Flashpop/DigitalVision through Getty Photos

Guess?, Inc. (NYSE:GES) brings a confirmed enterprise mannequin examined in lots of markets outdoors america since 1981. The corporate is making related effort to boost its ecommerce actions, and just lately reported acquisitions like that of WHP World and rag & bone. In my view, the monetary figures reported within the final decade, which included constructive internet earnings progress and FCF progress, are the very best indication of future enterprise success potential. With very conservative assumptions about future free money stream, a simplistic discounted money stream about GES implies vital upside potential within the inventory worth. For my part, administrators inside GES know nicely that the corporate seems undervalued at near $21 per share. In 2024, the corporate purchased its personal shares at near $34 per share.

GES, And My Assumptions With Regard To Future Technique

Based in 1981 and integrated in Delaware, GES designs, markets, and licenses attire and equipment for males, girls, and youngsters.

Supply: Firm’s Web site

For my part, additional investments to leverage the infrastructure and the corporate’s capabilities may improve future internet gross sales progress. Within the final annual report, the corporate introduced investments in productiveness, model extension, class growth, new licensees, and wholesale companions. In my view, these efforts will almost certainly deliver FCF progress. Apart from, additional investments in promotional actions, collaboration with influencers, and different go-to-market actions may speed up model relevancy of present manufacturers’ Heritage, Millennials, and Era Z.

With regard to the corporate’s ecommerce actions, for my part, ongoing digital growth will almost certainly proceed to drive internet gross sales progress. The corporate seems to take a position considerably in new instruments and platforms to broaden the digital enterprise segments. Additionally it is value noting that the corporate seems to obtain details about ongoing trend traits, precious suggestions from prospects, and smartphone functions. I assumed that these efforts will almost certainly deliver a aggressive benefit over smaller opponents.

Our Americas Retail phase additionally contains our instantly operated retail and different market web sites within the U.S., Canada, Mexico and Brazil. These web sites function as digital storefronts that, mixed with our retail shops, present a seamless purchasing expertise to the patron to promote our merchandise and promote our manufacturers. Additionally they present details about trend traits and a mechanism for buyer suggestions whereas selling buyer loyalty and enhancing our model id by means of interactive content material on-line and thru smartphone functions. Supply: 10-k

Acquisitions May Deliver New FCF Development

Contemplating the state of the stability sheet and the current acquisition of WHP World, I might expect that new inorganic progress may speed up the free money stream line. The addition of recent shops may additionally deliver internet gross sales progress coming from new and present prospects in these places. On this regard, it’s value noting that the corporate added 36 shops due to the acquisition of Rag & bone.

On April 2, 2024, the Firm and international model administration agency WHP World accomplished the beforehand introduced acquisition of New York-based trend model rag & bone. Supply: 10-QAs a results of our acquisition of the working belongings of rag & bone, we acquired 36 shops, consisting of 34 shops in america and two shops in Europe. Supply: 10-Q

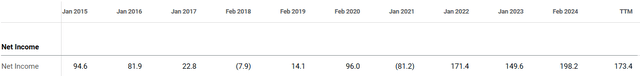

Web Revenue, And FCF Development Seen In The Final Decade

I believe that the market didn’t actually take note of the rise in internet earnings progress reported within the final ten years. Within the final ten years, internet earnings virtually doubled, which I believe proves that GES’ enterprise mannequin is working fairly nicely. Traders can also need to take a look on the firm’s unlevered free money stream reported in the identical time interval. FCF elevated within the final ten years, and the figures had been virtually at all times constructive.

Supply: In search of Alpha Supply: In search of Alpha

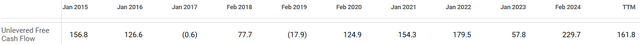

Different fascinating monetary figures to take note of that appear fairly helpful are the corporate’s discount within the complete quantity of shares excellent.

Supply: In search of Alpha

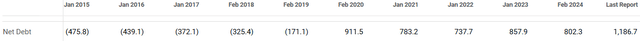

In my view, a decrease share depend will almost certainly result in will increase within the firm’s fairness valuation. I don’t recognize that the corporate’s internet debt elevated considerably from 2013 to 2024.

Supply: In search of Alpha

Nevertheless, the corporate seems to be making vital capital expenditures and reporting many new shops. Because of this, if free money stream progress continues to development north, for my part, the implied inventory honest valuation will almost certainly development greater.

