MarsYu

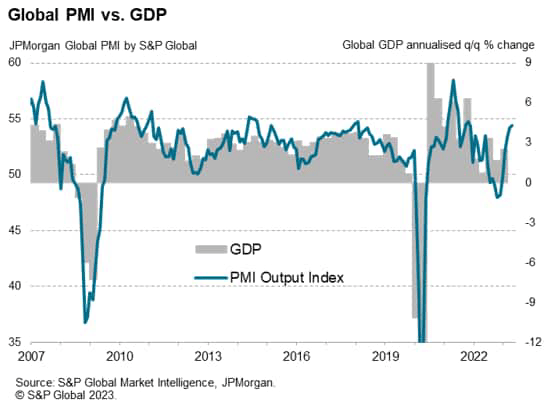

Global growth hit the fastest for a year and a half midway through the second quarter, according to the S&P Global PMI surveys based on data provided by over 27,000 companies. All major economies reported robust growth, in all cases bar India and Russia seeing service sector growth outperform that of manufacturing.

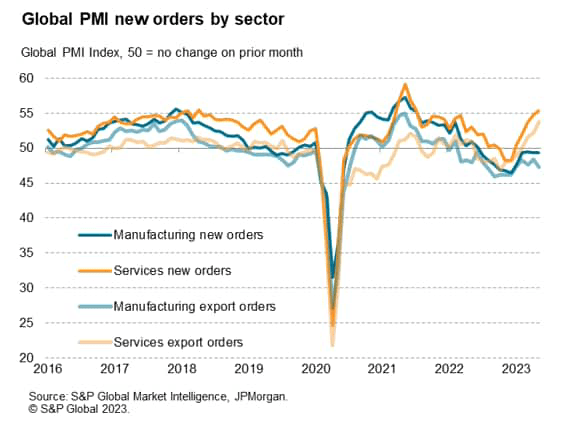

While manufacturing suffered a further loss of new orders, led by a steepening downturn in global trade flows, demand growth for services accelerated amid a record rise in exports.

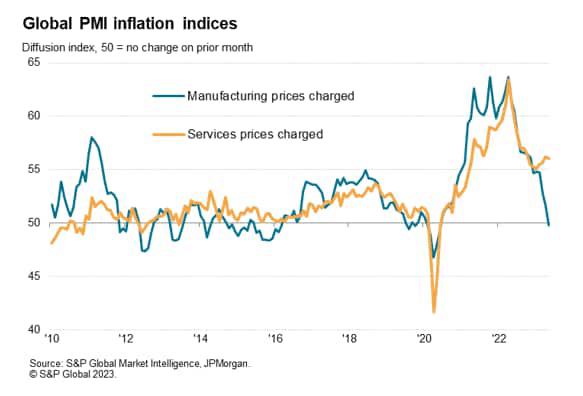

Resurgent post-pandemic demand for services has therefore continued to divert spend away from goods to services, which has led to a concomitant switching of inflationary pressures from goods to services. Goods prices are in fact now falling, while service sector inflation remains above any highs seen prior to the pandemic.

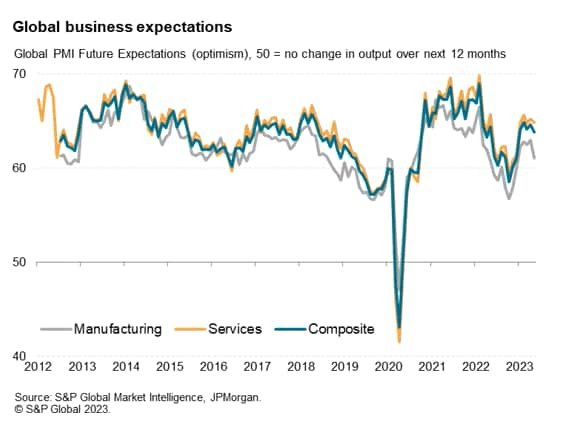

Companies expect this divergence to persist in the near term, with optimism sliding below its long-run average in manufacturing yet remaining buoyant in the service sector.

