Submitted by Brent Johnson of Macro Alchemist (learn it right here in pdf format)

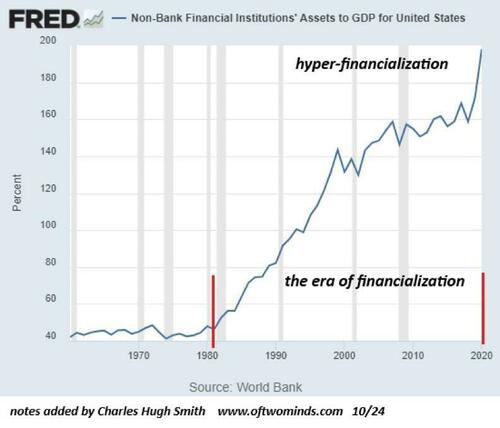

The transformation of banking and monetary companies away from conventional public markets and the banking system itself has been dramatic for the reason that International Monetary Disaster (GFC) of 2008.

This shift has reshaped the monetary panorama, as extra actions that have been as soon as dominated by banks and public markets have moved into personal and non-bank monetary sectors.

In 2008, when the GFC struck, the monetary world skilled a extreme breakdown. Banks, which had been the spine of lending and liquidity, stopped trusting each other, ceasing to lend in in a single day markets, that are essential for short-term liquidity. Concurrently, public markets suffered immense losses, with the S&P 500 plunging by roughly 50%.

In consequence, each the banking system and public markets successfully froze, changing into illiquid and dysfunctional virtually in a single day. What had as soon as been extremely liquid, easily functioning monetary ecosystems floor to a halt.

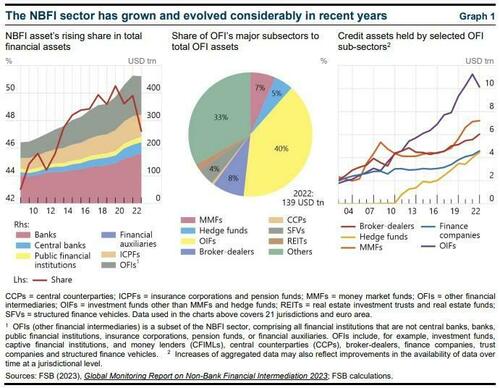

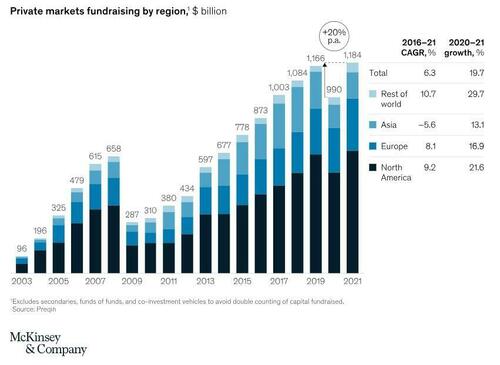

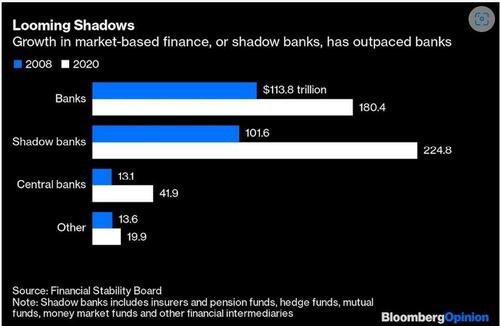

Quick ahead to in the present day, and we’re witnessing a putting evolution: the non-bank monetary sector, which incorporates establishments like hedge funds, personal fairness companies, and shadow banks, has grown bigger than the standard banking sector. Equally, personal markets, comparable to these for personal fairness, personal debt, and direct lending, are increasing at a a lot quicker fee than public markets.

This fast development is essentially altering the construction of worldwide finance.

Such a shift of this magnitude raises vital questions concerning the potential affect on future monetary crises. One key challenge is that risk-taking is now concentrated in markets which might be inherently much less liquid. Even earlier than a liquidity disaster happens, the monetary system is build up threat in markets that, by their nature, are more durable to exit shortly. So, what occurs when these already illiquid markets face a shock and grow to be even much less liquid, doubtlessly triggering a disaster?

Think about direct lending, personal credit score, and personal fairness investments, all of that are largely concentrated within the non-bank monetary sector. If the worldwide monetary system may expertise a disaster of the dimensions seen in 2008—when liquidity dried up in extremely liquid public markets—what may occur when the place to begin for risk-taking is in far much less liquid, personal markets?

