The well-worn adage ‘Keep it simple’ isn’t just a cliché; it holds true in many areas of life, including the stock market. It’s easy to get lost in the never-ending barrage of information and day-to-day drama on Wall Street, but a simple strategy will often point towards the best investment choices.

One such strategy is to keep an eye on the insiders’ moves. These corporate officers are the ones who know best what is going on in the companies they oversee. When they are seen buying shares of their own firms’ stock, especially in bulk, it sends a strong buying signal.

To keep things fair, the insiders must make these transactions public and the TipRanks’ Insiders’ Hot Stocks tool enables investors to see all the latest insider plays. With this in mind, we pulled up the details on two names that the insiders have been snapping up recently – they’ve been digging into their pockets for these, pouring millions into them.

What makes these picks even more intriguing is that they have received ‘buy’ ratings from banking giant Goldman Sachs, with price targets that suggest a solid upside potential. The combination of endorsement from Goldman analysts and insider buying might be a potent mix for gains, so let’s see why you might want to ride their coattails right now.

Royalty Pharma (RPRX)

Let’s start off with Royalty Pharma, a leading pharmaceutical company that specializes in investing in pharmaceutical royalty streams. Essentially, the company partners with other pharma firms by acquiring royalty interests in leading drugs and claiming a portion of their future product revenues. In addition to its investment activities, Royalty Pharma also plays an active role in supporting the development of new therapies and treatments. The company collaborates with biopharma partners to provide them with access to capital as they advance their research and development efforts.

During the most recently reported quarter, 1Q23, the company acquired royalty interests in Biogen’s Spinraza, which the company calls a ‘blockbuster for spinal muscular atrophy.’ Royalty interests have also been acquired in Novartis’ pelacarsen (Phase 3, cardiovascular disease) and Karuna’s KarXT (Phase 3, schizophrenia). Royalty Pharma considers both to have ‘multi-blockbuster potential.’

As for the results, the company benefited from a $475 milestone payment from Pfizer for migraine nasal spray Zavegapant’s approval. That helped net cash provided by operating activities increase by 125% to $1.03 billion. Elsewhere, the company saw total income and other revenues rise by 22% year-over-year to $684 million.

The shares, however, have been on the backfoot for most of the year and evidently CEO and founder Pablo Legorreta thinks the time is right for loading up. He recently purchased 230,000 RPRX shares. These are currently worth over $7.68 million.

Mirroring Legorreta’s confidence, Goldman Sachs analyst Chris Shibutani sees plenty to like here. He writes: “Having deployed $1.6bn of capital year-to-date, the company’s pipeline continues to strengthen, and the balance across the company’s portfolio of development-stage and commercial opportunities continues to reflect the robust opportunity set as innovation trends across the industry remains strong, and the financing environment for companies in the emerging biotechnology spaces continues to be challenging… A trove of Phase 3 datasets for key programs across the company’s royalty portfolio provide catalysts through the balance of the year.”

Accordingly, Shibutani rates RPRX shares a Buy, while his $58 price target makes room for 12-month returns of ~74%. (To watch Shibutani’s track record, click here)

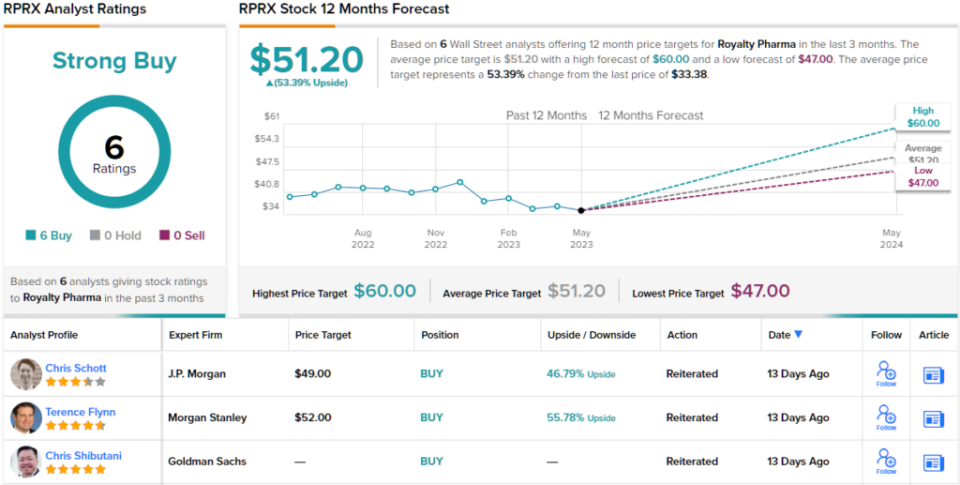

Shibutani’s bullish sentiment is shared by all of his analyst colleagues, leading to a Strong Buy consensus. With an average target price of $51.20, investors could potentially enjoy gains of ~53% within a year. (See RPRX stock forecast)

