cokada

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on December 12th, 2022.

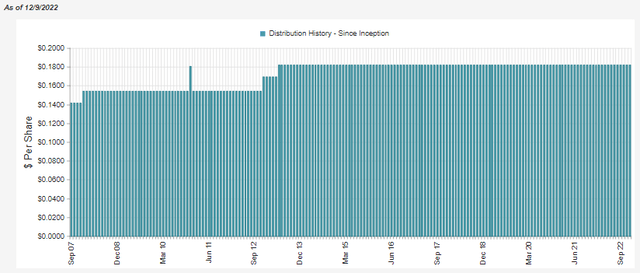

Guggenheim Strategic Opportunities Fund (NYSE:GOF) is a fund I’ve never covered specifically. It is one of the enviable closed-end funds that have never cut their distribution, and they also have an inception pre-2008. There’s only a handful of them, and I do brief updates on those funds periodically. That means they’ve survived a few different market tantrums now, which is certainly more impressive than a fund that launched a year or two ago and never cut its payout.

GOF had never caught my attention besides an arbitrage play last year. Stanford Chemist had covered more on that in-depth. More recently, this premium has continued to extend its run higher now after the merger play. To see such a premium on a fund with no distribution cuts isn’t unusual. However, I believe that distribution is not sustainable. Despite the lack of coverage, the fund continues to payout just the same.

With the merger, the fund became invested in a sleeve of equity positions. Since then, they have reverted back to an almost entirely fixed-income fund through 2022.

The Basics

- 1-Year Z-score: 0.82

- Premium: 25.62%

- Distribution Yield: 13.42%

- Expense Ratio: 1.51%

- Leverage: 25%

- Managed Assets: $1.91 billion

- Structure: Perpetual

GOF’s investment objective is “to maximize total return through a combination of current income and capital appreciation.” To achieve this, the fund essentially takes a multi-sector fund approach. They can invest in equity positions but have tilted towards fixed-income positions quite heavily. They also employ an options strategy that can be beneficial in flat markets. Ultimately, they aren’t limited and are quite a flexible fund overall.

The Fund will pursue a relative value-based investment philosophy, which utilizes quantitative and qualitative analysis to seek to identify securities or spreads between securities that deviate from their perceived fair value and/or historical norms. The Fund’s sub-adviser seeks to combine a credit managed fixed-income portfolio with access to a diversified pool of alternative investments and equity strategies. The Fund’s investment philosophy is predicated upon the belief that thorough research and independent thought are rewarded with performance that has the potential to outperform benchmark indexes with both lower volatility and lower correlation of returns as compared to such benchmark indexes. The Fund cannot ensure investors that it will achieve its investment objective. The Fund may invest without limitation in fixed-income securities rated below investment grade (commonly referred to as “junk bonds”); the Fund may invest up to 20% of its total assets in non-U.S. dollar-denominated income securities of corporate and governmental issuers located outside the U.S., including up to 10% in emerging markets; the Fund may invest up to 50% of its total assets in common equity securities consisting of common stock; and the Fund may invest up to 30% of its total assets in investment funds that primarily hold (directly or indirectly) investments in which the Fund may invest directly. The Fund will seek to achieve its investment objective by investing in a wide range of fixed income and other debt and senior equity securities (“Income Securities”) selected from a variety of sectors and credit qualities, including, but not limited to, corporate bonds, loans and loan participations, structured finance investments, U.S. government and agency securities, mezzanine and preferred securities and convertible securities, and in common stocks, limited liability company interests, trust certificates and other equity investments (“Common Equity Securities”) that the Fund’s sub-adviser believes offer attractive yield and/or capital appreciation potential, including employing a strategy of writing (selling) covered call and put options on such equities.

The fund utilizes leverage through reverse repurchase agreements and through borrowings to potentially enhance returns. Anything they can earn above the cost of leverage is a benefit to shareholders. Although, when underlying portfolio prices are declining, the downside is amplified. They ramped up their borrowings significantly due to the merger of funds last year. They went from around $38.5 million in borrowings to $128 million. The entire leverage outstanding was last reported at $463.36 million.

Their borrowings are based on 3-month LIBOR plus 0.85%. The reverse repurchase agreements are at various interest rates, but earlier in 2022, they peaked at around 2%. As rates rise, the costs of their leverage will also rise. That can reduce the net investment income in the fund as it takes a larger chunk out of total investment income.

