Andrey Grigoriev

Although the world is moving ever closer to one that’s dominated by data, there is no denying that much of what makes up the modern era requires a tremendous amount of infrastructure. That infrastructure does not come easy and it does not come cheap. It stands to reason, then, that there would be a large number of companies, some small, others very large, that would be dedicated to providing the goods and services to make it all come together. One such company that investors should be aware of is Granite Construction (NYSE:GVA). From a purely fundamental perspective, Granite Construction has experienced a rather rocky road in recent years. Economic health, changes in public spending, and tremendous amounts of exposure to commodities, are all a recipe for volatility. Even so, recent performance achieved by the company has been positive, and management expects that 2023 will be another year of growth on both the top and bottom lines for the enterprise. Add on top of this how shares are priced, not only on an absolute basis, but also relative to similar firms, and I do think that some upside could be warranted from here.

A dual focus

While the management team at Granite Construction describes the company as an infrastructure solutions firm, it really is two separate companies rolled into one. The first of these involves the Construction segment, which focuses on the construction and rehabilitation of roads, pavement preservation, bridges, rail lines, airports, and more. The second is the Materials segment, which involves the production and sale of aggregates, as well as asphalt production.

The Construction segment of the company is, by a wide margin, the largest of the two. During the 2022 fiscal year, for instance, it accounted for 80.7% of the firm’s sales. It was also responsible for 82.2% of the company’s profits. The remaining 19.3% of sales and 17.8% of profits, meanwhile, are attributable to the Materials segment. It is worth noting, however, that the picture for the company has been changing over the years. Over the past three years, for instance, revenue under the Construction segment has contracted, falling 11.9% from $3.18 billion to $2.80 billion. Over that same window of time, revenue associated with the Materials segment expanded 22.4% from $548.4 million to $671.4 million.

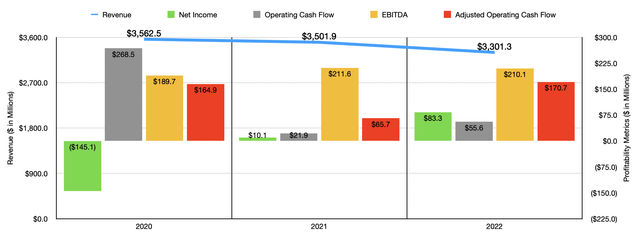

Author – SEC EDGAR Data

When you really dig into the data, you do see some things that are positive, and others that are negative. For instance, between 2020 and 2022, overall revenue for the company contracted from $3.56 billion to $3.30 billion. As I mentioned already, that decline was driven by the Construction segment. Management has attributed some of this drop to the winding down of large projects that the company had in some areas. But it’s also true that the firm’s decision to sell off some assets also impacted the company. The sale of one particular asset, for instance, was responsible for a net reduction in revenue from 2021 to 2022 of $173 million. That drop would have been larger had it not been for timing. Meanwhile, the growth experienced under the Materials segment was driven mostly by price increases, as well as higher market demand for aggregates.

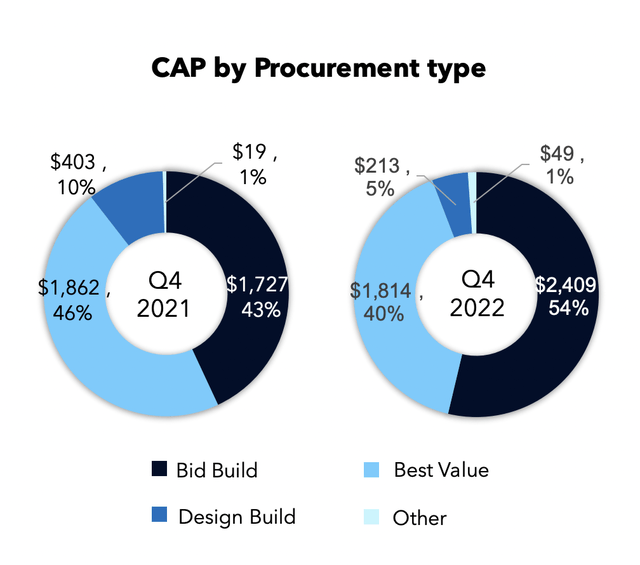

Granite Construction

Despite the decrease in revenue, the company has seen an increase in what is effectively backlog. This number grew from $4.01 billion in 2021 to $4.49 billion in 2022. This rise of $475.1 million was thanks to higher award volume, particularly during the final quarter of last year. Some of the most recent additions to the company’s roster of projects include $174 million for a runway project in California, $170 million for a highway project in Arizona, $160 million for a CM/GC railway project in Illinois, and $142 million for multiple road projects, all combined, throughout California.

