CloudVisual

Introduction

The dry bulk segment offers excellent risk-reward at the present stage of the shipping cycle-especially for Capesize vessels. In my opinion, we are in the first half of the cycle’s expansion phase, so the odds are skewed in investors’ favor. There are a few shipping stocks to bet on that theme. I have already presented two: Himalaya Shipping (HSHP) and Star Bulk (SBLK). Today’s article dissects Golden Ocean Group (NASDAQ:GOGL), the largest Capezise/Newcastlemax owner.

The company has healthy financials and pays dividends with adequate yield. GOLG trades at a higher PNAV compared to HSHP and SBLK. However, the company offers a balance between fleet specifications, LTV, and price.

Fleet

Considering its age profile and size, GOGL has one of the best fleets in the dry bulk industry. The company owns 52 Capesize (19 Newcastlemax and 33 regular Capes) vessels with an average age of 8Y and 31 Panamax with an average age of 6Y. GOGL also operates eight chartered-in Capesize ships. 49% of GOGL’s fleet is scrubber equipped.

Six newly built Kamsarmax ships were delivered in 2023, and one more will be delivered in January 2024. The new buildings will be financed with two facilities: an $80.0 million credit facility and an $85 million sale-and-leaseback agreement. The credit facility comes with interest at SOFR plus 1.8%, and the leaseback with interest at SOFR plus 1.85%.

In February 2023 the company ordered six Newcastlemax vessels equipped with scrubbers for $291 million. GOGL entered a new $233 million credit facility agreement secured by part of its fleet and cash. The facility has an interest rate of SOFR plus 1.9%. The ships took delivery in July 2023. All newly acquired vessels are chartered back to their former owner (H-Line) for 36 months at an average net TCE of $21,000/day.

In 4Q23, the company agreed to sell one Panamax for a net price of $15.8 million. GOGL expects to gain $1.4 million upon the sale. Another vessel was sold in 4Q23 for a total consideration of $21.6 million and a net gain of $5.8 million.

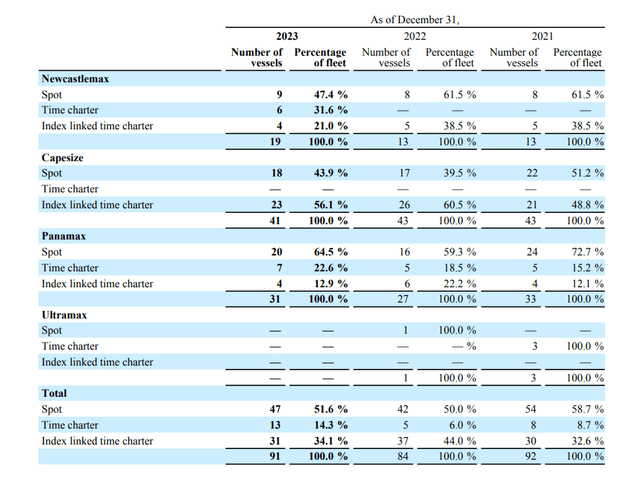

The chart below shows GOGL fleet employment.

GOGL 2023 report

In 2023, 51% of the company’s fleet operated under spot contracts, 14% under time charters, and 34% under index-linked charters. As a percentage of the fleet segments (measured in number of ships), Panamax had the highest exposure to the spot market, 64.5% FY23. Less than half of Newcastlemax/Capesize were employed under spot contracts.

At that stage of the shipping cycle, having higher spot exposure is beneficial. On the other hand, the cycle can peak any time, surprising all market participants. GOGL management does a good job managing the risk without sacrificing too much upside potential, diversifying between spot, time charters, and index-linked time charters.

