tumsasedgars

On our last coverage of Global Net Lease, Inc. (NYSE:GNL), we spoke about the reasons we exited the common shares in a timely fashion. We also covered the preferred shares, which are listed below.

- Global Net Lease, 7.25% Series A Cumulative Redeemable Preferred Stock (NYSE:GNL.PR.A)

- Global Net Lease 6.875% Series B Cumulative Redeemable Perp Preferred Stock (NYSE:GNL.PR.B)

- Global Net Lease, Inc. 7.50% Series D Cumulative Red Perp Preferred Stock (NYSE:GNL.PR.D)

- Global Net Lease, Inc. 7.375% Series E Cumulative Preferred Stock (NYSE:GNL.PR.E)

We ultimately suggested investor stick to bonds as they were likely the best bet.

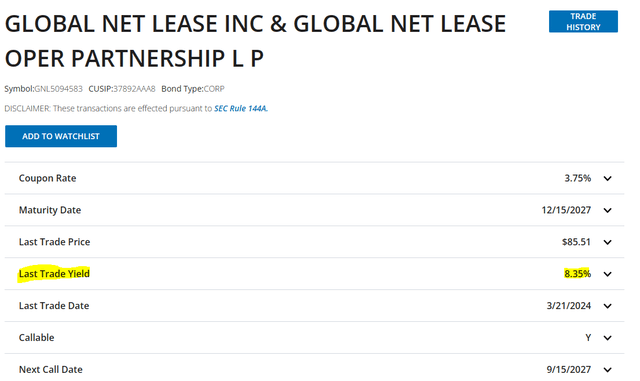

That said, if you really have to take an investment in GNL, the bonds are still the best relative bet. They are yielding about 8% to maturity right now on the 2027 notes and we think GNL should make it through that hump (the company, not the current dividend) with no issues. That is what we would focus on.

Source: 15.66% On Common Or 8.50% On Preferreds?

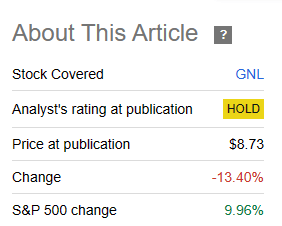

In the two and half months, the company has dropped like a stone and reset the dividend rate and AFFO expectations.

Seeking Alpha

We tell you why things are getting riskier for investors.

Q4-2023

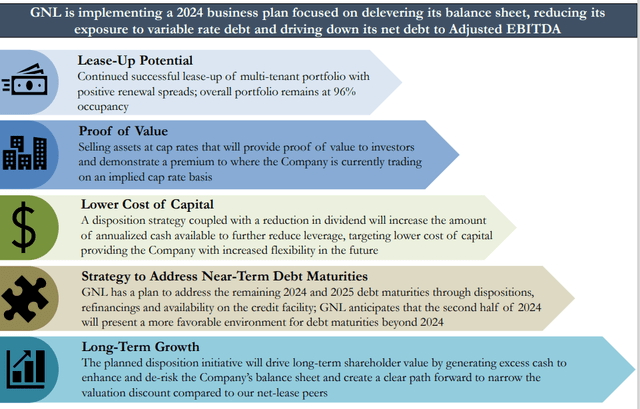

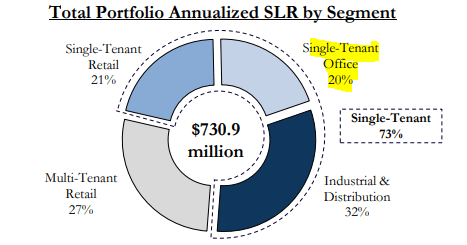

GNL recently completed its merger with RTL and the quarter was incredibly noisy. That said the company reiterated its pre-merger strategy.

GNL Presentation

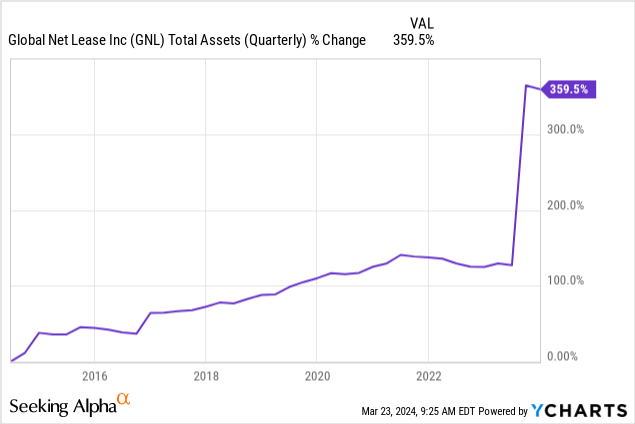

One notable thing here is that GNL, after years of acquiring serially without remorse is now looking to dispose assets. On the whole, we think these trades over the full cycle will be massively value destructive. Most of these properties were acquired during ZIRP (zero interest rate policy), by either GNL or RTL and selling now will come with far lower prices. GNL confirmed that the cash cap rate on these will be in the 7-8% range.

