Nikada

Expensive Fellow Traders,

I ended our Q3 letter saying, “[w]ith a concentrated portfolio of idiosyncratic firms, our returns have and can proceed to come back in chunks. As we ‘wait,’ progress is being made. I believe we maintain a number of multi-baggers and consider that the desk is ready for an additional ‘chunk’ of returns.” In This autumn, we had been certainly rewarded for our ready with one other chunk.

The Fund1 returned roughly 13%2 throughout the quarter and ended up greater than 27%2 for the total yr. Please consult with your particular person statements for precise efficiency as returns will fluctuate by fund, class, and timing of funding.

Greenhaven Highway’s final two letters have centered on the adage that “the massive cash is within the ready,” and it’s good to see a few of the appreciation within the portfolio that we have now been ready for.

WHAT WE DON’T OWN

Most of this letter can be dedicated to our largest holdings and up to date purchases, nevertheless it’s value noting what we do not personal: the S&P 500 (SP500, SPX). The truth is, solely considered one of our holdings, KKR, is within the index, representing about 0.20% of it. Your Greenhaven Highway portfolio presently has just about no overlap with the S&P 500.

The previous decade has favored dimension – massive firms have outperformed small ones. By year-end 2024, the “Magnificent 7” constituted nearly 40% of the S&P 500’s complete worth and drove a lot of the index’s 24%+ return for the yr. With out these seven, the remaining 493 returned simply 4.1%.3

The “Magnificent 7” are highly effective firms with direct ties to AI, which is able to undoubtedly change the world. AI also needs to be helpful to our portfolio. For instance, I consider that specialty insurer Hagerty (HGTY) will combine AI-based instruments over time to considerably scale back the price of servicing claims. Equally, Cellebrite (CLBT) will use AI instruments to dramatically enhance the effectivity of its customers and their investigations, and will be capable of seize a few of that worth.

When you’ve got not experimented with Google Gemini, particularly the Superior 1.5 Professional with Deep Analysis, I encourage you to take action. Just lately, I used to be attempting to grasp the size and scope of the damages doubtless impacting a specific property insurer as a result of tragic Los Angeles wildfires. In a matter of minutes, Google Gemini created a analysis plan, scanned 57 web sites, and generated a 5-page report with calculations that had been all sourced and footnoted. There have been some errors, however the high quality of the report was gorgeous. The expertise remains to be flawed, however the trajectory is obvious.

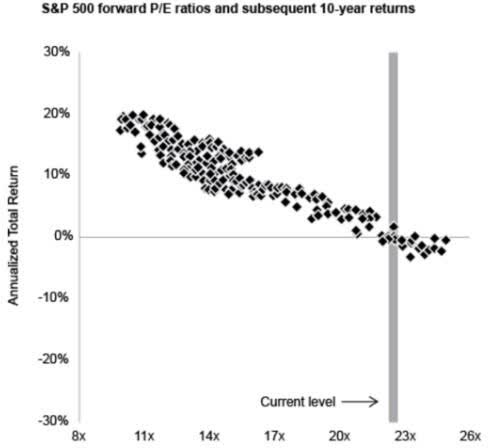

Perhaps this time is totally different and the Magazine 7 are so magnificent that they may proceed to drive the S&P 500 ever increased, however I’m skeptical. I’d level to 2 information factors. The primary is a chart compiled by J.P. Morgan Asset Administration that exhibits historic ahead returns for the S&P 500 at totally different ahead P/E ranges (see left).

Given the 2024 year-end ahead P/E ratio was just below 23X, the 10-year ahead returns from this degree are traditionally unfavorable.

The opposite information level I’d consult with is company-specific. On any given day, Apple (AAPL) is the most important or second-largest element of the S&P 500, comprising greater than 7% of the overall worth. In 2024, AAPL’s complete shareholder return was greater than 30%. That 30% return is great and is, actually, higher than Greenhaven Highway’s web return final yr. That mentioned, given the fast appreciation in share worth, it’d shock you that for the newest fiscal yr (ends September), Apple’s income elevated by lower than 3% year-over-year and its per-share earnings truly declined.

After the rise in share worth, AAPL ended the yr at $250.42 with a trailing P/E in extra of 41X final fiscal yr’s earnings of $6.08 per share. That kind of valuation sometimes implies {that a} fairly rosy future is in retailer for the enterprise. Nevertheless, Apple’s AI merchandise have been lackluster, the Imaginative and prescient Professional is rumored to have been discontinued, and the sluggish charge of innovation of their telephones is notable. The most important element of the index could also be working out of steam.

