHA mortgage, which is at the least one thing down. Two, given how a lot appreciation has occurred simply within the final 12 months, anybody who has purchased a house a 12 months or extra in the past has a considerable quantity of fairness of their property.

Because of this even when the market fell 20%, the overwhelming majority of individuals would nonetheless have optimistic fairness of their properties. In 2008, with so many individuals having near-100% mortgages on properties that have been collapsing in worth, many fell “underwater,” the place the property had extra debt connected to it than it was price. Thus, a vicious cycle started as many owners opted for “strategic defaults” as a result of it merely didn’t make sense to pay for a property that was price lower than nothing. This induced the market to fall even additional.

However as famous above, in a excessive inflation atmosphere, it’s extremely potential that actual property values may go down in actual phrases with out happening in nominal phrases. (For instance, actual property values go up 3%, whereas inflation is 7%). Provided that mortgages are unaffected by inflation, a nominal loss could make a strategic default the rationale choice for householders. However an actual loss that’s nonetheless nominally optimistic won’t ever make a strategic default the rationale choice.

And once more, we’re in a excessive inflation atmosphere, in contrast to the low inflation atmosphere that preceded the 2008 monetary disaster.

The opposite issue that made loans unpayable have been the rates of interest that shot up after the teaser fee expired. As famous above, these are principally gone. However as well as, there are fewer adjustable-rate mortgages than there have been within the years earlier than the crash. As The Monetary Samurai factors out, solely 4.7% of mortgages taken out in 2021 have been adjustable-rate mortgages! The remainder have been fixed-rate.

For comparability, again in 2006, nearly 35% have been adjustable-rate mortgages.

Thus, if the Fed continues to lift charges as anticipated, it can soften the market by making it costlier to take out a mortgage, however most present householders received’t be affected.

We’ve spent the previous 12 months refinancing all our funding loans with fixed-rate phrases till at the least 2027 to hedge towards fee will increase. My private house mortgage is at 3% on a 30-year mounted fee. Clearly, I’ll by no means refinance that one.

Certainly, as many individuals now have extremely low-interest loans mounted for 30 years and practically each landlord’s hire will increase haven’t stored up with quickly rising market rents, and extra cities and states restrict the quantity landlords can improve hire; it’s a must to wonder if anybody will ever transfer once more? However that’s a subject for an additional time.

The final level is that if unemployment shoots up, folks received’t have the ability to make their funds even when they’ve nice rates of interest. That is true, and a recession would undoubtedly improve the variety of foreclosures. However we’re already in a recession, and unemployment is barely 3.6%. If something, employers can’t discover sufficient folks prepared to work.

That might change, however it will appear the dynamics of this recession are a lot totally different than in 2008, and reaching 10% unemployment is unlikely. However even when that have been to occur, loads of well-capitalized buyers, together with on Wall Avenue this time round, want to purchase. And since sellers can have fairness of their properties, excessive unemployment is unlikely to set off a spiral of foreclosures like in 2008.

