ijeab

“Successful is not getting forward of others. It is getting forward of your self.” – Roger Staubach

The third quarter confirmed how straightforward it’s to get caught up within the horse-race features of investing. Because the Federal Reserve moved to chop rates of interest in September, questions instantly arose: Who’re the doubtless winners and losers of an accommodative financial coverage? Which equities is likely to be headed greater or decrease over the course of the easing cycle? And is that this the catalyst that might lastly propel small worth forward of enormous development?

This generally is a pointless train, particularly because the solutions are virtually by no means clear, nor instantaneous. For instance, whereas historical past tells us that worth shares will ultimately come again into favor, further persistence could also be required, as development does not sometimes relinquish its benefit till halfway into an easing cycle, in response to analysis by The Leuthold Group.

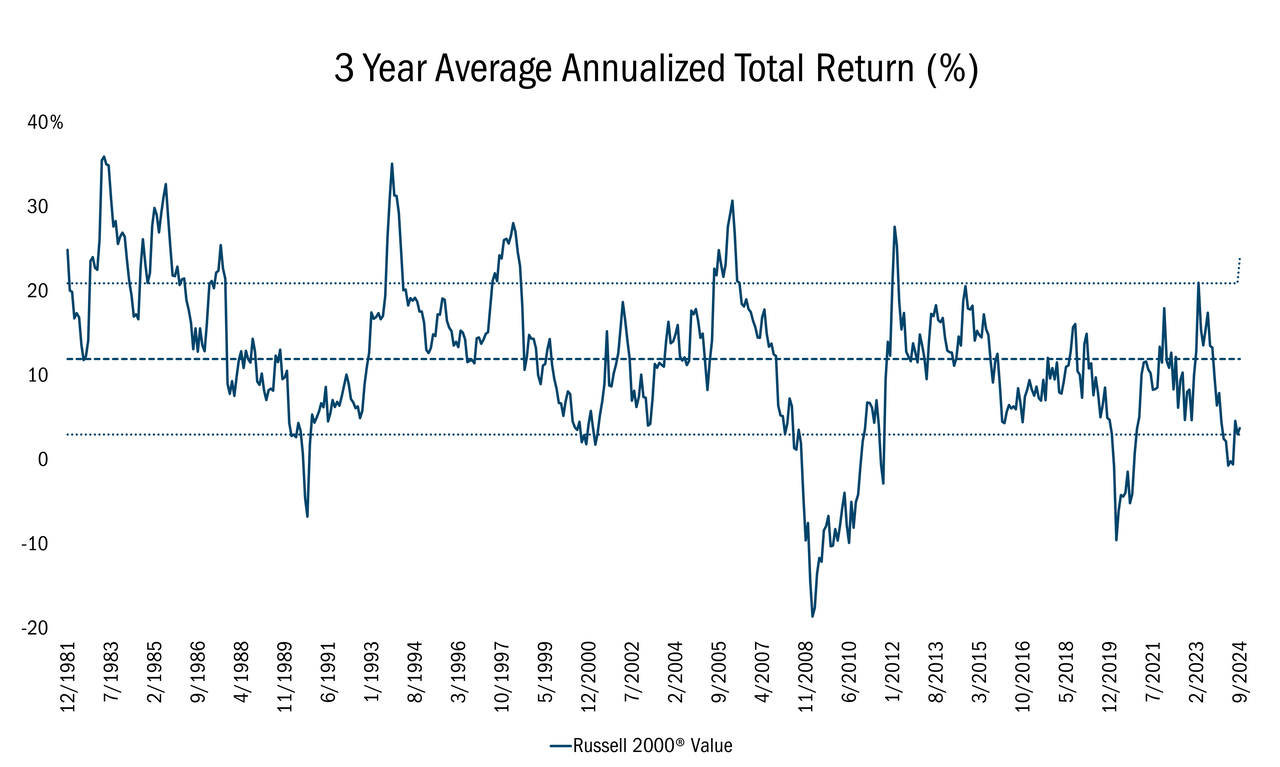

Equally, whereas we imagine small caps will profit from decrease borrowing prices, the financial considerations that drove the Federal Reserve to behave might proceed to stress rising companies within the quick time period. That is why it is necessary to establish firms with sturdy financials and wholesome free money circulate, with out overpaying, as outlined in our 10 Rules of Worth Investing™. In fact, this space of the market has carried out so poorly, comparatively talking, over the previous three years, that the bar is about fairly low for this group (see chart beneath). This provides us confidence within the alternative set for our asset class, even when the exact timing is unclear.

Supply: FactSet Analysis Techniques Inc. and Russell®, month-to-month knowledge from12/1/1981 to 9/30/2024. This chart represents the 3-year common annualized complete return share for the Russell 2000® Worth Index. All indices are unmanaged. It isn’t attainable to take a position straight in an index. Previous efficiency doesn’t assure future outcomes.

