aydinmutlu/E+ via Getty Images

Introduction

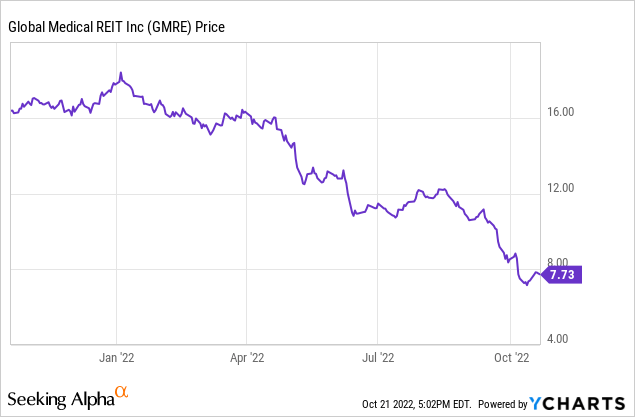

I have recently been adding positions to my fixed income portfolio, taking advantage of increased yields on the bond and preferred share market. Earlier this year, I was convinced Global Medical REIT (NYSE:GMRE) would be calling the 7.5% yielding preferred securities trading as (NYSE:GMRE.PA), but the call date in September passed by and the securities weren’t called. It looks like the market was expecting a call as the share price of the preferreds has decreased, making the risk/reward ratio very attractive at the current price of $23.25.

The performance of the REIT in the first half of the year was good

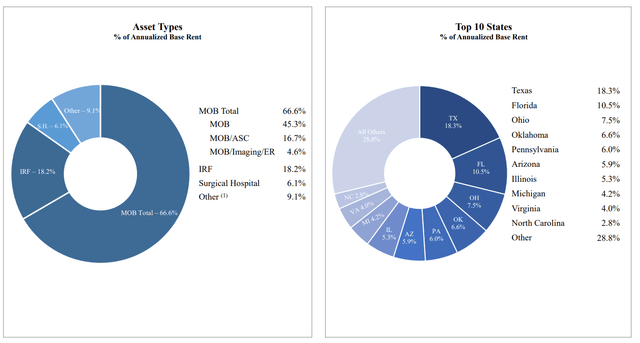

For a good overview of GMRE, I’d like to refer you to Dane Bowler’s recent article and Noor Darwish’s article which was published as I was writing this current article. I will solely focus on the REIT’s financial performance and the implications for the preferred shares.

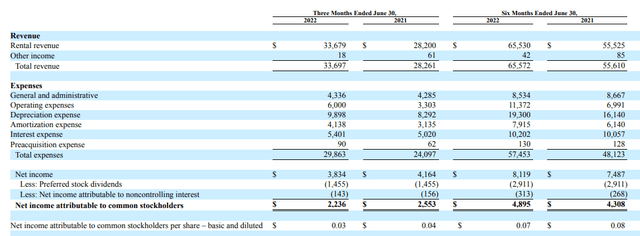

Before discussing the FFO and AFFO generated by GMRE, it’s worth taking a few minutes to have a look at the income statement. While a REIT should absolutely never be judged based on its quarterly income, the income statement does provide a lot of valuable information.

GMRE Investor Relations

In the first semester, the total rental revenue was approximately $65.5M. An increase of almost 20% compared to the first half of last year. The total operating expenses were $57.5M resulting in a net income of $8.1M.

GMRE Investor Relations

First of all, it is important to see the operating and G&A expenses, which came in at just under $20M, an increase from the $15.7M in the first half of last year. As Global Medical REIT’s portfolio expands, it is obviously quite normal to see the operating expenses increase as well.

Another important element here is the total interest expense of $10.2M ($5.4M in the second quarter of the year). As all depreciation and amortization expenses are non-cash expenses, the interest expenses represent approximately a third of all cash expenses. That’s fine, as this still represents just about 1/6th of the rental income.

A third important element and reason why having a quick look at the income statement usually is a good idea is the total cost of the preferred dividends. At less than $1.5M per quarter, GMRE easily covers those dividend payments.

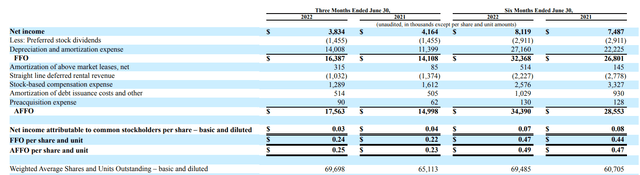

REIT investors should obviously mainly look at the FFO and AFFO performance of an investment vehicle to determine how cheap or expensive a stock is.

