Maria Grazia Attinasi, Rinalds Gerinovics, Vanessa Gunnella, Michele Mancini, Luca Metelli 09 June 2022

Provide bottlenecks have worsened for the reason that onset of the conflict, particularly in sectors largely depending on Russia’s and Ukraine’s exports. We assemble a brand new index of worldwide sectoral provide chain pressures (GSSP) which disentangles the contributions of seven industries to mixture provide pressures within the manufacturing sector. This indicator is derived from a vector auto-regression (VAR) with world buying managers’ index (PMI) variables similar to: output, output costs, and the suppliers’ supply instances of seven manufacturing sectors. A world provide shock is recognized by means of signal restrictions and the indicator is obtained bottom-up by aggregating the fluctuations in sectoral PMI suppliers’ supply instances (SDT) which might be defined by the worldwide provide shock.1 The GSSP indicator suggests that provide pressures intensified once more since March (Determine 1), with the pure sources and chemical industries sectors being the principle contributors. This sample of sectoral disruptions doubtless displays the influence of the conflict in Ukraine, as each Russia and Ukraine are essential exporters of metals and mining merchandise, in addition to merchandise used within the manufacturing of fertilizers (i.e. the chemical compounds sector).2 Such provide disruptions, not but totally captured by obtainable financial knowledge, are prone to intensify within the subsequent few months, particularly in Europe.

Determine 1 Provide chain stress indicator in world manufacturing

(customary deviations from the typical worth and level contributions)

Sources: IHS Markit and authors’ calculations. Newest commentary: April 2022.

Notes: Left (proper) hand aspect panel is aggregated at quarterly (month-to-month) frequency. Increased values of the indicator level to worsening within the provide chain pressures.