The results may very well be much more extreme and far-reaching.

This paper explores the fast enlargement of the non-bank monetary sector and the liquidity constraints that characterize personal markets.

One of many key considerations with liquidity crises is the cascading, second- and third-order results they’ll generate. These results happen when markets which might be perceived to be liquid—markets the place traders consider they’ll simply purchase and promote property—all of a sudden grow to be illiquid, trapping contributors and inflicting widespread disruptions.

Such second and third order results typically affect traders, establishments, and sectors that will ordinarily take into account themselves insulated from high-risk monetary actions.

Nonetheless, the interconnectedness of the worldwide monetary ecosystem signifies that shocks in a single a part of the system can shortly reverberate by way of others, catching seemingly unrelated gamers within the fallout. That is why understanding shadow banking, personal markets, and the broader non-bank monetary system is vital for assessing the dangers posed to the general monetary system.

The growing prominence of non-bank and personal monetary markets presents new challenges for managing liquidity and systemic threat. Because the monetary system turns into extra depending on these much less liquid sectors, the potential for liquidity crises and their ripple results throughout the worldwide economic system grows, highlighting the significance of monitoring and addressing dangers within the shadow banking and personal market ecosystems.

Backdrop – The International Monetary Disaster

No two monetary crises are precisely the identical, although human habits and feelings are all the time central to them. Every disaster has its personal distinctive traits, and so long as human nature stays fixed, cycles of increase and bust are inevitable.

Given in the present day’s traditionally excessive fairness valuations, comparisons to the International Monetary Disaster (GFC) of 2008 and the Dot-Com bubble of the late Nineteen Nineties are pure, and the present enthusiasm for Synthetic Intelligence is paying homage to previous durations of euphoria. Nonetheless, it’s necessary to do not forget that valuations are signs of broader market situations, not the underlying causes. For instance, throughout the Dutch Tulip Mania in 1636, a single black tulip was valued at a number of years’ wage—an indicator that one thing was amiss, however not the foundation of the difficulty.

Pinpointing the precise second when a monetary disaster begins is commonly solely attainable in hindsight. Did the GFC begin with the collapse of two Bear Stearns hedge funds in 2007? Was it the autumn of Bear Stearns itself? Or maybe Lehman Brothers’ collapse? Some may even argue it started with Meredith Whitney’s 2008 evaluation, revealing that Citigroup couldn’t preserve its dividend. The reply will depend on perspective—these immediately impacted by these occasions would doubtless give totally different timelines.

What’s essential in the present day is knowing that evaluating present credit score situations to 2008 is deceptive.

All credit score crises share a standard characteristic: relaxed lending requirements. Earlier than the GFC, subprime lending accounted for round 3% of mortgage lending; by 2007, it had surged to just about 25%. Mortgage requirements deteriorated so badly that defaults on the primary mortgage fee have been rising, but this was only one a part of the issue.

Different key gamers within the disaster have been establishments like Fannie Mae, Freddie Mac, and the mortgage insurer MBIA. So long as these entities retained their excessive credit score scores, they have been capable of preserve issuing loans to debtors who could not repay. MBIA, for instance, wrote billions in liabilities whereas holding solely $30 million in shareholder funds.

However the true breaking level got here when massive banks stopped lending to one another in a single day, pushed by considerations about each their counterparts’ liquidity and their very own over-leveraged stability sheets. Bear Stearns, as an example, had $3 of fairness for each $100 in property, a precarious 33:1 leverage ratio.

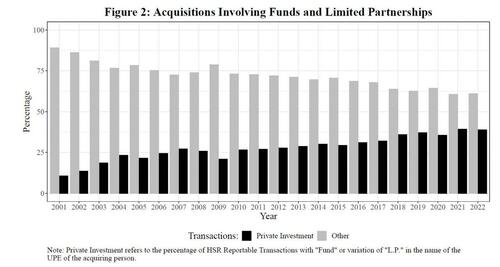

As soon as regulators stepped in after the disaster, they sought to stop a repeat by imposing stricter guidelines on massive banks by way of the Dodd-Frank Act. This curtailed buying and selling and market-making actions, bringing these monetary giants into line. However as with every monetary system, the place there’s demand, provide will discover a manner. This time, the non-bank monetary intermediaries (NBFIs) stepped in. In simply over a decade, these NBFIs grew to grow to be the biggest lenders, overtaking conventional banks.

