Douglas Rissing

The Senate on Friday passed a $460 billion spending bill to keep the U.S. government operating, taking a potential shutdown for several agencies off the table for the rest of the fiscal year.” Kathy Stech Ferek, Wall Street Journal.

“Friday’s measure authorizes the funding of federal agencies through the end of the current fiscal year at the end of September. Negotiators are still arguing over provisions of the six remaining bills facing a deadline of March 22, after which funding for agencies addressed by those bills would lapse.”

“The unfinished bills are considered harder to complete because they tough charged issues….”

So, Congress has kicked the can down the road again for the first group of bills and is expected to do the same with the second group.

Same old, same old….

But what about the budget?

What about the debt?

Well, it looks as if the game will continue on forever.

But, things do change. Budget practices are altered.

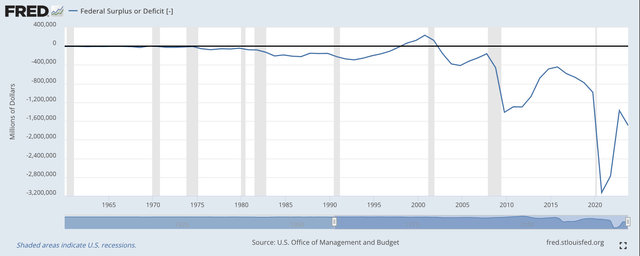

Take a look at U.S. history of the budget.

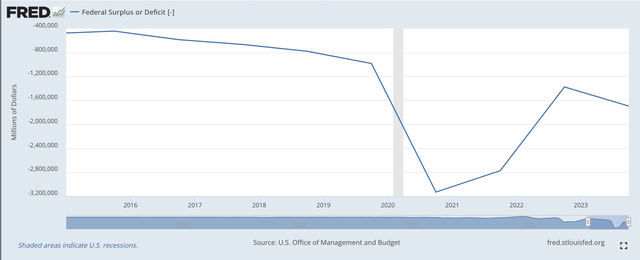

Federal Deficit or Surplus (Federal Reserve)

Things have changed.

But, let’s look on from the period of the budget surpluses of the Clinton administration.

These surpluses ended early in the twenty-first century under the leadership of the Bush-II administration. But, the following deficits were generally modest in size.

I would like to call attention to the difference that took place in the 2010’s, during the Obama administration.

Deficits increased, and one can explain the increased budget deficits taking place at this time to the change in overall policy focus which has remained to this time.

During this time, Ben Bernanke was introducing his new policy ideas in the Obama administration and then particularly into Federal Reserve policy-making.

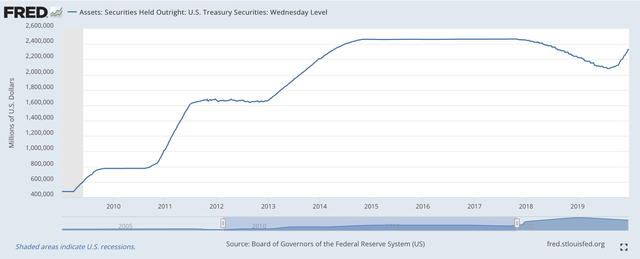

Ben Bernanke introduced the idea of quantitative easing into the policy-making of the Federal Reserve. Quantitative easing is the idea that the Federal Reserve will purchase securities outright to add to its portfolio on a steady basis, with nothing said about what might be going on in the federal budget.

In the following chart, you can see the three rounds of quantitative easing that took place in the early part of the 2010s.

Securities Held Outstanding (Federal Reserve)

Ben Bernanke was the Chairman of the Board of Governors of the Federal Reserve System from 2006 to 2014, and he introduced the policy called quantitative easing to the Fed and oversaw the first three rounds of quantitative easing taken by the Federal Reserve.

Janet Yellen took over at the Fed to follow Bernanke, and there were no efforts of quantitative easing while she was the chair. Jerome Powell became Fed chair in 2018.

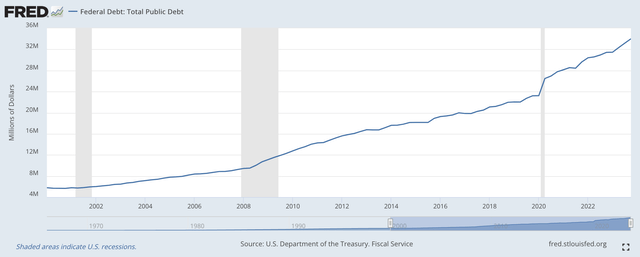

During this period, the federal government created a substantial amount of debt.