Global output growth at 18-month high

Global economic growth ticked higher in May, accelerating to its fastest for one and a half years. The Global PMI – compiled by S&P Global across over 40 economies and sponsored by JPMorgan – rose for a sixth consecutive month, up from 54.2 in April to 54.4, its highest since November 2021. The current reading is broadly consistent with robust annualized quarterly global GDP growth of just over 4%.

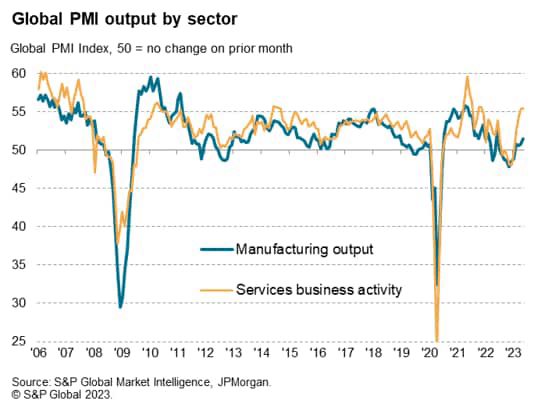

Expansion driven by service sector

The expansion was again largely a reflection of resurgent service sector activity, in turn often linked to reviving post-pandemic demand. Services output growth hit the fastest since November 2021, having now risen sharply over the past three months to build on more modest gains seen in the first two months of the year. Manufacturing output meanwhile rose only modestly again, up for a fourth successive month and growing at the fastest rate for four months, yet still lagging the service sector to a marked extent. The divergence between the performance of the two sectors remains among the widest on record.

Global services export growth at fresh survey high while goods trade weakens

There was again an even greater sector divergence in terms of new order inflows, where the gap between services and manufacturing grew to its widest since 2009. While demand growth for services accelerated to the steepest since July 2021, manufacturing new orders fell for an eleventh successive month.

The gap between global trade flows for goods and services was even wider. Exports of services saw the largest monthly gain since comparable global data were first available in 2014, yet new export orders for goods fell at an increased rate in May.

Surging demand for financial services

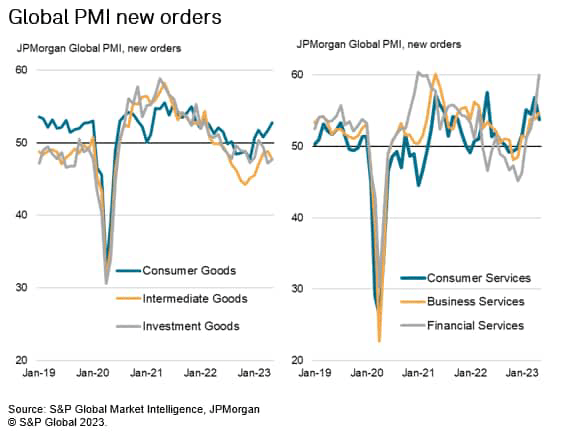

Looking further into the growth of demand, the largest improvement was recorded for financial services, where growth hit the highest since February 2021 and was the second-strongest since comparable data were first available in 2009. Demand for consumer services and business services also rose sharply.

In the manufacturing sector, demand growth was more varied. Rising demand for consumer goods contrasted with falling demand for investment goods (such as plant and machinery) and intermediate goods (inputs sold to other firms).

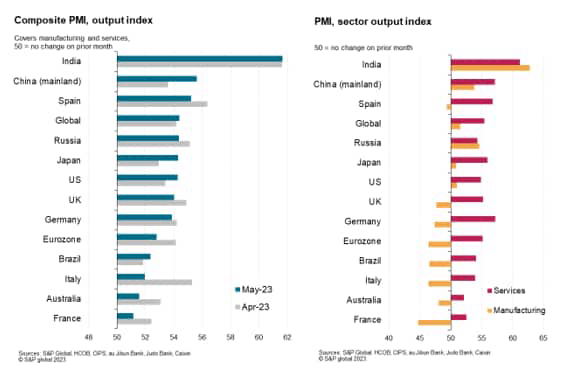

India leads global expansion

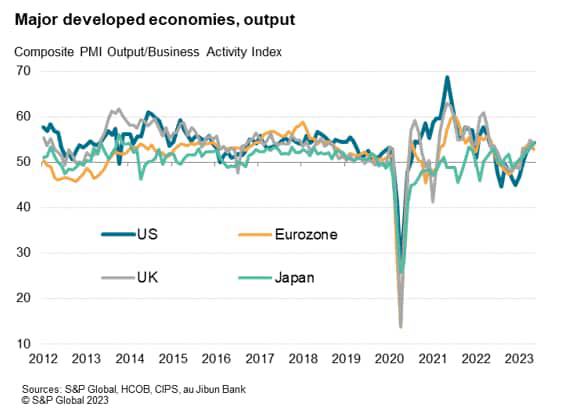

Looking at the major economies, robust expansions of output were recorded across all four of the largest developed world economies, albeit with the eurozone lagging behind slightly as its growth rate slowed to a three-month low. UK growth also slowed slightly, contrasting with accelerating growth in the US and Japan. US growth hit a 13-month high and Japan’s expansion was the steepest for a decade.

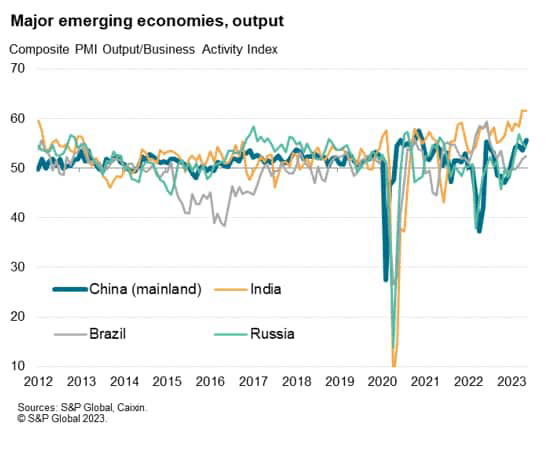

In the major emerging markets, India once again led the upturn with an expansion of output that matched the near-13-year high achieved in April. Growth also accelerated in mainland China to the fastest since December 2020 and hit a seven-month high in Brazil. Only Russia reported a slowing the pace of expansion, though even here growth remained solid.

Broad-based service sector outperformance

The outperformance of services relative to manufacturing was evident in all of the 12 largest economies surveyed in May except India and Russia, though the former once again recorded the steepest service sector gain of all economies covered.

While all 12 economies reported growth of service sector activity, manufacturing output fell in France, Italy, Brazil, Germany, the UK, Australia, and Spain. Only modest factory gains were meanwhile seen in the US and Japan.

Diverging price trends for goods and services

The varying demand conditions by sector fed through to divergences in inflationary trends. The further decline in new orders for goods led to increasing instances of discounting by manufacturers, meaning average prices charged for goods leaving the factory gate fell globally in May for the first time in three years, contrasting markedly with the record price hikes seen in early 2022. In the service sector, however, the rate of inflation remained elevated by historical standards. Although down sharply compared to the rate of increase seen in early 2022, and down slightly in April, global service sector inflation remains higher than at any time in the survey history prior to the pandemic.

Brighter outlook for services

The degree to which these sector variations in growth, demand, and prices will persist remains a major unknown and a key factor in gauging the economic outlook. Companies themselves expect the sector divergence to persist – manufacturers’ expectations of growth over the coming year deteriorated further in May, sinking to a five-month low to sit below the survey’s long-run (ten-year) average. Although service sector growth expectations also slipped lower, the overall degree of optimism remains encouragingly resilient and above the survey’s long-run average.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.