We Are

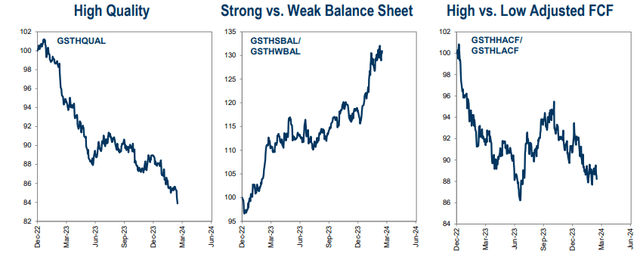

There’s a lot of chatter and many compelling narratives surrounding the importance of free cash flow generation in this era of higher interest rates. Firms that can produce real profits available to shareholders in the here and now are purported to be solid investment candidates. Unfortunately, reality has not matched overall sentiment in favor of the high free cash flow factor. According to Goldman Sachs’ latest weekly report, high vs. low adjusted FCF stocks have produced negative alpha since Q3 last year.

Indeed, the Pacer Global Cash Cows Dividend ETF (BATS:GCOW) has underperformed both the S&P 500 and the All-Country World Index over the past year. I had a tactical sell rating on the fund back in August of 2022, ahead of the final turn lower in the bear market that year, but am now upgrading the fund to a hold based on valuation, exposure to cyclical sectors, and some promising technicals.

High FCF Factor Drifts Down Since Q3 2023

Goldman Sachs

According to the issuer, GCOW is a strategy-driven ETF that attempts to provide a continuous stream of income and capital appreciation over time by screening for companies with a high free cash flow yield and a high dividend yield. Free cash flow is the cash remaining after a company has paid expenses, interest, taxes, and long-term investments. It is the source from which dividends are paid.

GCOW has grown substantially since I first covered the fund in Q3 2022. Total assets under management has swelled from $660 million to nearly $2 billion, as of March 18, 2024. It’s not a very cheap product with an annual expense ratio of 0.6%, but its trailing 12-month dividend yield is high at 5.2%. Share-price momentum is lackluster, earning the ETF a lukewarm C+ rating, worse than an A- rating from six months ago, while risk metrics are likewise not particularly appealing. Liquidity is healthy with the fund, though, given average daily trading volume of more than 410,000 shares and a median 30-day bid/ask spread of just three basis points.

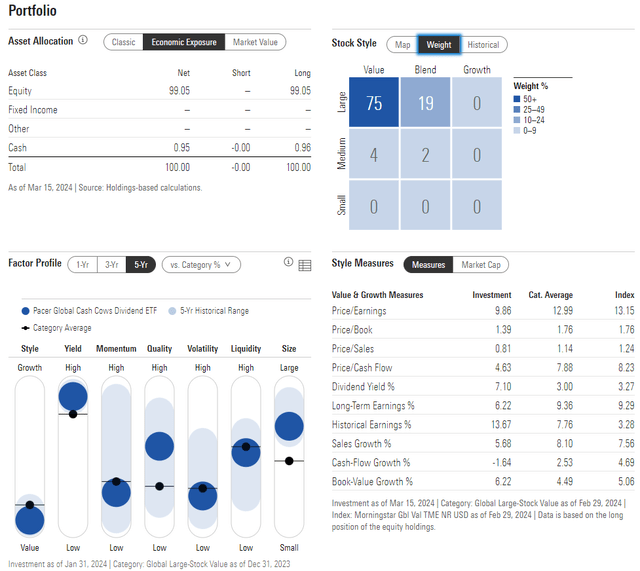

The 3-star, Neutral-rated ETF by Morningstar is heavily allocated to the large-cap value corner of the style box, so there isn’t much diversification with the portfolio. Just 6% of GCOW is considered mid-cap, and there is no growth exposure. With a price-to-earnings ratio under 10 and long-term earnings growth of 6.2, it’s a cheap absolute valuation, but adjusted for typical growth, and the fund is not a screaming buy considering the PEG ratio. Nevertheless, volatility is generally held in check with GCOW and it has a downright cheap price-to-sales multiple.