In occasions like these, we’re reminded of the phrases of Corridor of Fame quarterback turned profitable industrial actual property investor Roger Staubach, who argued that profitable should not be measured by how far forward you might be of others in any quick time interval. As a substitute, it is how a lot you develop in your personal growth and capability in the long term.

We agree. At Heartland, our 10 Rules of Worth Investing™ information each funding determination we make. Whereas these guidelines are unwavering, we’re dedicated to on the lookout for new and simpler methods to place our beliefs into observe with the objective of delivering constant efficiency over time.

Attribution Evaluation & Portfolio Exercise

For the quarter, the Heartland Small Cap Worth Technique gained 11.52%, outpacing the Russell 2000® Worth Index, which returned 10.15%. Safety choice was combined over the previous three months, with the Technique outperforming the benchmark in Client Discretionary, Power, and Industrials. We lagged in different areas reminiscent of Info Expertise and Well being Care.

12 months so far, the Technique is up 14.97% versus 9.22% for the Index, with safety choice being the first purpose for the outperformance. Inventory selecting was additionally the main driver of our efficiency over the previous one, three, and 5 years.

It’s value noting that we do not choose securities in a vacuum. We’re continuously assessing the portfolio’s general dangers and quick falls. Then we establish concepts which might be each engaging from an upside/draw back perspective that may play a key position in addressing deficiencies in our Technique. This energetic consciousness is a crucial a part of our course of. It’s akin to developing a profitable soccer crew. The impulse in each NFL draft could also be to pick one of the best quarterback popping out of school. However that won’t make sense if you have already got a franchise QB and must shore up your protection. That is how we go about selecting shares – we search for conditions the place our wants and alternatives converge.

A great instance is Centrus Power Corp. (LEU), a trusted provider of parts and providers for the nuclear energy business. We usually purpose to not deviate too removed from the sector weightings of our benchmark, preferring to let safety choice and our 10 Rules of Worth Investing™- not business bets – drive our efficiency relative to our energetic and passive friends.

After promoting a long-term oil producer, Berry Petroleum (BRY), earlier this yr, the portfolio was underweight Power, so we have been conscious of the potential want to spice up our publicity. For years, we had been monitoring and assembly with the administration of Centrus as a consequence of its distinctive place as America’s solely licensed uranium enrichment firm. Since 1998, Centrus has been offering utility prospects with a clear, dependable, and reasonably priced carbon-free energy supply. With world-class technical and engineering capabilities, Centrus is advancing the following technology of centrifuge applied sciences to revive home enrichment capabilities quite than counting on overseas sources, reminiscent of Russia.

As a consequence of numerous regulatory delays, nevertheless, the inventory had fallen out favor with traders, promoting off considerably from former highs. After thorough analysis, we up to date our evaluate of LEU’s enterprise, together with potential rivals, and Centrus scored favorably on our grid utilizing the ten Rules of Worth Investing™.

We established a place within the Spring, and as orders grew for his or her providers, we added to the holding all year long. Centrus is worthwhile with a stable steadiness sheet that features money 2.5X their debt.

In contrast, we exited a profitable metals and mining holding this yr as a result of its grid rating deteriorated. As curiosity in gold has grown, shares of the corporate, which acquires and manages valuable metallic royalties worldwide, appreciated considerably. Nevertheless, manufacturing difficulties at certainly one of their key producing mines surfaced, thus decreasing our estimates of earnings and money flows. Collectively, these elevated the danger whereas lessening the reward potential for the holding, inflicting our valuation of the corporate to fall, and placing it on the backside of the mining shares in our portfolio. With a worth to money circulate ratio of near 20X and the grid rating deteriorating to solely 5 of 10, we believed there have been higher values elsewhere.

For instance, our analysis indicated the outlook for New Gold (NGD), a pure Canadian gold and copper producer, was steadily bettering. NGD has met steering for eight consecutive quarters, as each of its mines are hitting their manufacturing stride. The corporate is forecast to faucet roughly 600,000 ounces of gold equal in FY2026, up 42% in contrast with final yr’s output. Wonderful drilling outcomes coupled with higher efficiencies have lowered New Gold’s all-in sustaining prices (AISC) to $1,381 per ounce of gold, down from a current excessive of $1,657. The corporate is on observe to slash AISC’s greater than 50% by 2026.

Beneath new administration headed by CEO Patrick Godin, who joined in 2022, NGD is having fun with monetary flexibility that enables for exploration to develop reserves and prolong the lifetime of mines. The crew continues to execute considerably growing manufacturing, slicing prices, and posting exceptionally sturdy free money flows. Our analysis course of was validated by sturdy insider shopping for within the firm. But regardless of doubling in worth, NGD was priced at 8x our estimated 2025 earnings, lower than 6.5x free money circulate and scored 8/10 on our analysis grid. We added to the place.

Outlook

Though our confidence in small worth shares is unwavering based mostly on the unrecognized alternatives on this section, we imagine persistence shall be required. We anticipate the backdrop for this section to enhance, because the Federal Reserve embarks on its first easing cycle because the world pandemic. Nevertheless, traditionally these coverage turns have taken longer than anticipated to unfold. Whereas we wait patiently, we stay dedicated to staying true to our 10 Rules of Worth Investing™ whereas continuously bettering our course of to optimize our efficiency over time.