The lesson right here is straightforward: credit score demand doesn’t disappear—it shifts. Understanding the place that demand goes is essential in predicting how future monetary dangers could unfold.

The Speedy Progress of Non-Financial institution Monetary Establishments (NBFI)

Along with the elevated regulatory stress on banks after the 2008 disaster, the extended low-interest-rate surroundings has been a significant catalyst for the fast development of non-bank monetary establishments (NBFIs).

With conventional financial savings accounts and authorities bonds providing traditionally low yields, traders started looking for larger returns by way of different avenues. NBFIs responded by providing a spread of monetary merchandise that offered extra engaging returns, comparable to collateralized mortgage obligations (CLOs), personal debt, actual property funding trusts (REITs), and different funding alternatives that banks, attributable to regulatory constraints, didn’t present.

This shift allowed NBFIs to fill a vital hole out there by catering to the growing demand for yield-driven funding merchandise.

As banks turned extra restricted of their skill to interact in riskier, high-yield actions attributable to post-crisis laws just like the Dodd-Frank Act, NBFIs stepped in with choices that weren’t solely higher-yielding but additionally typically extra advanced and fewer clear. The flexibleness of NBFIs to function with fewer regulatory limitations turned a sexy different for each institutional and retail traders hungry for returns in a low-rate world.

On the similar time, technological innovation has accelerated the expansion of NBFIs, particularly by way of the rise of fintech corporations. These companies have revolutionized the monetary companies sector by using information analytics, synthetic intelligence, blockchain, and digital platforms to ship extra environment friendly and accessible monetary options.

Fintech improvements comparable to peer-to-peer lending platforms, robo-advisors, on-line wealth administration companies, and digital fee methods have disrupted the standard banking mannequin. These applied sciences provide quicker, less expensive companies tailor-made to the trendy shopper, enabling people and companies to entry credit score, make investments, and handle their funds with out counting on conventional banks. Fintech’s rise has made NBFIs much more outstanding by offering an infrastructure that’s extra agile and aware of market calls for.

Nonetheless, with this agility comes a trade-off in oversight.

As a result of NBFIs are topic to fewer regulatory constraints than conventional banks, they’ll accumulate dangers that will not be seen to regulators or market contributors till it’s too late. Hedge funds, for instance, typically interact in extremely leveraged methods, which might enlarge losses during times of market volatility. The collapse of such funds can shortly spiral into broader monetary instability, as these companies are tightly interconnected with conventional banks and monetary establishments by way of varied channels of lending, derivatives, and funding portfolios.

An instance of this occurred in 2020, throughout the market turbulence triggered by the COVID-19 pandemic. Cash market funds, as soon as thought of secure and low-risk investments, skilled fast outflows as traders fled to security, highlighting the unpredictable fragility inside sure corners of the NBFI sector.

The spillover results of those outflows flowed all through the broader monetary system, underscoring the interconnected nature of banks and NBFIs.

Given the systemic significance of NBFIs, policymakers and regulatory our bodies, together with the Federal Reserve and the Monetary Stability Board (FSB), have grow to be more and more involved concerning the potential dangers posed by the rising affect of those establishments. There may be ongoing debate about whether or not NBFIs needs to be topic to the identical stage of scrutiny and oversight as conventional banks, significantly those who have grown massive sufficient to pose a major menace to monetary stability.

The problem for regulators is to strike a stability between encouraging the innovation and development that NBFIs carry to the monetary system, whereas guaranteeing that these establishments don’t grow to be the subsequent supply of systemic threat.

Nonetheless, historical past means that regulators are sometimes reactive reasonably than proactive with regards to addressing potential crises. Regardless of rising consciousness of the dangers related to NBFIs, regulatory intervention could lag till after vital monetary disruptions have already occurred.

The rise of NBFIs represents a profound shift within the U.S. monetary system. Their skill to innovate quickly, function with much less regulatory oversight, and meet investor demand for higher-yielding merchandise has allowed them to outpace the standard banking sector in lots of respects. But, their development additionally requires a more in-depth examination of their function in sustaining monetary stability.

The shortage of visibility into NBFIs’ stability sheets and actions poses a threat, because it makes it more durable to evaluate their vulnerabilities and potential for triggering broader monetary misery. As NBFIs proceed to increase, understanding their affect on the general monetary ecosystem might be essential in making ready for and mitigating the dangers of future monetary crises.