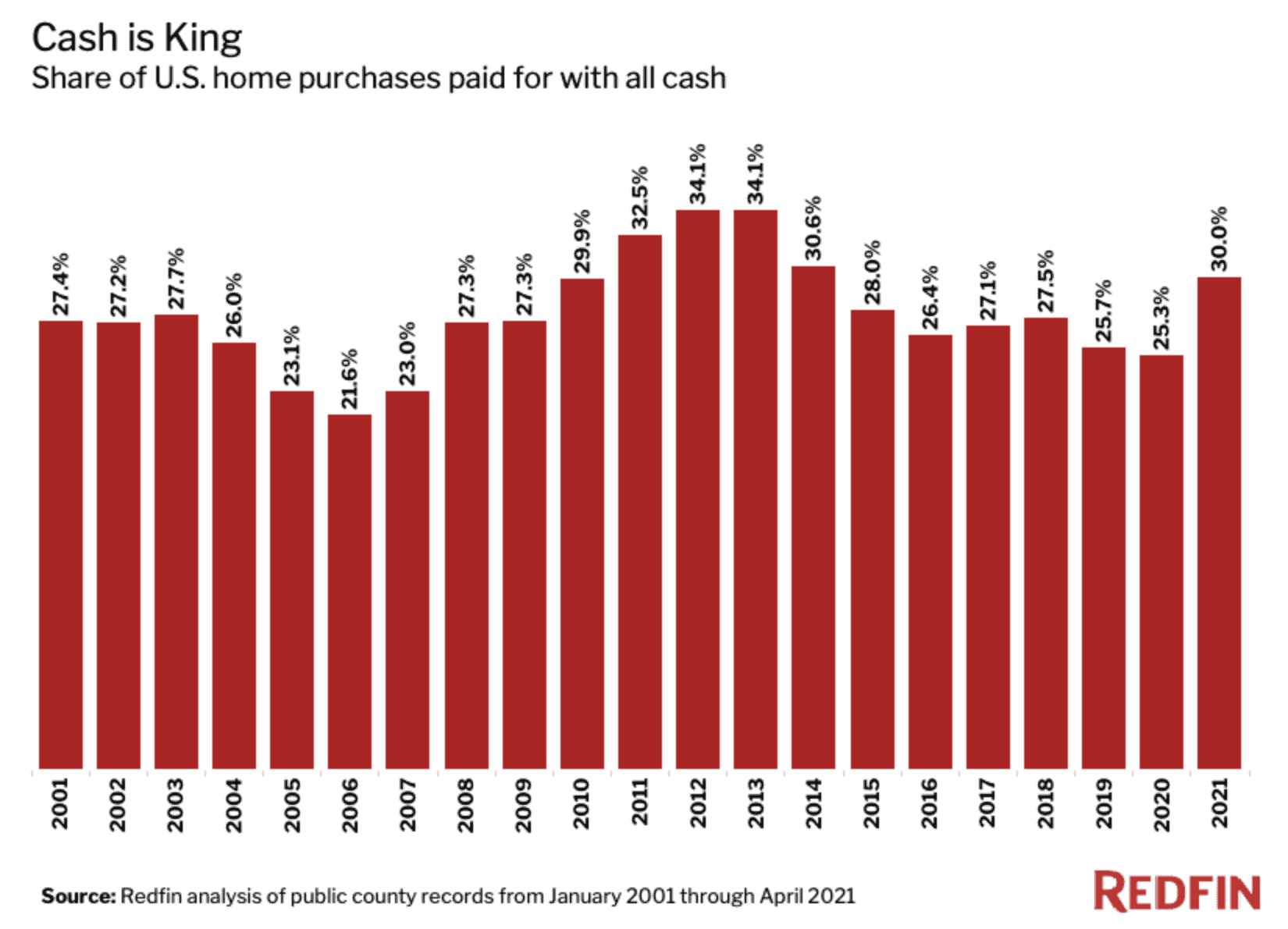

However furthermore, many extra property homeowners don’t even have mortgages to start with. The share of money patrons versus these shopping for with a mortgage was 30% in 2021 based on Redfin, the very best its been since 2014. Within the three years previous the 2008 crash, the charges have been 23.1%, 21.6%, and 23%.

Since 2008, it’s been at the least 25% annually and infrequently over 30%.

It’s laborious to get foreclosed on while you don’t have a mortgage within the first place.

3. There’s Nonetheless a Housing Disaster

Nonetheless, the most important purpose a housing collapse is unlikely is as a result of provide and demand are nonetheless undefeated.

And on the subject of housing, demand is blowing provide out of the water.

Based on Freddie Mac, in 2020, the US had a document 3.8-million-unit shortfall.

Earlier than the 2008 Monetary Disaster, the U.S. confronted the other scenario. Certainly, the nation was plagued by “recession ghost cities” and all-but-empty, newly constructed subdivisions. These days, 50-plus folks present as much as an open home.