Low-cost Valuation, And Rivals

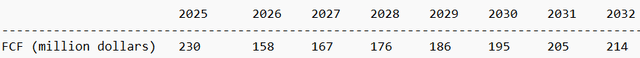

Based mostly on earlier free money stream progress, retailer depend progress, and different assumptions with regard to the rise in future capital expenditures, I made very conservative forecasts about free money stream progress from 2025 to 2032. I additionally assumed a WACC of 6%, which isn’t removed from the WACC utilized by different analysts. Apart from, I used exit EV/2032 Ahead FCF of about 11x, which, I believe, will not be removed from the buying and selling multiples reported within the sector.

Supply: In search of Alpha

The outcomes obtained included complete enterprise worth of $2.59 billion and a goal worth near ~$27 per share. Given the present inventory worth, for my part, there’s vital upside potential within the inventory valuation.

Supply: My Expectations

- NPV of FCF: $1027 million

- NPV of 2032 TV: $1569.49 million

- Complete EV: $2596 million

- Web Debt: $1186.7 million

- Fairness: $1410 million

- Shares Depend: 52.4 million

- Goal Value: ~$27

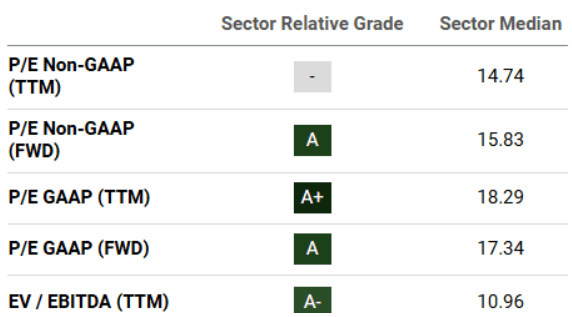

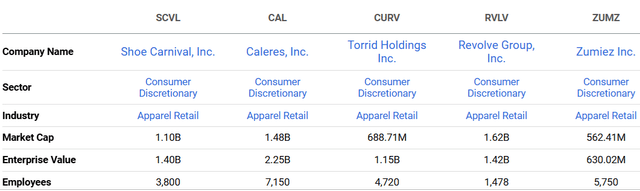

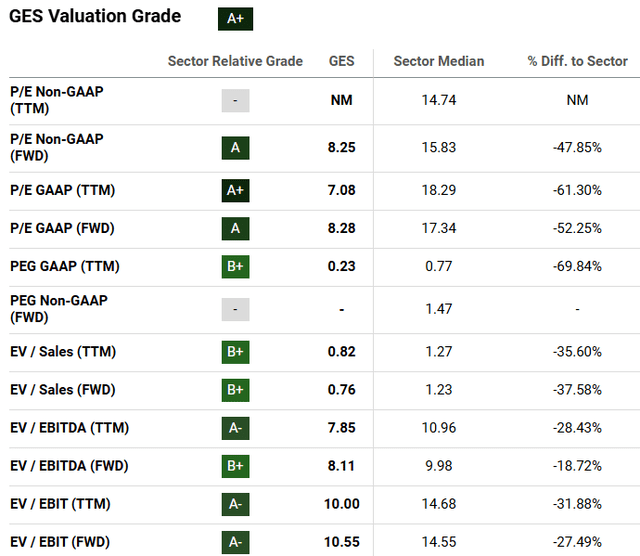

The corporate seems to commerce considerably undervalued as in comparison with opponents. Shoe (SCVL), Caleres (CAL), Torrid (CURV), Revolve (RVLV), and Zumiez (ZUMZ) report a median Ev/ TTM EBITDA of near 11x. Apart from, the sector median ahead PE GAAP is near 17x.

Supply: In search of Alpha

GES reviews an Ev/ TTM EBITDA of 7x, and the ahead PE GAAP is near 8x. For my part, new acquisitions, investments in productiveness, model extension, and efforts to boost its ecommerce actions may push the corporate’s inventory worth to extra logical worth marks.

Supply: In search of Alpha

Inventory Repurchases May Improve The Demand For The Inventory

In 2024, GES just lately approved a brand new inventory repurchase program for as much as $200 million. The corporate had one other inventory repurchase program, however GES acquired a variety of shares equal to the quantity approved by the Board of Administrators.

On March 25, 2024, the Board of Administrators approved a brand new $200 million share repurchase program (the “2024 Share Repurchase Program”). Repurchases beneath the 2024 Share Repurchase Program could also be made on the open market or in privately negotiated transactions, pursuant to Rule 10b5-1 buying and selling plans or different out there means. Supply: 10-Q

Up to now, the corporate acquired 0.3 million shares for as much as $10.3 million, so GES bought shares at near $34 per share. At this time, we are able to purchase shares at a worth mark that’s considerably decrease than $34 per share. For my part, corporations often purchase their very own shares when they’re fairly low-cost.