Personal Fairness and Credit score Markets

Personal fairness and personal lending haven’t solely expanded in dimension but additionally grown in complexity, changing into vital pillars of worldwide finance.

These sectors have advanced in response to regulatory adjustments, technological developments, and shifting investor demand, reflecting broader developments throughout the monetary panorama.

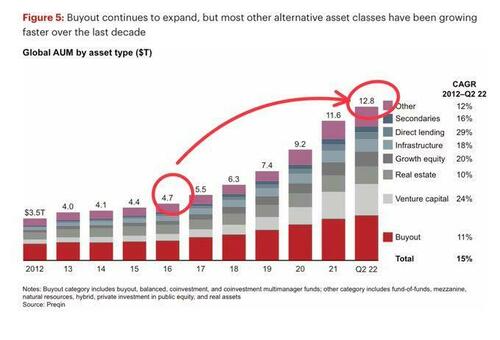

Initially, personal fairness was a distinct segment discipline centered on enterprise capital for early-stage corporations and distressed property. It performed a restricted function in mainstream company finance. Over time, nonetheless, personal fairness has matured into a complicated business that now employs a variety of funding methods, together with leveraged buyouts (LBOs), development fairness, particular conditions, distressed investing, and infrastructure investments.

Leveraged buyouts (LBOs), particularly, have grow to be a defining characteristic of personal fairness. These transactions permit companies to accumulate corporations utilizing a mixture of fairness and vital quantities of borrowed capital, with the expectation that the goal firm’s money movement might be used to repay the debt.

The rise of LBOs has reworked how personal fairness companies strategy worth creation, utilizing monetary leverage to amplify returns whereas taking management of enormous, established corporations. This technique has confirmed immensely worthwhile, but it surely additionally introduces larger ranges of threat, significantly in unsure financial environments.

In recent times, personal fairness companies have shifted from purely monetary methods, like cost-cutting and restructuring, to a extra hands-on operational strategy. Often known as the “operational value-add” technique, personal fairness companies now leverage their business experience and sources to drive operational enhancements, digital transformation, and management growth inside their portfolio corporations.

By partaking extra actively in enterprise operations, personal fairness companies are unlocking new development alternatives and producing extra sustainable returns, setting themselves other than conventional traders.

Moreover, personal fairness companies are more and more investing in technology-driven sectors, comparable to software program, fintech, healthcare expertise, and digital infrastructure.

The rise of tech-focused personal fairness funds displays the business’s rising recognition that innovation and information analytics are key to staying aggressive within the trendy economic system.

By adopting data-driven decision-making and enhancing due diligence processes, personal fairness companies are actually higher positioned to establish high-potential investments and maximize long-term development.

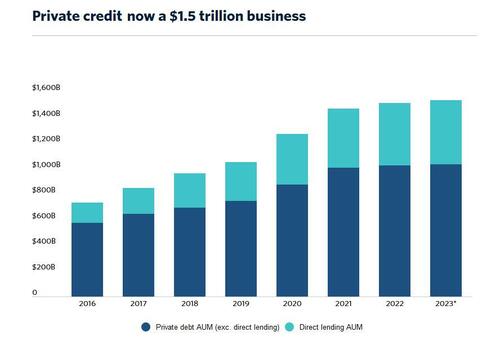

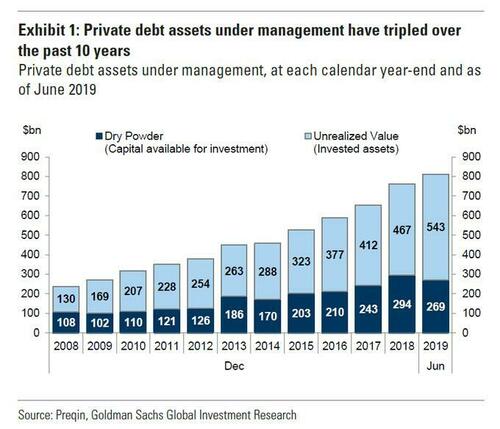

On the similar time, personal lending has grown right into a vital part of other finance, offering capital to corporations that won’t qualify for conventional financial institution loans. The sector’s fast enlargement is a direct response to the regulatory tightening following the 2008 monetary disaster, which restricted banks’ skill to interact in riskier lending actions.

