Today’s financial media is overrun with stories about failing banks and financial risk.

Yet five years from now, the only thing investors will remember about 2023 is the outrageous bargain prices on oil and gas companies.

We touched on this opportunity in last Wednesday’s issue.

In short, investors are worried that recent bank failures might lead to a recession.

And a recession would in turn lead to lower demand for oil and gas. So prices fell.

That’s why oil prices hit a 15-month low on Monday, with Goldman Sachs reducing its price target to $75 per barrel.

But the simple reality of supply and demand over the next five years tells a completely different story…

The Oil Market Experiences a Tidal Wave of Demand

Oil is an essential ingredient for the world’s growing economies.

And as these economies grow, they need more. So demand is growing faster than ever in the U.S. and Europe. But it’s soaring in rapidly-modernizing countries like India.

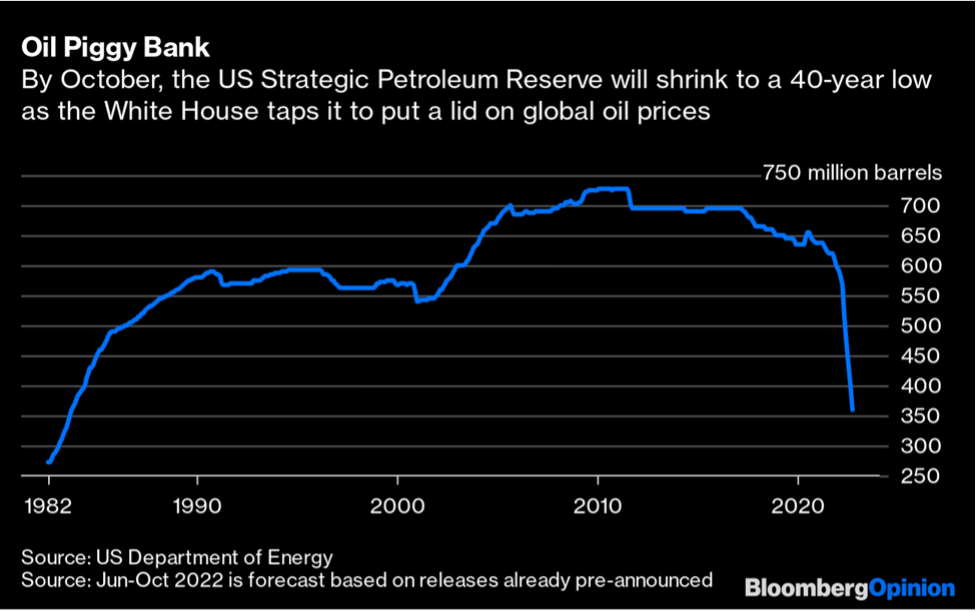

According to the International Energy Agency (IEA), the world will consume upward of 104 million barrels of oil each day by the end of this year … and production will fall short.

The chart below is based on IEA projections, with the shortfall highlighted in blue:

In short, we’re already short on oil supply.

That could quickly result in rising prices, long lines at the gas station and even rolling blackouts.

All of this is coming after decades of rising oil demand.

It’s the kind of thing anyone could’ve seen coming with a quick look at the numbers.

So what did the “genius” in Washington do to prepare and protect the country?

A Raw Deal

Renewable energy was a cornerstone of President Biden’s presidential campaign.

And since taking office, he’s made a point of going to war against fossil fuels — setting hard deadlines for getting away from oil, gas and coal.

Just this month, he promised to propose a bill that would get rid of $13 billion in oil and gas subsidies. That means getting rid of special incentives for drillers and explorers.

All of this is great news for Biden’s polling, but it won’t help Americans’ pocketbooks in the long-run.

