bjdlzx

Gulfport Energy (NYSE:GPOR) now appears to be significantly undervalued at around $70 per share currently. It is projected to generate over $400 million in positive cash flow in 2023 at current strip prices despite the potential to lose over $600 million on its 2023 hedges. Gulfport’s cash flow is projected to improve beyond 2023 at current strip due to reduced hedges.

Gulfport’s stock is down over -25% since early October despite natural gas strip prices remaining largely unchanged now. Even using a conservative valuation multiple, Gulfport appears to be worth around $100 per share using long-term $4 NYMEX gas. The current natural gas strip is above $4 indefinitely.

Potential 2023 Outlook

I am now modeling Gulfport’s 2023 production at approximately 1.05 Bcfe per day. Gulfport expects a return to a natural gas differential of approximately negative $0.20 for 2023.

At current 2023 strip of $5.50 NYMEX gas, Gulfport is projected to generate $1.531 billion in revenues after hedges. Gulfport has hedges affecting most of its 2023 production, resulting in an estimated hedging loss of $576 million at current strip.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 346,841,250 | $5.30 | $1,838 |

| NGLs (Barrels) | 4,343,500 | $33.00 | $143 |

| Oil (Barrels) | 1,724,625 | $73.00 | $126 |

| Hedge Value | -$576 | ||

| Total Revenue | $1,531 |

Gulfport is expecting an increase of under 5% for its D&C capex in 2023, along with a $20 million increase in leasehold and land capex. This may result in its total capex budget reaching around $485 million in 2023.

| Expenses | $ Million |

| Transportation, Gathering, Processing and Compression | $383 |

| LOE | $65 |

| Taxes Other Than Income | $72 |

| G&A | $43 |

| Interest and Preferred Dividends | $52 |

| Capex | $485 |

| Total Expenses | $1,100 |

This scenario would allow Gulfport to generate $431 million in positive cash flow in 2023 at $5.50 NYMEX gas despite those massive hedging losses.

Debt Situation

Gulfport is now projected to end 2022 with approximately $640 million in net debt, not including the effect of further share repurchases. The positive cash flow it is projected to generate in 2023 would thus reduce its net debt to around $209 million (not including spending on further share repurchases) by the end of 2023.

Gulfport may also be able to redeem its 8.0% unsecured notes due 2026 starting in May 2024. This would be another potential use for the significant free cash flow that it is projected to generate at strip prices.

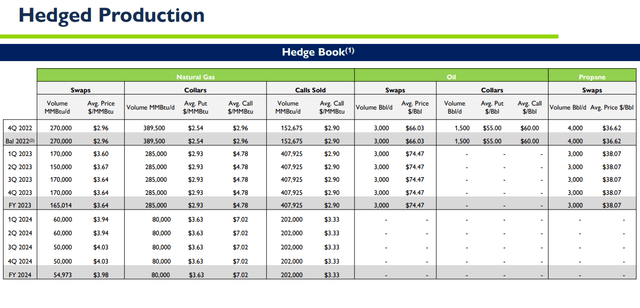

Hedges

Gulfport has hedges covering around 90% of its natural gas production for 2023, so its projected 2023 cash flow generally isn’t too much affected by changes in natural gas prices (except in the case where prices decline enough to fall below its collar ceilings).

Gulfport’s Hedges (gulfportenergy.com)

For 2024, Gulfport may have around 35% of its natural gas production hedged, so it is more affected then by changes in natural gas prices. The reduced hedges also make it likely that Gulfport can generate more positive cash flow in 2024 than in 2023.

Valuation

Gulfport has approximately 23 million shares outstanding if its preferred shares are converted into common shares. This could make Gulfport worth around $122 per share in a long-term (after 2023) scenario with $4 NYMEX gas and $70 WTI oil along with a 3.0x EV to unhedged EBITDAX multiple. This also is calculated using Gulfport’s projected year-end 2023 net debt of $205 million.

A 2.5x EV to EBITDAX multiple using those commodity prices would still make Gulfport worth around $100 per share. Thus Gulfport appears significantly undervalued currently if one believes that long-term natural gas prices will remain at $4+. As an example, the current 2025 strip for natural gas is approximately $4.55.

Gulfport’s current share price appears more appropriate for a scenario with long-term natural gas prices around $3.25 to $3.50.

Conclusion

Gulfport Energy looks capable of generating over $400 million in positive cash flow in 2023 at current strip despite the potential for massive hedging losses. Gulfport has fewer hedges after 2023, so it will most likely be able to generate higher amounts of free cash flow after 2023.

At its current share price, Gulfport appears significantly undervalued, with its shares appearing to be fairly valued in a long-term $3.25 to $3.50 natural gas environment while current long-term strip appears to be $4.50+.