Monty Rakusen/DigitalVision through Getty Photographs

Efficiency Evaluation

In my final protection of GigaCloud Expertise (NASDAQ:GCT), I had rated the inventory a ‘Impartial/Maintain’ to mirror my view of efficiency in-line with the S&P 500 (SPY) (SPX). Since then, the inventory has lagged the S&P 500 by 19.02%.

Efficiency Since Writer’s Final Replace on GCT (Searching for Alpha, Writer’s Final Article on GCT)

In fact, I may have captured this energetic return with a ‘Promote’ view. Nonetheless, regardless of my perception that natural gross sales progress was really ticking at half the headline revenues progress, on an absolute foundation, the corporate was nonetheless exhibiting spectacular progress at near 50% YoY.

Thesis

GigaCloud Expertise launched its Q2 FY24 outcomes final week. Upon assessment, I’ve a combined and conflicted view on the inventory:

- Working efficiency is supposedly sturdy

- Forensic assessments sign potential crimson flags

Working efficiency is supposedly sturdy

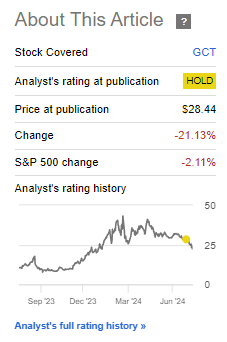

The bullish argument for GCT is concentrated on the excessive progress of the enterprise. On a headline foundation, the corporate is ticking at practically 100% YoY revenues:

Revenues (USD mn) (Firm Filings, Writer’s Evaluation)

On an natural foundation, utilizing my assumption of 30% income contribution from Noble Home (defined in-depth in my earlier notice on GCT), this quantities to a nonetheless spectacular progress of 56% YoY. The corporate is clearly an outlier since, as Founder and CEO Lei Wu famous within the Q2 FY24 earnings name, that is regardless of adverse progress within the total business:

Moreover, regardless of the business extensive problem, together with 7% year-over-year decline in retail furnishings sale furnishings gross sales within the first half of the 2024 in the US

– CEO Lei Wu within the Q2 FY24 earnings name, Writer’s bolded spotlight

Administration’s steerage for the following quarter implies a QoQ decline attributable to seasonality in Noble Home’s out of doors furnishings gross sales. Nonetheless, this might nonetheless result in a good progress of 54% YoY or 18% YoY in my estimate of natural progress.

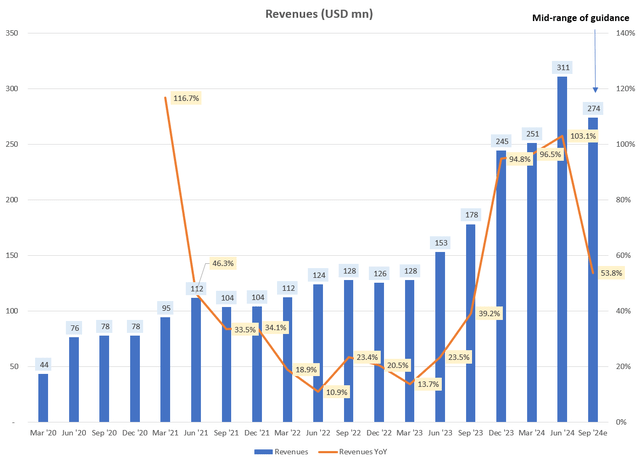

I consider for GCT’s platform sort of enterprise, the variety of patrons is likely one of the strongest main indicators of future, sustainable progress in revenues. And Q2 FY24 was a blowout quarter for GCT because the out of doors furnishings season introduced in a wave of recent patrons, lifting the client rely from 5,493 in Q1 FY24 to 7,257:

Energetic Patrons (Firm Filings, Writer’s Evaluation)

Even when there are not any incremental patrons, it’s affordable to anticipate income progress from the prevailing base as new patrons’ spends ramp up after initially decrease buying and selling volumes.

Margins (Firm Filings, Writer’s Evaluation)

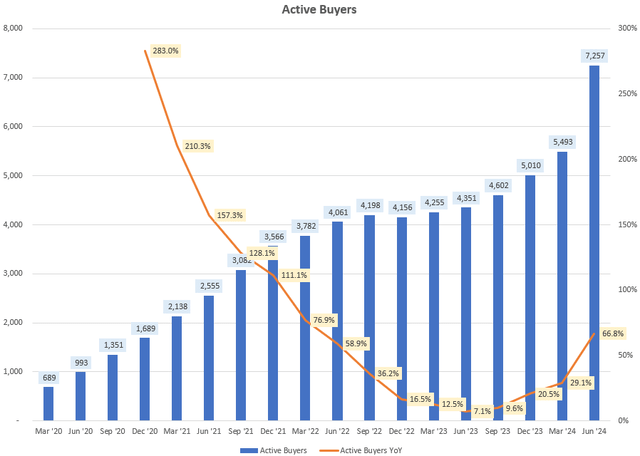

On the margins entrance, GCT has seen a little bit of a moderation in each gross margins and EBIT margins (I don’t pay a lot consideration to the corporate’s adjusted figures as that excludes the influence of stock-based compensation bills, which, I believe, are an actual financial value to a enterprise).