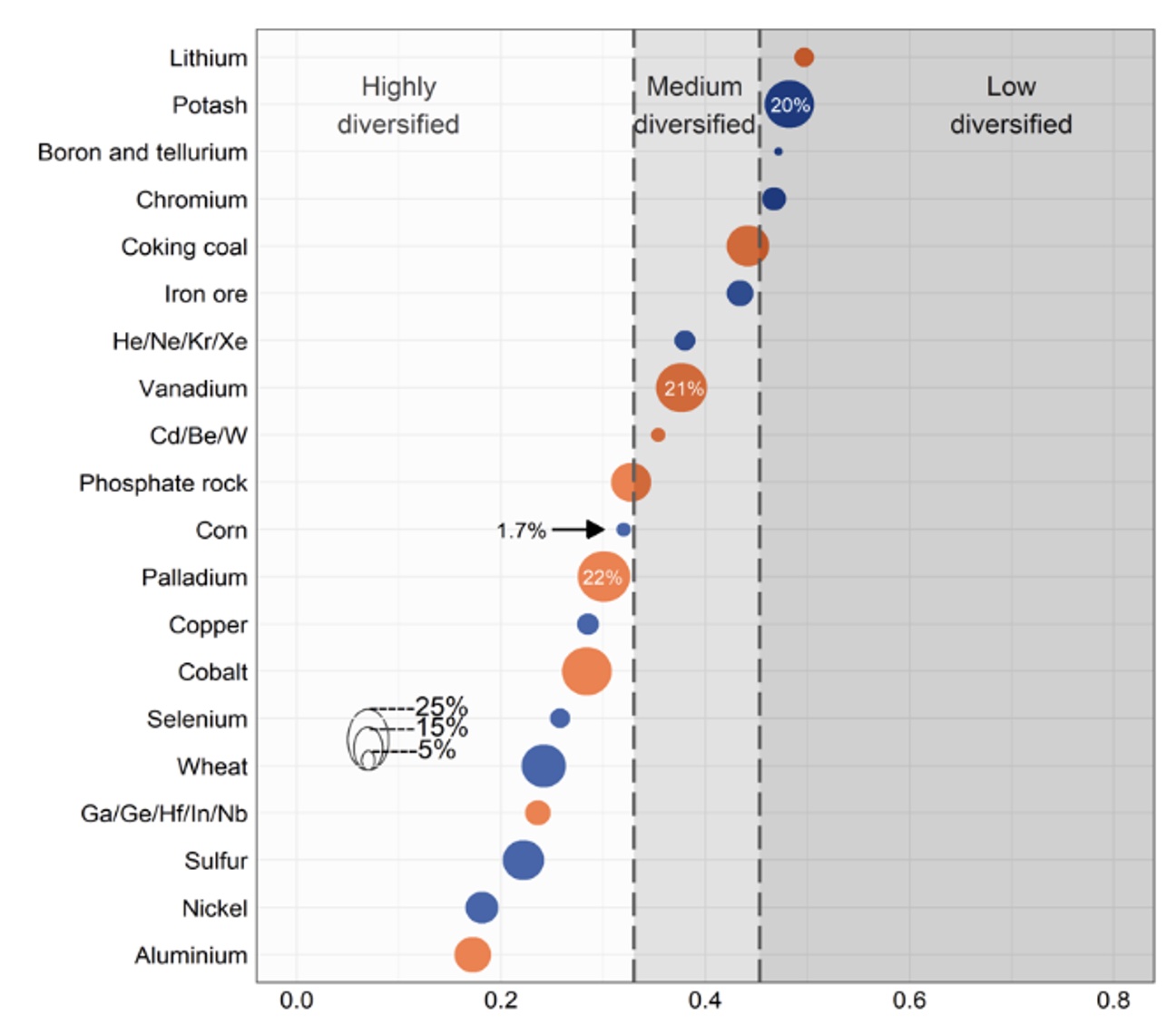

Determine 2 Russia’s share in world exports of uncooked supplies and diploma of export market focus

(share in world’s exports; Herfindahl-Hirschman index; 2019)

Supply: Commerce Information Monitor, European Fee and authors’ calculations.

Notes: Supplies marked with pink circles denote strategic uncooked supplies as outlined by the European Fee’s newest criticality evaluation (2020 Factsheets). The scale of the bubbles refers to share of Russia in world exports.

Russia’s commerce specialisation is beneficial to evaluate the potential implications of war-related disruptions for world provide chains and their geographical dimension. Russia’s exports of oil, fuel, and coal account for 15% of the world’s exports of those commodities and the EU is its largest importer and the area with the very best import dependence from Russia. This explains the provision pressures rising within the pure sources sector. Along with vitality commodities, Russia can also be a key exporter of uncooked supplies, together with these labeled by the European Fee (2020) as crucial given their financial significance and excessive provide dangers (Determine 2). For instance, Russia exports supplies used within the manufacturing of fertilisers, particularly potash, the place it has a dominant place, but in addition of sulphur and phosphate rocks. When taking a look at crucial uncooked supplies, Russia is a big exporter of palladium, vanadium, and cobalt, that are most prominently used within the manufacturing of 3D printing, drones, robotics industries, batteries, and semiconductors, thus affecting additionally different sectors, similar to digital home equipment, transportation, and most prominently the automotive sector. Russia can also be the fourth largest producer of coking coal, used for metal manufacturing, the place it additionally enjoys a dominant market place, whereas Ukraine is likely one of the largest exporters of iron ore, which is utilized in iron and metal industries.