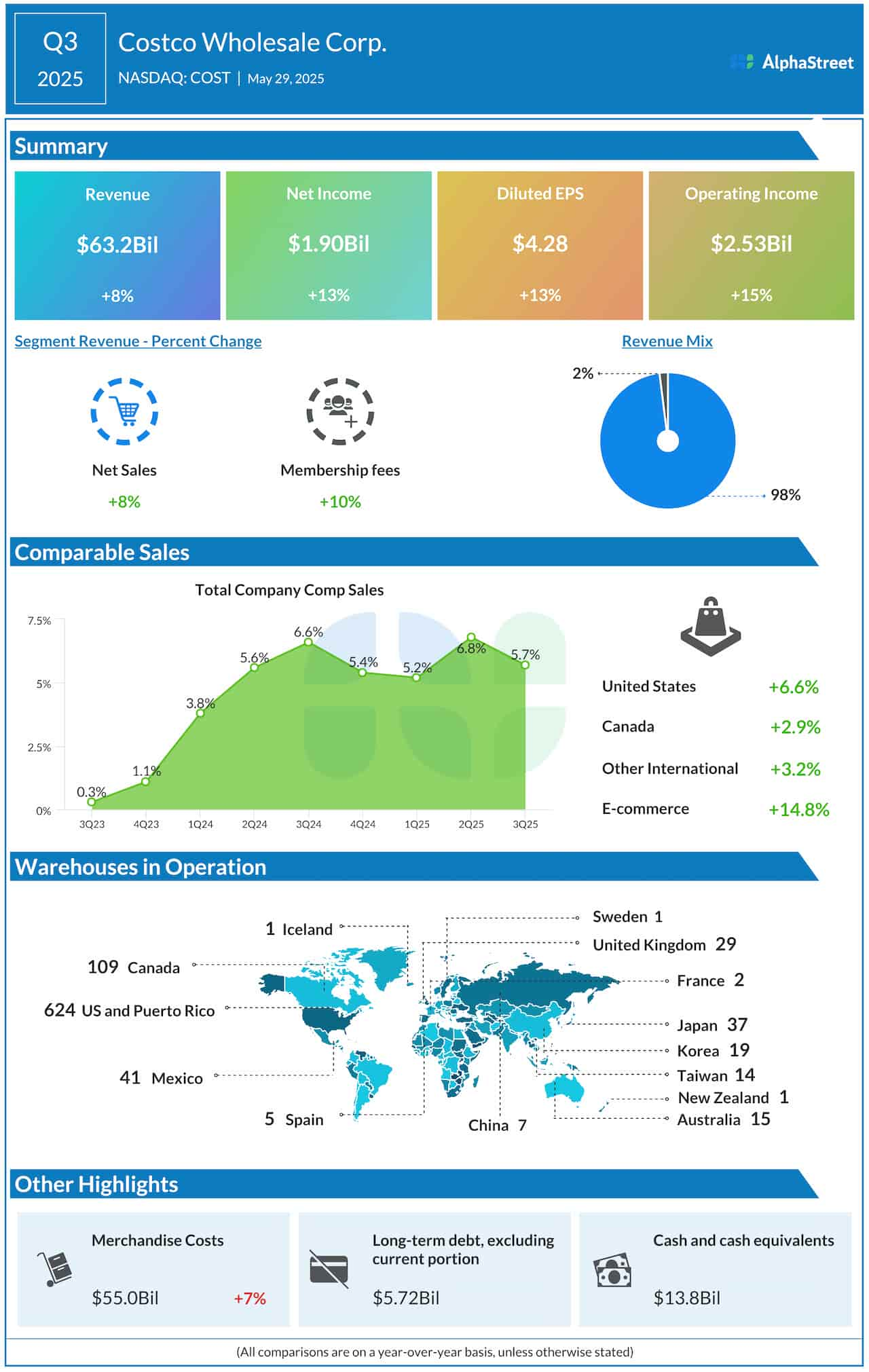

If you’re still not sure this is political, take a look at what happened to the U.S. Strategic Petroleum Reserve right around last year’s midterm elections:

That’s Biden dumping 40 years’ worth of oil into the market … right when his party was fighting off a “red wave” of midterm voters.

America is perfectly capable of becoming a net energy exporter.

We first became self-sufficient with net energy exports in 2019, under the prior administration.

But any real efforts to grow America’s oil production will be fighting an uphill battle against the Democrats’ party line.

As a result, oil supply is seriously handicapped — while a tidal wave of demand is surging all over the world.

And Economics 101 tells you exactly what happens when soaring demand meets shrinking supply…

10X Oil Boom

I haven’t seen a more obvious investment opportunity in the last several years.

Folks who thought oil and gasoline were expensive last year … when oil hit $120 a barrel … and gas was $5 a gallon … well, they might be in for a rude awakening.

Some analysts are already calling for $150 … $200 … or higher.

Now, I don’t make predictions, but I will share some FACTS with you.

Oil has already gone up 1,000% TWICE in the last 50 years.