Axon Enterprise (AXON)

Next up is Axon Enterprise, a major player in the law enforcement technology segment. Specializing in personal protection, the company is well-known for its Taser devices. Additionally, Axon is recognized for its Axon network, a service that combines hardware, software, and cloud-based services to support the entire law enforcement workflow. Axon’s offerings include body-worn cameras, digital evidence management systems, and connected devices that enable real-time information sharing and collaboration.

The company’s latest quarterly report, for 1Q23, was a curious case of hitting plenty of the right notes but still disappointing investors. Axon surpassed expectations on both the top and bottom lines. Revenue reached a record $343.04 million, marking a 34% year-over-year increase and surpassing the forecast by $23.3 million. Additionally, the adjusted EPS of $0.88 easily outperformed analysts’ anticipated value of $0.54.

Even better, for the full year 2023, Axon now expects revenue in the range between $1.44 billion and $1.46 billion, up from the prior ~$1.43 billion, and at the mid-point above consensus at $1.44 billion.

However, shares took a beating in the subsequent session, with investors seemingly concerned about a slowdown in future contracted revenue.

This is where our insider enters the frame. Evidently sensing an opportunity, Director Hadi Partovi recently picked up 10,000 AXON shares. At the current price, these are worth $2.01 million.

Despite some niggling concerns exhibited in the recent Q1 print, Goldman Sachs analyst Michael Ng remains squarely in the AXON bull-camp.

“New products such as TASER10 (shipping started in March) and Axon Body 4 (in trial) will contribute more meaningfully in 2H, creating further upside optionality to 2023 guidance, in our view. Although we were somewhat disappointed by the miss in TASER relative to our estimates (due to limited contributions from TASER10) and body cameras, revenue improvements in those respective businesses should materialize more meaningfully later in the year and into 2024,” Ng opined

“Importantly,” Ng wen on to add, “AXON Cloud revenue beat, growing $11 million QoQ, when normalizing from the revenue catch-up recognized in 4Q22, and we expect continued sequential revenue growth of $9-$10 million throughout the remainder of 2023, reinforcing the recurring cloud revenue investment thesis.”

As such, Ng keeps a Buy rating on AXON shares to go alongside a $262 price target. The implication for investors? Potential upside of ~30% from current levels. (To watch Ng’s track record, click here)

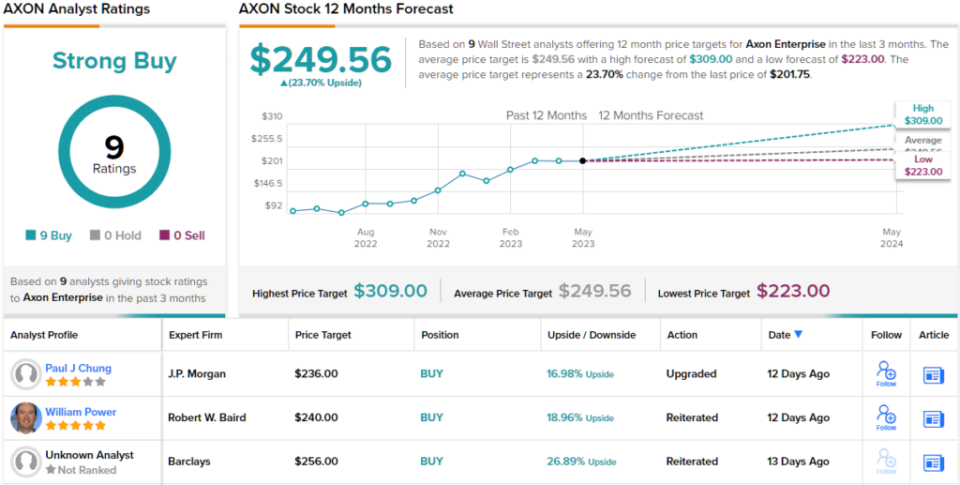

Overall, AXON gets big support on the Street. With a full house of 9 Buys, the analyst consensus rates the stock a Strong Buy. The forecast calls for one-year returns of ~24%, considering the average target stands at $249.56. (See AXON stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.