byakkaya

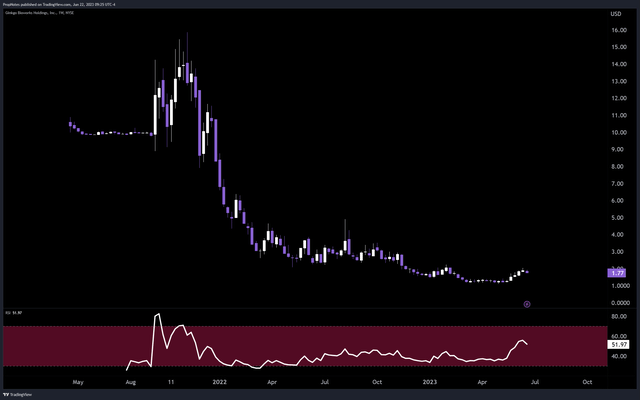

As a member of the SPAC class of 2021, Ginkgo Bioworks (NYSE:DNA) stock has seen its fair share of pummeling over the last few years. From an all-time high at ~$16 to the stock’s current price below $2, investors have been on a wild, fruitless ride.

Ginkgo has also seen its fair share of collateral damage as a result of who is invested. Cathie Wood’s funds have big positions in the stock, which has drawn derision from some in the broader investment community. At this point, many believe all she invests in are “profitless unicorns”, or companies that don’t stand a chance of earning money in the long run based on their underlying business models. For every Tesla (TSLA), there are ten Skillz (SKLZ), the thinking goes. Many point to her recent Nvidia blunder (she finished scaling out of Nvidia completely right before their recent blockbuster earnings) as further proof that an allocation in her funds is a potential contra signal.

However, we’re keen for another look at this potential disruptor. The field of cell engineering has a lot of potential applications in many different industries, including pharma, agriculture and industrial bioscience. Should the recent factors that have been holding down the stock abate, we think there’s significant opportunity for this company to once again be appreciated by the market.

History

Before we dive into the good and the bad; a quick history.

Ginkgo Bioworks is a synthetic biology company that was founded in 2008. The company is based in Boston, Massachusetts, and it specializes in using genetic engineering to create microorganisms with pharmacological, industrial, and agricultural applications.

The company’s first product was a yeast strain that could be used to produce a variety of flavors for beer. The company quickly expanded its product line to include other microorganisms, such as bacteria that could be used to produce fragrances, flavors, and other chemicals.

In 2014, Ginkgo Bioworks was the first biotechnology company to join the Y Combinator start-up accelerator program. The company raised $290 million in September 2019 and $350 million in October 2019, which valued it at $4.2 billion.

Ginkgo Bioworks has been involved in a number of high-profile projects, such as developing a yeast strain that can produce artemisinin, a drug used to treat malaria. The company has also partnered with a number of major companies, including Bayer, DowDuPont, and Novo Nordisk.

As the company has evolved, it now operates as a sort of third-party on demand research lab – “R&D as a service”. It still has some of its own products in its “biosecurity” segment, but as Covid becomes less and less relevant, it is increasingly partnering with companies that want to lean on their expertise in developing new biological products.

Financial Performance & Monetization

Alright, let’s throw the kitchen sink in first and begin by looking at the problems.

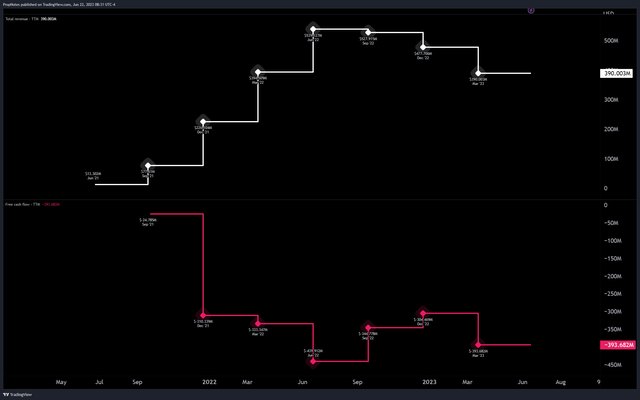

First up, the company remains unprofitable. And not “slightly” unprofitable; majorly unprofitable. This is a common phenomenon for new, growing companies, but the economics here may leave even the most forgiving growth investors a little puzzled.

Over the last few months, the company has produced $390 million in revenue, while netting out to -$393 million in free cash flow:

TradingView

For every one dollar the company brings in in sales, through the course of operations, 2 dollars head out the door – not good.