So why the change in tune after the decade long buying binge?

You probably saw why when you read the statement.

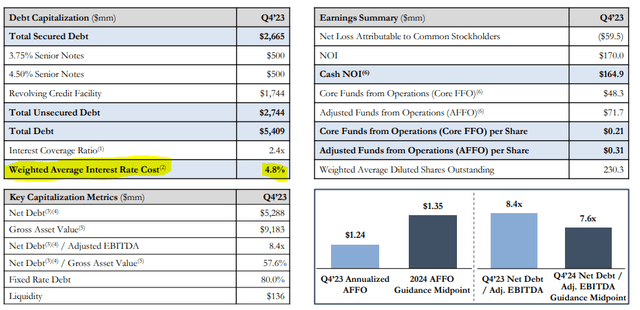

Our net debt to adjusted EBITDA ratio was 8.4 times. We ended the quarter with net debt of $5.3 billion at a weighted average interest rate of 4.8% and have liquidity of approximately $135.7 million and $206 million of capacity on the credit facility. The weighted average maturity at the end of the fourth quarter 2023 was 3.2 years with minimal debt maturity due in 2024. Our debt comprises $1 billion in senior notes, $1.7 billion on the multicurrency revolving credit facility and $2.7 billion of outstanding gross mortgage debt. Our debt was 80% fixed rate, which includes floating rate in-place interest rate swaps and our interest coverage ratio was 2.4 times.

Source: GNL Q4-2023 Conference Call Transcript

That 3.2 years is the problem and it will be a bigger problem for its assets in the single tenant office category.

GNL Presentation

GNL of course disagrees that this will be an issue.

One of the metrics that differentiates GNL’s single-tenant office portfolio is that it’s comprised of 70% mission-critical facilities, which we define as headquarters, lab or R&D facilities and feature 68% investment-grade or implied investment-grade tenants, which we believe provides our portfolio with rent stability and low level of default risk. Given GNL’s successful track record of lease renewals, the single-tenant office segment also includes limited near-term lease maturities, minimizing the risk of vacancy.

Source: GNL Q4-2023 Conference Call Transcript

But when your debt to EBITDA is in that range, you don’t need a lot of vacancies to move the stress.

2024 Outlook

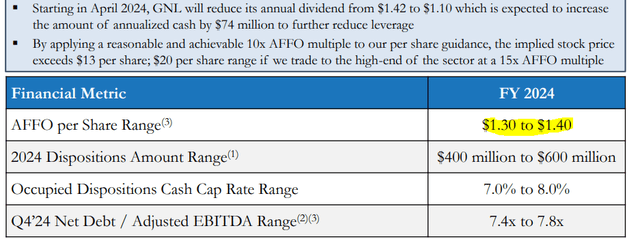

The AFFO is now expected to be around $1.35.