Direct lenders—together with personal credit score funds, hedge funds, enterprise growth corporations (BDCs), and institutional traders—provide a various array of debt devices, comparable to senior secured loans, uni-tranche loans, mezzanine financing, bridge loans, and subordinated debt. Personal lenders’ flexibility and velocity in underwriting and approving loans have made them an interesting possibility for corporations seeking to finance leveraged buyouts, acquisitions, expansions, or debt refinancing. Their skill to supply extra custom-made phrases than conventional banks has enabled personal lending to grow to be a major supply of financing, significantly for middle-market corporations.

The rise of personal lending has additionally been fueled by the worldwide seek for yield in a low-interest-rate surroundings.

Institutional traders, together with pension funds, insurance coverage corporations, and endowments, have more and more allotted capital to non-public debt because it gives engaging risk-adjusted returns with low correlation to conventional fairness and fixed-income markets.

This inflow of capital has allowed personal lending companies to scale their operations, even competing with conventional banks on bigger, extra advanced transactions.

Technological innovation has additionally performed a transformative function in each personal fairness and personal lending.

In personal fairness, developments in information analytics, synthetic intelligence, and machine studying have revolutionized deal sourcing, due diligence, and portfolio administration. Companies now use refined instruments to evaluate market developments, predict enterprise efficiency, and establish high-potential funding alternatives.

Equally, in personal lending, the rise of digital platforms and market lending has democratized entry to credit score, permitting companies to safe loans by way of on-line platforms that join debtors immediately with traders.

This innovation has streamlined the lending course of, decreased prices, and elevated transparency.

Resulting from their vital development, personal fairness and personal lending are dealing with elevated scrutiny from regulators attributable to considerations over excessive ranges of leverage, lack of transparency, and the potential buildup of systemic dangers.

In personal fairness, the usage of leveraged buyouts has raised questions concerning the affect of excessive debt ranges on the monetary stability of acquired corporations, particularly throughout financial downturns. Moreover, personal fairness’s affect on employment and wages has drawn criticism, with some arguing that short-term revenue motives can undermine long-term enterprise sustainability.

In personal lending, the fast enlargement of direct lending and personal credit score funds has triggered considerations concerning the buildup of credit score dangers outdoors the standard banking system. Since personal lenders function with far fewer regulatory constraints, there’s much less visibility into their threat exposures.

As these establishments proceed to develop and grow to be extra interconnected with conventional banks and different monetary establishments, misery within the personal lending market may have far-reaching implications for the broader monetary system.

The broader Non-Financial institution Monetary Intermediaries sector, of which personal fairness and personal lending are key elements, has seen explosive development for the reason that 2008 monetary disaster.

With the NBFI sector now being bigger than the standard banking system within the U.S., its development trajectory nonetheless reveals no indicators of slowing down.

This fast enlargement has caught the eye of regulators such because the Monetary Stability Board, who’re more and more involved concerning the systemic dangers posed by the shadow banking sector. Traditionally, tighter regulatory frameworks—just like the Dodd-Frank Act—have solely been enacted in response to crises, such because the 2008 meltdown, when it turned clear that larger oversight was wanted.

Their fast development and evolving complexity current each alternatives and challenges.

Whereas these sectors have offered new avenues for funding and credit score, their lack of transparency and regulatory oversight makes them weak to systemic dangers.

The FSB acknowledges the necessity for tighter regulatory frameworks to mitigate these dangers, however traditionally, such laws are typically reactive, applied solely after a disaster happens.

Laws comparable to Dodd-Frank wouldn’t have been essential had the Clinton Administration not repealed the Glass-Steagall Act within the Nineteen Nineties—a legislation initially enacted within the aftermath of the 1929 inventory market crash to manage the banking business. The repeal eliminated the separation between business and funding banking, a transfer that many argue contributed to the excesses main as much as the GFC.

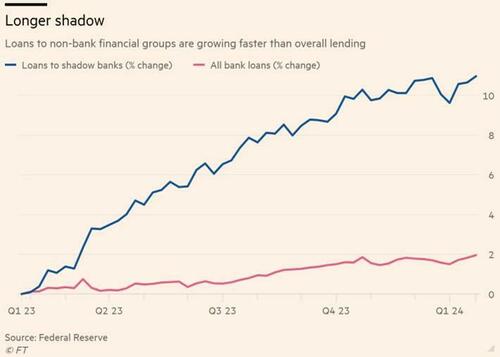

Right now, the NBFI sector has grow to be an more and more necessary borrower, which carries two vital implications.

