Arpelayo/iStock via Getty Images

The stock market is revealing a new positive message, even as market participants sell on earnings reports

This Thursday was the worst one-day sell-off since March, yet little follow-through on Friday when there was every reason for the market to sell off. Even though the high futures pre-market open began to deteriorate until we were well in the red and looking to fall hard. Instead, Friday’s mid-day bounce gave me confirmation that this is a new Bull Market Rally. We closed up on the S&P 500 and a bit down on the Nasdaq-100.

This week revealed little patience for some marquee names in the constellation of superstar-performing stocks. Namely Netflix (NFLX), Tesla (TSLA), and American Express (AXP). Their earnings reports reveal some themes that we could project onto other big stocks reporting this week. NFLX missed the revenue estimate, and active participants had no patience to hold onto the stock. However, as I read the reports and commentary, the big spike in subscriber growth will eventually feed into the advertising offering. NFLX eliminated their cheapest subscription, and I think that many will put up with ads to get their fix on Netflix. Let me add that the ad + lower subscription model brings the highest revenue per subscriber. So I am hoping it drops a bit more this week, as some traders who want to take a swing at the next FANG name might sell it down further.

As far as what TSLA revealed, Musk was on the call announcing new initiatives including growing mileage intake in FSD – Full Self Driving, refreshing Model 3/Y, and building a huge supercomputer. This takes investment and danger to both the margin and car output. Yet this is what we want to see a growth company do. Musk even referenced providing FSD AI to other OEMs. This would confirm that TSLA IS A SOFTWARE COMPANY. One would think that justifying TSLA’s high PE ratio would drive Teslarians mad with excitement and enthusiasm for the name. Frankly, I am almost ready to drink the Kool-Aid myself. Imagine if Toyota (TM) licensed FSD for Lexus, or VW (OTCPK:VWAGY) for Audi?

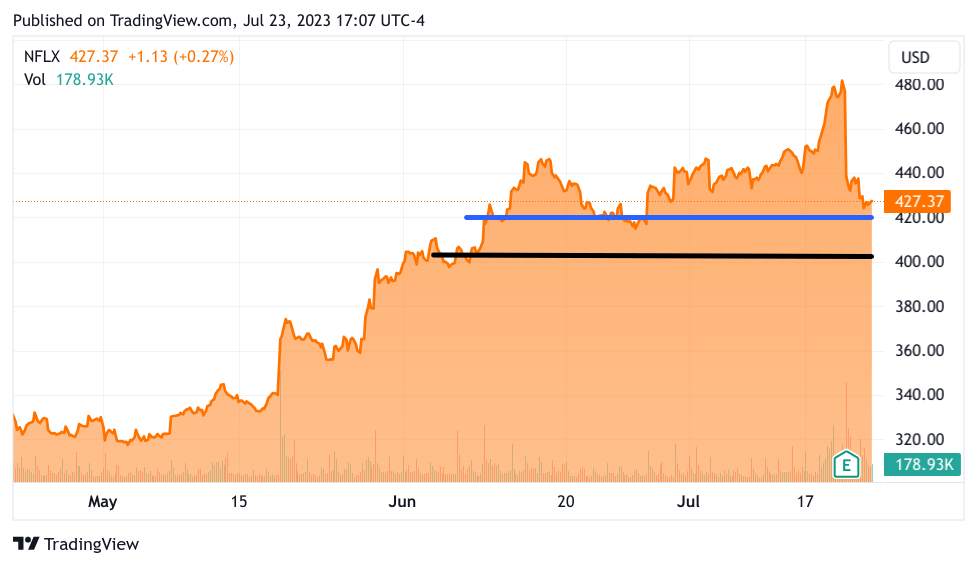

Even if the panning of a stock is justified the extent and sharpness of the selling seem rather overdone NFLX is down about 13% from the intra-day low to the 52-week high. And likely to go a bit lower as I indicate in the chart below:

TradingView

This is the 3-month chart of NFLX. The stock closed at 427.32. The blue horizontal line is at 420. There is some support at this level but I think it breaks under 420 and stabilizes in the mid-teens. I will likely add shares at this level and start setting up some call options at this level.

