KanawatTH

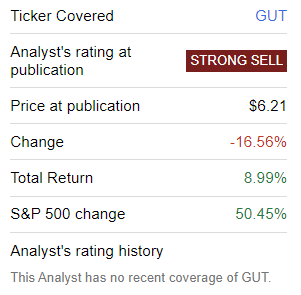

I last covered the Gabelli Utility Trust (NYSE:GUT), a leveraged CEF investing in U.S. and international utilities, in mid-2020. In that article, I argued that GUT’s excessive premium made the fund a strong sell.

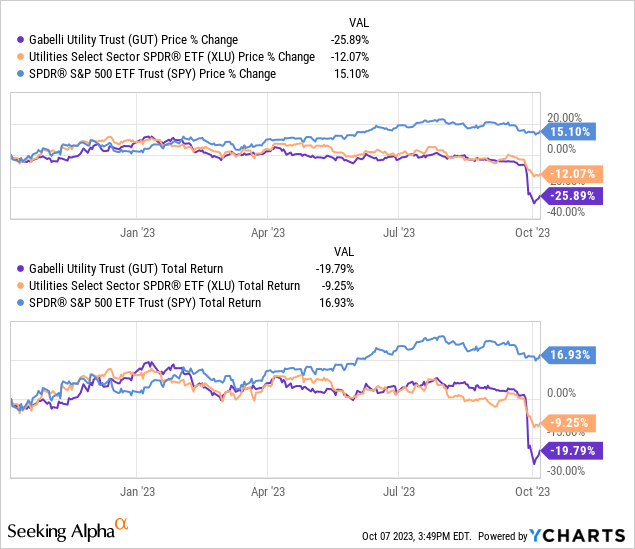

I’ve been keeping an eye on GUT since, waiting for its excessive premium and share price to drop to more reasonable levels. GUT’s share price remained stable for a few years after writing that article, but took a nosedive in late September, with capital losses of more than 25%. Said losses wiped out several years worth of gains and distributions, and have led the fund to significantly underperform relative to the S&P 500:

GUT

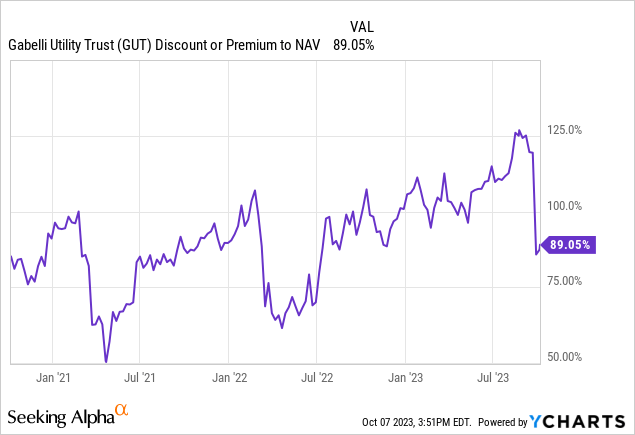

Although GUT’s premium has come down these past few months, it remains excessively elevated at 89.1%. GUT’s excessive premium could lead to significant capital losses and underperformance moving forward, and reduces the fund’s distribution yield. The premium is excessive enough to make the fund a strong sell, in my opinion at least.

GUT’s Premium in Context

In all honesty, I think that an 89.1% premium to NAV is self-evidently a deal-breaker for any CEF, but some investors might appreciate a closer look into GUT and its premium regardless. Let’s start with some context.

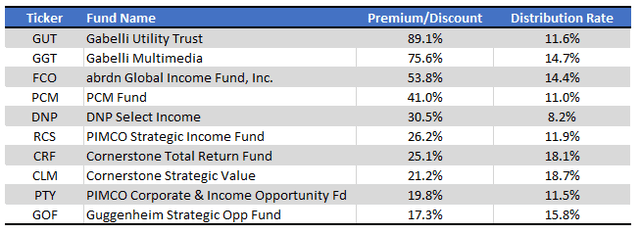

GUT’s premium is the highest in the entire CEF space, although the Gabelli Multi-Media Trust (GGT) comes close, with a 75.6% premium. Several other CEFs have excessive premiums as well. Consider the 10 CEFs with the highest premiums:

Cefconnect – Chart by Author

GUT’s premium compares extremely unfavorably with that of the average CEF, which trades with a 9.7% discount, as per Cefconnect. Investors are looking at an almost triple-digit difference in discounts when comparing GUT and the average CEF. The gap is self-evidently huge, and excessive.

