onurdongel

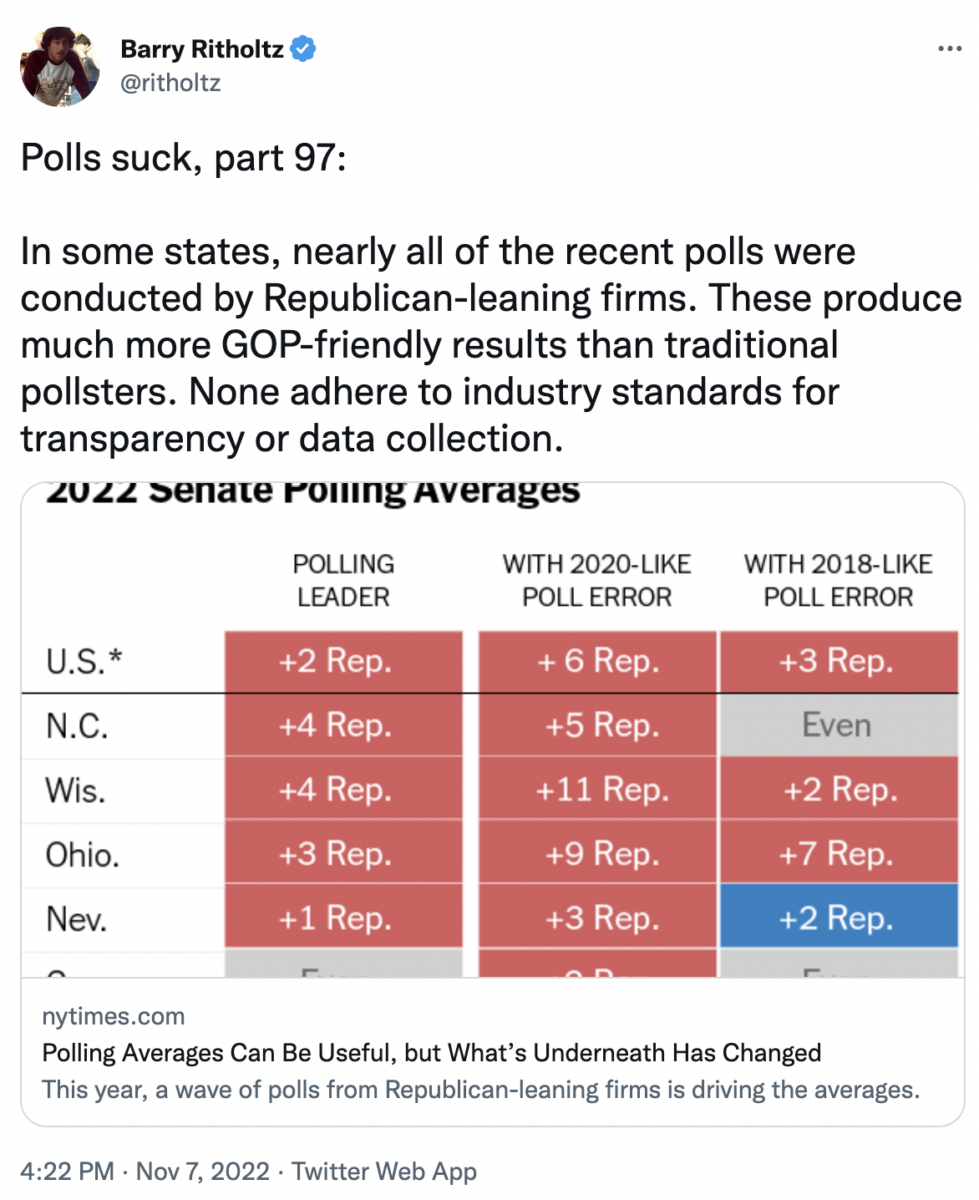

Since the October 13 low in the stock market, the Materials sector has led equities. The resource-heavy and dollar-sensitive group has benefited from fresh multi-month lows in the Greenback as the euro currency rallies above $1.09. Moreover, the risk-on area flies in the face of recession calls from many Wall Street strategists. Price often dictates the narrative, and now some forecasters are coming around to the soft-landing story.

One firm that is forecast to generate big EBITDA this year trades at a low valuation and has one of the best long-term charts you’ll find. Let’s unpack Graphic Packaging (NYSE:GPK).

Materials Leading The Way Since October

Stockcharts.com

According to Bank of America Global Research, Graphic Packaging Holding is a leading manufacturer of paperboard packaging products with $7.2bn in revenues in 2021. It is the largest producer of folding cartons in North America (37%+ share) and has 1.45mn tons of coated unbleached kraft (CUK) production, 1.2mn tons of solid bleached sulfate (SBS) production, and 1mn tons of coated recycled board (CRB) production. GPK derives roughly 90% of its sales from North America and the remainder from Europe.