I think other names this week will give us the same opportunity

To me, this could mean that other names will be similarly slammed by stock market participants for any minor infraction on percentage margins, revenue estimate misses, or any blemish that masks the future potential of some great names out there. Barron’s quote: “Already there’s a high bar: 74% of S&P 500 constituents have beaten earnings expectations, but only 52% of stocks rose after results, according to Dow Jones Market Data.” This will play to our advantage this week because this is a new and sustainable Bull Market Rally

So why am I claiming that we are in a new Bull Market Rally

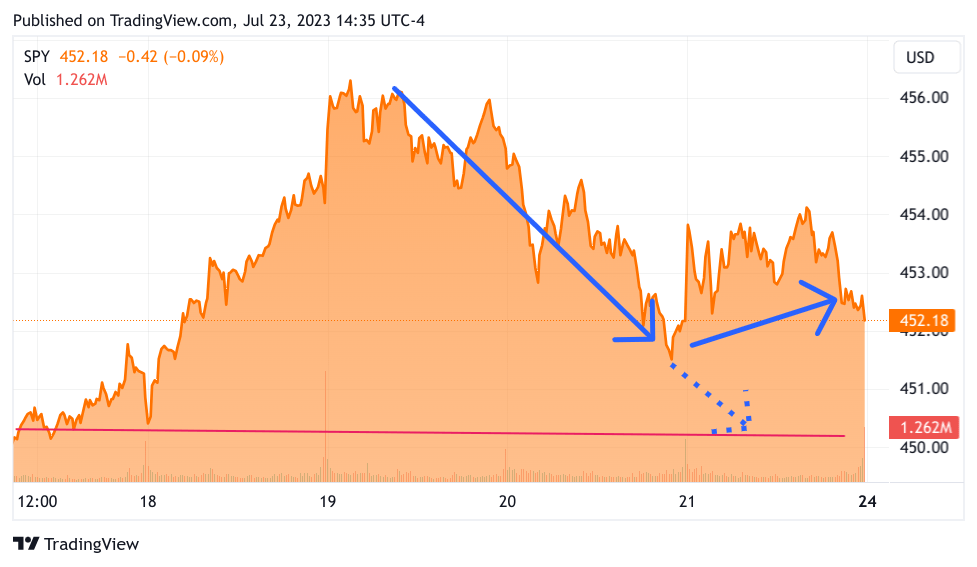

Any kind of turbulence now will help extend this rally. There are still a lot of money managers that haven’t participated in this rally and many of them are hoping for a chance. There are also trillions in money markets and as interest rates settle down, they should go lower. This will pull in more funds to stocks. I believe that this week’s rate rise will be the last, and as inflation continues to fall the current Fed funds rate level will be too restrictive to the economy. Am I saying the PCE that comes out on the 27th and shows that we reached 2% inflation? Of course not, but it continues to move in that direction. Any little bump in inflation might unsettle the market, but that would, in my opinion, provide another buy-the-dip operation by those who have been left behind waiting for that 15%-20% correction to take us back to 3800. Most market participants have concluded that this is just not happening right now. I believe we now have a big supply of buyers. What makes me so sure? Thursday was the worst 1-day fall (-2.05%) in the Nasdaq stocks since March. The next day started with a positive futures premarket, by the time the market opened the indexes were barely positive and getting worse at the same time the 2-Year interest rate again reached as high as 4.875% at 12-PM. Then just when things seem bleakest interest rates fell just as precipitously and buyers came in to pick at the bottom, reversing what seemed like a repeat of the bad old days of ‘22. The Nasdaq did close in the negative but hardly and the S&P 500 closed positive. Am I making too much out of this? Think about it, Friday in the summer, low volume day, and the market just slammed down the day before. The easiest way to go is down further, and it did, yet by lunchtime the market started climbing higher as the dip buyers came in. In the bad old days, the Nasdaq going down 300 points the day before brought another 200 points down the next day. Things are just different now and I for one am going to act accordingly. Check out this chart for the S&P 500 ETF (SPY). This is the 5-day chart.

TradingView

The Nasdaq slammed down 300 points on Thursday and instead of following through lower (blue dotted arrow) to where the S&P 500 started the week (red horizontal line) which I would have expected. Instead, the market rallied up about 25 S&P 500 points. Realize that stocks have been going up for weeks without anywhere close to this size sell-off. Who would have been shocked to see the selling continue? Yet it didn’t. The message of the market is further upside. We are seeing signs of a serious FOMO rally. If you wait for more confirmation of a new bull market you will be left behind. That said we saw something else last week as we discussed at the beginning of this article. Big-cap tech names getting overly punished by market participants. Does this mean that the rally is going to spread out in earnest? I think it will. That allows us to buy the weakness in some of these tech names that got too expensive.

