undefined undefined/iStock via Getty Images

Healthcare REITs suffered the biggest decline this week as the sector continues to fight staffing challenges and profitability issues.

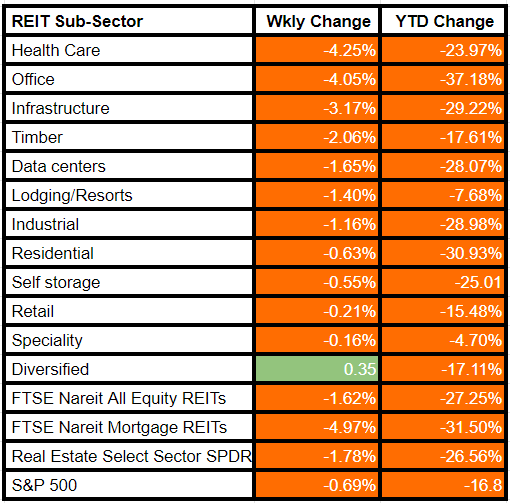

W/W, the subsector fell 4.25% in the week ending Nov. 18, against the broader equity REITs index that was down by mere 1.62% and the S&P 500 index that decreased by just 0.69%.

Meanwhile, the broader real estate index fell by 1.78% on a weekly basis.

The sector has lagged over the past quarter because of sharply higher labor costs, a sluggish post-COVID recovery in patient volumes and the waning of government fiscal support. However, the performance of healthcare providers could rebound in 2023, if the reduction in contract labor expense continues.

The office subsector, next major laggard for the week, was the worst performing property sector YTD. With labor markets still historically tight, employees are still dictating the terms of the “Work from Home” dynamic, and corporations are not expected to pay for half-empty space indefinitely.

On the contrary, net lease REITs reported a gain this week, with the diversified subsector index rising by 0.35% W/W. The subsector offers an opportunity to benefit from necessity based and post-pandemic demand drivers at a safe distance despite rising rates, at relatively attractive valuations.

Here is a look at the performance of the REIT subsectors weekly: