BeneathBlue

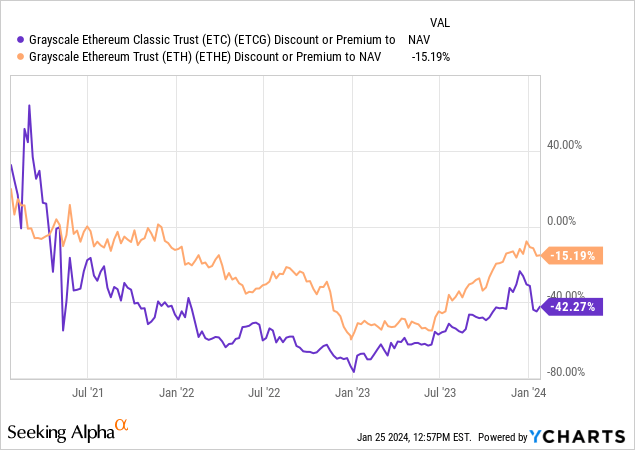

It has been nearly eight months since I last covered the Grayscale Ethereum Classic Trust (ETCG) for Seeking Alpha. Despite a monstrous 62% discount to net asset value at that time, I called the trust shares a “sell” anyway and noted some of the key reasons for that rating. Most importantly, related parties owned more ETCG as a percentage of total shares outstanding than any other Grayscale fund. Among them, Digital Currency Group CEO Barry Silbert had already disclosed selling ETCG shares.

Despite my bearishness the fund overall, ETCG has rallied with the broader cryptocurrency market since my article. The rally in Ethereum Classic (ETC-USD) has actually been slightly less impressive than the rally in ETCG shares as the NAV discount rate has closed slightly. At 42%, ETCG still remains the biggest arbitrage opportunity of any Grayscale fund if you’re a long term believer in Ethereum Classic.

Which brings us to the other reason for my bearishness ETCG, I am of the view that Ethereum Classic is a dying network.

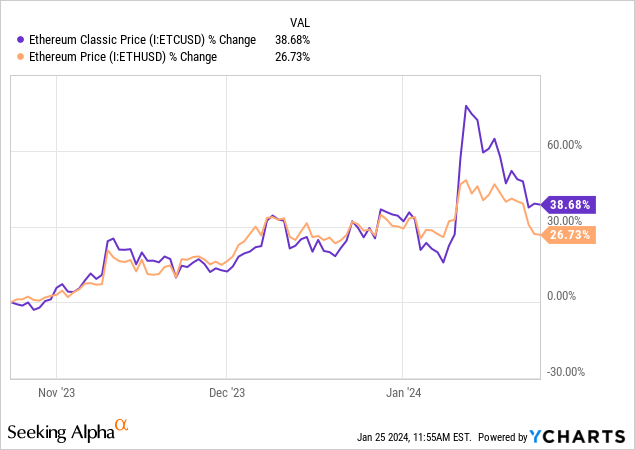

Imagine my surprise then seeing ETC outperforming Ethereum (ETH-USD) by a fairly wide margin over the last month. This price increase in the coin itself has also created a meaningful surge in miner profitability. Given the recent action in the price of the underlying asset and in the slight closing of the NAV discount, I wanted to provide an update for readers.

In this article, I’ll highlight some of the important metrics that I look for in broader blockchain network health and we’ll explore an upcoming upgrade that may actually result in some problems.

Ethereum Classic Network Activity

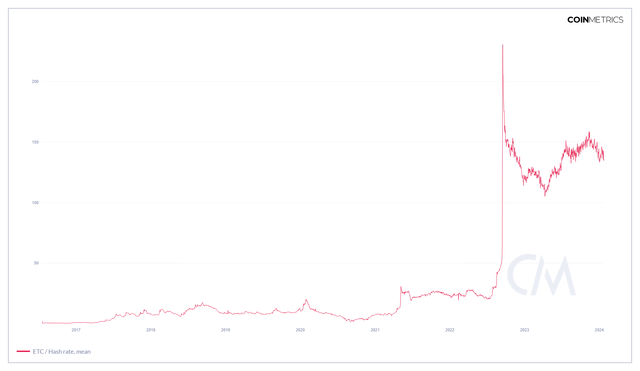

Network security is one of the first things someone can look to when assessing the health of a blockchain. For Ethereum Classic, there was an absolutely massive spike in average hash rate in September 2022. The reason for this surge in network hash was because of Ethereum’s pivot to a full proof of stake consensus mechanism. Since Ethereum mining was previously conducted with GPUs, displaced miners had limited options for where they could migrate their machines.