In 1973, OPEC placed an embargo on oil to the U.S. The oil was there … but they wouldn’t ship it to us.

As a result, prices went from $3.50 to $40 a barrel. That’s a 1,000% increase.

The same thing happened starting in 1998. World tensions were rising and the growth in China’s economy drove prices from $12 a barrel to $140…

That’s more than a 1,000% increase.

Two years ago, oil dropped to $50 a barrel. If oil goes up 1,000% … we’re talking about $500 oil, minimum, in the next decade.

And it’s possible that it could move even higher.

Because in the past, when oil jumped 1,000%, it caught most people by surprise … they didn’t even see it coming.

So right now, $500 oil might seem a bit out there, but we’ve seen these types of 10X moves in oil in the not too distant past.

Oil investors may stand to make a fortune in the next few years.

And after screening hundreds of stocks, I’ve found my top choice.

It’s a company with easy access to hundreds of millions of barrels in proven reserves — and it’s aggressively returning value to shareholders while lowering debt AND growing its business.

This could be the best investment of the decade.

I’m revealing all the details in a special event next Wednesday. In order to attend, you just have RSVP here.

I’ll also be sending exclusive updates to everyone that signs up to attend the event.

It’s all free. So put your name in here now. You can thank me later.

Regards,

Charles Mizrahi

Founder, Alpha Investor

The Continuing Problem With Banks

I mentioned yesterday that, as part of USB’s buyout of Credit Suisse, $17 billion in Credit Suisse AT1 bonds were wiped off the books.

In case you need a refresher, AT1 bonds are a special type of bond that can be converted to equity when the bank is under stress. By swapping debt for equity, it reduces the risk that a bank will have to go to the government hat-in-hand, asking for a bailout.

Now, wiping away debt sounds great. Who wouldn’t want their debts wiped clean?

The problem is: One person’s debt is another person’s asset. And now that the dust is settling, we’re starting to see who was left holding the bag.

PIMCO, one of the largest bond managers in the world, has reportedly lost $340 million due to its exposure to Credit Suisse’s AT1 bonds.

Now, before we cry for PIMCO, it’s worth mentioning that the asset manager has $1.7 trillion in assets. The Credit Suisse bonds amounted to just 0.2% of the total.

But we also have yet to see if more bank bonds disappear in the months ahead. Just as Mike Carr noted last week, there was a six-month gap between the Bear Stearns failure and the Lehman Brothers failure during the 2008 financial crisis.

We’ll have to wait and see what happens to the banking sector.

But in the meantime, let’s talk about who owns PIMCO funds.

Chances are, you do.

What Are PIMCO Funds?

PIMCO funds are widely held in American 401(k) plans. Most of the plans I’ve contributed to over the years had at least one PIMCO fund. This company also manages billions of dollars of pension assets for corporations, as well as state and local governments.

I would be shocked if you, or someone close to you, didn’t have at least a little exposure to PIMCO.

I’m fixated on this because the report I read specifically mentioned the bond manager by name. But do you think for a minute they are the only manager affected by this AT1 bond wipeout?

I don’t like playing the fear card. I think history has been pretty clear that the optimists win over time. But all the same, let’s not take unnecessary risks.

I’ve been recommending for the past two weeks that you keep your cash in the bank under the FDIC insurance limits of $250,000.

If this means opening multiple accounts in various banks across town, do it. It costs you nothing but a couple hours of time, and it eliminates a very real risk that the bank that happens to hold your life savings blows up — and doesn’t get bailed out.

If you already invest in bonds, you should also give your bond funds a good, hard look. While I would normally be in favor of bond funds as a way to diversify and reduce credit risk, I can’t make that same recommendation today.

In this environment, it makes more sense to cherry pick the best individual bonds, keeping most in short-term U.S. Treasurys.

When it comes to stocks, I recommend you focus on quality. Charles Mizrahi focuses on strong, bullet-proof businesses. That’s really the only approach that makes sense to me for a long-term investment right now.

His latest investment is a deeper look into the oil market. Because after settling at $80 a barrel last year, the U.S. and Europe are growing increasingly desperate for more oil.

And with this demand rising, Charles has pinpointed a special type of oil investment that, historically, makes the best gains. We’re talking a 10X oil boom in the next five years.

So make sure to sign up to watch his free presentation on this — on March 29 at 4 p.m. EST.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge