jetcityimage/iStock Editorial via Getty Images

This article is an outgrowth of my own research on how your taxes reduce the money you have in retirement to spend. Those taxes come from many directions while you are working and then when you are retired. Most people accept them as a necessary evil to increase their net worth and accumulate a retirement nest egg. In August, I wrote ” Dividends Aren’t For Taxable Accounts,” which was part 1 in this journey. Now one year from the inception of this account, I am going to review one of the biggest reasons why this account is up over 17%.

First, a quick review of the rules of the road for this portfolio.

Setup and Ground Rules

I will invest in 10 Non-dividend paying stocks that are initially contained within the S&P 500 index. If they are later dropped from the index, I may sell and reallocate or do nothing. If they later decide to pay a dividend, I will try and sell prior to the x-date and reallocate the cash to a new stock or the ones remaining. When I invest the cash into these 10 stocks, I will generally invest an equal dollar amount into each 10 using the features of a broker which allows this type of “dollar” investing instead of “share” investing. In the spreadsheet below, I will show a scaled value of $100k. This last bullet point was changed to add a small position of the equally weighted S&P 500 ETF (RSP).

Starting Positions

Below is an allocation by Sector:

Communication Services

Facebook (META); Alphabet Inc (GOOG) (GOOGL); Netflix Inc (NFLX)

Consumer Discretionary

Amazon (AMZN); Chipotle Mexican Grill Inc (CMG); Tesla (TSLA)

Financials

Berkshire Hathaway Inc (BRK.A) (BRK.B)

Industrials

Boeing (BA)

Information Technology

Salesforce Inc (CRM); PayPal Holdings Inc (PYPL)

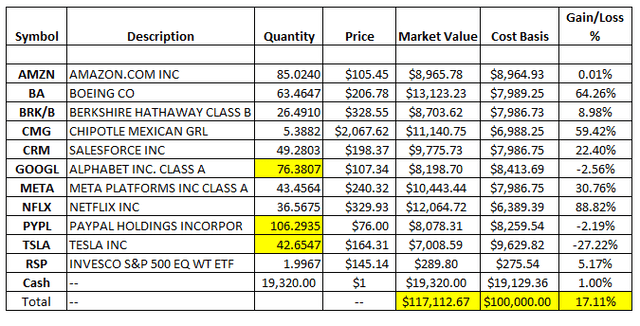

Below are the current standings as of 04/30/23:

My spreadsheet of real results

My spreadsheet of real data scaled to a cost basis of $100k.

As can be seen from the above, two positions did not get filled for the simple reason that their valuation ran too fast away from my initial buy point, and so I decided to not chase them. These stocks were CMG and NFLX, which currently are sitting on gains of 59.4% and 88.8% respectively. Since my last update 6 months ago, I decided to deploy some of the cash and its interest into 3 of my laggards, as denoted in yellow above. I now have taken the cash position from the original 20% down to 16.5%.

At this point, you may be wondering how a portfolio of 10 stocks got a return of 17% when during the same period the market got a return of less than 3%.

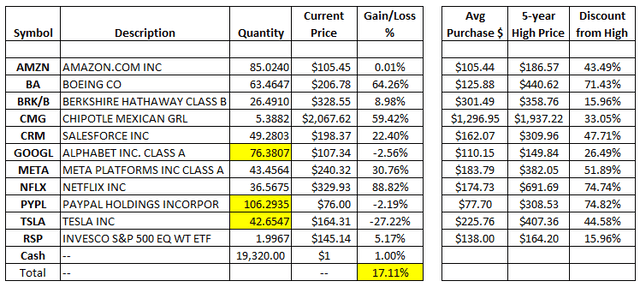

This next table may shed some light on that:

My spreadsheet of real data

To understand what happened in 2022, first the Fed started raising interest rates in March 2022, and they just completed their 10th consecutive raise on May 3rd 2023. This caused many investors to start dumping many of their most popular holdings. As is the case with many growth stocks, most were overvalued, except for Boeing, which I consider a special case. Boeing had taken a big “haircut” to its recent high in 2019, which was further exasperated by the Pandemic in 2020. It and Netflix are two of my biggest gainers, as you can see above.

As it happens, selloffs are usually overdone. It is usually only luck that allows you to take advantage of these pullbacks. I was able to take advantage of market pullbacks in May and June with money that was not needed for my retirement cash flow. My retirement cash flow is handled at least in part with this strategy that I put in place a little over 7 years ago:

The DGI10 & TR7 Strategy.

Now back to the reason for the above table. It shows my average purchase price for each stock, along with the most recent High closing price in the past 5 years. From that data you can extract the discount to that high price which I got for each stock. While it is not always an exact correlation that getting a good price will allow you to make money, it certainly helps with the math.

Conclusion

Most of you that have been following me for years know that I am not a proponent of timing the market or selling stocks just because they appear to be overvalued. That is a losing proposition in the long term, but in this case the timing was right for me to take advantage of the “natural order of the market” which is as we all know up, then down, then up and more of the same.

It is important to understand how the total return of the investments you put in your account affects your retirement and the money left over for your heirs. We also know that the total return is directly related to the income you can generate in retirement. The math tells us that the income will be the same for the same total return, whether you sell shares to generate it or get the income directly from dividends. If you want to see that math worked out, here are two articles I wrote in 2019 demonstrating it, called Is There Magic in Dividends and A Dividend, What is it Good For.

Each person must understand their needs and be able to choose the strategy that best fits them. Just because something works for one person does not make it suitable for the next. Often, money may be tight during retirement, and which strategy you choose can make a difference. However, if the strategy is volatile beyond your tolerance level, which in itself can sometimes make that strategy unsuitable for you.

You also must realize that past performance is no guarantee of the future, and in that regard, all the information presented here is past performance. The information provided here is for educational purposes only. It is not intended to replace your due diligence or professional financial advice.