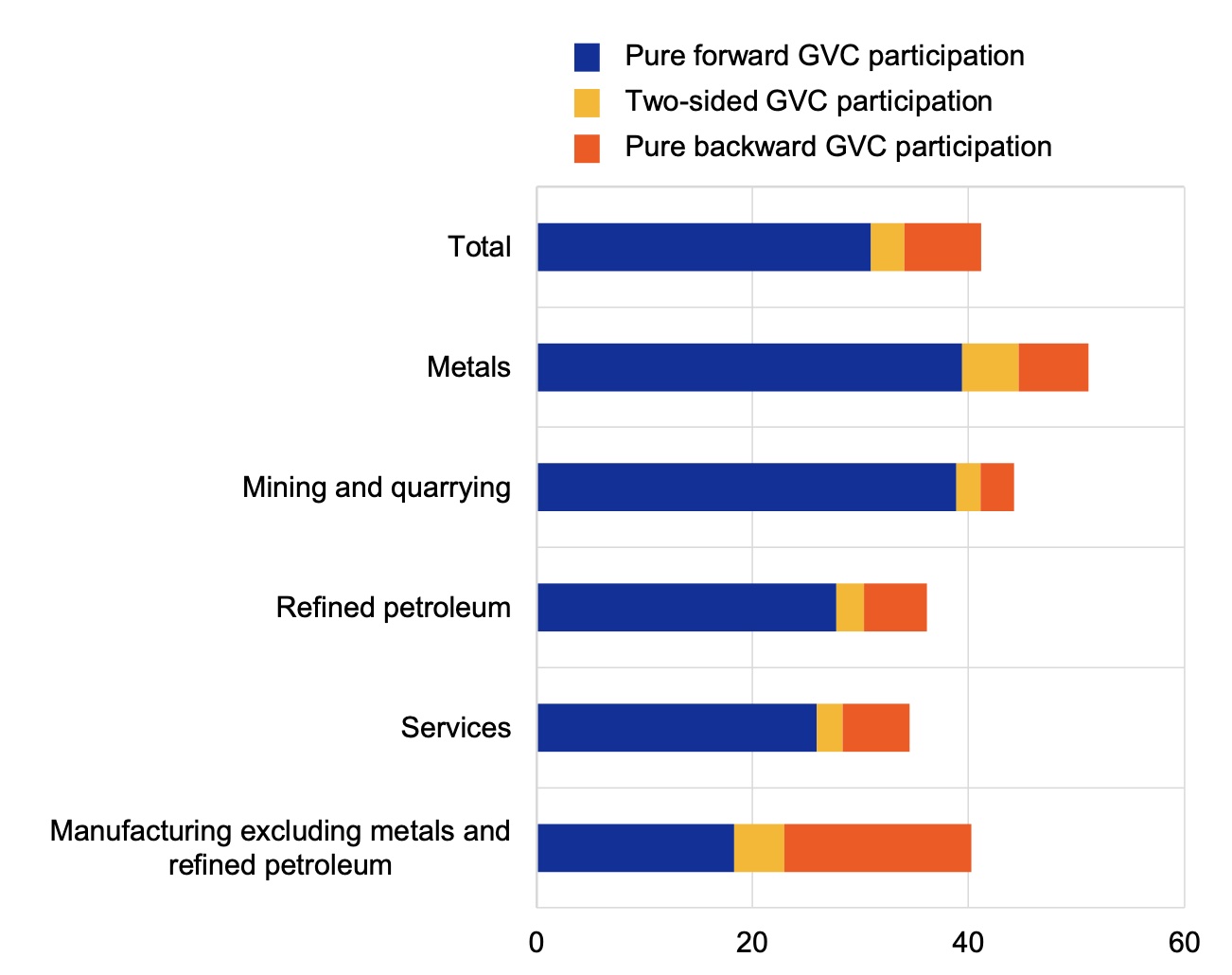

Battle-related disruptions to manufacturing and commerce flows from Russia could also be amplified by means of world manufacturing networks given the nation’s vital ahead integration in world worth chains. Russia’s share in world ahead world worth chains participation is round double the scale of its share in gross world commerce (2.8% versus 1.5%). Notably, Russia has one of many highest ahead participation charges in provide chains, as greater than 30% of its exports include inputs utilized by its commerce companions as intermediate inputs, in comparison with a worldwide common of simply 18% (Determine 3). That is defined by Russia’s specialisation in vitality and steel industries, that are intrinsically extra ahead built-in, being positioned upstream within the manufacturing course of. Due to this fact, disruptions to Russia’s exports may effectively propagate downstream by means of provide chain networks, having an influence additionally by way of the oblique commerce (Winkler and Wuester 2022, Winkler et al. 2022). Furthermore, as Russian inputs are concerned in a number of levels of manufacturing, implications of disruptions might doubtlessly be long-lasting, in step with earlier firm-level empirical proof based mostly on the Tohoku earthquake (Boehm et al. 2019).