GMRE Investor Relations

And Global Medical REIT appears to be relatively cheap. The REIT reported an FFO of $32.4M and an adjusted FFO of $34.4M in the first half of this year. Despite the increased share count, the FFO per share and unit came in at $0.47, an increase compared to the $0.44 in the first half of last year.

The main takeaway for investors in the preferred shares of GMRE is the excellent preferred dividend coverage ratio. As the FFO and AFFO obviously already include the $2.9M in preferred dividends the payout ratio of the preferred dividends is very low. The FFO before these dividends is approximately $35.3M which means that based on the H1 results, GMRE only needed 8.2% of its FFO to cover the preferred dividends. Or in other words, even if the FFO (before preferred dividend payments) would fall by 90%, the preferred dividends would still be covered.

I was surprised to see the preferred shares weren’t called

The main reason why I don’t have a position in GMRE.PA yet is because I was convinced the REIT was planning to call the securities in September, which was the first call date. As this didn’t happen, the ‘expectation value’ related to the call was no longer applied and the GMRE preferred stock started to slide to bring the yield in line with some of its peers. At the current share price of $23.25, the preferred yield has increased to just over 8% as the preferred shares offer a cumulative dividend of $1.875 per year, payable in four equal quarterly installments of $0.46875.

The first possible call date was on September 15th, and these securities are now callable at any given time. As the real estate markets were under pressure throughout the summer, I think it is entirely possible GMRE didn’t call these securities out of an abundance of caution but as the main ‘panic’ now appears to settle down, I wouldn’t rule out seeing GMRE calling this relatively small issue. As there are only just over 3.1 million preferred shares outstanding, GMRE would only have to pay $77.5M to call these securities. If it would decide to do so, it would save $5.8M in preferred dividend payments on an annual basis. Based on the current diluted share and unit count of 69.7M would boost the FFO and AFFO by in excess of $0.08 per share on an annual basis.

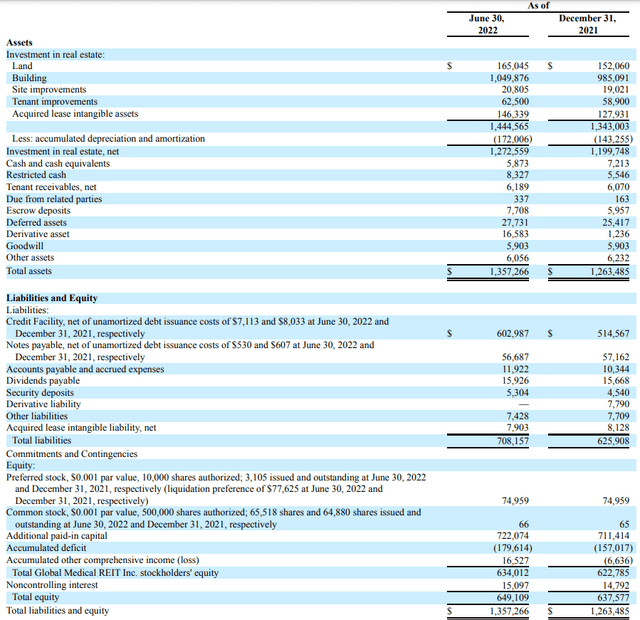

As the balance sheet appears to be pretty robust, a call actually seems likely. As you can see below, the current book value of the assets is $1.27B and the net debt is approximately $644M. While this means the LTV ratio based on the book value is just over 50%, the LTV ratio based on the acquisition value is less than 45%. And considering the current rental income exceeds $130M on an annualized basis, I think even the current fair value is even higher than the acquisition cost.

GMRE Investor Relations

It is also great to see that in excess of $555M of the equity portion of the balance sheet consists of common equity, which ranks junior to the preferred shares. This means that even if the fair value of the real estate assets would decrease by 40% from the current book value, GMRE would still be able to repay the preferred shareholders in full.

Investment thesis

The conclusion is pretty simple: the preferred shares enjoy an excellent dividend coverage level (exceeding 1,000%) and asset coverage level (810%, excluding the value of goodwill on the balance sheet). I am surprised GMRE didn’t call the preferred shares but I would not be surprised should the REIT decide to call them in a few quarters anyway. The management downplayed this in the Q2 call so I’m not banking on it and I would be happy to just collect the 8%+ yield.

I currently have no position in GMRE.PA but I think I will initiate a long position sooner rather than later as this preferred security meets all my investment criteria.