Administration attributes the gross margin moderation of 190bps QoQ to greater supply prices owing to greater freight charges in late April and Might. Nonetheless, the outlook appears higher as these logistics prices have moderated in July 2024.

On the EBIT stage, the QoQ erosion in margins is 490bps. Under the gross revenue line, most of that is pushed by greater SG&A prices, which dragged working margins by 280bps QoQ. Administration attributed this to greater staffing and fee prices. I interpret greater staffing specifically as a superb signal, because it most likely signifies rising enterprise scale to help greater gross sales.

On the entire, GCT’s all the things appears nice… supposedly. I’m cautious as a result of:

Forensic assessments sign potential crimson flags

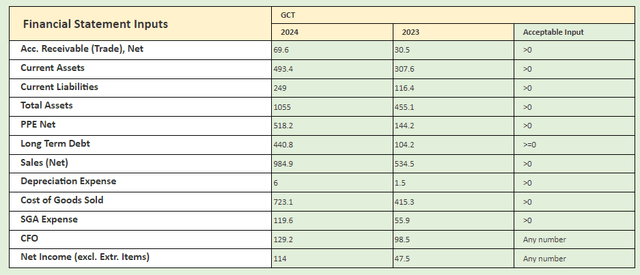

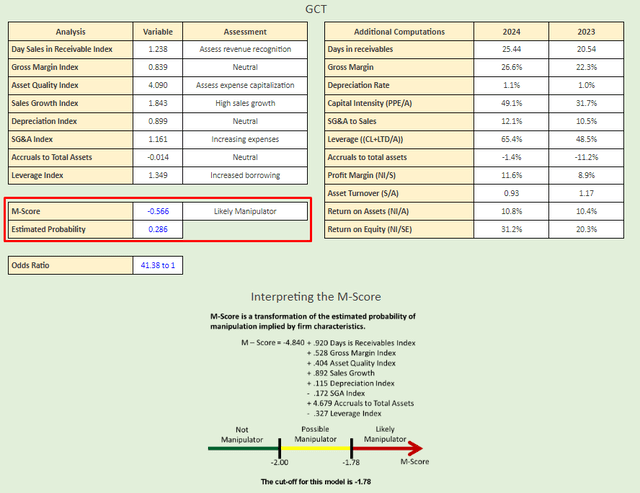

The Beneish M-score is a forensic check for monetary assertion manipulation. It has been used to detect potential manipulation in firms comparable to Enron early on. The next desk exhibits the important thing inputs for GCT utilizing LTM information as of Q2 FY24:

Beneish M-Rating Inputs (Kelley Faculty of Enterprise, Writer’s Inputs from Firm Filings)

The output M-Rating is -0.566, which locations the corporate within the “Seemingly Manipulator” vary. Particularly, the probability of manipulation stands at 28.6%; which I deem to be sufficiently excessive to acknowledge a possible crimson flag.

Beneish M-Rating Outputs (Kelley Faculty of Enterprise, Writer’s Inputs from Firm Filings)

This consequence, mixed with what, I consider, is a scarcity of transparency in key reporting and the CFO’s latest resignation, makes me extremely cautious of GigaCloud Expertise even when its operational efficiency may be very wholesome.

Valuation hardly issues if there are doubts on governance

It’s onerous to worth an organization if the inputs to that valuation mannequin might not be credible. On this case, the M-score says there’s a 28.6% likelihood that there’s manipulation within the monetary reporting, which might skew all valuation fashions’ output utilizing that information.

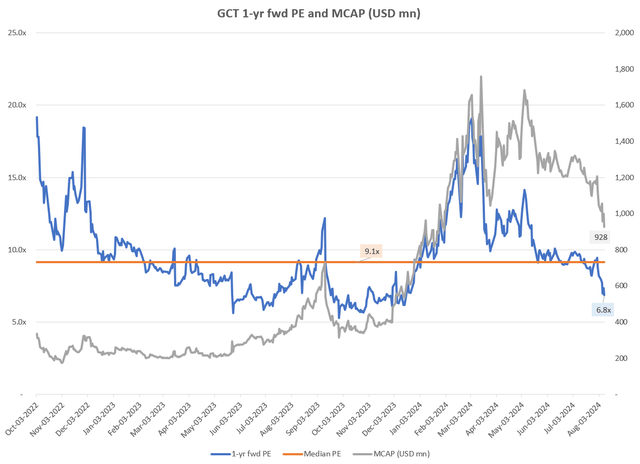

GCT at present trades at a 1-yr fwd PE of 6.8x; a wholesome 25% low cost to its longer-term median PE stage. Nonetheless, for the explanations said above, that is largely irrelevant within the face of considerations on monetary reporting integrity.

GCT 1-yr fwd PE and MCAP (USD mn) (Capital IQ, Writer’s Evaluation)

Technical Evaluation

If that is your first time studying a Searching Alpha article utilizing Technical Evaluation, you could wish to learn this publish, which explains how and why I learn the charts the best way I do. All my charts mirror complete shareholder return as they’re adjusted for dividends/distributions.

