I can not recall a parallel period to this when it comes to financial cross-currents. There are credible arguments on plenty of key knowledge: Inflation, retail gross sales, NFP, JOLTs, and NILF. It’s nearly as if you’re not confused concerning the financial system, then you definately most likely will not be paying consideration.

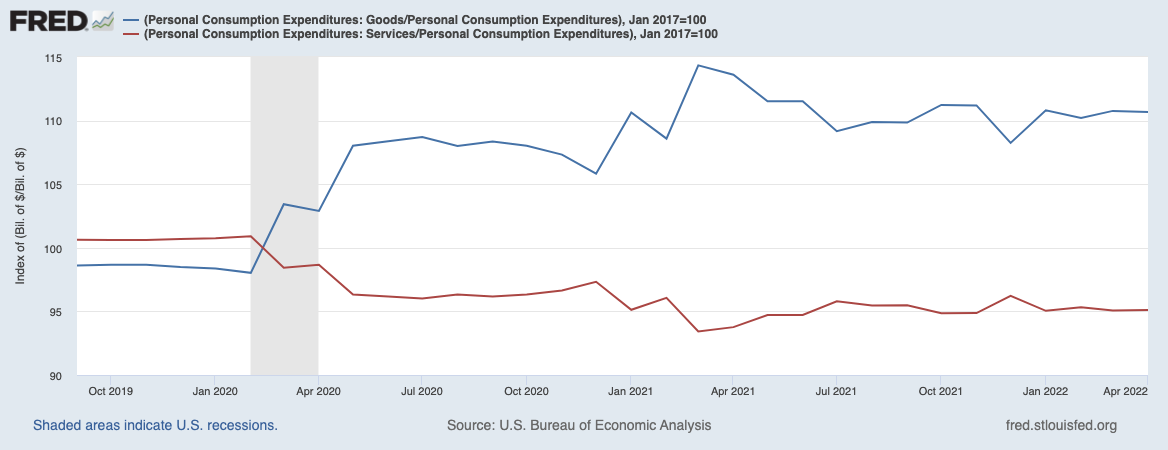

I wished to briefly spotlight an enchanting chart courtesy of Invictus that I think may clarify among the underlying confusion and problem in understanding the present state of the financial system.

The chart above reveals each Items (blue line) and Companies (crimson line) relative to whole private consumption expenditures. Its priced in billions and reveals the previous 10 years (Jan 2012=100). If you wish to play with the chart your self, simply click on the picture above and have at it.

Take into consideration this even in mild of the stock shortfall of single-family houses, and the issue find new vehicles (or getting used vehicles at affordable costs). And nonetheless, we see elevated Items consumption and diminished Companies. Word the height in Items got here lengthy earlier than the present inflation spike.

If we zoom in, you will get a way of how spending habits have modified post-pandemic:

~~~

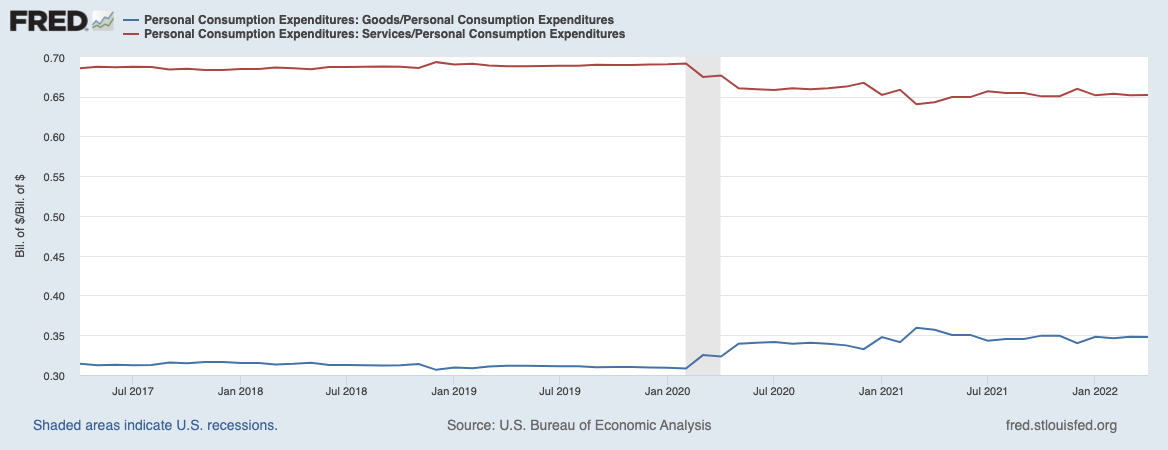

Let’s have a look at this in a single final context: Percentages of Items and Companies consumption:

That’s the previous 5 years (the 10-year model is comparable however tougher to see the adjustments). As you may see, the financial system remains to be almost 5% beneath the pre-pandemic ranges of Companies, and nearly 5% above the pre-pandemic ranges of Items.

As places of work re-open, individuals go on holidays, and life begins to normalize, we must always see these strains start to go again towards their prior ranges. However I’ve robust reservations about If & When we’re heading all of the again quickly. There’s a substantial share of people who find themselves by no means going again to a 9-to-5, Monday to Friday workplace gig, and take into consideration what which may imply to the steadiness of consumption.

That is simply one other considered one of many cross-currents making it a problem to grasp the cureent U.S. financial system…

Hat tip on the charts to Invictus!

Beforehand:

Are We in a Recession? (No) (June 1, 2022)

The Put up-Regular Financial system (January 7, 2022)

“Unprecedented” Is 2020 Phrase of the 12 months (December 6, 2020)