I claim that this is a new bull market in the title of this article so what am I saying? I have to say that the way I see the price action we are going to breach the all-time closing high of 4796.56. What happens in the Fall season might take us down first, or after we reach it, but we will break it and likely end the year above that. There are just too many positives, inflation moving off the stage, infrastructure booming, factory construction alone at $190B a 30-year record, auto manufacturing at 16M cars annual rate, Construction of new homes in May (the most recent measure) shot up dramatically to an annual pace of 1.56 million units, 16% increase from the month before and permits went up as well. So with inflation moderating, as well as interest rates, why wouldn’t stocks reach new highs?

Even good earnings could see tech stocks fall. So here’s the plan

As we saw above some great names fell after reporting earnings, offering an opportunity for those looking to catch up to buy into these names just as the rally gathers even more momentum. Of course, not all names will behave this way, but if you make a plan now you will be able to react that much quicker this week.

Instead of predicting blowout reactions to blowout earnings I am encouraging I am going to wait until AFTER the stock of my fancy reports. I think earnings reports as I indicated in my last article are one of the few things to give pause to the rally. Though I don’t think the effect will be lasting at all.

Here is a list of stocks reporting this week that interests me. You should be making your lists. My tactical approach is to adhere to the assumption that patterns often repeat. Well-known large-cap names (NFLX, TSLA, AXP) sold off hard last week, and I think the same will occur with some of the names here. I am not sure this theme will remain throughout earnings season, or that all the names below will sell off at all. But if one or two names do sell off, they could be mighty good opportunities. As I’ve said, in my opinion, we are now in a new bull market.

Monday Earnings

Meh

Tuesday Earnings

Alphabet (GOOGL, GOOG) I don’t think market participants are prepared for the huge spending increase required to provide compute power for Generative AI, and also build software to make it easier for enterprises to build on top of their service. Even though it is an investment for future growth. I could see GOOGL selling off about as much at NFLX I will be thrilled to pick it up 10% to 15% lower

Microsoft (MSFT) I see the same fate for this name as for GOOGL. They have to be spending a ton and perhaps more than GOOGL to stay ahead. MSFT is also much more fully priced than GOOGL so it could fall harder

Wednesday Earnings

Boeing (BA) Great trading vehicle below 205. The price action has been weak lately. If it sells off even 5% to 6%, I would trade it again.

ServiceNow (NOW) Generative AI could be a threat to its no-code interface. No doubt new investment is going on to integrate AI and raising costs to stay competitive. SAP sold off hard. NOW could as well. I would be a buyer as well.

Meta Platforms (META) META is still considered a bargain but it’s up 3X from its low. They are also spending a ton on generative AI. It could sell off at the same magnitude as GOOGL or more.

Thursday Earnings

Intel (INTC) I think INTC is amid a turnaround, and the foundry business is essential to the USA. That said they will still have a lot of disappointing news to share. This might finally go into my long-term investment account.

KLA Corp (KLAC) – essential in chip manufacturing. I want to add it to my long-term investments if it sells off more

Carrier (CARR) – recently acquired world leader in heat pumps in Germany. CARR is a growth stock in my opinion. Many of the new homes will opt for heat pumps instead of AC. CARR will reap the benefit. I already have this name as a long-term investment if it sells off enough I would add it. I don’t think I would trade it.

DexCom (DXCM) I only wish DXCM sells off hard. I have it in my long-term investment account. I would love to pick it up down significantly and make a trade of it as well.

Friday’s Earnings

Chevron (CVX) Both CVX and XOM should still be printing money with WTI in the 70s

Exxon Mobil (XOM) CVX and XOM are good long-term investments with good dividends

The above is an incomplete list of the companies reporting this week. Perhaps you have different stocks in mind to buy if market participants decide to take profits. Make your plan. If fact if I have a message to the active traders and investors is; to spend some time on the weekend to plan what you want to do during the week. This will give you the ability to act faster than the other guy. If the market doesn’t behave the way you thought it would perhaps hold on to your money until you figure it out.

It’s not a contradiction, though it might seem that way.

Finally, I recognize that calling for a new bull market while simultaneously calling for a sell-off of stock reporting this week seems to be contradictory. I believe that all or any of these stocks are an opportunity to get long. Meaning, I think this selling is very temporary, and it is likely that the indexes might not be as impacted as last week since the Nasdaq-100 has been rebalanced. I would not be surprised that any stock that sells off hard this week will make back its loss quite soon.

Good luck out there!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.