First, the road between conventional banks and non-bank monetary establishments has grow to be more and more blurred, though they function below totally different regulatory regimes. This blurring creates ambiguity round threat oversight.

Second, NBFIs are borrowing at a a lot quicker fee than the general market, elevating considerations that the sector may very well be headed for a disaster of its personal.

The query stays: will regulators act in time, or will they as soon as once more be left enjoying catch-up when development charges like these grow to be unsustainable?

Furthermore, personal fairness companies and direct lenders have grow to be very important sources of credit score for small and medium-sized enterprises (SMEs) and leveraged buyouts. These areas are sometimes thought of too dangerous or capital-intensive for conventional banks, additional underscoring the rising function that NBFIs play in offering important credit score the place banks have grow to be extra risk-averse.

As NBFIs proceed to increase in affect and borrowing magnitude, the urgency for regulatory our bodies to deal with their systemic dangers grows—earlier than one other monetary disaster emerges from the shadows.

Shadow Banks and Personal Markets – Illiquidity

Liquidity threat is without doubt one of the most vital challenges confronted by personal fairness and personal lending companies, largely formed by the illiquid nature of their investments, market dynamics, and their funding buildings.

These companies make investments primarily in property with out energetic secondary markets, making it tough to shortly convert investments into money. Whereas taking up illiquidity threat permits them to pursue larger returns, it additionally exposes them to appreciable vulnerabilities, particularly throughout instances of monetary stress or financial downturns.

In personal fairness, companies purchase stakes in privately held corporations or interact in leveraged buyouts (LBOs) of public corporations. These investments usually contain multi-year commitments, with the objective of enhancing operations, rising worth, and ultimately exiting through a sale or preliminary public providing (IPO).

Nonetheless, when markets enter downturns, the exit methods of personal fairness companies typically face extreme constraints.

In such conditions, potential patrons could vanish, and IPO markets could shut, leaving companies unable to promote their holdings at favorable costs—or in some circumstances, unable to promote in any respect. This lack of liquidity creates vital challenges, tying up capital for much longer than anticipated and doubtlessly derailing deliberate funding cycles. With out the flexibility to exit their investments, personal fairness companies can expertise a liquidity crunch, the place the lack to generate money movement limits their skill to return capital to traders, pursue new investments, or meet different monetary obligations.

Equally, personal lending companies face their very own liquidity dangers.

These companies present loans to companies that usually fall outdoors conventional banking channels, together with middle-market corporations and people with decrease credit score scores. Whereas these loans usually provide larger yields to compensate for the larger threat, they arrive with a significant trade-off: illiquidity. Not like publicly traded bonds, which will be shortly purchased and offered on secondary markets, personal loans lack a prepared market, making it tough for lenders to boost money in instances of want.

In periods of monetary misery, these dangers grow to be much more pronounced. Corporations dealing with financial challenges could wrestle to satisfy their compensation schedules or refinance their debt, resulting in the next fee of defaults. As defaults rise, the worth of those personal loans can plummet, leaving lenders uncovered to vital losses. The lack to promote or restructure these illiquid loans in a well timed method compounds the liquidity threat, as lenders face mounting stress to satisfy their very own monetary commitments.

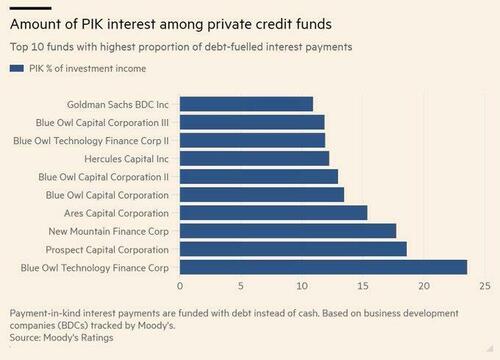

Furthermore, the growing use of payment-in-kind (PIK) buildings, the place curiosity funds are capitalized reasonably than paid in money, provides one other layer of complexity.

Whereas PIK preparations present momentary aid to debtors by suspending money funds, they heighten liquidity dangers for lenders. Capitalizing curiosity reasonably than receiving money inflows delays income and pushes the lenders deeper into illiquid positions, additional limiting their skill to generate liquidity when wanted. In instances of financial stress, this could depart lenders with rising obligations however restricted choices for elevating money, intensifying monetary vulnerabilities throughout the system.

After all, a key issue that exacerbates liquidity threat in each personal fairness and personal lending is the usage of leverage.