In the course of the three months ended Could 4, 2024, the Firm repurchased 0.3 million shares beneath its 2024 Share Repurchase Program at an combination value of $10.3 million. Supply: 10-Q

Dangers

New retailer designs, new product designs, advertising campaigns, or new acquisitions may fail. Because of this, the corporate’s return on funding or internet gross sales progress might be decrease than anticipated. As well as, adjustments in trend traits or adjustments within the style of present or new shoppers may additionally decrease future internet gross sales progress, and can also have an effect on future internet earnings progress. Underneath these circumstances, if fairness researchers decrease the expectations in regards to the firm, for my part, the inventory worth may decline considerably.

The corporate makes a big a part of its complete earnings outdoors america. Therefore, for my part, a rise in commerce rules for corporations from america may decrease future internet earnings progress. The corporate may even have difficulties in bringing the CFO made outdoors america to the U.S. On this regard, GES supplied the next explanations.

A good portion of our product gross sales are generated outdoors of the U.S. In fiscal 2024, roughly 77% of our consolidated internet product gross sales was generated by gross sales from outdoors of the U.S. Supply: 10-k

The present political panorama has launched better uncertainty with respect to future earnings tax and commerce rules for U.S. corporations with vital enterprise and sourcing operations outdoors the U.S. Supply: 10-k

GES reported {that a} vital a part of the corporate’s suppliers is situated in China. Given earlier tensions between america and China and tariff associated dangers, for my part, GES may undergo from will increase within the complete quantity of taxes. Because of this, shareholders may undergo from decrease internet earnings progress, which can additionally result in decrease inventory worth will increase.

Whereas now we have been lowering our dependency on China sourcing, significantly for our U.S. enterprise, and mitigating tariff-related dangers, the continued financial battle between the U.S. and China has resulted in elevated tariffs being imposed on items we import from China. Supply: 10-k

The corporate can also undergo from will increase in taxes in lots of jurisdictions as a result of GES does function in lots of international locations. Specifically, the European Union and the OECD just lately ready the Base Erosion and Revenue Shifting “Pillar 2” pointers, which suggest a rise within the international minimal tax as much as 15%. GES reviews holdings in lots of jurisdictions, which can be affected by these new propositions. Because of this, I believe that the corporate might undergo a rise in taxes paid globally.

Moreover, the Group for Financial Cooperation and Improvement has launched sure pointers, together with the Base Erosion and Revenue Shifting “Pillar 2” pointers. The OECD Pillar 2 pointers handle the growing digitalization of the worldwide economic system, re-allocating taxing rights amongst international locations. The European Union, many different member states and varied different governments have adopted, or are within the strategy of adopting, Pillar 2, which requires a world minimal tax of 15% to be efficient for tax years starting in 2024. Supply: 10-k

GES may undergo considerably from new inflation or will increase within the worth of sure enter prices, which may make manufacturing costlier. Specifically, will increase within the worth of cotton, sure chemical compounds, or dyes in addition to a rise in transport prices due to enhance within the worth of oil may additionally decrease future internet earnings progress.

My Take

With a few years within the enterprise and operations in lots of international locations, GES continues to ship constructive internet earnings and FCF progress. For my part, the corporate already proved that its enterprise mannequin is sustainable in lots of jurisdictions. Therefore, I might count on new FCF progress pushed by new international locations and markets all around the world. Additionally it is value noting that the corporate’s geographically diversified enterprise profile may deliver sure internet gross sales stability in case of a world recession. As well as, given ongoing inorganic efforts, just like the acquisition of WHP World and Rag & bone, and the overall amount of money in hand, I might count on retailer progress depend pushed by new acquisitions. Lastly, for my part, the ecommerce actions and new associate alliances may be a internet gross sales driver. With all this in thoughts and the brand new inventory repurchase program introduced in 2024, I might expect inventory worth will increase within the coming future.

![[Twitter CEO Parag Agrawal] I’m excited to share that we’re appointing @elonmusk to our board! : shares [Twitter CEO Parag Agrawal] I’m excited to share that we’re appointing @elonmusk to our board! : shares](https://external-preview.redd.it/gx10VzF0tsyfDCp-XkCOscmoGWQdx6_jZDukGeTZtgs.jpg?auto=webp&s=a42584f7d6d288b52ff77933b9d64a1fcfb7b6a0)