Ethereum Classic Hashrate (CoinMetrics)

Ethereum Classic has remained a proof of work network and many of the miners who previously secured Ethereum have shifted over to Ethereum Classic since Bitcoin (BTC-USD) requires ASICs rather than GPUs. Admittedly, I’m surprised by the resiliency of the average hash rate on Ethereum Classic. While it’s still well below the initial spike following “The Merge,” average hash is well ahead of where it was this time last year. Another metric to consider is transfer volume:

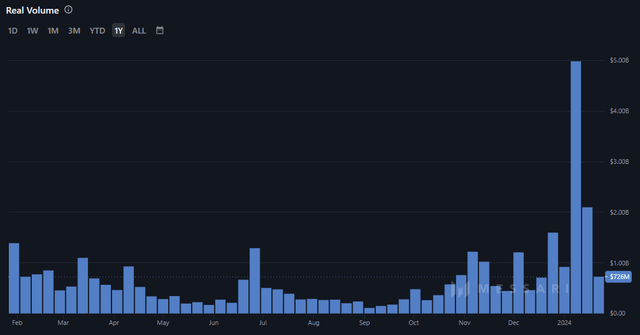

Ethereum Classic Weekly Volume (Messari/Kaiko)

Heading into the week of January 22nd, Ethereum Classic has been averaging $2.7 billion in weekly real transfer volume. This is more than 3x the average weekly real transfer volume from the prior month and well ahead of the averages from last summer. Real transfer volume is an adjustment that strips out wash trading from exchanges. This spike in transfer volume is interesting considering the daily active user of the Ethereum Classic network has largely collapsed over the last 2 years:

| Avg DAUs | BTC | ETH | ETC |

|---|---|---|---|

| 2022 | 913,857 | 550,761 | 27,867 |

| 2023 | 946,236 | 486,907 | 16,613 |

| YOY | 3.54% | -11.59% | -40.38% |

Source: CoinMetrics

For the full year 2022, the average DAU figure came in at slightly under 28k. Last year’s average fell over 40% and so far January’s figure is down under 15k per day. So it isn’t necessarily that the network is being used by more people. The data would actually suggest that less people are now using the network, they’ve just been using it to a larger degree more recently. Nailing down where that usage is happening isn’t quite clear to me.

Ethereum Classic TVL (DeFi Llama)

Ethereum Classic’s Defi footprint is virtually non-existent at just $608k in total value locked. There is no real stablecoin market to speak of whatsoever and there are just 4 protocols listed on Defi Llama – the largest of which makes up basically all of the TVL. This is highly unusual for a smart contract blockchain with a multi-billion dollar circulating coin market cap.

The Spiral Upgrade

One thing that could be driving high transfer volume is Ethereum Classic’s developers are hard forking the network on January 31st. The rationale provided for this move through ECIP 1109 is to bring the network up to current EVM standards for potential dApp migration:

Enable the outstanding Ethereum Foundation Shanghai network protocol upgrades on the Ethereum Classic network in a hard-fork code-named Spiral to enable maximum compatibility across these networks.

This would theoretically position Ethereum Classic well if there was any catastrophic failure of the Ethereum network. As an EVM chain, migrating applications from Ethereum to Ethereum Classic will be more simple following what the developers are referring to as the “spiral” upgrade. This sounds well and good but I do see a potential problem:

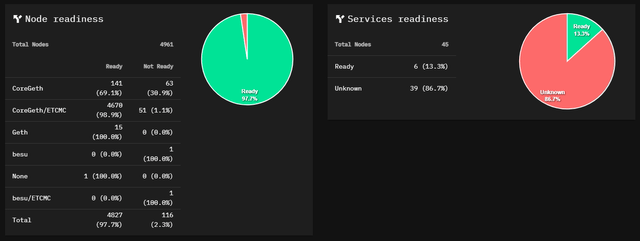

Spiral Status (etcnodes.org)

If I’m interpreting this upgrade status page correctly, just 13.3% of services are ready for the spiral upgrade. This appears to be an issue. From a recent community blog post:

If you are a miner, mining pool, node operator, wallet operator or other kind of ETC stakeholder, please upgrade your node/s to minimize the risk of network splits.