Personal fairness companies typically rely closely on debt to finance acquisitions, utilizing the acquired firm’s money movement to service that debt. When money flows falter or rates of interest rise, debt servicing turns into tougher, doubtlessly forcing companies to inject extra capital into struggling corporations or promote property at a steep low cost.

In personal lending, leverage is current each within the mortgage construction and in borrowing corporations. If financial situations worsen, extremely leveraged debtors could wrestle to repay their loans, resulting in defaults and creating additional liquidity stress for lenders who depend upon common repayments to take care of their very own monetary commitments.

One other dimension of liquidity threat comes from the fund construction itself.

Personal fairness and credit score funds are usually closed-end, which means traders can not entry each day liquidity like in mutual funds or ETFs. Buyers commit capital for a set interval, often 5 to 10 years, anticipating distributions from asset gross sales over time.

Nonetheless, if too many traders demand early liquidity, these funds could also be pressured to liquidate property below unfavorable situations, creating what is called a liquidity mismatch. This drawback is commonly magnified throughout financial crises, when many traders search to withdraw funds concurrently, placing extra stress on these funds to generate liquidity when they’re least capable of.

The COVID-19 pandemic offered a current instance of this liquidity mismatch. In the course of the market turmoil, many traders sought to cut back their publicity to riskier property, prompting vital stress on personal fairness and credit score funds to satisfy these calls for in a tough market. If pressured into fireplace gross sales, these funds can push asset costs decrease, sparking a downward spiral that additional erodes investor confidence and will increase redemption requests.

Personal fairness and lending companies additionally depend on exterior financing from banks or different monetary establishments to handle liquidity wants and execute offers. This reliance additional entangles these companies with conventional banks and non-bank monetary intermediaries (NBFIs), regardless of working below totally different regulatory frameworks. In instances of financial stress, banks could tighten lending situations or withdraw credit score, including extra complexity to liquidity administration for these companies.

The interconnectedness of the monetary markets signifies that liquidity points inside personal fairness and lending companies can have broader implications for the whole monetary system. As these sectors have grown, they’ve grow to be deeply intertwined with banks, institutional traders, and different market contributors. A liquidity disaster in a single space can set off wider disruptions, affecting asset costs, credit score availability, and investor sentiment throughout the monetary ecosystem.

For the broader NBFI sector, managing liquidity threat is vital, because it immediately impacts their operational stability and skill to navigate monetary stress. NBFIs, which embrace entities comparable to asset managers, hedge funds, insurance coverage corporations, personal fairness companies, and personal credit score funds, present essential monetary companies with out the identical entry to central financial institution liquidity or deposit bases that conventional banks depend on.

This lack of entry makes liquidity administration more difficult for NBFIs, significantly as a result of they typically maintain or finance illiquid property comparable to personal debt, actual property, or fairness stakes in personal corporations. In periods of volatility, these property grow to be much more tough to liquidate, exposing NBFIs to vital liquidity threat if they should meet sudden money calls for.

Many NBFIs face an extra problem from their reliance on short-term funding to finance longer-term investments. This funding mismatch, the place liabilities are short-term and property are long-term, leaves NBFIs weak when short-term funding markets tighten or grow to be dearer.

As an example, hedge funds and personal credit score funds typically depend upon short-term repurchase agreements (repos) or business paper to finance their positions. If these markets dry up during times of stress, NBFIs can face extreme liquidity pressures that threaten their solvency.

Investor runs or mass redemption requests are one other outstanding liquidity threat for NBFIs. Funding funds, comparable to mutual funds, ETFs, and hedge funds, permit traders to redeem their investments on quick discover. In instances of uncertainty, a rush of traders making an attempt to withdraw their cash can drive NBFIs to promote property shortly at depressed costs, additional exacerbating market stress and undermining investor confidence.

Given the interconnectedness of NBFIs with the broader monetary system, liquidity challenges can have far-reaching results. Many NBFIs preserve relationships with banks and different establishments by way of credit score strains, derivatives, and different monetary devices.

If an NBFI experiences a liquidity disaster, the affect can shortly unfold to different market contributors, affecting asset costs and destabilizing the broader monetary system.

The rising systemic significance of NBFIs highlights the necessity to fastidiously handle liquidity threat inside this sector. As these establishments proceed to tackle roles historically crammed by banks, the potential for liquidity pressures to create broader market disruptions has elevated.

Whereas NBFIs present important credit score and monetary companies, their reliance on illiquid property and short-term funding leaves them significantly weak to market shocks, making liquidity threat a central concern for the steadiness of the monetary system.