The Atlanta-based $6.9 billion market cap Containers & Packaging industry company within the Materials sector trades at a near-market 17.3 trailing 12-month GAAP price-to-earnings ratio and pays a market-rate 1.8% dividend yield, according to The Wall Street Journal.

GPK is ranked very strongly by Seeking Alpha’s quant figures given its GARP characteristics and high price momentum. Buttressing that case was a call from Deutsche Bank earlier this month making GPK a ‘catalyst call buy idea’ by the bank. Also, back in October, the company topped earnings estimates helping to send the stock higher, but that also marked a near-term peak in the shares. Risks for the firm include acquisition volatility and integration issues, rising input costs as well as broader recession risks.

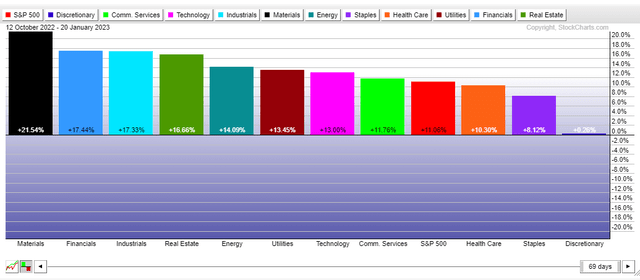

On valuation, analysts at BofA see earnings having more than doubled in 2022, but then moderating sharply to just a 6% growth rate this year with a sequential drop in per-share profit in 2024. Overall, earnings should normalize near $2.50. The Bloomberg consensus forecast is about on par with what BofA expects.

Dividends, meanwhile, are seen as being steady at $0.30. Both Graphic Packaging’s operating and GAAP earnings multiples are attractive around 10 in the coming quarters while its EV/EBITDA ratio is significantly below the average ratio in the market, which is a positive for GPK. Finally, the stock trades at about 10 times free cash flow, which is a high FCF yield. The forward operating PEG ratio is just 0.3, according to Seeking Alpha, well below the sector median of 1.95, making it an ideal GARP candidate.

Overall, the valuation is attractive, and shares could reasonably be priced in the upper $20s if we assign a P/E closer to that of the market, but still at a discount.

Graphic Packaging: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

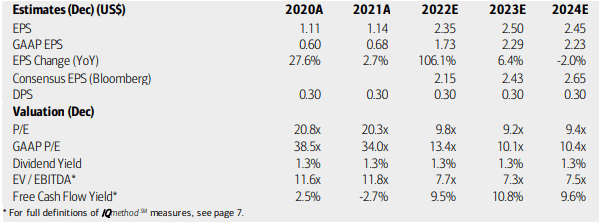

Looking ahead, corporate event data from Wall Street Horizon show a Q4 2022 earnings date of Tuesday, February 7 before market open with a conference call later that morning. You can listen live here. The event calendar is light on volatility aside from the earnings release next month.

Corporate Event Calendar

Wall Street Horizon

The Technical Take

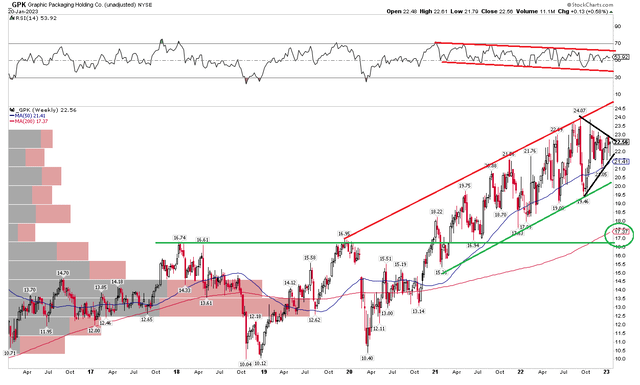

GPK has been a massive winner on both an absolute and relative basis for the last few years. Shares are in a broad uptrend but have recently consolidated in a symmetrical triangle pattern when assessing the weekly chart. Notice in the chart below that RSI is on the decline throughout this bull market, and I see the current coil as a bullish continuation pattern. The presumption is that the stock should resolve to the upside with a possible measured move price objective to near $27 based on the $4.50 range of the triangle added to the breakout point near $22.50 should a move higher indeed happen.

I see support in the $19 to $20 range at the moment, so a long position with a stop under $19 is a favorable risk/reward play. Bigger picture, the stock’s 200-week moving average is upward sloping, which is a good sign and shares have major support in the $16 to $17 area as evidenced by a breakout from that former resistance area in early 2021.

GPK: Broad Uptrend, Near-Term Bullish Consolidation

Stockcharts.com

The Bottom Line

GPK has a low valuation with solid share-price technical momentum. A long position here should work well for both near-term traders and long-term value investors.