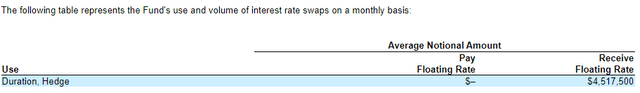

The good news for GOF is that there are two ways they are hedging against this risk of interest rates. The first is through interest rate swaps, where they essentially swap a floating rate for a fixed one.

Interest rate swaps involve the exchange by the Fund with another party for its respective commitment to pay or receive a fixed or variable interest rate on a notional amount of principal. Interest rate swaps are generally centrally-cleared, but central clearing does not make interest rate swap transactions risk free.

GOF Hedge (Guggenheim)

The second way they are hedging against rising costs is that their portfolio is also exposed to floating rates. That limits the fund’s overall duration. The income generated from these underlying holdings will increase as rates rise.

The fund’s last total expense ratio at the end of May 2022 was reported at 1.83% when including these leverage expenses.

Performance – Premium Pushes Higher

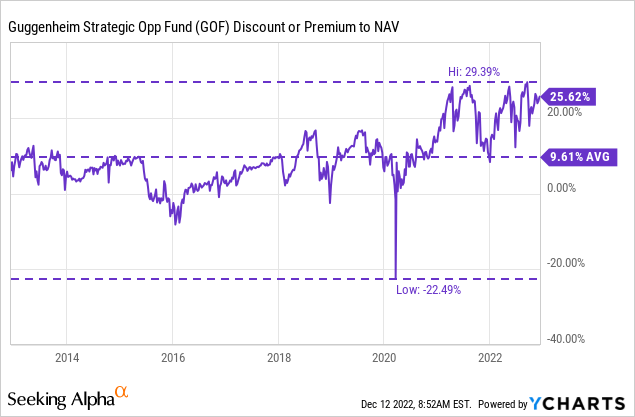

It seems like some funds always trade at a premium, no matter what. The PIMCO funds can also be classified in the never-ending premium camp.

It certainly is true; premiums can run high for a long time. However, the combination of higher premiums than usual and an uncovered distribution sets up the fund for what could be quite the tumble.

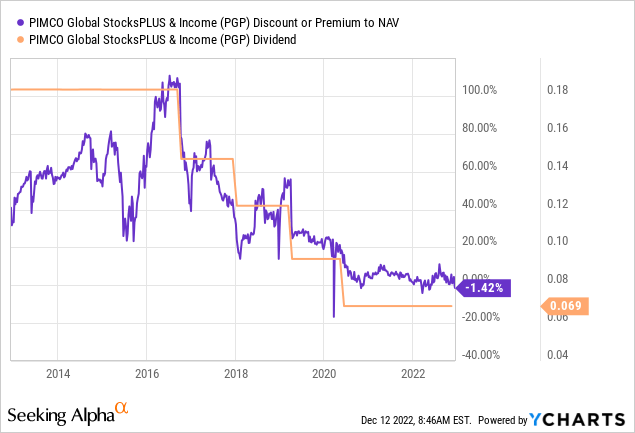

It reminds me of PIMCO Global StocksPLUS & Income (PGP) over the last decade. A bit less of an extreme case for GOF, but a similar trajectory could follow. PGP traded at massive premiums for years, but as soon as the fund started to cut its distribution, it tumbled. It was almost in perfect lockstep; we would see a distribution cut, and then the premium would collapse.

YCharts

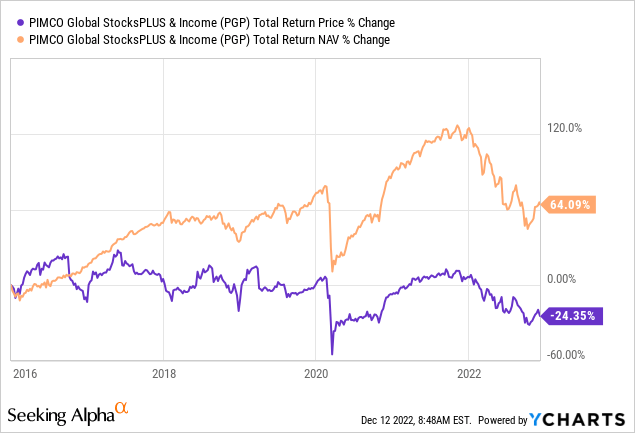

Today the fund still trades right around parity with its NAV, but investors that bought in 2016 are still not recovered due to the compression in the premium. This isn’t just on a price basis; this is looking at total share price return, which means including the expectation that the distribution was reinvested. That’s even while the actual total NAV return has shown positive results.

