Kameleon007

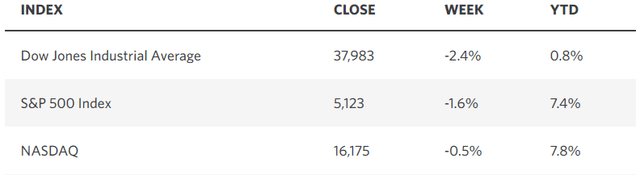

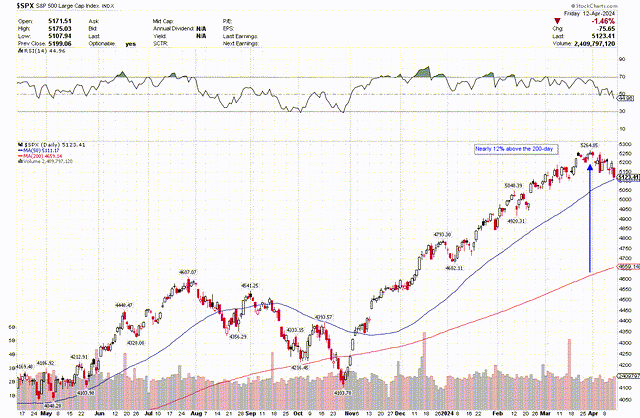

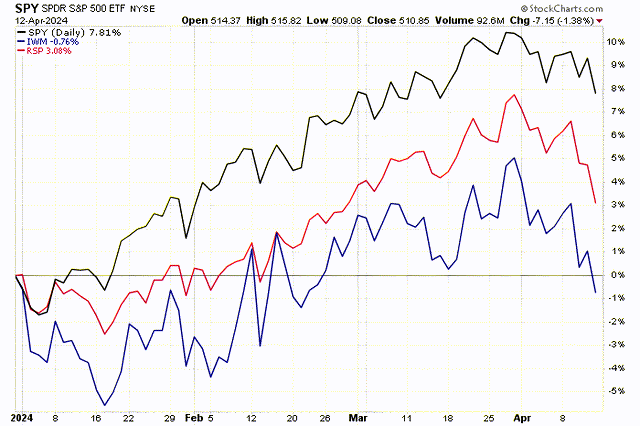

We finally had a pullback in the stock market after a five-month melt up that was largely uninterrupted. All it took was fear that the disinflationary trend was ending, concern that the Fed may not reduce interest rates at all this year as a result, and a significant escalation in the conflict between Israel and Iran that some fear could lead to war in the Middle East. If this trifecta of turmoil can’t produce a pullback of 5% or more in the S&P 500 index, then it will be an extraordinarily bullish development. As of Friday, all this doom and gloom produced was just a 2% retracement from the all-time high, which is healthy from the standpoint that it has reconnected the index with its 50-day moving average.

Edward Jones

The purveyors of pessimism were out in full force last week, warning about a stronger dollar, higher-for-longer interest rates, an oil-price shock, and anything else that might unsettle investors. Jamie Dimon warned about the possibility of 8% long-term interest rates. Former Treasury Secretary Larry Summers asserted that the Fed may have to raise short-term interest rates again. There are always things to worry about whether you are investing based on a macroeconomic strategy or bottom-up company analysis. Some of them are legitimate concerns, while others are not. The most important thing is whether the positives outnumber the negatives and if the rates of change are moving in a favorable direction. At this juncture, the bulls are still in charge.