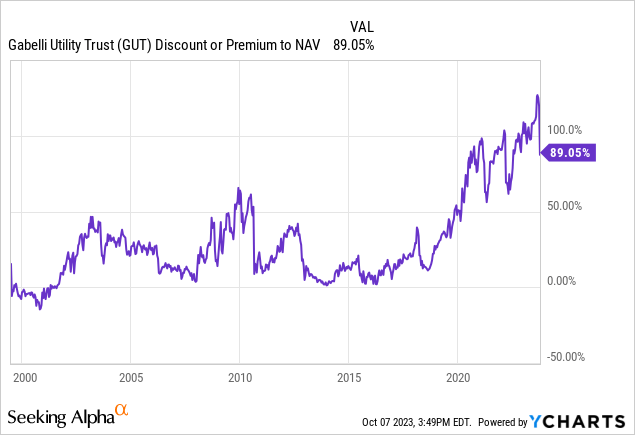

GUT generally trades with a double-digit premium, but these really only started to take off after 2020. I’m unsure what the catalyst was, but perhaps it was as simple as the fund’s share price remaining resilient in the face of the pandemic. GUT’s current premium is much higher than the fund’s long-term average, but about normal for the fund post-pandemic.

GUT’s Premium – Negatives

GUT’s excessive premium harms investors in two key ways.

Excessive premiums can always come down, leading to significant capital losses and underperformance. This is no idle threat. As can be seen in the graph above, GUT’s premium recently decreased, causing the fund’s share price to tumble more than 25%. The catalyst for said drop seems to have been significant losses in the utilities sector. GUT’s losses were much higher, however, with the fund significantly underperforming industry and equity market benchmarks.

GUT’s premium remains excessive, so further losses are possible. Right now, I see two potential catalysts for further reductions in fund premiums and attendant losses.

First, momentum and sentiment in the equities market, utilities sector, and the fund itself, is decisively negative. Momentum caused a significant narrowing in the fund’s discount last week, and the same could very well be true this week.

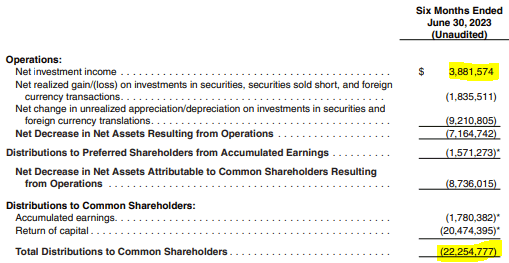

Second, is a potential distribution cut. As per my calculations, GUT’s distributions is almost all return of capital, with a measly 17.4% distribution coverage ratio.

GUT

Sooner or later, that distribution will get cut, which should act as a catalyst for a narrowing of the fund’s premium. Losses could mount.

Besides potential capital losses, GUT’s premium harms investors in another important way. Higher premiums are equivalent to higher share prices, which depresses the distribution yield that investors receive. If GUT traded at NAV, it would sport a 22.2% distribution yield. GUT trades with a massive premium, reducing its yield to 11.7%, an almost double-digit difference. Lower distribution yields means lower shareholder returns, a pretty significant, straightforward negative.

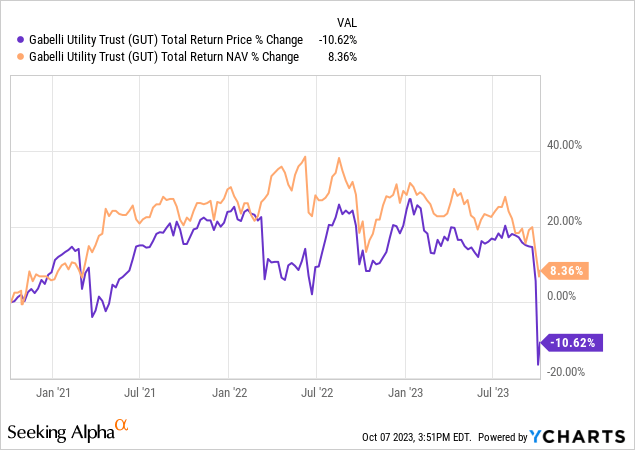

Importantly, one can see the impact from the above in the fund’s medium-term performance. GUT’s premium has slightly risen these past three years.

Nevertheless, price returns have significantly lagged behind NAV returns, due to reduced fund distributions.

I really want to emphasize the point above. GUT’s premium increased, yet price returns were lower than NAV returns. Excessive premiums have a significant negative impact on fund returns, due to lower distributions, even if premiums do not move. GUT’s premium is excessive enough that medium-term returns trend around zero even if premiums do not move. The more significant losses occur if premiums drop, but the situation is quite terrible even if these do not.

GUT’s Premium – One Surprising Positive

GUT’s premium has a surprising positive. GUT sometimes issues shares at a premium, which is accretive to NAV per share and income per share. The math behind this is a bit complicated, but the intuition is simple enough.

When a fund trades at a, let’s say, 80% premium to NAV, investors must pay $1.80 for every $1.00 in assets they buy. Investors are overpaying by 80%, a terrible deal.

When a fund issues shares at an 80% premium to NAV, it receives $1.80 in cash for every $1.00 in assets it sells (more accurately, it raises more cash than it dilutes shareholders, but close enough). That extra $0.80 cents is pure profit for the fund, and for its shareholders.

In practice, GUT does not issue enough premium shares to counteract the negative impact of its excessive premium.

Conclusion

GUT’s excessive 89.1% premium make the fund a strong sell.