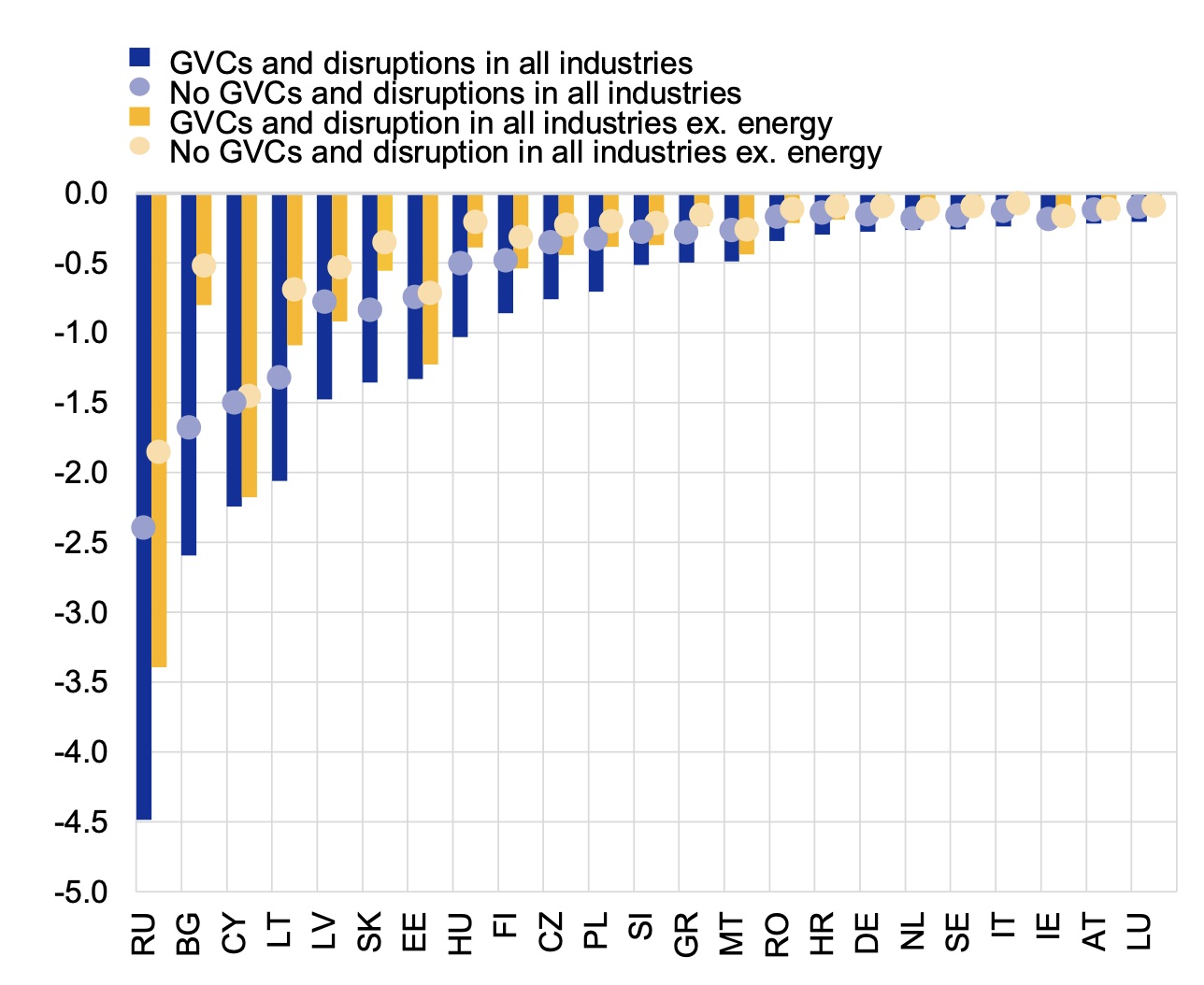

Quantitative commerce fashions which account for world worth chain linkages discover that the scale of the welfare results of commerce disruptions as a result of conflict is double in comparison with customary fashions. In a current work (Borin et al. 2022) a multi-sector, multi-country common equilibrium commerce mannequin (Antràs and Chor, 2018) is exploited to gauge to what extent provide chains might amplify the results of the collapse in commerce between Russia and its buying and selling companions. A decline in Russian imports from sanctioning nations in step with the latest commerce knowledge is obtained by means of a rise in bilateral commerce limitations. The outcomes counsel that Russia and a few EU nations, most notably Central and Jap European nations and Finland, can be affected disproportionally in comparison with others, with the welfare results being considerably bigger when sanctions on vitality are assumed, suggesting a extremely pervasive position for vitality inputs in manufacturing (Determine 3). Oblique cross-country and cross-sectoral linkages results act as a big magnifier, as they double the scale of the usual (i.e. non-global worth chain) results, particularly for these nations which have tighter provide chain linkages with Russia. One caveat to those findings is that the quantitative commerce mannequin encompasses a excessive diploma of substitutability throughout inputs, a function arguably unrealistic particularly within the quick run for crucial inputs similar to vitality (Bachmann et al. 2022). Underneath decrease however believable diploma of substitutability, Borin et al. (2022) present that the magnitude of the results on financial exercise of disruptions to commerce in vitality merchandise can be increased than estimated above and, within the case of a full vitality embargo, they might enhance markedly and should attain 4% of GDP within the euro space.

Determine 3 Russia’s participation in world worth chains throughout sectors by completely different modes

(proportion share of complete exports, 2020)

Sources: World Financial institution WITS, ADB MRIO tables.

Notes: Measures are based mostly on Borin et al. (2021).

Determine 4 Amplification results of worldwide worth chains

(GDP adjustments, percentages)

Supply: Borin et al. (2022).

Notes: The mannequin with GVCs depends on a full input-output construction. The mannequin with out GVCs makes use of an altered input-output construction the place commerce in intermediate merchandise is attributed to commerce in ultimate merchandise. Information refers to 2018. Solely nations the place welfare adjustments are bigger than 0.2% are reported.

