ipopba

Silicon Valley Bank, which was specifically focused on serving venture capital firms based in Silicon Valley, was forced out of business last week following a bank run, and Hercules Capital Inc. (NYSE:HTGC) took a significant valuation hit as a result of being at the epicenter of this firestorm.

Having said that, I believe that Hercules Capital has a fantastic, once-in-a-decade investment opportunity because the BDC pays its dividend, has strong liquidity, and the valuation currently reflects a very high margin of safety. Here is a more thorough investment overview.

Market Stress And Investment Opportunity

Hercules Capital was one of the victims of Silicon Valley Bank’s collapse, which has already had repercussions.

The VC-focused business development company mainly invests in Silicon Valley-based businesses in the fields of technology, life sciences, and renewable energy. Since Thursday, the collapse of Silicon Valley Bank (SIVB) has resulted in a frightening 25% valuation haircut as worries about Hercules Capital’s deposit exposure to Silicon Valley Bank increased.

The BDC reiterated its solid balance and liquidity position and provided details regarding its exposure to SVB in a statement that Hercules Capital was compelled to release on Monday.

In its statement, Hercules Capital reiterated that:

We do not, however, hold any cash or cash equivalents or have any direct banking or operational relationship with SVB and we do not expect any direct impact on our day-to-day operations as a result of SVB’s closure.

Additionally, Hercules Capital provided its portfolio companies with $50 million in short-term secured funding with the goal of assisting those companies that had deposits tied to Silicon Valley Bank. Considering that regulators backstopped SVB’s deposit base over the weekend, this emergency cash pool may no longer be required.

Hercules Capital also pointed out that the company maintained a well-diversified portfolio which, as of 31 December 2022, had very solid portfolio quality (HTGC’s non-accrual ratio was 0.1% at the end of 4Q-22).

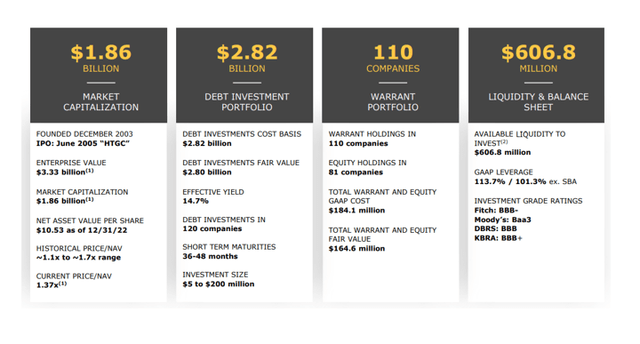

The business development company also had access to a sizable cash reserve. Given that the BDC has no real exposure to SVB and that Hercules Capital had more than $600 million in available liquidity, I believe that the BDC will soon experience a significant valuation re-rating.

Available Liquidity (Hercules Capital Inc)

You Can Get A 15.6% Yield Now And This Yield Is Covered By NII

Currently, Hercules Capital distributes a quarterly dividend of $0.39 per share, or $1.56 per share, on an annual basis. But earlier this year, Hercules Capital also announced a $0.32 supplemental dividend that will be paid in four $0.08 per share quarterly installments.

HTGC is offering a total pay-out of $1.80 per share over the following twelve months (four regular dividends at $0.39 per share and three supplemental dividends at $0.08 per share), as the March payout has already been made.

A 15.6% dividend yield is available to investors in passive income at a stock price of $11.53.

Passive income investors should remind themselves that HTGC is covering its dividend pay-out with net investment income and has done so consistently over the past few years, despite the extreme stress the financial market is currently experiencing.

Hercules Capital has enough faith in the BDC’s earnings potential to declare four supplemental dividends in order to distribute excess income. The BDC’s dividend pay-out ratio in 4Q-22 was just 77%.

Now Trading Only At A 9% Premium To NAV

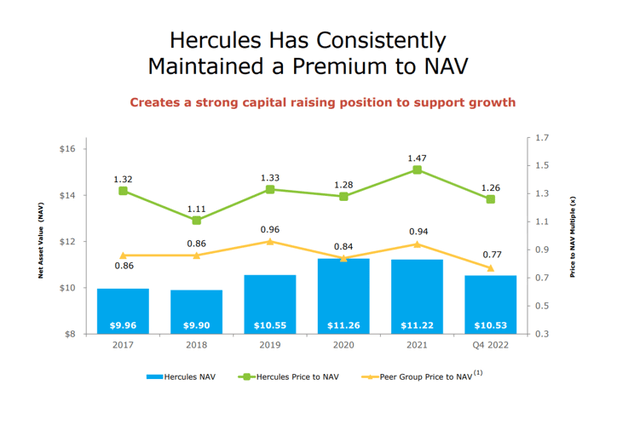

As I have said numerous times in past articles on the business development company, Hercules Capital’s strong credit quality, consistent portfolio growth and good dividend coverage have led to a premium valuation which in turn has allowed the BDC to raise capital repeatedly and scale its investment platform.

The current premium to book value for Hercules Capital is just 9%, which is remarkably low when compared to the BDC’s historical trading norm.

Hercules Capital has consistently traded at a NAV multiple in the range of 1.3-1.5x, and I believe that the BDC will return to this valuation level once the panic subsides.

Net Asset Value (Hercules Capital Inc)

Why Hercules Capital Could See A Lower Valuation

The failure of Silicon Valley Bank has done a real disservice to market trust and confidence as the market has recently become much more erratic. If the contagion effects can’t be stopped, it’s possible that the central bank and the FDIC will also need to save other banks.

Having said that, the operational risks are actually quite low, as stated in Hercules Capital’s update from Monday, and shouldn’t induce investors to sell into the decline if the stock enters a new short-term down channel.

My Conclusion

In my opinion, the current selloff in HTGC represents a once-in-a-decade opportunity for investors seeking passive income.

Hercules Capital, which did not see a decline in its fundamentals, can benefit greatly from the selloff because the BDC was punished for its exposure to the Silicon Valley venture capital-backed investment sector.

I am very confident that the BDC will be able to sustain its dividend pay-out and that the BDC’s valuation could increase in a few months because Hercules Capital covers its dividend with NII, has a strong portfolio quality, and has no real exposure to Silicon Valley Bank.

I believe this is a great opportunity to receive a covered dividend of 15.6%.