Although revenue with the company has declined over the past three years, bottom line results have improved. The firm went from generating a net loss of $145.1 million in 2020 to generating a profit of $83.3 million in 2022. It is true that operating cash flow worsened during this time, falling from $268.5 million to $55.6 million. But if we adjust for changes in working capital, it would have risen modestly from $164.9 million to $170.7 million. And finally, EBITDA for the company managed to climb from $189.7 million to $210.1 million over the three-year window covered.

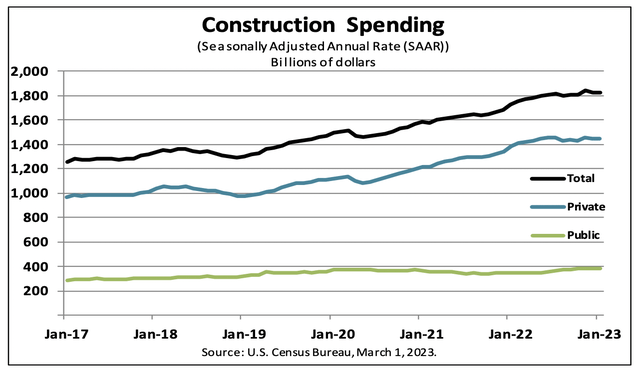

Census Bureau

One thing that should definitely help the company is that construction spending in the US looks set to rise even more this year. In January, for instance, highway spending totaled $118.3 billion. That’s up significantly from the $101.7 billion reported for January of 2022. Overall construction spending between public and private entities grew from $1.73 trillion in January of 2022 to $1.83 trillion in January of this year. A growth in government investment, combined with strong private construction spending that has been driven by record-high corporate profits, has resulted in this expansion. According to one source, the American Institute of Architects, or AIA, total non-residential construction spending in the US should climb by about 5.8% this year compared to what it was last year. Though it is forecasted to slow to less than 1% growth in 2024.

This forecast, combined with the increase in what is effectively backlog for the business, is likely why management is forecasting revenue this year of between $3.4 billion and $3.6 billion. At the midpoint, that would translate to an increase over what the company saw in 2022 of 6.1%. On the bottom line, the only metric that management gave a forecast for was EBITDA. At the midpoint, it should come in at $288.8 million. This would imply adjusted operating cash flow for the company of roughly $234.6 million for the year. No revenue guidance was given for 2024. However, management did say that the EBITDA margin should expand sufficiently next year relative to what it is going to be this year. If we were to assume revenue that remains flat in 2024, this would imply EBITDA, at the midpoint, of roughly $350 million for that year.

Author – SEC EDGAR Data

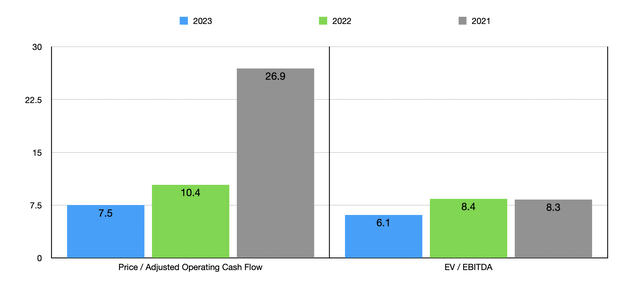

As you can see in the table above, I valued the company using not only the estimates for 2023, but also the actual data for both 2021 and 2022. Shares of the company look especially cheap when we use the 2023 forecast. But even using the data from 2022, shares look attractively priced. As part of my analysis, I also compared the company to five similar businesses. On a price to operating cash flow approach, the four companies with positive results ranged from a low of 5.3 to a high of 30.3. Only one of the five firms was cheaper than Granite Construction. Meanwhile, using the EV to EBITDA approach, we end up with a range of between 6.7 and 17.6, with only two of the five firms cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Granite Construction | 10.4 | 8.4 |

| MYR Group (MYRG) | 12.4 | 11.4 |

| Construction Partners (ROAD) | 30.3 | 17.6 |

| Primoris Services (PRIM) | 15.7 | 7.3 |

| Sterling Infrastructure (STRL) | 5.3 | 6.7 |

| Ameresco (AMRC) | N/A | 17.0 |

Takeaway

Because of the nature of Granite Construction, I wouldn’t exactly call the company a great prospect for long-term investors. The firm is subject to extreme volatility depending on market conditions. Having said that, recent performance has been more satisfactory and the near-term outlook looks encouraging. Add on top of this how shares are priced compared to similar businesses, and I do think that it offers some upside for investors from here.