4Q23 and FY23 figures

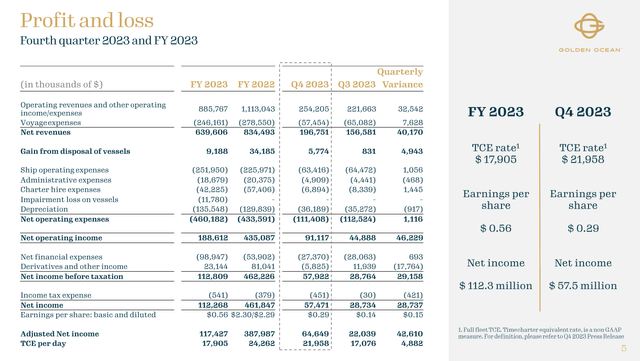

In 4Q23, GOGL employed its ships for $21,958/day fleet-wide TCE ($25,176/day for Capesize and $16,738/day for Panamax). In 4Q22, the company achieved a composite TCE of $17,076/day.

GOGL presentation

GOGL had a solid fourth quarter in 2023, achieving significant profit growth compared to 4Q22. The robust day rates improved the company’s revenue; GOGL delivered $254 million in operating revenue in 4Q23, 15% higher than in 4Q22. Over the same period, voyage expenses and OPEX declined 12% and 1.5%, respectively. Higher rates and lower expenses resulted in higher net income and EPS. In 4Q23, GOGL delivered $57.5 million net income and $0.29/share EPS (basic), compared to $28.7 million net income and $0.14/share EPS (basic) in 4Q22. Adjusted EBITDA for 4Q23 was $123 million, or 57% higher than 4Q222 adj. EBITDA.

FY23 TCE rates were $17,905/day, while FY22 was $24,262/day. The declining rates resulted in lower operating revenues of $885 million FY23 vs $1,113 million FY22. On the other hand, voyage expenses decreased YoY by $32 million, dropping to $246 million in FY23. Fleet OPEX increased from $225 million FY22 to $251 million FY23, offsetting the lower voyage expenses. FY23 GOGL realized $112.3 million, resulting in $0.56/share EPS (basic) vs. FY22’s $461.8 million net income and $2.30 EPS.

In the last quarter of 2023, GOGL contracted its ships at higher TCE rates than the FY23 average figures ($21,958/day vs $17,905/day). With high confidence, I expect dry bulk rates to remain strong over 2024, especially for the Capes, due to higher demand for transporting major bulks (bauxite, iron ore, and coal).

GOGL TCE rates for 1Q24 are $25,000/day for Capes and $15,400 for Panamax. The fleet’s availability is 74% for Capes and 84% for Panamax. For 2Q24, the company has contracted 25% of days at an average TCE of $25,000 /day for Capesize and 19% at an average TCE of $14,200/day for Panamax.

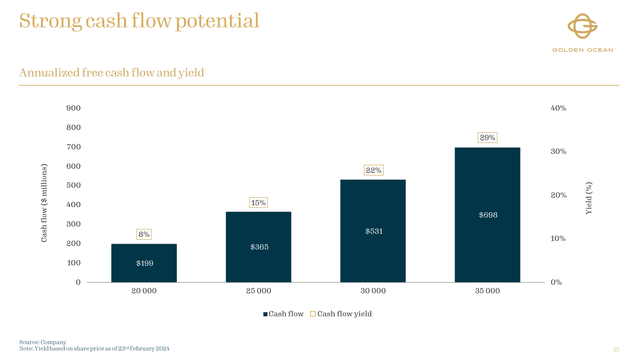

Let’s look at GOGL’s cash flow sensitivity to TCE rates.

GOGL presentation

At a $20,000 TCE rate, the company delivers a $199 million cash flow or an 8% yield. By increasing the day rates by 25% (from $20,000 to $25,000), the yield almost doubles, reaching 15%. If the rates reach $35,000/day, the cash flow yield would top 29%.