For the final a number of years, not proudly owning the S&P 500 as a complete, or its largest parts individually, has been a headwind, comparatively talking. I’m not calling the highest or for a direct reversal of that development, however a number of growth has pushed a lot of the outperformance, and I’m blissful searching outdoors of the S&P 500 proper now.

GETTING THERE

One of many nice pleasures of my work life has been my relationship with Chuck Royce. Final yr, the Museum of American Finance inducted Chuck into their Corridor of Fame (true story, I used to be there) and honored him with their Monetary Innovation Award. To me and to many others, Chuck is the godfather of small cap investing. When he speaks, I pay attention. (Full disclosure, the Royce household is a seed investor in Greenhaven Highway).

An organization that’s small and illiquid will usually commerce at a reduction to its bigger and extra liquid friends. Years and years in the past, after I was first attending to know Chuck, I used to be taking a look at investing in a really small, very illiquid firm and was scuffling with its “illiquidity low cost.” Was the share worth discounted sufficient given the shortage of liquidity?

If anyone might supply sound perception, it was the Godfather, so I requested Chuck to sit down down with me to debate the corporate. I walked him by means of the merchandise, administration, and valuation, and ended with my query concerning the applicable illiquidity low cost. Like many conversations with sensible folks, I didn’t get my precise query answered. As an alternative, he politely informed me that I used to be anxious concerning the unsuitable factor. The true query he proffered was, “Will the corporate get there?” to which I responded, “Get the place?”

Chuck went on to clarify that companies face all types of challenges, but when they will execute persistently, over time the small and illiquid firm will develop into bigger and extra liquid. With development and execution, the illiquidity problem solves itself, so the extra necessary questions are: Will their stability sheet derail them? How will competitors reply? Will margins erode? How lengthy is the runway? Will merchandise develop into out of date? Can administration scale the enterprise? Is there keyman threat?

Chuck’s level was easy: Whereas pricing issues, a enterprise’s capability to outlive and prosper over time issues extra. Companies sometimes fail. That is true even for public firms. As long-term traders, understanding a enterprise’s capability to outlive and prosper for an extended time period is extra necessary than calculating the precise low cost that must be embedded inside at the moment’s buy worth. Can the corporate keep within the sport? Can they keep away from getting knocked out? Can they “get there?” For smaller firms, that is the crucial query.

TOP 5 POSITIONS

Beneath, I’ll talk about our largest holdings by means of the lens of “getting there.”

PAR Expertise (PAR)– PAR’s underlying level of sale (POS) enterprise has an annual churn of lower than 5%. This can be a implausible, steady base upon which to construct a enterprise that may “get there.” Their continued development and their profitable worth will increase additional support their capability to “get there.” By a mix of natural development and acquisitions, PAR ended the yr as a a lot bigger and stronger firm, rising annual recurring income (‘ARR’) from $137M on the finish of This autumn 2023 to greater than $270M at year-end 2024.

The corporate has a number of paths for continued natural development, together with the rollout of Burger King (U.S.), which has already contracted with PAR. As one other optimistic signal for PAR’s cross-selling initiatives, Burger King simply purchased PAR’s back- workplace resolution for his or her U.S. company shops. Different paths for natural development embrace growing penetration in comfort shops with their loyalty and funds merchandise (simply launched), providing PAR’s current buyer base POS options for his or her worldwide operations (because of the TASK acquisition), continued cross-selling (funds, again workplace, loyalty, on-line ordering), and continued new emblem wins (I count on one other Tier 1 buyer this yr). I consider PAR may also proceed to gas development through acquisitions. For instance, PAR not too long ago purchased an analytics platform that’s instantly accretive and could be offered throughout the corporate’s buyer base for years to come back.

Trying ahead, the aggressive panorama stays favorable, the pipeline sturdy, and the worth proposition compelling. The a number of could contract, however I consider that, even with none new acquisitions, in 2 years this firm can be greater than 50% bigger on a recurring income foundation, considerably worthwhile, and in a position to deal with its debt, which doesn’t come due till 2030. Even when PAR isn’t “there” fairly but, they nonetheless had a transformative yr in 2024 and are well-positioned for worthwhile development going ahead. I consider that they will develop into a Rule of 40 firm subsequent yr.