Clearly, this is a business in need of some stabilizing, as not many companies of this size can withstand this level of cash burn for long periods of time.

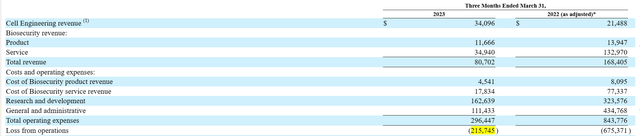

Thankfully, things have improved somewhat in recent quarters. In their most recent filing, the company reported operating losses of $215 million, which is significantly better than the $675 million the company lost in operating costs the same period the prior year:

10-Q

However, revenue has also dwindled as the company’s lucrative biosecurity products are less in demand with Covid mostly in the rearview.

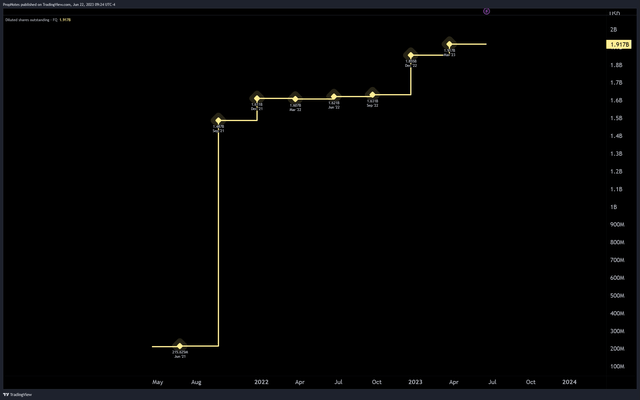

While the company continues to burn cash, it also continues to dilute investors:

TradingView

Since the SPAC, Ginkgo has diluted investors to the tune of nearly 500 million shares.

This is in part responsible for the company’s poor share price performance:

TradingView

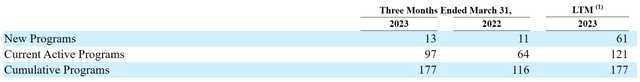

Finally, the one other big issue; the company’s slow program growth.

Essentially, the company operates a full-service tech platform & lab space so that other companies can conduct product research.

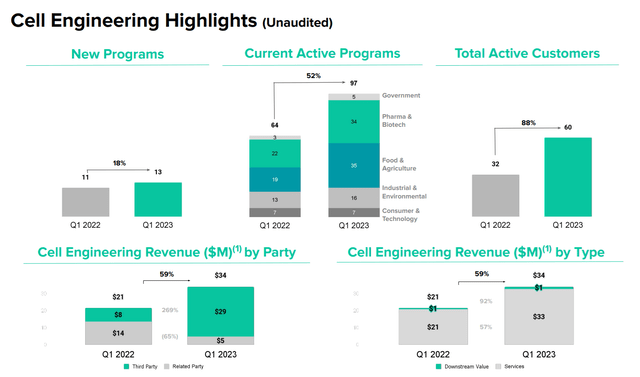

While Ginkgo did increase its new programs from 11 to 13 year-over-year, the overall pace of growth remains slow:

10-Q

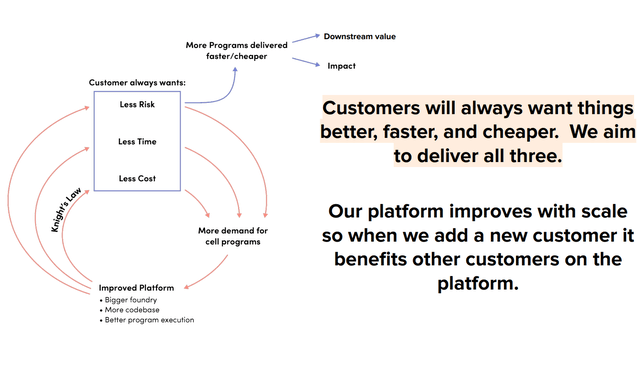

Again, Ginkgo earns money in this cell engineering segment by monetizing its “Foundry” services (physical lab space built to help other companies develop new products), as well as its “Codebase” (a proprietary set of data and cell samples the company uses to help companies research new products).

The company claims that consolidating the lab space, data and engineering workflows leads to a virtuous cycle in the company’s business:

Our Foundry wraps proprietary software and automation around core cell engineering workflows— designing DNA, writing DNA, inserting that DNA into cells, testing cells to measure performance—and leverages data analytics and data science to inform each iteration of design. The software, automation and data analysis pipelines we leverage in the Foundry drive a strong scale economic that we refer to as “Knight’s Law.” We expect Foundry output, which we currently measure by daily strain tests, to increase year over year, while the cost per strain test decreases. We expect to be able to pass these savings along to our customers, allowing them to take more “shots on goal” with their programs.