We thanks on your continued belief and confidence in Heartland.

Basically yours,

The Heartland Funding Crew

Composite Returns* 9/30/2024

The US Greenback is the foreign money used to specific efficiency. Returns are offered internet of advisory charges and internet of bundled charges and embrace the reinvestment of all revenue. The returns internet of bundled charges have been calculated by subtracting the best relevant sponsor portion of the individually managed wrap account charge from the online of advisor charges return. Previous efficiency doesn’t assure future outcomes. The Small Cap Worth Technique seeks long-term capital appreciation by investing in micro- and small-cap firms, usually with market capitalizations of lower than the biggest firms within the Russell 2000 Worth Index, on the time of buy. The micro- and small-cap section of the inventory market is strong with hundreds of publicly traded points, lots of which lack conventional Wall Road analysis protection. Thus, we imagine this market is commonly inefficient, mispricing companies and providing alternatives for elementary research-minded traders reminiscent of Heartland. The Small Cap Worth Technique invests in small firms chosen on a worth foundation. Such securities usually are extra risky and fewer liquid than these of bigger firms. Worth investments are topic to the danger that their intrinsic values will not be acknowledged by the broader market. Heartland Advisors, Inc. (the “Agency”) claims compliance with the World Funding Efficiency Requirements (GIPS®). The Agency is a completely owned subsidiary of Heartland Holdings, Inc. and is registered with the Securities and Trade Fee. For a whole record and outline of Heartland Advisors composites and/or a presentation that adheres to the GIPS® requirements, contact Institutional Gross sales at Heartland Advisors, Inc. on the handle listed beneath. As of 9/30/2024, Centrus Power Company Class A (LEU) and New Gold Inc. (NGD), represented 4.86% and a couple of.77% of the Small Cap Worth Composite’s internet property, respectively. The longer term efficiency of any particular funding or technique (together with the investments mentioned above) shouldn’t be assumed to be worthwhile or equal to previous outcomes. The efficiency of the holdings mentioned above might have been the results of distinctive market circumstances which might be now not related. The holdings recognized above don’t symbolize all the securities bought, offered or advisable for the Advisor’s shoppers. Portfolio holdings are topic to alter. Present and future portfolio holdings are topic to danger. In sure instances, dividends and earnings are reinvested. GIPS® is a registered trademark of CFA Institute. CFA Institute doesn’t endorse or promote this group, nor does it warrant the accuracy or high quality of the content material contained herein. Individually managed accounts and associated funding advisory providers are offered by Heartland Advisors, Inc., a federally registered funding advisor. ALPS Distributors, Inc., shouldn’t be affiliated with Heartland Advisors, Inc. The statements and opinions expressed on this article are these of the presenter(s). Any dialogue of investments and funding methods represents the presenters’ views as of the date created and are topic to alter with out discover. The opinions expressed are for common info solely and will not be meant to supply particular recommendation or suggestions for any particular person. The particular securities mentioned, that are meant for instance the advisor’s funding type, don’t symbolize all the securities bought, offered, or advisable by the advisor for shopper accounts, and the reader shouldn’t assume that an funding in these securities was or could be worthwhile sooner or later. Sure safety valuations and ahead estimates are based mostly on Heartland Advisors’ calculations. Any forecasts might not show to be true. Financial predictions are based mostly on estimates and are topic to alter. There isn’t a assure {that a} explicit funding technique shall be profitable. Sector and Business classifications are sourced from GICS®. The World Business Classification Normal (GICS®) is the unique mental property of MSCI Inc. (MSCI) and S&P World Market Intelligence (“S&P”). Neither MSCI, S&P, their associates, nor any of their third celebration suppliers (“GICS Events”) makes any representations or warranties, categorical or implied, with respect to GICS or the outcomes to be obtained by the use thereof, and expressly disclaim all warranties, together with warranties of accuracy, completeness, merchantability and health for a selected function. The GICS Events shall not have any legal responsibility for any direct, oblique, particular, punitive, consequential or every other damages (together with misplaced income) even when notified of such damages. Heartland Advisors defines market cap ranges by the next indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell High 200®. Due to ongoing market volatility, efficiency could also be topic to substantial short-term modifications. Dividends will not be assured and an organization’s future capacity to pay dividends could also be restricted. An organization at present paying dividends might stop paying dividends at any time. There isn’t a assurance that dividend-paying shares will mitigate volatility. Russell Funding Group is the supply and proprietor of the logos, service marks and copyrights associated to the Russell Indices. Russell® is a trademark of the Frank Russell Funding Group. Knowledge sourced from FactSet: Copyright 2024 FactSet Analysis Techniques Inc., FactSet Fundamentals. All rights reserved. Heartland’s investing glossary supplies definitions for a number of phrases used on this web page. |

Unique Publish