Lifecore (LFCR)– Of our prime holdings, Lifecore faces essentially the most uncertainty in “getting there.” However the path exists: They’ll triple manufacturing with no further capital funding. Their largest buyer, Alcon, is thru its destocking section. Alcon additionally has contractual minimal quantity step-ups that may kick in for 2027. The phrases of the contracted quantity step- ups haven’t been disclosed, however I estimate them to be on the order of $25M within the medium time period and greater than $50M in the long run.

At current conferences and on investor calls, there was a noticeable enhance in administration’s references to the potential for brand new contracts for current medicine (tech transfers) in addition to the potential for a big contract with a multinational firm.

Thus, along with the contractual step-ups that ought to assist drive income, a number of different levers are being pulled. The mix of value containment and income development/working scale make the trail to improved margins fairly believable.

The brand new CEO, Paul Josephs, brings substantial enterprise growth expertise from Mylan. Due to investments already made, Lifecore can practically triple manufacturing with no further capital required. With elevated volumes and higher expense administration, administration displays have indicated that EBITDA margins ought to enhance from 15% to 25%+ within the medium time period. The ultimate ingredient for being a multi-bagger can be a number of growth. For context, two different CDMO companies, Catalent and Avid Biosciences, had been not too long ago bought for greater than 22X EBITDA and 6.3X gross sales, respectively.

Simple arithmetic exhibits the potential: At $300M income and 25% EBITDA margins, you get $75M EBITDA. Apply a 15X a number of and assume 50M shares after debt conversion, and also you attain $20 per share versus at the moment’s sub-$7 worth. There may be additionally the potential for increased multiples and better EBITDA margins. We aren’t enjoying to make 5% or 10% right here. Curiously, the CEO made his first open market buy of shares this yr and took a contract closely tied to share worth.

KKR (KKR) – KKR has been in enterprise for 48 years and ended the third quarter with $624 billion in property below administration (AUM), up 18% year-over-year. On the agency’s final investor day, they highlighted that 80% of their methods will not be but scaled and they’re simply scratching the floor with people. The truth is, they laid out an $11 trillion development alternative within the options trade. Given their model title and historic monitor file, they’re extremely well- positioned to monetize that wave. KKR has not solely “gotten there”, however they’re additionally very, very more likely to keep“there.”

Cellebrite (CLBT)– Cellebrite has a decade-long historical past of rising shortly and profitably and is a Rule of fifty firm (development charge + EBITDA margin), rising their recurring income by 26% whereas sustaining EBITDA margins of 24%. I consider this development ought to proceed as they’re at first of an improve cycle: administration expects 15% of the shopper base to have upgraded in 2024, leaving an extended runway for 2025 and 2026. The corporate ought to speed up its federal alternative by acquiring FedRamp certification in 2025, which is able to make it simpler for Federal prospects to buy Cellebrite merchandise. Even with out FedRamp, the U.S. Federal authorities represents greater than 30% of income.

As mentioned in earlier letters, I consider Cellebrite can be a big beneficiary of AI as they’re integrating it into their merchandise, and I consider they’re well-positioned to dramatically enhance buyer productiveness. They’ve distribution, information, and guardrails to verify solely the right information is analyzed. Since businesses are constrained on hiring expertise, software program is essentially the most viable path to decreasing case backlogs and growing closure charges (the KPIs of Cellebrite’s prospects). Cellebrite ought to be capable of seize a few of the incremental worth they may ship.

Whereas I’ve little doubt that Cellebrite will “get there,” I do surprise who the CEO can be and if it would stay an unbiased public firm. After 20 years on the helm, Yossi Carmil stepped down from the CEO position on the finish of 2024, saying the plan after reporting Q3 revenues exceeding $100 million. Good for him! Cellebrite’s Government Chairman of the Board, Tom Hogan, has stepped into the interim CEO position. Tom has an extended historical past in software program and was an working associate at Vista Fairness, which has an awesome playbook for optimizing software program firms. I speculate that Tom will develop into the everlasting CEO and should, within the medium time period, attempt to promote the corporate to Axon Enterprise (AXON), which is a 5% shareholder.