However, unfortunately, there’s been little evidence of this in the company’s results. If the company’s end-to-end proprietary engineering and codebase was that strong of a value proposition, wouldn’t the company be seeing quicker growth? If the scaling function really is exponential, then theoretically new program starts would be increasing at a faster rate.

We wouldn’t be harping too much on this point, except for the fact that management advertises it heavily in their investor presentation materials, and even created their own name for this flywheel; “Knight’s Law”:

Company Presentation

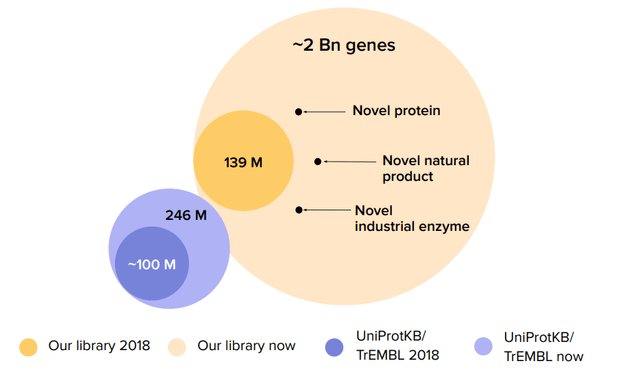

That said, the company is seeing vast increases in its data sets, so the jury is out for better monetization of this asset farther into the future:

Company Presentation

Now that we’ve covered the issues with the company, let’s talk about the good stuff.

The Product

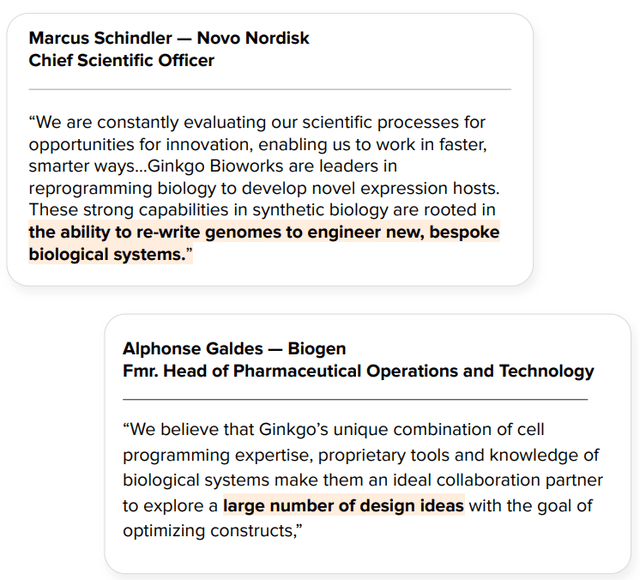

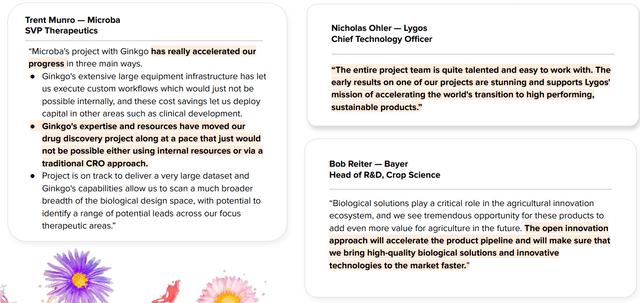

Sure, the company is unprofitable. And sure, it’s losing a big driver of revenue as Covid becomes less and less of a threat over time. However, customers seem to love the company’s cellular engineering offering and value proposition:

Company Presentation Company Presentation

If these testimonials (from big names, like Novo Nordisk, Biogen, and Bayer) are to be believed, then Ginkgo provides an excellent R&D offering on multiple fronts. What is the specific value prop?

Essentially, the company turns R&D into a variable cost, the end-to-end product is simply better, and it allows for better ROI:

Company Presentation

In the same way that WeWork has allowed companies to turn office space into a variable cost with a high degree of flexibility and speed, Ginkgo is helping pharma, agriculture, and life science businesses turn cellular R&D into a variable cost with a high degree of flexibility and speed.

It’s true that these screencaps are all from the company’s recent earnings presentation, which is essentially a sales pitch where the company can put its best foot forward with investors. However, they do a good job of laying out the long-term case for investing in Ginkgo, hence their inclusion.

