Has inflation peaked?

Once we take a look at the info, there are encouraging indicators in varied sectors. Three of probably the most signficant are Vehicles, Properties, and Labor/Wages:

• Vehicles: The semiconductor scarcity despatched new automotive provides down and costs increased; this additionally helped drive used automotive costs up. However business insiders are assured semi provides are normalizing (hopefully, over the remainder of the 12 months). And, they’re seeing costs start to roll over.

Right here is Nick Woolard, Lead Trade Analyst at TrueCar:

“We’re additionally now beginning to see indicators of demand adjusting. Increased rates of interest mixed with increased gasoline costs current a headwind to demand, which can clarify why common used listing costs are lowering, down 1.6% in Could versus April 2022. When it comes to worth changes, in comparison with the start of the month we’re seeing extra automobiles being marked down than for a similar interval final 12 months. That is more true for used vehicles the place we’re seeing over half of our used listings getting a downward worth adjustment for the reason that starting of the month. This pattern is led by the used full-size automobile phase.” (emphasis added)

Rising provides would go a great distance, however for now, rising credit score prices may be capping new and used automotive costs.

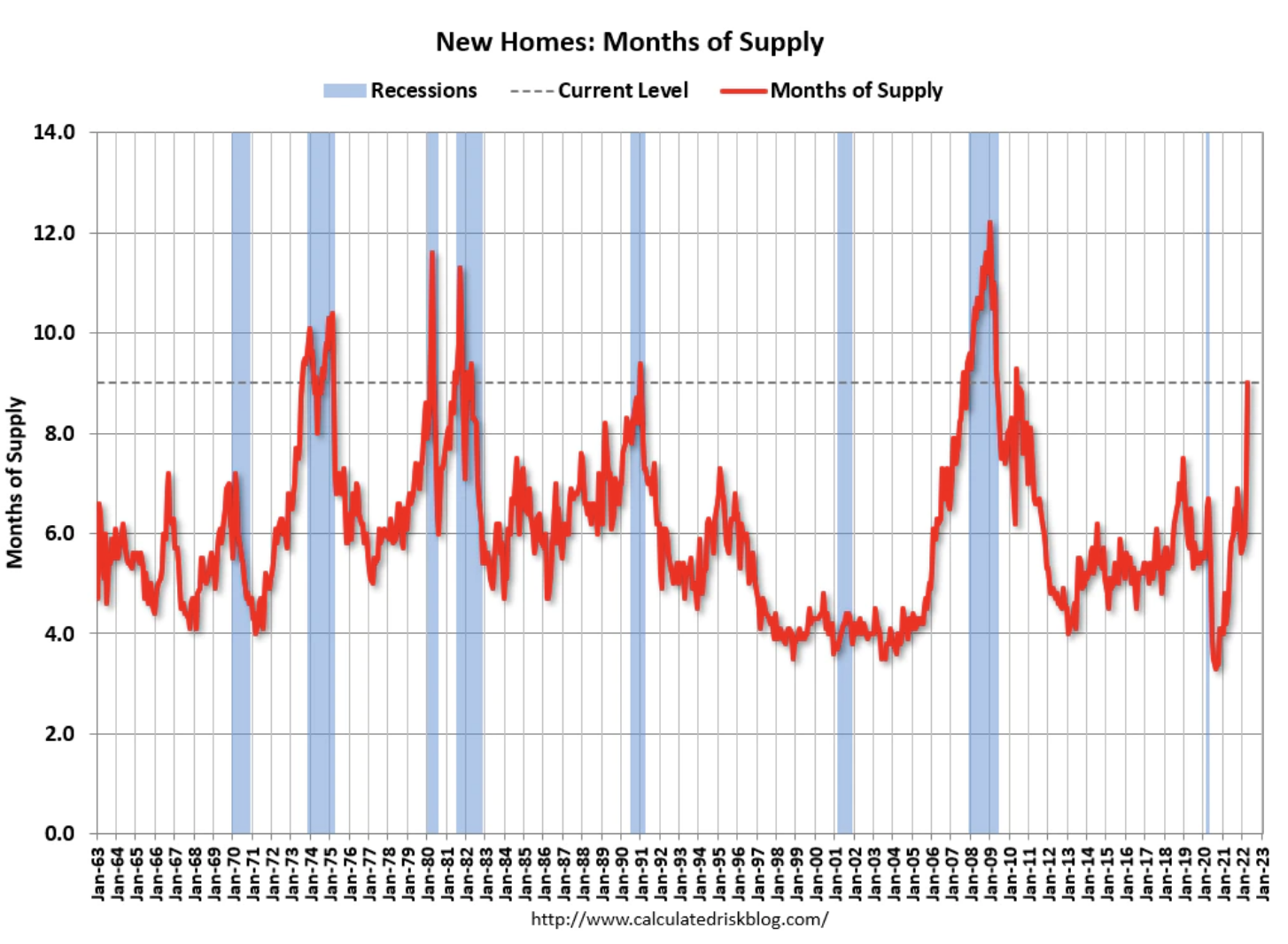

• Properties: Stock is growing, with 6 months of latest dwelling provide underneath building. Gross sales of latest houses are falling, feeling the chew of upper mortgage charges.

April New House Gross sales fell precipitously — the 4th consecutive month-to-month drop. And Current House Gross sales in April additionally fell — down 2.4% from the earlier month, and down 5.9% 12 months over 12 months. We now have had 6 straight months of declines in EHS.

However we have now but to see costs roll over. The largest impediment to falling costs stays the low provide of houses relative to demand. The very best hope for costs to reasonable is for provide to rise. Within the meantime, elevated charges are placing a cap on costs, particularly for the underneath $1m houses.

Ideally, Single Household House costs stabilize after which drift decrease. On the very least, we’re on the lookout for indicators that the unsustainable charge of enhance we confirmed yesterday has peaked.