GCOW: Portfolio & Factor Profiles

Morningstar

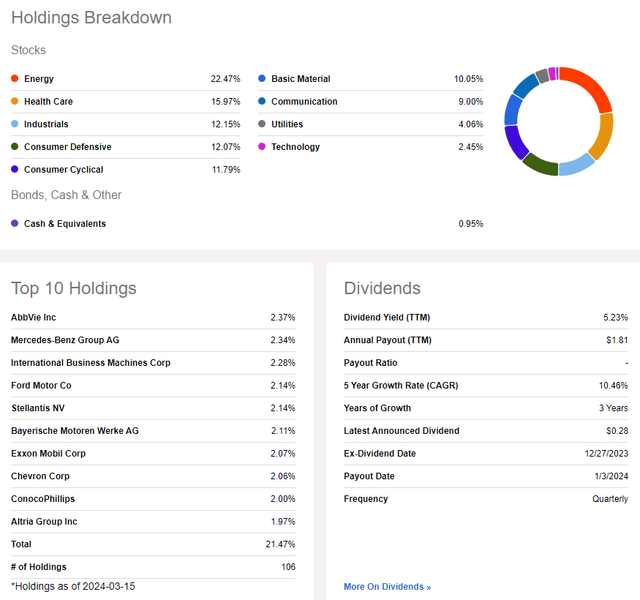

Driving the P/E ratio down is a high 22.5% exposure to the Energy sector – the least expensive slice of the global market. The diversified Health Care sector is 16% of the ETF, while the cyclical Industrials space is 12% followed by defensive Consumer Staples. With its modified equal-weight approach, the top 10 positions account for just 21.5% of the allocation.

GCOW: Holdings & Dividend Information

Seeking Alpha

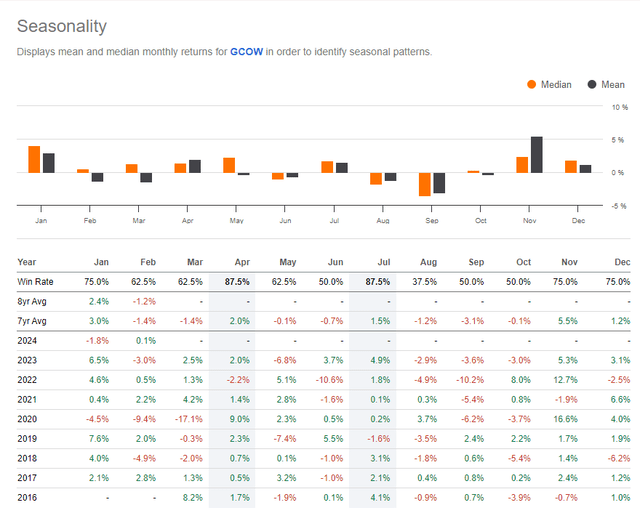

Seasonally, GCOW’s best month is April, though losses have historically been seen during May and June before a strong start to the second half of the year.

CGOW: Bullish April Trends

Seeking Alpha

The Technical Take

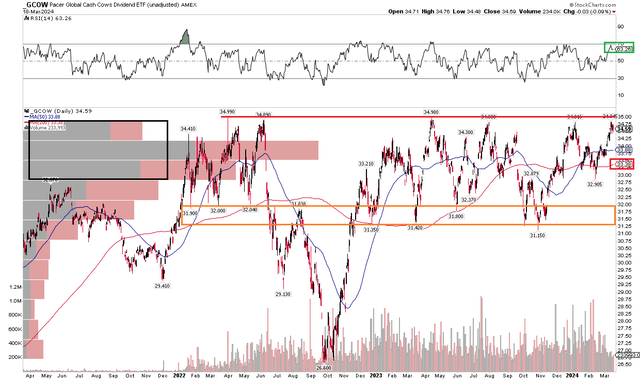

With a low valuation and high exposure to Energy, which may be breaking out technically, GCOW’s chart shows some potential. Of course, key resistance remains in play just under the $35 level. That has been an ongoing area of selling pressure over the past two years. While the global stock market has rallied to all-time highs, GCOW has been a relative laggard since early last year.

Also take a look at the long-term 200-day moving average. It’s basically flat in its slope, suggesting that there is no real trend ownership from either the bulls or the bears. What’s encouraging, though, is that the RSI momentum gauge at the top of the chart has been in elevated territory since last December. With a key support range between $31 and $32, a breakout above $35 would portend an upside measured move price objective to nearly $39, so keep that price on your radar.

Overall, GCOW has been an underperforming ETF, but with key resistance being tested again, the bulls may soon take the reins.

GCOW: Key Resistance at $35

Stockcharts.com

The Bottom Line

I have a hold rating on Pacer Global Cash Cows Dividend ETF. I see the fund as a solid value with decent technicals, but high exposure to the Energy sector remains a risk should that group fall out of favor. GCOW is an active bet on what has been an underperforming set of factors.