GNL Presentation

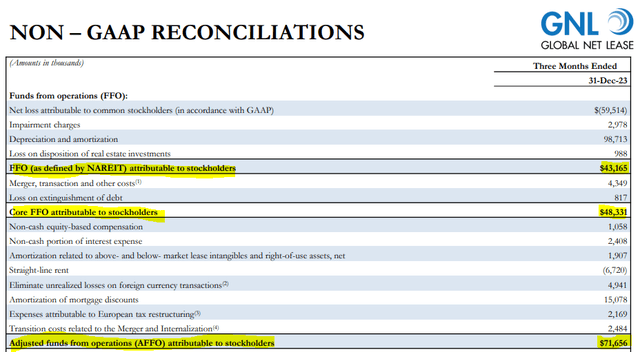

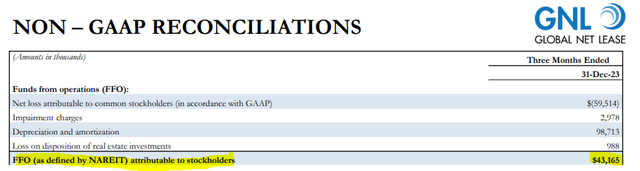

The funny aspect here is that most analysts still show FFO expected at around $1.10 per share. This would generally not make sense as analysts will not ignore management guidance to such an extent. But the confusion for investors (not analysts) stems from the fact that GNL is talking about AFFO while analysts are focused on FFO. In most REITs, AFFO tends to be lower than FFO. While there is no standard definition of AFFO on the US side (Canadian REITs are more consistent with this), generally AFFO involves reducing the FFO down by maintenance capex and straight line rent. In the case of GNL, as seen in Q4-2023, AFFO was substantially higher than FFO.

GNL Presentation

GNL expects a similar delta for the entire year 2024. We will leave it up to the readers to decide what actually is the real measure of owner’s equivalent earnings but those “one-time” adjustments have been a regular feature for GNL.

Our Outlook

GNL believes that 15X AFFO is possible.

As we’ve taken a conservative approach, our strategy for deleveraging is designed to be earnings neutral with the expectation that our net debt to adjusted EBITDA will decrease by approximately 1 full turn. By applying a reasonable and achievable 10 times AFFO multiple to our per share guidance, the implied stock price exceeds $13 per share, $20 per share range if we trade to the high end of the sector at a 15 times AFFO multiple.

Source: GNL Q4-2023 Conference Call Transcript

Realistically, when you have W. P. Carey Inc. (WPC), Agree Realty Corporation (ADC) and Realty Income (O), trading at an average of 13X FFO, we would pay about 7X FFO for GNL after we won the lottery and 5X before. Note that we said FFO and not the fluffed up AFFO number. So at $7.50 (considering we have not won the lottery), GNL looks expensive. The new dividend of $1.10 is close to a 100% payout ratio on the now expected FFO. This FFO is supposedly bumped up by all the various synergies expected. But the only thing investors need to focus on here is that the weighted average interest rate is still from the ZIRP era.

GNL Presentation

Any reasonable repricing of this over the next 3 years can mean a lot of issues for the company. Investors might think we are being overly cautious, but just look at the facts. We have had the biggest easing of credit conditions since the end of the global financial crisis. Despite that, GNL”s near term bonds yield 8.35% to maturity.

FINRA

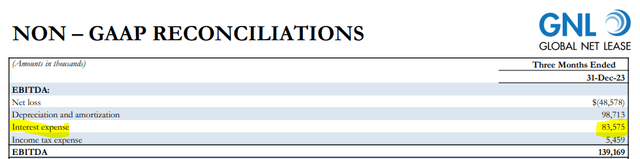

GNL is of course paying the coupon rate on that but just imagine if you reprice this entire deck to even 7.2% from 4.8%. That is a 50% increase, but fairly reasonable assumption unless we go back to ZIRP. It is not hard to find or to do. There is the Q4-2023 interest expense.

GNL Presentation

50% of that is about $42 million. So if you extract $42 million out of existing FFO, you won’t be left with a lot.

GNL Presentation

Verdict

Of course that reset is a long time away but everything we have seen shows that GNL’s base rate of FFO will decline over time. So by the time we get to that 2027 maturity things may look even worse. GNL needs to get the leverage down and Fitch’s line in the sand will require a lot of FFO reducing asset sales.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

–Lack of material improvements in EBITDA and reduction of debt such that Fitch expects the combined entity’s leverage above 8.0x on a sustained basis;

–Lack of meaningful improvements in governance such that Fitch expects capital access to remain constrained for the combined entity at the ‘BB+’ rating level.

Source: Fitch

In all of this, we have the preferred shares trading actually higher than when we last wrote about this. They currently yield around 8.3% collectively. We believe they represent a very high risk relative to that yield. As we had shown recently, you can get 7%-8% yields with virtually zero credit risk over a 5-7 year horizon. With GNL, your credit risk is far higher than even implied by their credit rating in our opinion. So the 8.3% yield is just too low. If we were getting 10%-12% that would be a different matter. Investors can lose a lot in preferred shares. Those using the one line thesis “Regulated, Ergo Safe” for CorEnergy Infrastructure Trust, Inc. (OTCPK:CORRQ) and its preferred shares CorEnergy Infrastructure Trust, Inc. DEP SHS REPSTG (OTCPK:CORLQ), found that out with a 96% loss. But here, we are downgrading all the preferreds to a Sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.