Burford (BUR) – Burford is not simply “getting there” – they’re already the chief in litigation finance with a 27% historic gross IRR and losses on solely 13% of instances, in keeping with their disclosures. I’ve gone out of my approach in previous letters to spotlight simply how good the corporate has been traditionally at financing litigation. They hardly ever lose cash on instances, partially as a result of the overwhelming majority (76%) settle. They do, nonetheless, often have “monster winners” that return 10X, 50X and even 100X their preliminary funding.

Burford’s management group personally owns inventory totaling 9% (>$200M) of the corporate and has been a web purchaser of the shares. With aligned insider possession, traditionally low loss charges, and tangible ebook worth making up greater than 80% of their share worth, Burford is a well-capitalized and sustainable enterprise.

In 2024, Burford was worse than “lifeless cash” because it posted a share worth decline. It’s hardly ever straightforward to isolate the reason for a share worth decline, however apparently traders had some consternation over the slowing tempo of investments in new instances. Whereas I’ve tried to focus our consideration on Burford’s present and future enterprise, I believe it’s time to look deeper on the YPF case.

The overall details of the YPF case will not be disputed. YPF is an oil firm working in Argentina that was publicly traded. In 2012, Argentina nationalized the corporate and gave no compensation to current shareholders. Burford has been financing the case of the shareholders in opposition to Argentina. YPF nonetheless exists, and the Argentinian authorities has benefited for greater than a decade from the shares they stole/nationalized with out compensation.

This litigation in opposition to Argentina has gone on for years, together with appeals by Argentina disputing if Burford even has the suitable to gather and if the U.S. courts have jurisdiction. The plaintiffs Burford financed had been finally awarded $16B, which is incomes $1B per yr in curiosity. In spherical numbers, a full payout would doubtless be value greater than $6B for Burford, or $25+ per share. To place this in perspective, that is double the place the shares ended the yr for a single case in Burford’s portfolio. We are able to debate the magnitude and timing of the last word payout, however I consider the anticipated worth isn’t $0.

Clearly the market isn’t pricing in a full settlement with Argentina. The Argentinian authorities has used each delay tactic legally obtainable to them. Argentina additionally doesn’t have the cash to pay Burford or different YPF claimants. Nevertheless, issues are enhancing in Argentina. Below President Javier Milei, who got here into workplace in December 2023, there already has been broad regulatory reform, and are working in direction of getting the nation’s fiscal home so as. Milei has shrunk the dimensions of presidency and simply reported its first price range surplus in 14 years!

Milei desires to be welcome in worldwide circles. He goes to the “world convention” in Davos, Switzerland, and has named his canine Milton Friedman. To understand his ambitions, he might want to work with the IMF and world capital markets, which might be simpler with a profitable decision of the YPF case the place a earlier regime unambiguously stole from international shareholders who haven’t but obtained any restitution. I consider there’s a deal available.

Up to now, there have been higher proxies for Argentinian reform and progress than Burford shares. The S&P’s Argentina index (Merval) surged 172.52% in 2024 vs. a decline for Burford. With so many events concerned, together with the Argentinian authorities and varied U.S. courts, the vary of outcomes for any Burford/YPF settlement could be very extensive. That mentioned, I believe there’s a larger than 50% probability that we get a settlement value no less than the whole 2024 year-end share worth of Burford within the subsequent 2 years (to be paid out over years). Milei didn’t create this downside, however I more and more suppose he’ll remedy it. In the meantime, Burford has an impressive litigation finance enterprise that retains chugging away by funding lawsuits with excessive anticipated worth returns. I don’t suppose BUR stays lifeless cash, and an honest Argentina settlement might double the worth of the shares in a single day. We might “get there” with a step operate enhance in share worth.

ONE MORE TO WATCH – IWG

Whereas not in our prime 5 largest positions, I wished to revisit Worldwide Office Group (OTCPK:IWGFF). I wrote extensively concerning the firm within the This autumn 2023 letter. IWG was additionally quickly “lifeless cash” in 2024 with its share worth declining. As a reminder, IWG is the most important operator of versatile/shared workplace areas. The corporate is more and more shifting to an asset-light mannequin the place they associate with landlords which have vacant area. Within the new partnership mannequin, IWG places up no capital for the renovations and doesn’t incur the liabilities of a multi-year lease. As an alternative, they create their methods, instruments, and expertise to handle the websites. I consider there’s nearly no draw back to a partnership for IWG, however there’s upside through administration charges and a share of the revenues for the partnership services. As a result of the entire means of signing up a associate, managing the location renovation, and at last recruiting tenants takes nearly 3 years to succeed in maturity, the economics of the partnership mannequin will not be totally evident in IWG’s historic financials.

