Shares of Hasbro Inc. (NASDAQ: HAS) have fallen 39% over the past 12 months and 12% over the past one month. The company is slated to report its fourth quarter 2022 earnings results on Thursday, February 16. Last month, the toymaker announced some major organizational changes and provided preliminary results for the fourth quarter and full year. Here are a few things to note in the upcoming earnings report:

Revenue

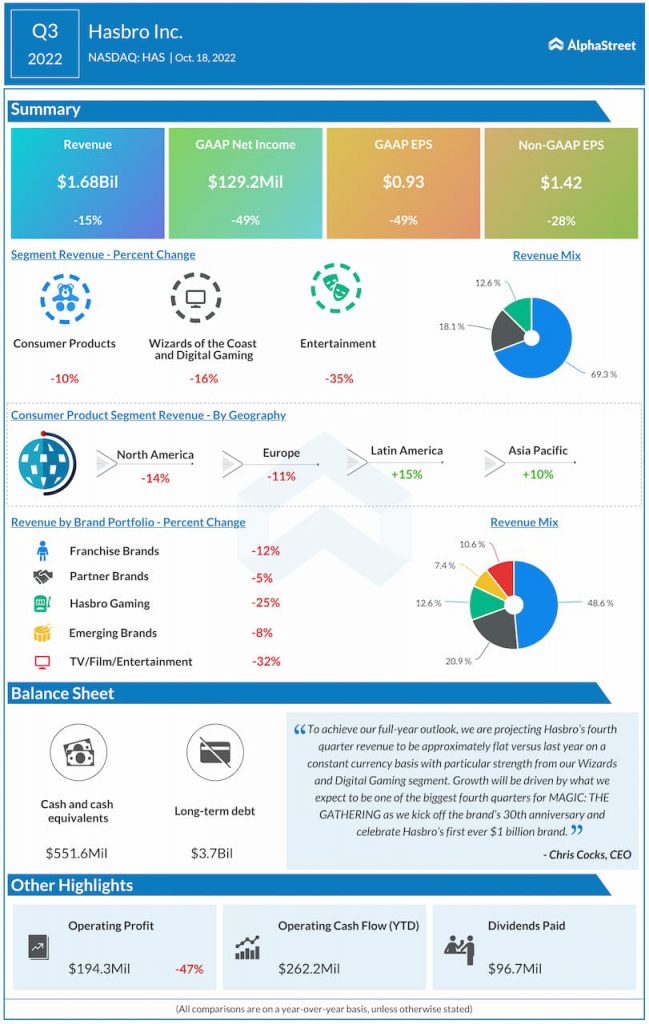

In its preliminary results announcement, Hasbro stated that revenue for the fourth quarter of 2022 will be approx. $1.68 billion, reflecting a 17% drop year-over-year. This matches the consensus target. In the third quarter of 2022, revenues fell 15% YoY to $1.68 billion, hurt by high inflation.

Profits

Hasbro will report a loss per share of $0.93-1.00 on a GAAP basis for Q4 2022. This compares to EPS of $0.59 in the same period a year ago. In Q3 2022, GAAP EPS fell 49% YoY to $0.93.

The Dungeons & Dragons owner will report adjusted EPS of $1.29-1.31. The consensus target is for EPS of $1.29. This compares to adjusted EPS of $1.21 last year and $1.42 in the third quarter.

Segments and organizational changes

While Wizards of the Coast and Digital Gaming segment revenue will increase 22% YoY to $339 million, the Consumer Products and Entertainment segments will see double-digit declines. Revenues in Consumer Products will be down 26% to $1 billion with the underperformance attributed to a challenging holiday consumer environment. Entertainment segment revenues will be down 12% YoY to $335 million.

Hasbro aims to generate $250-300 million in annualized run-rate cost savings by the end of 2025. As part of these efforts, the company is laying off 15% of its global workforce. The toymaker had also announced that its COO Eric Nyman is leaving the company. Details on the changes to its organizational model as well as management team are worth looking out for.

Preliminary full-year results

For the full year of 2022, revenue will be down 9% YoY to $5.86 billion. GAAP EPS will be $1.40-1.46 while adjusted EPS will be $4.43-4.45. Wizards of the Coast and Digital Gaming segment revenue will be up 3% YoY while Consumer Products and Entertainment segments will see revenue declines of 10% and 17% respectively.

Click here to read more on toy stocks

The post Hasbro (HAS) is set to report Q4 earnings this week; here are a few things to note first appeared on AlphaStreet.