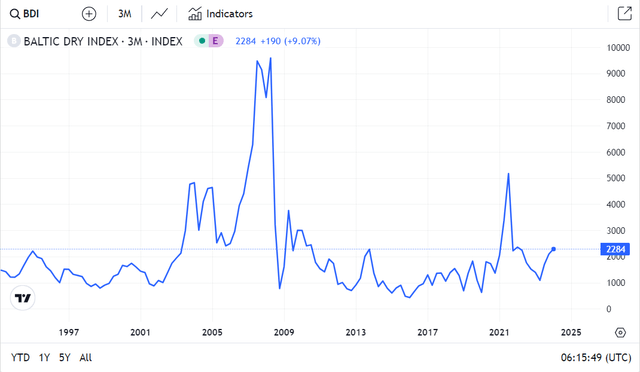

Doubling day rates is not a black swan event for dry bulk vessels. Volatility is inherent in TCE rates, especially for Capesize vessels. The chart below shows the history of the Baltic Dry Index and the BDI Index back to the 1990s.

Trading Economics

The peak in 2006-2007, caused by the booming Chinese economy, created enormous demand for commodities, hence for cargo ships. At one point, the demand surpassed the supply, resulting in a steep day rate increase. In 2021/2022, we had another peak in dry bulk rates. China was the major driving force, and Capesize ships reaped the most benefits.

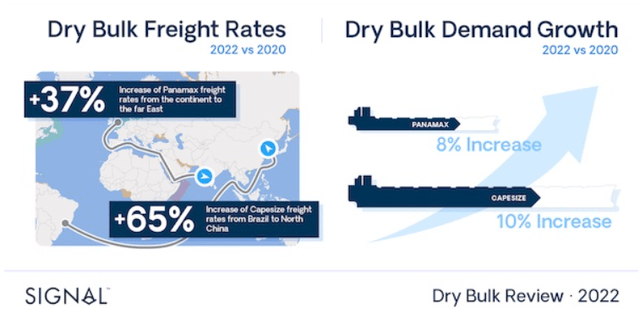

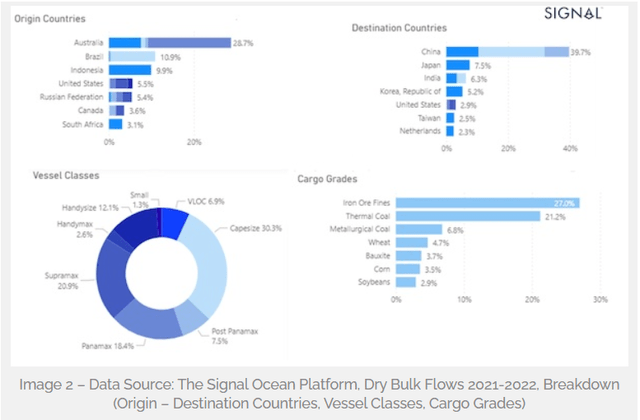

The two charts below give a glimpse into the 2022 dry bulk market.

Signal

Signal

The major bulks, such as iron ore and thermal/metallurgical coal, played a pivotal role in dry bulk demand. Since 2024 is the Year of the Dragon, the CCP will do its best to keep the Chinese economy strong. Loose fiscal policy is one of the tools to achieve that. CCP reinstated its plans to maintain economic growth around 5% and urban unemployment rate at 5.5% a week ago. Besides that, the Chinese government plans to expand its defense budget by 7.2%. The result is a growing need for major bulk commodities. The bulk carriers, especially Capesize/Newcastlemax, will remain in high demand since they are the best option to transport large quantities of iron ore, bauxite, and coal.

Balance sheet

GOGL has $116 million in cash, $1,260 million in long-term debt, and $1,460 million in total debt. The capital structure is 76.5% total debt/equity and 44.9% total liabilities/total assets.

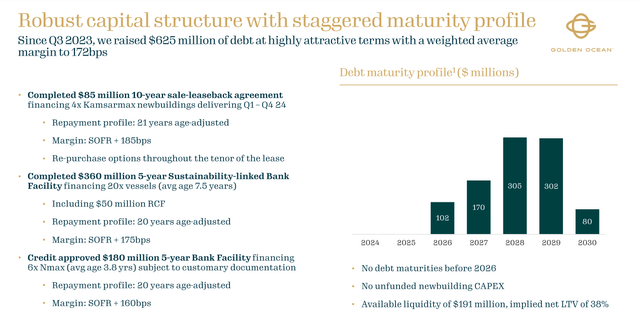

The chart below shows the company’s debt amortization schedule.

