Elena Bionysheva-Abramova

Just over six months ago, I wrote on Hecla Mining (NYSE:HL), noting that pullbacks below US$3.90 would likely provide a low-risk buying opportunity. While the stock traded below these levels after silver briefly slid below the psychological $18.00/oz level, it has since recovered nicely and outperformed most of its peers in the Silver Miners Index (SIL). This outperformance can be attributed to the solid operating results year-to-date in a challenging environment (labor tightness, inflationary pressures) and the smart to acquire in the lower portion of the cycle (Alexco) vs. paying up in the upper portion of the cycle like Kinross (KGC) did with Great Bear earlier this year.

Not only will this new acquisition boost silver production in 2023, but it’s an excellent fit for Hecla, which prides itself on being a Tier-1 jurisdiction producer with industry-leading margins, a major differentiator vs. its peer group. The latter is an important distinction. While First Majestic (AG) may have added a Tier-1 operation in Jerritt Canyon, it does not enjoy anywhere near industry-leading margins. That said, Hecla has now advanced more than 70% from its September lows, and I don’t see any margin of safety at current levels. For this reason, I see no reason to pay up for the stock above US$5.70.

Greens Creek Operations (Company Presentation)

Q3 Production

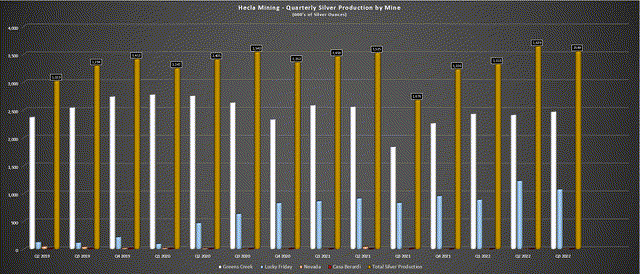

Hecla Mining released its Q3 results in November, reporting quarterly production of ~3.55 million ounces of silver and ~44,700 ounces of gold, a 30% increase in silver production, and a 6% increase in gold production on a year-over-year basis. These represent strong increases in silver production, but it’s worth noting that the company was up against easy year-over-year comps, with Q3 2021 production impacted by staffing issues that affected grades (mining focused on lower-grade and more easily accessible areas), and it was also a softer quarter for Lucky Friday (Q3 2021) with slightly lower grades in the period. Still, the Q3 2022 production was commendable in a tight labor market, even if the sharp headline increase was related to easier comps.

Hecla – Quarterly Silver Production by Mine (Company Filings, Author’s Chart)

Digging into the quarter a little closer, Greens Creek saw a strong performance with record throughput (~2,500 tons per day), with the mine processing ~230,000 tons at 13.6 ounces per ton, up from ~211,100 tonnes processed at 11.1 ounces per ton in Q3 2021. This boost in throughput and better grades helped the asset to produce 2.47 million ounces of silver at industry-leading all-in-sustaining costs [AISC] of $8.61/oz. Meanwhile, the company had another solid quarter at Lucky Friday with 1.07 million ounces of silver produced, with higher tonnes processed and higher grades. That said, costs remained elevated ($15.98/oz), impacted by weaker base metals prices that impacted by-product credits and inflationary pressures.

Finally, looking at Casa Berardi, production increased on a year-over-year basis. Unfortunately, costs also increased ($1,738/oz vs. $1,476/oz), with AISC margins plummeting to [-] $25/oz in Q3 2022, down from $316/oz in the year-ago period. This was despite increased production and a higher denominator with the higher costs related to higher exploration spend, inflationary pressures, and increased sustaining capital (TSF expansion) in the period. The result was that Hecla’s consolidated AISC for its gold business increased to $1,738/oz, and while its silver business performed very well, AISC rose to $14.20/oz (Q3 2021: $12.82/oz). Casa Berardi’s cash costs increased less than AISC but were still up 15% year-over-year.

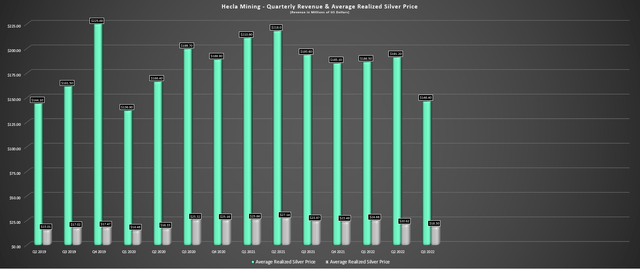

Sales & Margins

While Hecla’s output was solid, and work at Keno Hill is progressing well (goal of 50% of development complete by year-end), revenue and margins were down sharply in the period. Beginning with sales, Hecla saw a significant impact from a lower average realized silver price ($18.30/oz vs. $23.97/oz) and the deferral of a silver concentrate shipment from Greens Creek to ensure adequate volumes of concentrate for cost-effective shipping. Hence, I don’t see any reason to worry about the sharp sequential and year-over-year decline in sales and free cash flow (Q3 2022: [-] ~$61 million], given that this was largely a one-time issue and the weaker silver prices were out of the company’s control. However, margins have been impacted by inflationary pressures exacerbated by weaker base metals prices.