YCharts

I believe that’s why GOF could be in for a similar ride, but perhaps on a smaller scale. PGP isn’t the only fund, either. It’s just one of the most extreme examples that can be easily visualized.

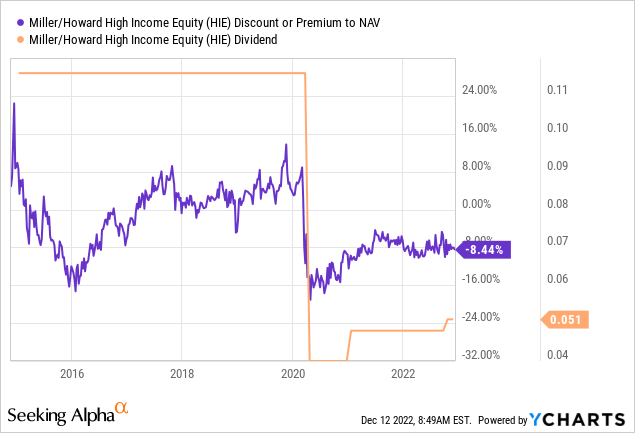

Take a look at another example, the Miller/Howard High Income Equity (HIE). A fund that has a tilt towards energy. They never cut their distribution for years until the 2020 crash hit. Once they did, the premium disappeared rapidly.

YCharts

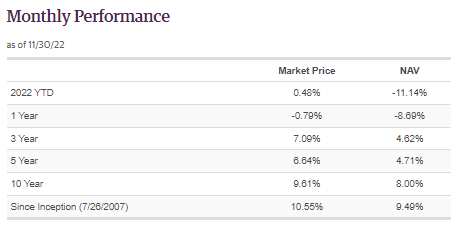

If we look at GOF’s annualized returns, the rising premium is what is pushing the fund to its stronger results on the surface.

GOF Annualized Returns (Guggenheim)

On a YTD basis, the underlying portfolio has been doing fairly poorly despite the market price return showing a slight positive. That’s simply from the premium expansion we’ve been seeing. The premium is near the decade high and well above its decade-long average.

YCharts

Distribution – The Potential Catalyst For Premium Deflation

We know that the fund has never cut its payout.

GOF Distribution History (CEFConnect)

However, that doesn’t mean a fund is earning its distribution. CEFs can pay out basically whatever they want, and for however long they want to – assuming they don’t deplete NAV completely.

In this case, investors could buy today and receive a distribution yield of 13.42%. Here’s where the first warning of a significant premium can come in besides just being a generally poor idea to buy at large premiums. It is a fact that while investors collect 13.42%, the fund has to earn 16.86%. Now I know yields are rising due to falling fixed-income prices, but even this should be viewed with hesitancy.

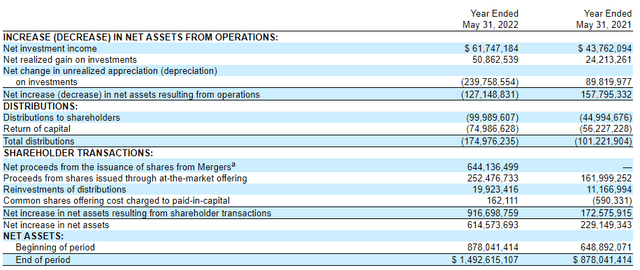

When looking at their last annual report, we can see that coverage is lacking.

GOF Annual Report (Guggenheim)

A fixed-income-focused CEF should get the majority of its distribution coverage entirely from net investment income. Ideally, it would be over 100% covered for a fixed-income fund.

In GOF’s case, we can see that NII coverage comes in at around 35.3%. Last year it was 43.2%. So we’ve seen a decline in coverage. One of the reasons that NII grew year-over-year, and so did the total distributions, is because of the fund’s merger.

Additionally, the fund constantly issues shares through its at-the-market offering and dividend reinvestment program. Since the fund trades at a regular premium, this is a positive. The shares are added in an accretive manner to both NAV and income. It’s also worth noting that investors get a 5% discount on market price or NAV, whichever is higher, for participating in the DRIP.

Unfortunately, we can see that despite the accretive nature of these share issuances, it wasn’t enough to grow coverage entirely year-over-year. At the same time, the fund was carrying a sleeve of equity positions, which could have also limited the fund’s NII. Still, it is a worrying long-term trend as it isn’t new. In fiscal 2020 and 2019, NII coverage was 40.58% and 44.23%, respectively.