GOGL presentation

In January 2024, GOGL entered into an agreement for a $250 million credit facility to refinance three credit facilities. The new facility has the following terms: an interest rate of SOFR plus 1.85% and maturity in January 2028. The debt is secured by 20 of the company’s ships.

In February 2024 GOGL signed a $360 million credit facility to refinance 20 vessels. The interest rate is SOFR plus 1.75%. The facility includes sustainability-linked component of an additional 0.05% depending on exhaust gas emissions reduction. It has a five-year term and age-adjusted amortization schedule.

A large portion of company’s debt matures in 2028 and 2029, $305 million and $302 million, respectively. GOGL generates adequate liquidity to cover its debts. FY23 operating cash flow was $266 million, and operating income was $191 million. GOGL had to cover $99 million in net interest expenses for the same period.

With a robust dry bulk market, I expect the company to improve its liquidity position and save some cash for rainy days. In the shipping businesses, such days come more often than we as investors wish.

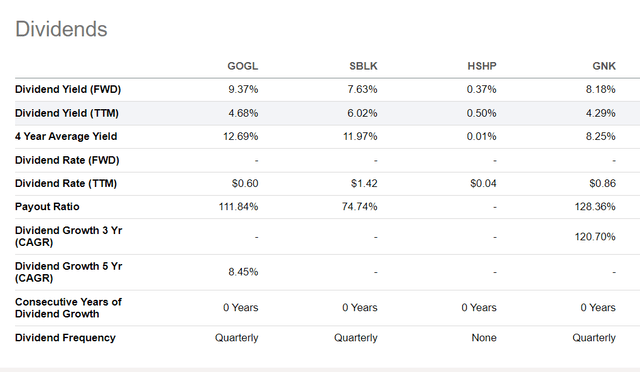

Dividends and Buybacks

GOGL announced a $0.30/share cash dividend for 4Q23. The TTM dividend yield is 4.68%. The table below compares GOGL, SBLK, HSHP, and GNK dividend metrics.

Seeking Alpha

SBLK leads the pack, while GNK and GOGL share the second/third place. Given HSHP’s new fleet and high capital expenditures, a 0.50% TTM yield is understandable.

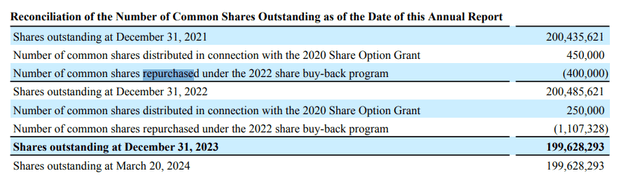

On October 03, 2023, GOGL announced its $100 million share buyback program, which is another 12-month extension of the program started in 2022. The table below the 2023 annual report shows GOGL share buybacks for 2022/2023.

GOGL 2023 annual report

In 2023, GOGL repurchased shares for $8.357 million (250,000 common shares), resulting in a 0.30% buyback yield. In FY22, the company purchased shares for $3.27 million.

With rising TCE rates, I expect dividends to grow higher. The 2021/2022 shareholders distribution is a great example. GOGL paid an average quarterly dividend of $0.518/share (calculated for eight quarters of 2021 and 2022), 70% higher than the 4Q23 dividend.

Valuation

To estimate GOGL’s value, I use P/NAV and relative valuation. To calculate fleet replacement cost, I use the last Compass Maritime weekly. The quoted prices are for five- and ten-year-old vessels. Given GOGL`s average age of 8Y for Capes and 6Y for Panamax, I use 5% annual depreciation to estimate the price discounting the price of a ten-year-old ship.