IWG trades for roughly 7X my estimate of this yr’s working money stream, a valuation sometimes reserved for a enterprise in decline. However IWG is rising and making progress on a number of dimensions that ought to enhance its worth over time. Over the course of 2025, I believe IWG ought to pay down debt and provoke a inventory buyback. The corporate ought to full its transition to GAAP financials, which is able to permit for a transition from a London itemizing to a U.S. itemizing, a course of that tends to end in increased valuation multiples. Extra importantly, IWG will proceed to signal and open partnerships. Over time, the partnership enterprise ought to have sufficient scale to be listed individually. There are lots of similarities to the IWG partnership enterprise and resort administration firms comparable to Hilton and Hyatt, however valuation isn’t presently considered one of them as Hilton trades at >30X free money stream and Hyatt at greater than 20X free money stream.

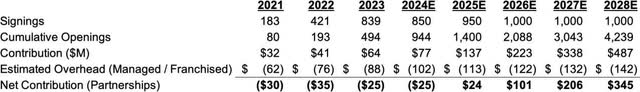

Beneath is a straightforward mannequin displaying the expansion of simply partnership signings, open places, and contribution from Partnerships. The a part of the enterprise that I’m most enthusiastic about almost certainly misplaced cash in 2024, however because the signed places come on-line, the profitability ought to come shortly. There must be working leverage within the mannequin.

We should wait, however the partnership mannequin ought to “get there” and develop into an more and more significant portion of the income of the enterprise. The Partnerships portion of the enterprise, which ought to appeal to the best a number of as evidenced by Hilton/Hyatt, is rising the quickest. Final yr’s losses ought to flip to contribution because the variety of open websites continues to develop. Larger contribution + increased a number of ought to result in increased share worth.

RECENT SALE

We offered nearly all our MarketWise (MKTW) holdings throughout the quarter, practically concluding our worst funding for the reason that founding of the Partnership. Looking back, I underestimated simply how massive of a beneficiary the corporate, a multi-brand content material and expertise platform for self-directed traders, was from Covid. I take some solace in that, throughout the whole IPO and subsequent 3+ years, insiders had been web patrons of shares and the most important holders and board members by no means offered a share. I had excessive hopes for Porter Stansberry as CEO. He led the corporate for the 20 years earlier than their IPO. His numbers had been a factor of magnificence. Worthwhile development yr after yr after yr. He left the corporate shortly earlier than the IPO however returned in 2023. Individuals matter and when he left the CEO position, I started to consider the exits. MarketWise constructed an unbelievable enterprise with solely $50K of invested capital, they usually could actually be capable of rebuild the expansion algorithm, however we’re unlikely to be shareholders for that journey.

SHORTS

We ended the yr brief 2 firms dealing with vital litigation with the potential for treble damages (i.e., 3X the precise quantity) for his or her actions and potential liabilities far in extra of their market capitalizations. We’re additionally brief 3 main indices and held some deep out of the cash places on a significant index.

RECENT PURCHASES

Just lately, we bought shares in two firms which are listed outdoors of the U.S., are present process transitions, and are experiencing deep market skepticism about their capability to “get there.” These positions are mentioned within the appendix.

OUTLOOK

Let me be direct about market situations: shares aren’t low-cost. With increased rates of interest sometimes resulting in decrease multiples and a possible reversion to historic valuations, I count on general market multiples to say no. This creates headwinds for our portfolio’s share costs.

However a number of compression could be offset by development. If multiples merely maintain regular, our firms ought to proceed strengthening. Keep in mind – we do not personal the market. We personal a small assortment of firms with sturdy administration groups and compelling merchandise. We could must endure the ups and downs of a number of compression and growth, however, collectively and over time, I consider that our firms will “get there.” I consider that progress is being made throughout the waits and there are chunky returns available.

Sincerely,

Scott

APPENDIX – NEW PURCHASES IN This autumn

Supply Hero (OTCPK:DLVHF, DHER) – New Buy

A easy thesis underlies this complicated enterprise: The market is giving us massive, worthwhile items of Supply Hero without cost. Supply Hero is the “world’s main native supply platform working market, own-delivery and darkish retailer companies.” Supply Hero has the #1 meals supply app in over 50 nations and >90% of their gross merchandise worth (GMV) is from nations the place they’re #1. The supply app trade tends to coalesce round one or two winners in every market as shoppers need choice, low value, and quick supply, which the most important gamers are finest positioned to offer. Equally, eating places wish to attain a broad viewers and can gravitate in direction of the platforms driving essentially the most enterprise.