Total Public Debt (Federal Reserve)

Notice that in 2008, the slope of the curve takes a turn upwards and this shift continues into 2019 when the curve takes a leap upwards and then continues at a faster pace through the end of the period.

It appears as if Bernanke’s program of quantitative easing was accompanied by a major jump upwards in government spending and government spending that was financed by debt.

With quantitative easing taking place at the Fed and massive new amounts of government debt being issued by the federal government, one might expect that this would create an environment of substantially rising prices.

This didn’t happen.

Modest, but steady growth in the securities portfolio of the Federal Reserve set the framework for the path of inflation.

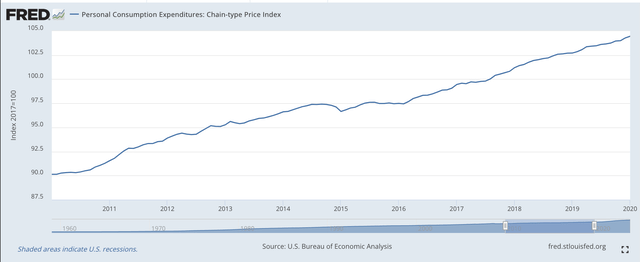

Here is the picture for the 2010s.

Price inflation for personal Consumption Expenditures (Federal Reserve)

The compound rate of consumption price inflation during this period was right around 2.3 percent.

Not bad.

We had the Fed conducting a monetary policy of quantitative easing and we had a federal government spending as it had never done before and…and…price inflation was very modest.

Apparently, Bernanke’s scheme of quantitative easing dominated the narrative.

And, what has happened since the Covid-19 pandemic started?

Federal Surplus or Deficit (Federal Reserve)

The federal deficit has nose-dived.

And, this is the budget picture we seem to be right in the middle of at this time.

The Federal Reserve, under the leadership of Jerome Powell, went into a very, very expansive policy of quantitative easing to protect the economy’s downside and then, as inflation seemed to be raising its head, shifted, in March 2022, to a policy of quantitative tightening.

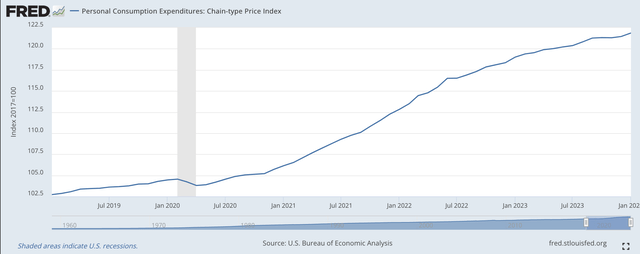

And, what did prices do?

Price Inflation for Personal Consumption Expenditures (Federal Reserve)

Price inflation has gone up during this period of time, but, given the efforts of the Federal Reserve to go into quantitative tightening, the inflation has rapidly dropped.

Right now, the rate of consumer price inflation is 3.1 percent and is seemingly moving lower.

Again, we see that changes in monetary policy have the greatest impact on prices and fiscal policy fails to directly drive the rate of change in prices.

How do we explain this?

Government deficits and growing government debt can have an influence upon what the Federal Reserve does with its securities portfolio.

Larger and sustained government deficits generating growing federal debt can force the Federal Reserve to buy more securities to keep interest rates from rising.

In a case like this, government deficits and rising debt can add to the pressure for prices to rise. But, it is only because the fiscal policy is “forcing” the monetary policy to provide more “money” to the financial markets.

In Mr. Bernanke’s scheme, monetary policy does not get “forced” into becoming looser and looser.

The Fed’s current round of quantitative tightening has been going on for 24 months. The Fed has not stopped disposing of securities bought outright for two years.

The Fed seems to have convinced investors to follow its lead. The federal government can go and “do its thing” while prices and inflation follow Federal Reserve operations.

As Nobel-prize-winning economist Milton Friedman argued, inflation is a monetary thing.

Mr. Ben Bernanke seems to have constructed a system of monetary policy that agrees with the conclusion of Mr. Friedman…and that works.

Federal budgets and deficits are going up. Inflation seems to be coming down. A disciplined Federal Reserve seems to be doing its job.