By the end of 2021, Fed officials realized that they had made a mistake, allowing aggregate demand to grow at an excessive rate. They began to move toward tightening monetary policy. Unfortunately, they moved so slowing that there ended up being almost no tightening during the first nine months of 2021. They worried about frightening markets. This was a big mistake.

While inflation was accelerating in early 2022, the Fed was content to let short-term rates stay near zero. All the Fed did was move from “not even thinking about raising rates” to “thinking about raising rates”. Many Fed watchers wrongly thought that this represented tightening. In mid-March, they raised rates by a measly quarter point, far too little to slow the relentless rise in core inflation. Policy was still expansionary. And yet many pundits thought the Fed was overreacting, moving too aggressively.

Now we are about to pay the price for the Fed gradualism. Bloomberg just suggested that there is a 100% chance of recession next year. I think that’s too high, but the risk is clearly increasing. By not tightening aggressively at the end of 2021, the Fed let inflation get much more deeply entrenched in the economy. With even core inflation now rising, the pain associated with bringing it down will be much greater. A small recession in 2022 would have been better than a bigger one in 2023.

As Matt Yglesias likes to say, if the Fed expects to gradually raise rates by 200 or 300 basis points over the next year, it should probably do it right away. It’s like getting into a cold lake—just jump in; don’t wade in one inch at a time.

The Fed needs to stop worrying about scaring markets and focus on their core responsibilities. In the long run, the worst thing that can happen to markets is a bad macroeconomy. Get the economy right and the markets will follow. Markets like stable NGDP growth.

PS. Just to be clear, gradualism was not the Fed’s primary error. The biggest mistake was abandoning the policy of average inflation targeting. That’s what allowed inflation to accelerate in the first place. A huge unforced error, which severely damaged the Fed’s credibility.

PPS. The Guardian is still arguing that the problem is supply-side inflation, despite 9.5% NGDP growth over the past year:

“Raising interest rates isn’t working, and the Fed’s overly aggressive actions are shoving our economy to the brink of a devastating recession,” said Rakeen Mabud, chief economist at the progressive Groundwork Collaborative think tank. “Supply chain bottlenecks, a volatile global energy market and rampant corporate profiteering can’t be solved by additional rate hikes.”

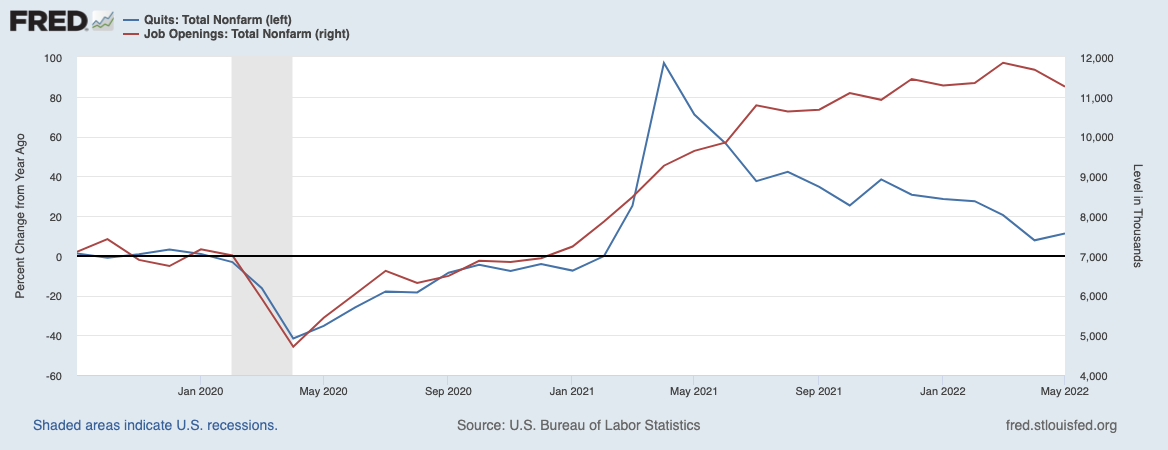

The Fed and some economists maintain that demand generated by a hot labor market and higher wages are driving inflation, and higher unemployment and interest rates are panaceas. . . .

The price drops aren’t materializing because current inflation largely isn’t demand- or labor-driven as it often is during inflationary periods, said Claudia Sahm, a former Fed economist and founder of Sahm Consulting.

“High inflation is not workers’ fault, but the Fed is waging a war on US workers,” Sahm said.

Not sure I’d call the lowest unemployment rate in 53 years “a war on US workers”.