As meals supply apps have developed, two developments have emerged which are value highlighting. The primary is that the platforms that management their very own supply have tended to “win,” as they can higher fulfill prospects who finally need meals delivered shortly and sizzling when it arrives at their door. The second development is the addition of “fast commerce” the place the apps can help you order extra than simply meals, sometimes offering entry to a lot of distributors comparable to grocery shops, pharmacies, magnificence merchandise, and so forth. The addition of fast commerce orders will increase utilization of the supply networks, gives an extra income stream, and drives increased frequency of purchases from customers. The necessity to management supply and supply greater than meals from eating places dramatically will increase the complexity of those companies. This isn’t so simple as throwing up a web site and accepting bank cards. Operations are complicated, scale issues, and density issues.

Analyzing Supply Hero is tough as they function in 72 nations throughout a number of enterprise strains. The corporate is suppressing income by investing to develop the enterprise. Along with totally different markets being in numerous phases of development, the corporate additionally operates in numerous aggressive landscapes. In some nations Supply Hero is dominant, in others it’s engaged in costly canine fights to seize market share. For a very long time, Supply Hero fell into the “too arduous” pile.

Within the second half of 2024, Supply Hero started to disclose the economics of a few of their markets. Extra importantly, the corporate not too long ago listed its Talabat division, which serves the Center East area together with the UAE, Kuwait, Qatar, Bahrain, Egypt, Jordan, Oman, and Iraq. On account of itemizing Talabat, Supply Hero raised just below $2B and minimize its debt in half, successfully taking any short-term debt points off the desk. The itemizing additionally highlighted simply how good of a enterprise Talabat is and the way good a scaled meals supply enterprise can develop into.

In spherical numbers, Supply Hero has a market capitalization of €8.7B, plus one other €2B in debt for an enterprise worth of €10.7B. In opposition to that enterprise worth, Supply Hero retained just below €8B of Talabat inventory. Talabat is a small piece of the general enterprise, representing roughly 15% of income/GMV. This dynamic of getting most of Supply Hero for “free” raises 3 potential situations. The primary state of affairs is that Talabat inventory is wildly overvalued, making any sum of the elements valuation inaccurate. The second state of affairs is that the remaining 85%, non-Talabat enterprise is being precisely mirrored within the present mixed valuation. The third state of affairs is that the €10.7B enterprise worth above displays a mispriced safety and we might make actual cash over time by proudly owning Supply Hero.

State of affairs 1 – Talabat is wildly overvalued: This doesn’t look like the case. Talabat generated over $400M in working money stream in 2024 whereas rising revenues and GMV in extra of 20%. Talabat is predicted to develop each money stream and revenues at an identical charge in 2025. I’d argue that, for a fast-growing enterprise with working leverage, buying and selling at 20X trailing working money stream isn’t wildly mispriced. The truth is, I believe there’s a very affordable case to be made that it’s undervalued.

State of affairs 2 – The remaining 85% of the corporate is overvalued at below €3B: I’d level out that Uber provided $950M – just below 1/3 of this €3B stub worth – for Supply Hero’s Taiwan enterprise. The Taiwan enterprise is lower than 5% of DHER’s remaining non-Talabat GMV. The Uber deal was scuttled for regulatory causes, however its existence would indicate that the market is ascribing simply ~€2B in worth to Supply Hero’s remaining enterprise, excluding Talabat and Taiwan. This implied valuation encompasses subsidiaries that maintain the #1 market share in nations comparable to South Korea, Italy, Greece, Argentina, and Turkey. South Korea alone generated roughly $500M of adjusted EBITDA in 2024. Assembling a mosaic of those details, I don’t suppose the remaining 85% is value just below €3B or the remaining 80% (excluding Talabat and Taiwan) is actually value lower than €2B.

State of affairs 3 – We Make Actual Cash: Supply Hero actually has challenges, together with stiff competitors from Coupang in South Korea and Meituan in Saudi Arabia. The corporate can be navigating labor legislation points within the EU and the failed sale of the Taiwan enterprise, however I consider it is a enterprise headed in the suitable path. Within the final letter we mentioned firms partaking in “self-help” and the profitable itemizing of Talabat and the tried sale of its Taiwan enterprise reveal that Supply Hero falls into this bucket. As well as, the corporate has dramatically decreased losses over the previous 4 years and has guided to being free money stream optimistic for 2024.