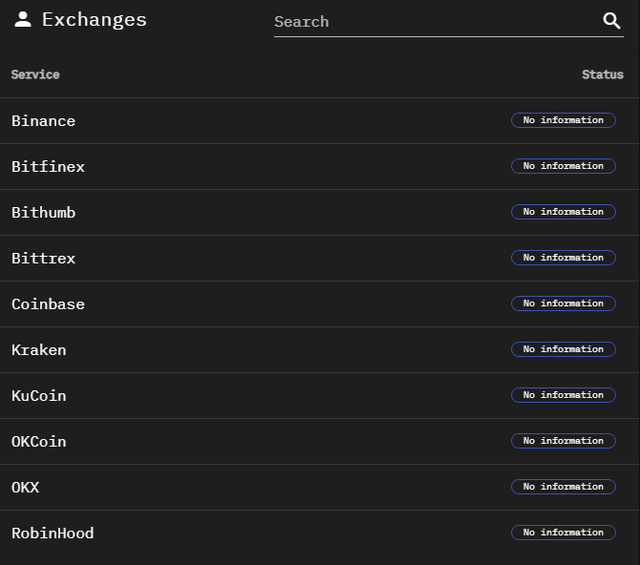

That doesn’t sound good. On January 23rd, the Ethereum Classic profile on X posted a request to the community to get exchanges to confirm that they’re ready for the upgrade. As of article submission, none of the exchanges have confirmed readiness with Ethereum Classic:

Spiral Upgrade Readiness (etcnodes.org)

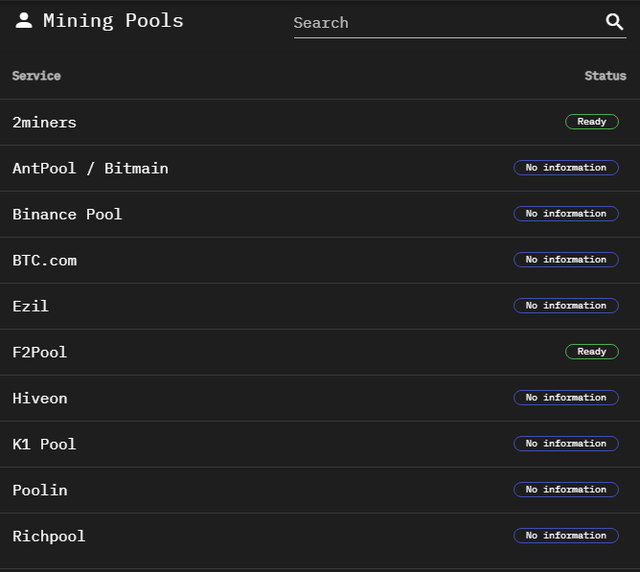

Additionally, just two of the mining pools are confirmed ready for the spiral upgrade:

Spiral Upgrade Readiness (etcnodes.org)

Keep in mind, this upgrade is projected to happen on January 31st and the market doesn’t appear to be ready for it. I’m not sure how this could impact the price of ETC if the fork happens and there’s a network split, but I can’t imagine any of this is a good thing.

Summary

I personally can’t justify buying ETCG even at a 42% discount to NAV. I think the apparent lack of confirmation in readiness for the Spiral hard fork is a pretty clear indication that Ethereum Classic has serious adoption issues as a network. As I’ve said in previous posts covering the fund, I can absolutely empathize with the “code is law” ethos of Ethereum Classic’s users and developers. But as an investable asset, I don’t think ETC will get the job done.

There are 14 million shares of ETCG. Despite a small reduction over the last 3 quarters, related parties still own 23% of the shares outstanding. In my view, any move to liquidate those shares is going to pummel the price as I just don’t see much demand for the underlying asset. I’m maintaining my sell call.