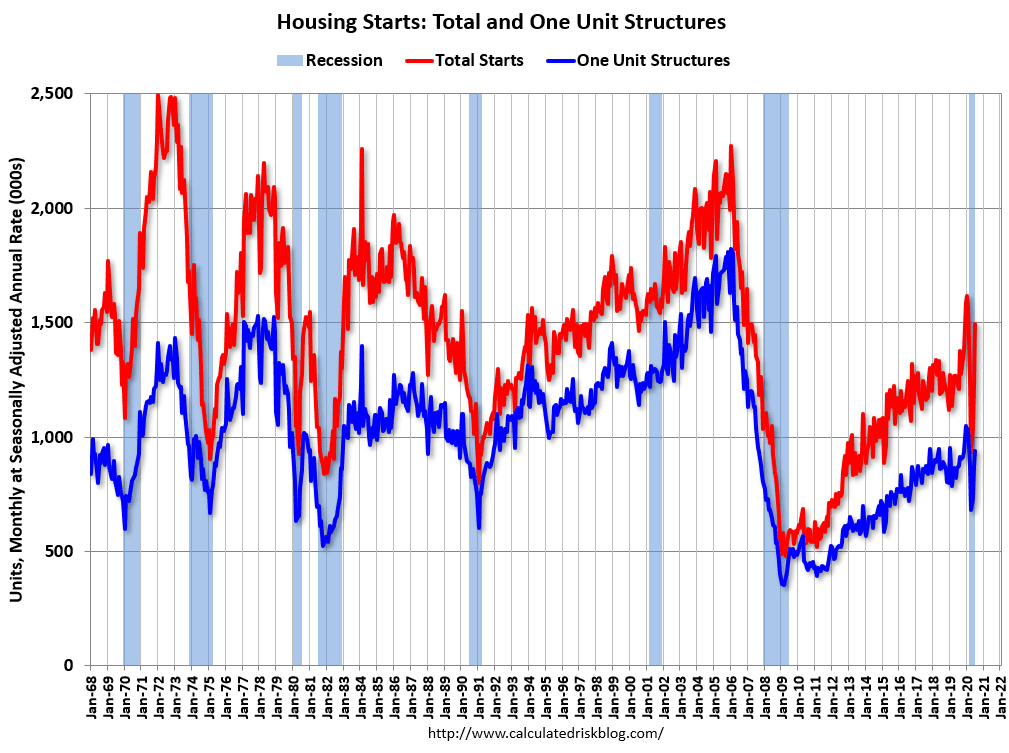

What occurred was quite simple; we stopped constructing. Previous to the 2008 crash, there have been over 1,000,000 housing begins annually since 1991 and over two million between 2004 and the bubble bursting.

Housing begins cratered to 500,000 in 2009 and solely topped 1.5 million in 2019. Then Covid hit and nearly each venture was considerably delayed.

All of the whereas, the American inhabitants stored rising. And all these folks want someplace to reside.

Sadly, homes and residences can’t be wished into existence. The complete course of, from permits to move-in, usually takes over a 12 months. In different phrases, this isn’t an issue that may be ended rapidly.

For the housing market to break down, it must collapse despite demand being far increased than provide. This could be an exceptionally odd factor to occur.

Closing Ideas

We’re undoubtedly reaching the bounds of affordability for People to purchase a house, particularly with rising rates of interest. This by itself ought to cool the true property market off (which we’re already seeing) and will trigger a correction.

However all the things else, from lending requirements to economy-wide inflation to the ratio of mounted mortgages to adjustable-rate mortgages to the nonetheless large housing scarcity make a 2008-like collapse extremely unlikely.

And there’s another issue to think about. As I famous in my earlier piece, inflation will doubtless be round for fairly a while partially as a result of there’s little political will to cease it. That’s as a result of actually placing a cease to inflation will doubtless throw us right into a considerably deeper recession.

Proper now, the political divide is as broad because it has been in a few years. Washington doesn’t wish to throw gas on this fireplace.

If in some way a housing disaster began anew, the proof signifies that the political class would abdomen as a lot inflation as needed to stop one other collapse. In different phrases, count on the Fed to drop rates of interest again to zero and the federal government to bail out householders and Wall Avenue this time round and never simply Wall Avenue with as a lot quantitative easing as needed. Additionally, count on banks to be taught their lesson (at the least partially) and do extra quick gross sales and deeds in lieu of foreclosures than final time, particularly within the early going.

However alas, the proof additionally signifies that such selections received’t must be made as a housing collapse doesn’t seem like across the nook.

In fact, that doesn’t imply the financial system is nice. It wasn’t good within the Nineteen Seventies and isn’t good immediately. However it’s not 2008 both, and we will at the least be pleased about that.

Put together for a market shift

Modify your investing techniques—not solely to outlive an financial downturn, however to additionally thrive! Take any recession in stride and by no means be intimidated by a market shift once more with Recession-Proof Actual Property Investing.

Word By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.