Supply Hero is buying and selling at lower than 10X 2025 EBITDA, a determine that’s rising 50%+. Now we have the chance for all 3 engines of share worth returns to fireplace right here – revenues can develop double digits, margins are enhancing a lot sooner, and we are able to get a number of growth on each the listed Talabat shares and the remaining Supply Hero enterprise. I consider we have now the chance to make multiples of our cash because the enterprise grows and if multiples develop.

Vistry (OTCPK:BVHMF, VTY) – New Buy

Generally the market overreacts to short-term points in a declining enterprise whereas lacking the worth within the rising one. That is Vistry. As three revenue warnings drove shares down 50%, we purchased into this UK homebuilder that is transitioning from conventional homebuilding to a capital-light partnership mannequin centered on inexpensive housing.

The standard homebuilding enterprise – which they’re exiting – requires substantial upfront capital and faces cyclical dangers. The partnership enterprise, their future focus, sometimes requires much less capital for shorter intervals whereas working with authorities and non-profit companions.

Administration has been very clear. As they transition away from the standard Homebuilding enterprise, there can be extra money on the order of $1B as extra stock and land is offered off. Vistry has been paying down debt and shopping for again inventory. Up to now, the buyback has been comparatively modest at £300K per day however must be extra aggressive as soon as the debt is paid off.

The shares ended the yr buying and selling under tangible ebook worth, which I consider is successfully under liquidation worth such that you could possibly theoretically promote the land, completed homes, and works in progress and never lose cash. The shares had been additionally valued at 7X ahead earnings, which can be depressed and could also be understated, as I think that 2025 has been “kitchen sinked” with sure prices lumped in and sure gross sales delayed. Even with the earnings warnings and price overruns in Homebuilding, the corporate will make greater than £300M in 2025 delivering 17K+ items. Their medium-term steering, which can get pushed out or revised, was for £800M in working earnings on 22K residence items at 12% margin. Vistry is buying and selling at simply over 3X their medium-term steering. Common UK homebuilders commerce at greater than 10X working earnings.

Administration has to execute, however the setup is in place for each earnings development and a number of growth whereas a big share buyback is going on. It’s straightforward to pencil out a 4X or extra IF administration actually has their arms across the prices which we and others can be watching intently. It was the attract of 4X+ upside for one thing which goes asset-light and buying and selling under liquidation worth that had us purchase our first homebuilder. I’m admittedly not fluent within the UK housing market or the vagaries that drive the companions’ (councils, and so forth.) habits, so it is a smaller place. If the corporate doesn’t “get there” the truth that they’re buying and selling under liquidation worth ought to present some safety.