Conclusion

The transformation of the worldwide monetary panorama for the reason that 2008 International Monetary Disaster (GFC) has been monumental.

The shift from conventional banking methods and public markets towards non-bank monetary intermediaries (NBFIs) and personal markets has considerably altered the construction and functioning of finance. In consequence, NBFIs—together with hedge funds, personal fairness companies, personal credit score funds, and fintech corporations—have grown to occupy a bigger portion of the monetary ecosystem, changing into main gamers in company lending, funding administration, and liquidity provision.

One of the crucial profound developments has been the fast enlargement of personal fairness and personal lending markets. These sectors have advanced to satisfy investor demand for higher-yielding alternatives, providing a variety of revolutionary monetary merchandise comparable to leveraged buyouts (LBOs), personal credit score, and different debt buildings. The rise of those markets is a testomony to the adaptability of finance and the relentless pursuit of returns. Nonetheless, it isn’t with out vital threat—significantly within the realm of liquidity.

Liquidity threat stays a vital problem for personal fairness and personal lending companies. Each industries depend on illiquid property, comparable to personal debt and fairness stakes, that are tough to transform into money when wanted.

This inherent illiquidity can grow to be a significant vulnerability during times of monetary stress, when market situations deteriorate, exit methods are delayed, and asset gross sales grow to be constrained. The advanced and sometimes opaque nature of those investments additional compounds the chance, making it tough for market contributors and regulators to precisely assess the extent of publicity.

Using leverage amplifies these dangers.

Personal fairness companies, particularly, make the most of vital quantities of debt to finance acquisitions, whereas personal lenders present loans to extremely leveraged debtors. When financial situations worsen, the pressure on each the companies and their debtors turns into acute, resulting in elevated defaults, liquidity shortages, and the potential for pressured asset gross sales. This case is exacerbated by the “payment-in-kind” (PIK) buildings that delay money movement, creating extra stress on companies’ liquidity positions.

One other essential facet of liquidity threat lies within the fund buildings utilized by personal fairness and personal credit score companies. Closed-end funds with restricted liquidity choices can face a liquidity mismatch throughout financial downturns, as seen throughout the COVID-19 pandemic.

Buyers, looking for to withdraw capital, could drive these funds to promote property at unfavorable costs, sparking additional market disruption. Furthermore, the reliance of personal fairness and lending companies on exterior financing from conventional banks ties them carefully to the regulated monetary system, regardless of working below totally different regulatory frameworks.

As personal fairness, personal lending, and NBFIs proceed to develop in affect, so too does their interconnectedness with the broader monetary system.

This interconnectedness poses systemic dangers.

A liquidity disaster inside one sector may shortly cascade throughout the monetary panorama, resulting in broader disruptions in asset costs, credit score availability, and investor sentiment. The ripple results of a disaster in personal markets or shadow banking may undermine the steadiness of the worldwide economic system, simply because the collapse of main monetary establishments did throughout the 2008 GFC – however with much less warning attributable to much less visibility.

The place to begin for personal markets is illiquidity, in contrast to public markets whose place to begin is liquidity. When issues get illiquid, and so they all the time do, this may pose a a lot larger drawback for personal markets.

Regardless of the numerous function NBFIs play in trendy finance, the regulatory framework governing these establishments lags behind their rising significance. NBFIs function with far much less oversight than conventional banks, which heightens the dangers related to leverage and illiquidity.

Whereas the teachings from previous crises, such because the GFC, have led to some regulatory enhancements, historical past reveals that laws typically comply with crises reasonably than forestall them.

The query stays whether or not policymakers can enact tighter oversight of the NBFI sector earlier than a liquidity-driven disaster emerges.

In conclusion, the rise of NBFIs and personal markets presents each alternatives and challenges.

Whereas these sectors have offered new avenues for funding and credit score, their inherent illiquidity and use of leverage make them weak to market shocks. The rising systemic significance of NBFIs highlights the necessity for a proactive regulatory strategy to managing liquidity dangers.

Solely by addressing these vulnerabilities can the monetary system hope to mitigate the affect of future crises, guaranteeing that the advantages of monetary innovation don’t come at the price of systemic stability.

About

The Macro Alchemist is an amalgamation of concepts, experiences, and investing disciplines sourced over a long time from the minds of Brent Johnson and Michael Peregrine.

Discover this newest subject additional, and extra market insights from the creators, at MacroAlchemist.com