Shares of the Las Vegas Sphere (formally the MSG Sphere), owned by Sphere Leisure Co (SPHR), have plunged right into a vicious bear market this yr amid fears that its subsidiary, MSG Networks—a regional sports activities community—faces potential chapter. However, Goldman Sachs analysts Stephen Laszczyk and Antares Tobelem have initiated protection with a “Purchase” score, arguing that the upside potential for the Las Vegas Sphere is stable and that the market has overstated the dangers tied to MSG Networks.

MSG chapter fears have despatched SPHR shares tumbling 36% since peaking at round $48 in mid-February. Quick curiosity has surged to 7.7 million shares—roughly 29.5% of the entire float.

On Thursday, Laszczyk and Tobelem supplied purchasers with an in depth observe about their determination to provoke a “Purchase” score on SPHR:

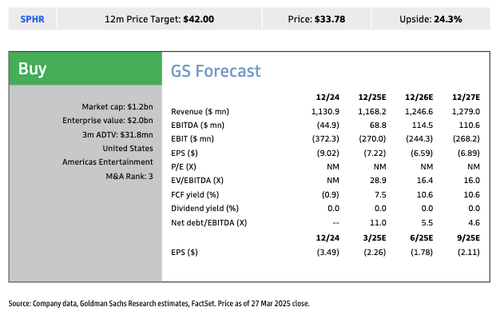

- We provoke on Sphere Leisure (SPHR) with a Purchase score and a $42 worth goal (12-month), representing 24% potential return. At $33.80 a share (off ~20% YTD by way of 3/26), we consider that the market is at present under-appreciating two key elements of the corporate’s progress story and over-estimating a possible danger.

The analysts defined extra about their bullish name, outlining three bullish causes:

Particularly, we consider that the market is under-appreciating the chance for the Las Vegas Sphere to proceed to reinvent itself with new content material and enhance execution to develop Income and AOI (GSe is ~5% above consensus for Sphere section AOI),

under-appreciating the chance so as to add further Sphere franchises across the globe (see addressable market evaluation inside), and

over-estimating the probability {that a} exercise of the MSG Networks debt shall be worth damaging.

The worth in SPHR is predicated on the Las Vegas Sphere, the world’s largest spherical construction—geared up with a 16K decision LED display screen that wraps across the viewers for a completely immersive visible expertise, which surpasses even legacy venues like Madison Sq. Backyard.

Org Chart Overview throughout the MSG Advanced

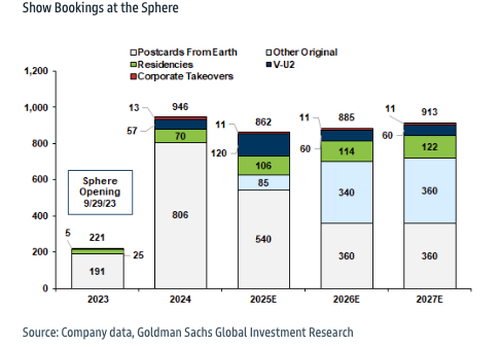

The analysts anticipate elevated operational enchancment by way of elevated utilization of present days, higher programming cadence, and better ticket and hospitality pricing. Their mannequin forecasts the Sphere section AOI to extend considerably, from -$20M in 2024 to $158M in 2027E, outpacing the common analyst estimates on Wall Road. With premium experiences, versatile scheduling, and continued demand for immersive content material, the analysts consider the Sphere is positioned for a number of years of continued progress regardless of “newness” fading fears.

“Whereas we admire the argument that The Sphere has benefited from its “newness” in its first yr of operation, we consider considerations that the venue is a fad and could have problem reinventing itself to drive continued curiosity are exaggerated. We see alternative for The Sphere so as to add content material, optimize present rely and timing, and enhance operations in a method that interprets into continued progress,” the analysts mentioned.

We consider SPHR is at present buying and selling at a worth that solely captures the seen income streams from the LV and AD Spheres

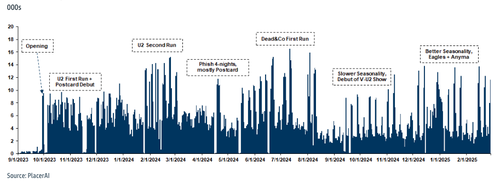

Las Vegas Sphere Lifetime Foot Site visitors

Every further Sphere construct in a brand new metropolis might generate low tens of thousands and thousands in AOI for SPHR by way of royalty charges alone

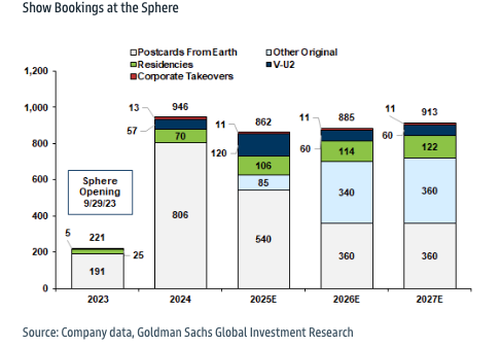

The Las Vegas Sphere present rely must be close to that of the complete 5-venue MSGE footprint by ~2027 on account of improved utilization

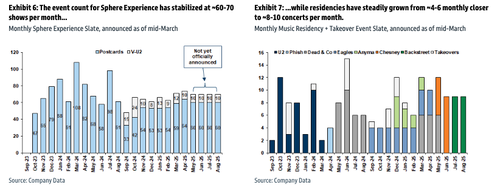

The occasion rely for Sphere Expertise has stabilized at ~60-70 exhibits per 30 days…

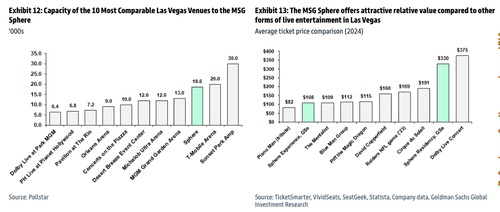

Capability of the ten Most Comparable Las Vegas Venues to the MSG Sphere

In the meantime, the MSG Networks section faces secular headwinds from cord-cutting and unfavorable carriage renegotiations. The analysts anticipate that “profitable renegotiation of MSG Networks’ debt phrases, with out the necessity from Sphere Leisure to inject important capital, can be a web optimistic for Sphere’s inventory, which we consider seems to be pricing in some danger that Sphere Leisure makes use of its personal capital to bail collectors out.”

All in all, the analysts have a $42 worth goal, which displays a mix of present optimistic Sphere efficiency, potential franchise enlargement, and a low likelihood of worth destruction from MSG Networks’ debt points.

. . .

lol

Grateful Lifeless performed the Las Vegas sphere—think about tripping balls and looking out up and seeing this. There’s no method I’m getting back from that pic.twitter.com/o1D9dWXYeW

— ØSØ (@OsoBlanc0) May 30, 2024

Don’t do medication after which go to the Sphere in Vegas. You should have a foul time. pic.twitter.com/tjm9Q9bbFr

— Alpha Liger (@AlphaLiger) January 16, 2025

Jerry Garcia would’ve preferred the Sphere pic.twitter.com/IFPKbzD4eM

— Las Vegas Regionally 🌴 (@LasVegasLocally) March 22, 2025