Footnotes 1 Greenhaven Highway Capital Fund 1, LP, Greenhaven Highway Capital Fund 1 Offshore, Ltd., and Greenhaven Highway Capital Fund 2, LP are referred to collectively herein because the “Fund” or the “Partnership.” 2 See finish notes for an outline of this web efficiency. 3 J.P. Morgan Asset Administration: Information to the Markets, Q1 2025 DISCLAIMERS AND DISCLOSURES NOT AN OFFER OR RECOMMENDATION. This doc doesn’t represent a suggestion to promote, or the solicitation of any supply to purchase, any curiosity in any Fund managed by Greenhaven Highway Funding Administration LP and/or its associates, MVM Funds LLC and Greenhaven Highway Capital Companions Fund GP LLC (all collectively “Greenhaven Highway”). Such supply could solely be made (i) on the time a professional offeree receives a confidential non-public placement memorandum describing the providing and associated subscription settlement and (ii) in such jurisdictions the place permitted by legislation. The dialogue on this doc isn’t supposed to point general efficiency which may be anticipated to be achieved by any Fund managed by Greenhaven Highway and shouldn’t be thought of a advice to buy, promote, or in any other case put money into any specific safety. Portfolio holdings change over time. Securities referred to in these supplies don’t signify the entire securities held, bought, or offered by Greenhaven Highway. Any references to largest or in any other case notable positions will not be based mostly on the previous or anticipated future efficiency of such positions. An funding in a Fund is speculative and is topic to a threat of loss, together with a threat of lack of principal. There is no such thing as a secondary marketplace for pursuits within the Funds and none is predicted to develop. No assurance could be given {that a} Fund will obtain its funding aims or that an investor will obtain a return of all or a part of its funding. By accepting receipt of this communication, the recipient can be deemed to signify that they possess, both individually or by means of their advisers, adequate funding experience to grasp the dangers concerned in any buy or sale of any monetary devices mentioned herein. FORWARD LOOKING STATEMENTS. Sure data contained herein constitutes “forward-looking statements”, which could be recognized by way of forward-looking terminology comparable to “could,” “will,”‘ “ought to,” “count on,” “anticipate,” “goal,” “aim,” “venture,” “think about,” “estimate,” “intend,” “proceed” or “consider” or the negatives thereof or different variations thereon or comparable terminology. Attributable to varied dangers and uncertainties, precise occasions or outcomes or the precise efficiency of a person funding, an asset class or any Fund managed by Greenhaven Highway could differ materially from these mirrored or contemplated in such forward-looking statements. Previous efficiency isn’t indicative of future outcomes. Greenhaven Highway undertakes no obligation to revise or replace any forward-looking assertion for any purpose, except required by legislation. Any projections, market outlooks or estimates on this doc are forward-looking statements and are based mostly upon sure assumptions and shouldn’t be construed to be indicative of the particular occasions which is able to happen. Except in any other case acknowledged, all representations on this doc are Greenhaven Highway’s beliefs on the time of its preliminary distribution to recipients based mostly on trade information and/or analysis. The forward-looking statements contained in these supplies are expressly certified by this cautionary assertion. INFORMATION COMPLETENESS AND RELIABILITY. Whereas data utilized in these supplies could have been obtained from varied printed and unpublished sources thought of to be dependable, Greenhaven Highway doesn’t ensures its accuracy or completeness, accepts no legal responsibility for any direct or consequential losses arising from its use, can’t settle for duty for any errors, and assumes no obligation to replace these supplies. Hyperlinks contained herein will not be endorsements, and Greenhaven Highway isn’t answerable for the performance of hyperlinks or the content material therein. USE OF INDICES. Indices, to the extent referenced on this doc, are introduced merely to point out common developments within the markets for the interval and will not be supposed to indicate {that a} Fund’s portfolio is benchmarked to the indices both in composition or in degree of threat. The indices are unmanaged, not investable, don’t have any bills and should mirror reinvestment of dividends and distributions. Index information is offered for comparative functions solely. It shouldn’t be assumed that any portfolio(s) managed by Greenhaven Highway will include any particular securities that comprise the indices described herein. The S&P 500 is a inventory market index that tracks the efficiency of 500 of the most important publicly traded firms within the U.S., representing a broad cross-section of industries. The Russell 2000 is a inventory market index that measures the efficiency of the two,000 smallest firms within the Russell 3000 index, offering a gauge of the efficiency of small-cap shares within the U.S. Web Efficiency (i) is consultant of a “Day 1“ investor within the U.S. restricted partnership Greenhaven Highway Capital Fund 1, LP, (ii) assumes the best potential administration payment of 1.25%, (iii) assumes a 25% annual incentive allocation topic to a loss carry ahead, excessive water mark, and 6% annual (non-compounding) hurdle, and (iv) is introduced web of all bills. Fund returns are audited yearly, although sure data contained herein could have been internally ready to signify a payment class presently being provided to traders. Efficiency for a person investor could fluctuate from the efficiency acknowledged herein on account of, amongst different elements, the timing of their funding and the timing of any further contributions or withdrawals. Greenhaven Highway Funding Administration LP is a registered funding adviser with the Securities and Trade Fee (“SEC”). SEC registration doesn’t indicate a sure degree of ability or coaching. The Fund(s)/Partnership(s) will not be registered below the Funding Firm Act of 1940, as amended, in reliance on exemption(s) thereunder. Pursuits in every Fund/Partnership haven’t been registered below the U.S. Securities Act of 1933, as amended, or the securities legal guidelines of any state, and are being provided and offered in reliance on exemptions from the registration necessities of mentioned Act and legal guidelines. The enclosed materials is confidential and to not be reproduced or redistributed in entire or partially with out the prior written consent of MVM Funds LLC or Greenhaven Highway Capital Companions Fund GP LLC, as relevant. |

Authentic Submit

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.