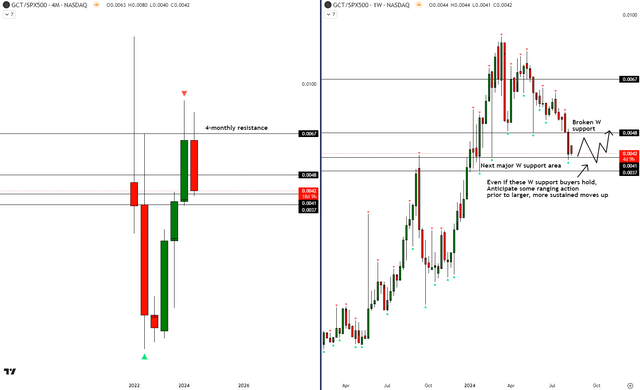

Relative Learn of GCT vs SPX 500

GCT vs SPX 500 Technical Evaluation (TradingView, Writer’s Evaluation)

On a relative technical evaluation foundation vs the S&P 500, GCT has damaged via the earlier weekly help I had highlighted earlier. Now, the inventory is close to the following main weekly help space. I consider, even when there’s a bullish response from this stage, we’re prone to see some ranging motion first earlier than sustained strikes up. On the entire, if one offers the corporate the advantage of the doubt within the forensic and governance elements and adopts a bullish slant, the technicals level towards efficiency in-line with the S&P 500 going forward.

Key Danger – An Error of Omission

The one factor that stops me from being a bull on GCT is a poor studying on the forensic Beneish M-Rating, which suggests a 28.6% likelihood of manipulation within the monetary statements reporting. That is merely a statistical mannequin. GCT could also be a legitimate distinctive case that yields a false constructive studying for manipulation. Therefore, I consider the important thing threat to my view in not investing within the inventory could be an error of omission in case GCT is certainly a false constructive.

Takeaway

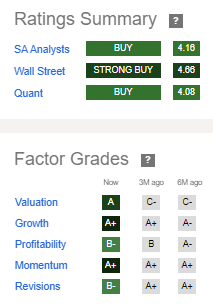

I perceive the bullish views on GigaCloud Expertise as it’s reporting some great progress charges (>50% YoY), handily outperforming the business, which is seeing gross sales contraction. Buying and selling at a mere 6.8x 1-yr fwd PE, the corporate appears like a compelling purchase, scoring nicely throughout all metrics from the consensus of fellow Searching for Alpha analysts, Wall St and likewise Searching for Alpha’s Issue Grades + Quant Ranking System:

Rankings and Issue Grades for GigaCloud Expertise (Searching for Alpha)

Nonetheless, regardless of all this, I’m hesitant to drag the ‘Purchase’ set off as the corporate flashes crimson flags on a key forensic metric; the statistical Beneish M-Rating mannequin suggests there’s a 28.6% likelihood of manipulation within the monetary statements. In my final protection of GCT, I already expressed my dismay at some lack of proactive and clear reporting of key metrics such because the natural vs inorganic progress cut up. The poor M-Rating studying and the truth that the CFO – the important thing individual accountable for monetary reporting – has resigned from the corporate makes me particularly cautious of the inventory.

I might argue that after governance and integrity of the monetary statements is below doubt, the valuation arguments don’t matter as such evaluation principally depends upon the veracity of the corporate’s reported financials. On a relative technical evaluation foundation vs the S&P 500, I consider even when there’s a bullish response close to the present weekly help ranges, it will be preceded by some ranging motion first, whereby the inventory would carry out in-line with the S&P 500.

To be clear; I wish to emphasize that I’m not claiming that GCT is manipulating its monetary statements. I’m merely noting {that a} respected statistical mannequin suggests a 28.6% probability of manipulation. In fact, GCT might very nicely be a false constructive studying on this forensic crimson flag examine. If that’s true, then I might be mistaken to not be bullish on the inventory. Nonetheless, that may be a threat of omission I’m prepared to simply accept. As I at present lack readability both approach on the governance of GCT, I’m taking the middle-line and ranking the inventory a ‘Impartial/Maintain’.

Tips on how to interpret Searching Alpha’s scores:

Robust Purchase: Anticipate the corporate to outperform the S&P 500 on a complete shareholder return foundation, with greater than typical confidence

Purchase: Anticipate the corporate to outperform the S&P 500 on a complete shareholder return foundation

Impartial/maintain: Anticipate the corporate to carry out in-line with the S&P 500 on a complete shareholder return foundation

Promote: Anticipate the corporate to underperform the S&P 500 on a complete shareholder return foundation

Robust Promote: Anticipate the corporate to underperform the S&P 500 on a complete shareholder return foundation, with greater than typical confidence

The standard time-horizon for my views is a number of quarters to round a 12 months. It isn’t set in stone. Nonetheless, I’ll share updates on my adjustments in stance in a pinned remark to this text and may additionally publish a brand new article discussing the explanations for the change in view.