The inputs for the NAV equation are as follows:

- Capesize 8Y $51.8 million

- Panamax 6Y $33 million

GOGL’s fleet replacement value is $3,725 million.

NAV input figures are:

- GOGL fleet value $3,725 million

- Current Assets: $278 million

- Total Liabilities: $1,567 million

GOGL NAV = $2,436 million

GOGL Market Cap = $2,510 million

GOGL trades at 105% P/NAV. For reference, SBLK trades at 83% PNAV and HSHP at 80% PNAV.

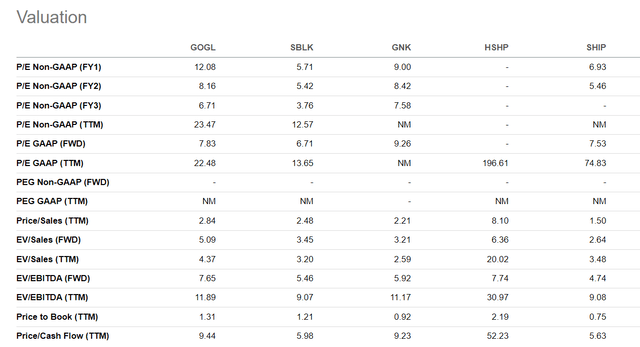

I picked Star Bulk (SBLK), Genco Shipping (GNK), Himalaya Shipping (HSHP), and Seanergy (SHIP) for comparative valuation. The reason is simple: those companies have high exposure to the Capesize segment.

The bullet points below shows fleet composition/average age/scrubbers installations/LTV per company.

- SBLK: 19 Capes, 17 Newcastlemax, 7 PostPanamax, 39 Kamsarmax, and 2 Panamax, 18 Ultramax, 8 Supramax; 10.5Y average fleet age; 94% scrubber equipped; 38%LTV

- GNK: 18 Capes and 27 Ultramax/Supramax;11.7Y average age; 37% scrubber equipped; 12%LTV

- HSHP: 12 Newcastlemax; 0-1Y average age; all dual-fuel LNG + scrubbers; 49% LTV

- SHIP: 17 Capesize; 12.4Y average age; 53% scrubber-equipped; 38% LTV

The following table compares GOGL vs. its peers, EV/Sales, EV/EBITDA, and Price/Book.

Seeking Alpha

GOGL trades at 4.37 EV/Sales, 11.89 EV/EBITDA, and 1.31 Price/Book, which is in the upper percentile compared to its peers. HSHP commands the highest multiples due to its brand-new fleet of dual-fuel vessels. Conversely, GNK and SHIP are cheaper due to their fleet age.

Relying only on valuation gives a fragmented view. To make informed investment decisions, we must consider the company’s leverage (LTV and capital structure) and fleet quality. GOGL strikes a good balance between price vs. value, leverage, and fleet specifications.

Risks

The risks for GOGL are common for all bulk shipping companies. The primary one is the Chinese economy. As mentioned, 2024 is the Year of the Dragon, so the CCP will do its best to boost the economy using fiscal measures. Major bulk exports are rising globally, and most are heading to China. At least for now, the fiscal stimulus is working. GOGL has a young fleet, so the operational risk caused by unplanned repairs and frequent maintenance is low.

Financially, GOGL has a robust balance sheet, so I do not expect any issues servicing its debts and funding its operations. The operating risk due to an aging fleet is relatively low. GOGL’s fleet average is below ten years (8Y for Capesize and 6Y for Panamax). Having a newer fleet reduces the operating costs for maintenance and unplanned repairs.

Final thoughts

GOGL is an excellent proposition for betting on rising Capesize/Newcastlemax demand. I give credit to GOGL management for doing a great job expanding the company’s fleet. I believe we are in the middle of the expansion phase, so the capital investments will pay off-first by boosting companies’ cash flow and second by increasing companies’ NAV due to inflationary pressures and rising TCE rates. GOGL pays dividends with attractive yields. With TCE rates getting stronger, I anticipate higher dividends. I give GOGL a buy rating.