• Labor & Wages: Anecdotally, we’re listening to that a lot of corporations hiring sprees are over. Some retailers which will have overhired — Amazon, Walmart, Goal — are even doing layoffs.

My colleague Josh Brown observes:

“We’re going to have a really wholesome and blissful labor power, paid greater than it had been previous to the pandemic. However the labor scarcity goes to ease significantly within the second half of this 12 months. We’re already listening to about this easing on convention calls throughout a number of industries. Together with from each Walmart and Amazon, the biggest and second largest personal employers in America. They are saying they’re overstaffed. Different CEOs and CFOs have been telling Wall Road that discovering individuals has develop into simpler this spring. Or that they may merely want much less individuals. The impact is identical.”

Labor has obtained an awesome reset over the previous few years to the upside. That appears to be ending, as Wages are stabilizing. The will increase had been overdue, however the mad scramble and hiring bonuses are coming to an finish.

~~~

These are encouraging indicators that inflation has probably peaked, however falling costs usually are not occurring throughout each sector. Most notably, we see Power and Meals stay elevated. A few of that could be a operate of the Russian invasion of Ukraine, however that’s not the one driver of worth in these areas.

Rents are additionally excessive, following a plummet in 2020, a full restoration in 2021, and an ongoing rise in rents since.

Nonetheless, it’s encouraging to see provide come on-line, costs reasonable, and demand cool in three necessary sectors . . .

See additionally:

TrueCar Releases Evaluation of Could Trade Gross sales. (AP Information, Could 25, 2022)

Employment-related inflation has peaked. (The Reformed Dealer, Could 25, 2022)

New House Gross sales Decline Sharply, ~6 Months of Stock Beneath Development. (Calculated Threat, Could 19, 2022)

Current-House Gross sales Decreased to five.61 million SAAR in April (Calculated Threat, Could 19, 2022)

Beforehand:

Aspirational Pricing (Could 25, 2022)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

How All people Miscalculated Housing Demand (July 29, 2021)