Hecla Mining – Quarterly Revenue & Average Realized Silver Price (Company Filings, Author’s Chart)

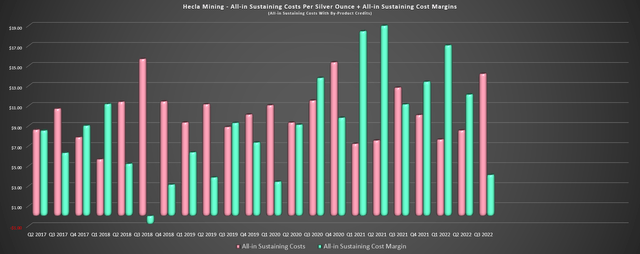

As shown below, Hecla’s AISC margins dipped from $11.15/oz to just $4.10/oz in Q3 2022, with AISC increasing due to a smaller benefit from by-product credits (lead/zinc) due to lower metals prices, with the largest decline coming from zinc ($1.23/lb vs. $1.35/lb). Earlier in the year, the strength in base metals had helped Hecla to buck the trend of sector-wide margin compression in its silver business, but this wasn’t the case in Q3, and margins did take a significant hit. Hecla noted that it continues to see inflationary pressures among labor, steel, fuel, reagents, and other consumables, and due to the tight labor market, subcontractor usage was higher in maintenance at Greens Creek.

Hecla – AISC & AISC Margins (Company Filings, Author’s Chart)

Although this margin compression is disappointing, Hecla should have a much better Q4 and Q1 from a margin standpoint, given that the silver price is finally working in its favor. In fact, silver is up more than 30% from its Q3 lows and could average $22.00/oz or higher in Q1 2023. So, while we may not be seeing the benefits of some moderation in inflationary pressures, margins should benefit sequentially from higher gold and silver prices vs. what looks to be a short-term peak in operating costs in Q3 2022 for the sector. Meanwhile, from a sales and production standpoint, we should see a nice lift in silver production this year as Keno Hill is expected to contribute at least 2.0 million ounces and reach full production by year-end. Let’s take a look at the valuation:

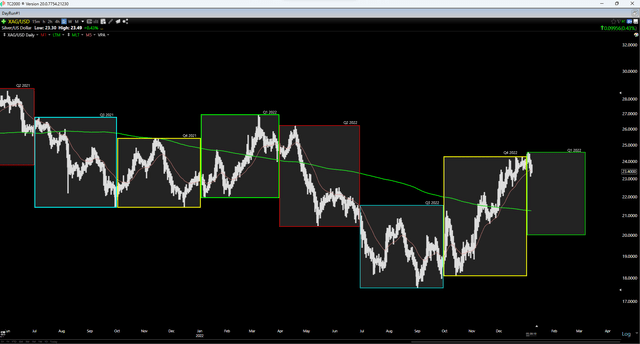

Silver Futures Price (TC2000.com)

Valuation & Technical Picture

Based on ~607 million shares and a share price of $5.70, Hecla traces at a market cap of $3.46 billion, with its share count increasing by more than 10% related to the terminated Keno Hill stream and the acquisition of Alexco. This has left Hecla trading at nearly 1.60x P/NAV based on an estimated net asset value of ~$2.24 billion. Although a premium is warranted, given that it checks all the boxes for investors looking for exposure to silver (Tier-1 jurisdictions, diversification, strong margins), I have never found any value in paying more than 1.20x P/NAV for any precious metals producer from an investment standpoint, let alone ~1.55x P/NAV at current levels.

Looking at the stock from a cash flow standpoint, the stock isn’t cheap on this metric either. This is because it’s currently trading at ~13.3x FY2023 cash flow estimates ($0.43 per share), which is a slight premium to its long-term average. Even if we were to use a premium cash flow multiple of 15.0 to reflect Hecla’s unique positioning as a Tier-1 jurisdiction silver producer with long reserve lives and industry-leading margins, this would still place fair value at $6.45. This translates to only a 13% upside from current levels, which isn’t nearly enough upside to justify going long a cyclical fact. In fact, I generally prefer a minimum 35% discount to fair value, placing Hecla’s low-risk buy zone at $4.20 or lower.

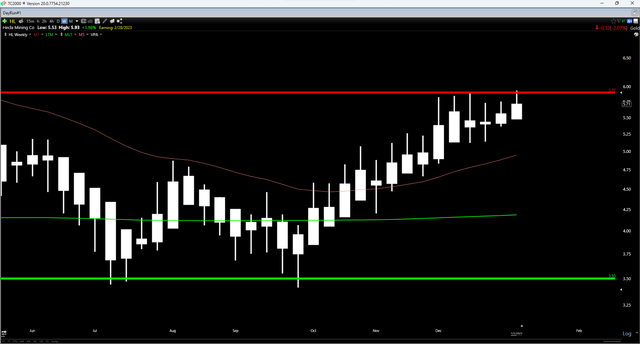

HL Weekly Chart (TC2000.com)

Finally, if we look at HL from a technical standpoint, we can see that the stock is extended above its long-term moving average (green line) and above its major support level at $3.50. Meanwhile, the stock is within 5% of a short-term resistance zone at $5.90 – $6.15. Given that the stock has just $0.45 in potential upside to the upper end of its resistance zone and $2.20 in potential downside to its next strong support level, its reward/risk ratio sits at 0.20 to 1.0, suggesting this is nowhere near a low-risk buying opportunity for the stock. In fact, I see this rally above US$5.70 as an opportunity to book some profits.

Summary

Despite headwinds sector-wide (labor tightness, inflationary pressures), Hecla put together a solid year operationally. And as noted in my previous update, I think the move to acquire Alexco was a smart and calculated bet executed at the right price in the lower portion of the cycle. That said, there is no investing without valuation, as Joel Greenblatt says, and I don’t see any way to justify paying ~13.3x forward cash flow and more than 1.50x P/NAV for a cyclical stock and especially not in a risk-off environment for the general market. This doesn’t mean that Hecla can’t go higher, but I see this sharp rally above US$5.70 as an opportunity to take some profits into strength.