It would mean scant little without evidence to back it up, though. That’s why the progress in this segment is so exciting. Sure, new program launches are growing much more slowly than we would like. However, progress is being made on other fronts, and revenue is growing:

Company Presentation

As you can see from the results above, third party cell engineering revenue has grown significantly over the last year, which shows increased adoption and contract size amongst third party clients. This hasn’t led to increased program launches, but better sales momentum per program, which is encouraging. Also, the company retains its high level of client diversity, which should buttress results against particular industry slowdowns.

We would like to see increased downstream value from the company’s portfolio of cell programs, but this should hopefully begin to increase over time. We’ll watch this metric along with new program launches as the main KPI’s to track as investors.

Liquidity

The real question, then, is whether or not the company will be able to see its vision to fruition. If the company’s cash burn is too substantial, then it may be difficult for management to achieve their goals.

This is where we have some good news: Liquidity is relatively strong.

As of the most recent quarter, cash stood at over $1.2 billion, with negligible liabilities and only 400 million in long term debt. Thus, as long as the company can right-size its operations further and get close to breakeven on their cellular engineering offering, then the company is positioned well for the future.

As it stands, Ginkgo Bioworks currently losing around $200 million per quarter. However, more than half of this is SBC and non-cash expense, which leads to a much lower actual ‘burn’ number in terms of runway. We estimate that the company has at least 2 more years of cash on hand to improve unit economics and retain key personnel before things will deteriorate.

Thus, despite the ‘operating losses’, we actually don’t have too much concern about the cash burn.

Of note: the company is wielding its equity as a tool to reduce cash burn. And, though this may be an expensive long-term solution to “pay off” (SBC, Buybacks, etc), if it gives the company a better shot at surviving to that point, then we’re ok with it, given the execution difficulty of the company’s vision.

Valuation

So – what are people paying for this right now in the market?

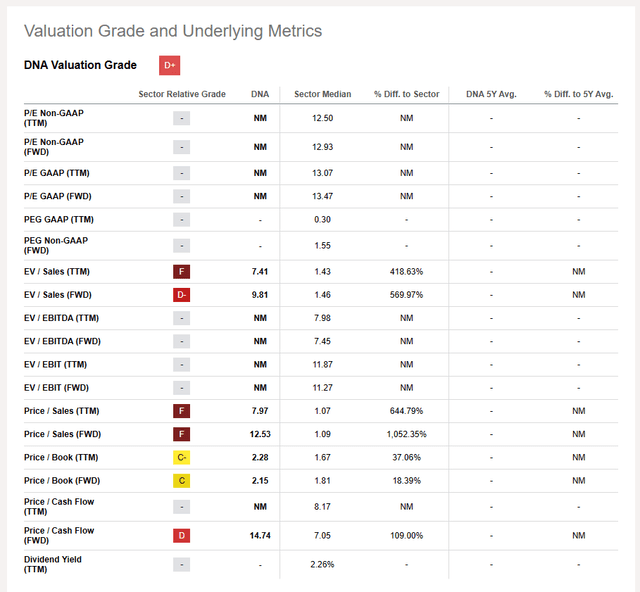

Unfortunately; 8x sales:

Seeking Alpha

While we think the company has the liquidity and product to reach a critical mass where it may begin to build a solid margin for itself as it grows revenues, so too does the market.

Sure, there’s room for the multiple to expand should rates come down, but 8x sales for a company as inherently speculative as Ginkgo seems pricey.

The issue here in finding fair value is the high degree of uncertainty in the company’s future – it things ‘work’, then the company could be worth seriously more than 8x sales. If the company fails, then obviously it’s worth nothing.

We see DNA’s closest peer as TWST, which currently trades at 4.3x sales. Given Ginkgo’s growth story, if we could get the stock at an entry point closer to that, we’d be very excited. Right now, that puts an attractive entry point closer to ~$1 in the stock, but this may change as the company continues to dilute shareholders.

Summary

Ultimately, in our view, what you do with Ginkgo Bioworks depends on your time horizon and your tolerance for opportunity costs. If you’re short term oriented, we don’t think DNA will be going anywhere fast. The company is diluting at too high of a rate for buyers to make a dent, and it doesn’t give the company enough time to execute its way out of short-term top line headwinds.

However, if you’re more long-term focused, then buying some shares, socking them away, and letting the company execute to the best of its abilities – especially given the runway – seems like a decent bet.