References

Antràs, P and D Chor (2018), “On the Measurement of Upstreamness and Downstreamness in International Worth Chains”, In L Y Ing and M Yu (eds.), World Commerce Evolution: Development, Productiveness and Employment, London, UK: Routledge, Chapter 5.

Bachmann, R, D Baqaee, C Bayer, M Kuhn, A Löschel, B Moll, A Peich, Okay Pittel and M Schularick (2022), “What if? The Financial Results for Germany of a Cease of Power Imports from Russia”, Working Paper.

Borin, A, F P Conteduca, E Di Stefano, V Gunnella, M Mancini and L Panon (2022), “Quantitative evaluation of the financial influence of the commerce disruptions following the Russian invasion of Ukraine”, Occasional Paper Sequence, Banca d’Italia, forthcoming.

Borin, A, M Mancini and D Taglioni (2021), “Measuring Publicity to Danger in International Worth Chains”, World Financial institution Coverage Analysis Working Paper No. 9785.

Boehm, C E, A Flaaen and N Pandalai-Nayar (2019), “Enter linkages and the transmission of shocks: Agency-level proof from the 2011 Tōhoku earthquake”, Assessment of Economics and Statistics 101(1): 60-75.

European Fee (2020), “Essential Uncooked Supplies Resilience: Charting a Path in the direction of better Safety and Sustainability”.

Winkler, D, L Wuester and D Knight (2022), “The results of Russia’s world worth chain participation”, in M Ruta (ed.), The Affect of the Battle in Ukraine on International Commerce and Funding, The World Financial institution.

Winkler, D and L Wuester (2022), “Implications of Russia’s invasion of Ukraine for its worth chains”, VoxEU.org, 11 Could.

Endnotes

1 The indicator is obtained by aggregating the fluctuations of the sectoral PMI supply instances that are as a result of world provide shock. These sectoral fluctuations are weighted by the relevance of varied sectors within the world economic system. The indicator compares effectively with the indicator GSCPI produced by the NY Fed, sharing a excessive diploma of correlation (round 90%). The sectors thought of within the indicator are Chemical compounds, Pure sources, Vehicles & Auto components, Meals and Drinks, Family & Private Use Merchandise, Industrial items, and Technological Gear.

2 Our indicator doubtless picks up additionally the results of the extreme lockdown measures launched in China since mid-March in response to the unfold of the Omicron variant, and which brought about disruptions to financial exercise and logistics.