Stockcharts

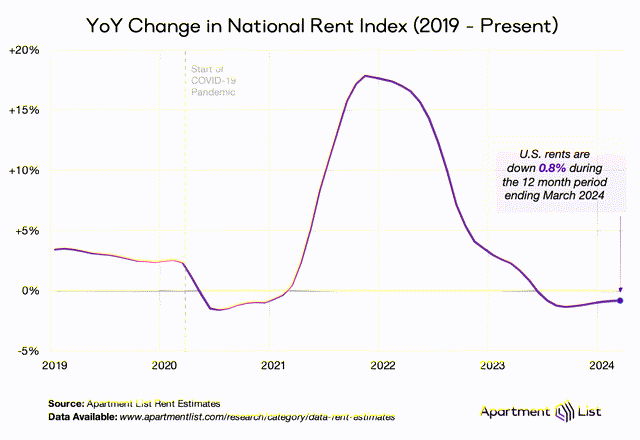

Inflation Is Not A Concern

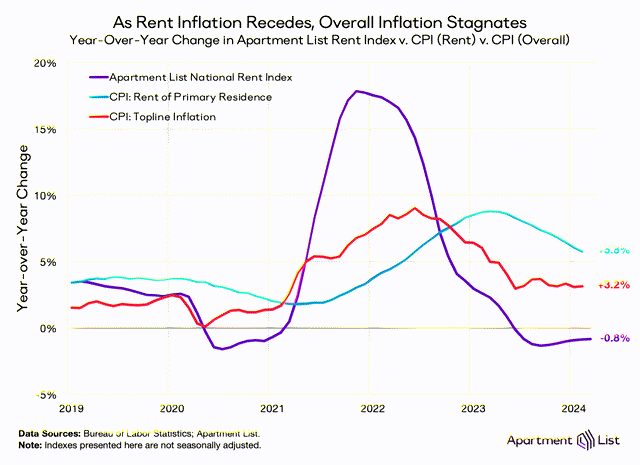

Some are concluding that the disinflationary trend has ended after last week’s core Consumer Price Index showed the inflation gauge increased by 0.4% in March for a third month in a row, resulting in no change in the annualized rate at 3.8%. If only this group would acknowledge that the calculation is horribly flawed. The shelter component, which supposedly rose 5.7% year-over-year, accounted for nearly half the increase in the core rate, but real-time data from the private sector tells a different story.

In their National Rent Report for April, the research team at Apartment List shows that prices ticked up 0.6% last month, which is consistent with the seasonal pattern. That resulted in a year-over-year decline in rental rates of 0.8% on a nationwide basis, which is the tenth consecutive month of declines. Critics will say that rents in their city are still climbing. That may be the case, but the market doesn’t care about YOUR rate of inflation, as it focuses on the nationwide figure that is used to compute the index.

Apartment List

Therefore, how can the shelter component of the inflation gauge still reflect an increase of 5.7%? It is flawed because the calculation considers the price changes in all rents in force over the past 12 months rather than the price changes in new leases, which is far more reflective of inflation today. This is why the Apartment List index leads the overall CPI. If the Bureau of Labor Statistics used new leases to calculate today’s rate of shelter inflation, both the nominal and core rates would be below 2%. Instead, we must wait for the higher price increases of 10-12 months ago to be replaced with current increases (or decreases) over the coming months.

Apartment List

These well-understood facts are why Chairman Powell is not backing away from three rate cuts during 2024. This has not deterred some market commentators from homing in on line items within the core services segment of the index to find things that are rising in price. Yet there are no canaries in this coal mine. The disinflationary trend remains firmly intact.

The Fed’s Rate Cuts

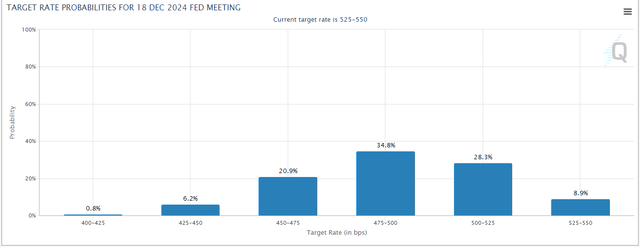

Three months ago, the consensus was convinced that the Fed would start reducing short-term rates in March by 25 basis points for a total of six times through the end of the year. That was my assumption as well on the basis that the economy would have started to show more signs of slowing by now. I have no problem being off the mark on that count, as the bull market has absorbed the shift to just two rate cuts that start much later than March, due to the economy’s ongoing resilience. In other words, the soft landing and bull market narrative is still on track.

CME

That said, how can anyone have confidence that the central bank will cut rates only twice, much less raise rates as an attention-seeking former Treasury Secretary espoused last week. The reality is that no one really knows. The Fed has stated its decisions will be data dependent. We don’t have the data yet. The good news is that markets are comfortable with a more gradual easing process. I still think we will see a deceleration in both the rate of economic growth and inflation that allows the Fed to cut rates three times or more. If so, that should be a renewed tailwind for risk asset prices later this year.

Iran And Israel

The conflict obviously escalated over the weekend with Iran retaliating through drone attacks on Israel for the bombing of its Syrian embassy. This has lifted oil prices, and some think it explains the breakout in gold to new all-time highs. Bonds and stocks dropped in price Friday over fears of what may transpire over the weekend.

In my experience, geopolitical events have never derailed an economic expansion or bull market. The only thing that would greatly concern me is a near doubling in the price of crude oil from its recent low to some $120/barrel on a sustained basis. That could cause enough of an energy shock to result in a contraction in economic activity. Today, I see that possibility as very remote. Therefore, the current turmoil is another excuse for risk asset prices to pullback or correct and resolve the overbought condition that persisted through the first quarter of the year. In other words, this should present buying opportunities.

The Opportunities Are In Rotation

The pullback in the S&P 500 may only be 2% at this point, but it has been deeper for the average stock and the Russell 2000 index. This is still where I would prefer to go shopping for sectors and names that trade at a discount to the multiple of more than 20-times earnings one must pay to own an S&P 500 index that is dominated by a handful of technology-related names. Once this pullback has run its course in the broad market, we should see breadth resume its improvement, as the soft landing for the US economy comes into plain view.

Stockcharts