izusek/E+ via Getty Images

Investment Thesis

GitLab (NASDAQ:GTLB) will report its fiscal Q2 2024 results on Tuesday after hours.

I make the case that GitLab is well-positioned with strong prospects and primed to deliver investors with strong upside over the next twelve months.

Furthermore, here I discuss the top noteworthy bearish consideration that has kept a lid on GitLab’s stock, namely the impact of AI on GitLab’s intrinsic value.

Separately, GitLab has consistently remarked that next fiscal year it will be operating as a cash flow breakeven enterprise. This means that GitLab can continue to grow at around the mid-20s% CAGR while not incurring significant cash flow losses.

Altogether, I believe that investors will in time reprice this stock higher.

Why GitLab? What to Think About Heading into Q2 Results

GitLab is like a virtual toolbox for software development teams. It’s designed to make it easier for these teams to collaborate and build software together. With GitLab, developers can manage their code, keep track of all the changes they make, and even automate the steps needed to turn their code into working software. This means less manual work and more efficient teamwork.

In simple terms, GitLab is not just about writing code; it’s about making the whole software-making process smoother and faster. It’s like having a one-stop shop for everything from coding to testing, so teams can work together smoothly and deliver better software faster. It’s all about simplifying the way software gets made.

Anyone following the GitLab story closely will be acutely aware of the bear case that has surfaced that AI could make writing code easier, therefore democratizing coding for everyone. And by extension, doing away with GitLab’s value proposition.

For my part, I suspect that the potential negative impact of AI on GitLab’s value proposition is too much in the future. Just too uncertain. Yes, AI can simplify code writing and therefore democratize software development so that more users can write software.

And by extension, with more developers coding, the cost of software development could decrease, which in turn could increase an uptick in the need for software products.

Put another way, I believe that GitLab’s Sid Sijbrandij will spend his energy during the earnings call describing how AI will be a net positive for GitLab. For my part, I believe that the ultimate impact of AI on GitLab is for now too uncertain and that investors don’t need to overly trouble themselves in answering the unknowable and uncertain future.

Revenue Growth Rates Due to Be Upwards Revised

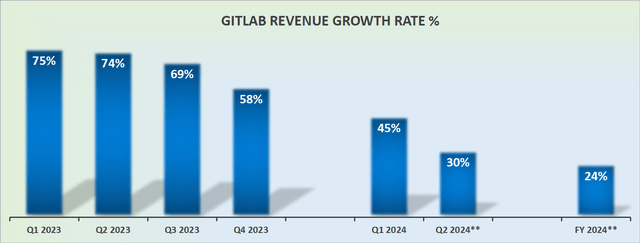

Author’s calculations revenue growth rates

The graphic above implies that fiscal 2024 will continue to see GitLab’s revenue growth rates continuing to slow down at a steady clip. The implication here is that by fiscal Q4 2024, GitLab’s revenue growth rates could be around 20%, which is half the growth rate that GitLab reported in the last quarter, fiscal Q1 2024, at 45%.

I simply don’t believe that such a dramatic deceleration will end up being on the cards.

Furthermore, one company’s cost line is another company’s revenue line. Hence, if the macro environment has become more favorable, as I believe it will, this will translate into GitLab being well-positioned to upward revise its full-year revenues.

As such, I believe GitLab could end up revising its revenue targets to around $565 million for full-year fiscal 2024 (approximately a 4% increase). This would be enough good news to excite investors, but not too much that they’ll feel too stretched and priming themselves to underdeliver against heightened expectations.

GTLB Valuation — Not Expensive

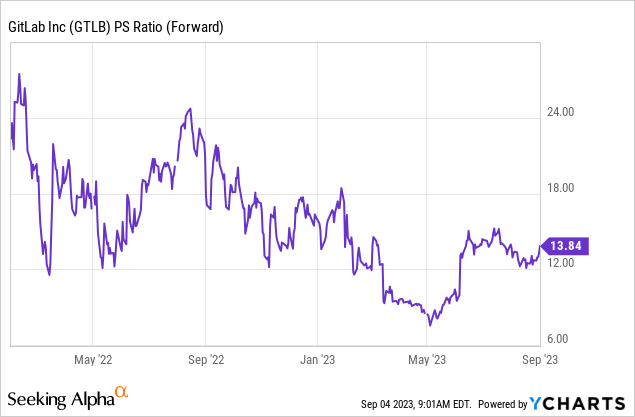

As you can see above, for more than a year GitLab’s P/sales multiple has been compressing, even though it did expand since May, overall has compressed down to around 14x, which remains completely reasonably priced.

The one detraction to the bull case is that GitLab is still burning through cash flows. On the other hand, GitLab holds no debt, and more than 13% of its market cap is made up of cash.

The Bottom Line

I’m not entirely certain about the impact of AI on GitLab’s business, but its current valuation seems reasonably priced. There are optimistic prospects for the company due to its role as a software development collaboration platform, but there are also concerns that AI could make coding more accessible, potentially diminishing GitLab’s value proposition.

However, I’m unsure if this AI threat is imminent or distant. GitLab aims to achieve cash flow breakeven in the next fiscal year, which could lead to stock price appreciation if it sustains growth.

The uncertainty surrounding AI’s impact on GitLab’s future is significant, but for now, it might not be an immediate concern. Additionally, the company’s valuation appears reasonable, with a P/sales multiple of around 14x and a healthy balance sheet with no debt and a significant cash reserve. As we await the Q2 results, I’m cautiously optimistic about GitLab’s future.