GOF Annual Report (Guggenheim)

In 2019, NII per-share was $0.97, then $0.89 in 2020. It rose in fiscal 2021 to $0.95 but then back down again to $0.80 for fiscal 2022. That’s against the $2.1852 annual distribution of the fund.

The increase in income from the floating rate exposure of the fund could accelerate going forward now with higher rates, but the shortfall in coverage isn’t likely to be filled. The gap seems too wide at this point without some cut to the distribution or interest rates high enough that it would certainly break things in the economy.

With lower coverage over the years, it becomes clear that a cut is quite inevitable but the when is undetermined. It could be years or even another decade. As said, they can essentially payout what they want. With issuing new shares, the fund itself could be getting larger, and that’s good for management. The per-share NAV and per-share NII are moving lower.

GOF’s Portfolio

As mentioned above, the fund is quite diversified and flexible, able to invest however they want – with some rather minimal limits. At the end of May 2022, they held a fairly meaningful sleeve of 21.3% in equity positions. At the end of August, they were back to their fixed-income exposure.

GOF Asset Exposure (Guggenheim)

The heaviest and most meaningful allocations here are the high-yield corporate bonds, bank loans, ABS, investment-grade corporate bonds and net credit derivatives.

GOF Asset Type Exposure (Guggenheim)

The bank loans and some of the ABS exposure will be the floating rate exposure in the fund. This means that when rates rise, the income generation of the fund can rise through these types of instruments.

They take the ABS (asset-backed securities) and break down the sub-categories even further. ABS is a broad term, so it’s great to see a better breakdown.

GOF Asset-Backed Exposure breakdown (Guggenheim)

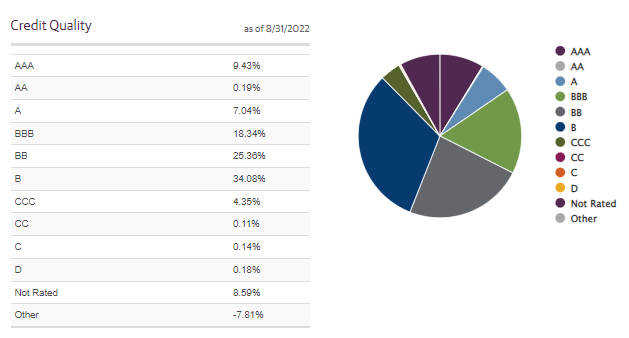

From there, the credit quality of the fund is actually quite diverse. As we saw above, they have some exposure to investment-grade bonds, and that includes a fair bit allocated to AAA rated debt. That’s going to be reserved for the Treasury holdings and similar higher-quality instruments.

GOF Credit Quality (Guggenheim)

One reason this could be viewed as bad is that it’s the exact place that is getting hit hardest by higher interest rates. They are often issued with longer maturities and lower yields, making them more sensitive. On the other hand, the portfolio is still invested heaviest in below-investment-grade bonds, which is typically the case with CEFs.

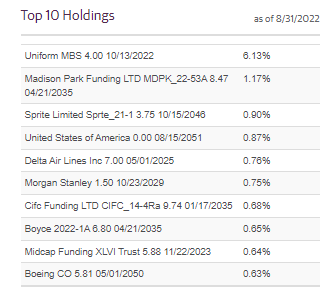

The way they mitigate the risks here is to spread it out in a highly diversified portfolio. If we look at the top positions, none of them make up a very large allocation. According to CEFConnect, the fund holds 1310 positions.

That is except for the top holding. However, since it is an MBS holding, it is backed by hundreds or even thousands of mortgages itself. So while it’s a ~6% weighting for GOF here, each underlying loan could be less than 1% weighting in the security.

GOF Top Holdings (Guggenheim)

Conclusion

GOF is in the envious CEF position of never cutting their distribution and having an inception pre-2008. That’s a club where only a very small handful of CEFs belong. However, a higher premium and questionable sustainability of their distribution mean it’s always at risk of losing that status. That’s why I’ve personally avoided GOF and don’t find it compelling.

At this point, it is clear that other investors don’t feel the same way as they push the fund up to near-all-time high premiums. Additionally, I’ve been wrong in being skeptical about GOF’s payout for years now. Where I feel they should cut to a more sustainable level, they keep declaring the same distribution month after month.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.