bin kontan

Thesis

WisdomTree Enhanced Commodity Strategy Fund ETF (NYSEARCA:NYSEARCA:GCC) is a relatively new commodity ETF that is actively managed. Though its expense ratio is very attractive, its short track record discourages me to consider it for a long-term diversified portfolio right now.

Further, its performance has been underwhelming compared to returns of other actively managed ETFs out there. And I cannot find any other redeeming quality that would make the fund an attractive option.

That’s why I recommend interested investors examine other funds for exposure to commodity markets. Regardless, I do believe that it’s worthwhile to keep an eye on it and wait to see how it performs in a different market environment against competing ETFs in the future.

What Does GCC Do?

GCC is an actively managed ETF that was issued by WisdomTree Trust on 12/21/2020 and is co-managed by WisdomTree Asset Management, Inc. and Newton Investment Management North America, LLC. Its goal is to provide investors with exposure to commodity markets.

More specifically, the fund allocates capital across the 4 following sectors:

- Energy

- Agriculture

- Industrial Metals

- Precious Metals

Like many other commodity ETFs, GCC invests indirectly in commodities through futures contracts. Unlike others, the fund has allocated 2.54% of its portfolio to Bitcoin futures contracts and the issuer states that it may allocate up to 5%; bear that in mind if you already have exposure to Bitcoin. Right now, the portfolio is mostly exposed to gold, crude oil, and copper.

Performance

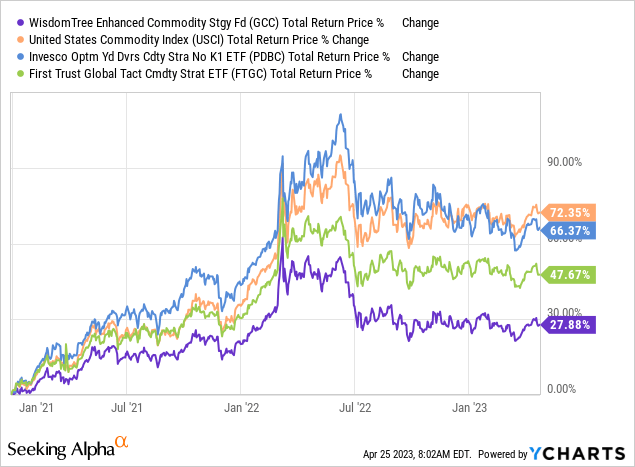

Since its inception, the fund’s market price has increased by 28.20%. Further, the issuer shows after-tax returns of 15.85% since the fund’s inception. Because of the very short track record, I think that the annualized results will not convey anything meaningful to investors. Therefore, I will proceed with a comparison between GCC and other commodity ETFs:

As you can see from the chart above, since GCC was launched, it has underperformed other actively managed commodity ETFs by a wide margin. Unfortunately, there are no redeeming factors here as GCC had the biggest maximum drawdown and highest correlation to the market since its inception.

| Ticker | Max. Drawdown (%) | Annualized Standard Deviation (%) | Correlation (SPY) | Beta (SPY) |

| GCC | 17.68 | 14.54 | 0.45 | 0.36 |

| USCI | 14.16 | 17.77 | 0.31 | 0.3 |

| PDBC | 17.32 | 17.72 | 0.31 | 0.29 |

| FTGC | 13.2 | 14.91 | 0.4 | 0.32 |

| Source | portfoliovisualizer.com |

The only appealing aspect that the chart also hinted at is the relatively low volatility of the fund. With an annualized standard deviation of 14.91%, it’s the least volatile of the commodity ETFs above, closely followed by the First Trust Global Tactical Commodity Strategy Fund (FTGC), which had the lowest maximum drawdown and was less correlated to the market than GCC.

I don’t think there’s any appeal to GCC thus far, though the future bringing new economic environments for this young fund may present some. For now, those seeking either low-volatility, appealing risk-adjusted returns, or long-term alpha in commodities can find better bets in some competing ETFs and ETNs.

For instance, the Direxion Auspice Broad Commodity Strategy ETF (COM) has delivered superior risk-adjusted returns compared to other commodity ETFs. Additionally, the iPath Pure Beta Broad Commodity ETN (BCM) has outperformed both similar ETNs and ETFs over a long period and its elimination of tracking error is even more promising for long-term investors.

Fees

| Ticker | Expense Ratio | AUM | Inception Date |

| GCC | 0.55% | $183.44M | 12/21/2020 |

| USCI | 1.01% | $199.56M | 08/10/2010 |

| PDBC | 0.59% | $5.47B | 11/07/2014 |

| FTGC | 0.95% | $2.96B | 10/21/2013 |

GCC has an expense ratio of 0.55%, which looks like a fair fee for an actively managed fund. Surprisingly it has a small capital under management when compared to other actively managed ETFs, some of which charge as much as nearly double the fee.

This is primarily the reason that I am looking forward to seeing how the fund fares under a larger variety of economic conditions against its competitors.

Risks

In order of importance, I am listing the most significant risks that, as an investor, I believe you should be aware of before you buy GCC:

- Sector Concentration Risk: GCC is actively managed and the asset allocations are determined by the managers based on the economic outlook and other factors. For this reason, at a certain point, the portfolio may be concentrated in a particular commodity sector, such as energy, metals, livestock, etc.

- Cryptocurrency Risk: The fund may invest up to 5% in Bitcoin which is a highly volatile asset and may be the cause for increased portfolio volatility over time.

- Counterparty Risk: Since GCC gets exposure to commodities via futures contracts, there is also counterparty risk.

- Commodity Risk: The fund is indirectly exposed to commodity prices which are affected by various factors such as market events, political changes, war, and regulatory developments.

Verdict

In conclusion, I believe it’s too early to select GCC as a way to get exposure to commodities. It was issued at the end of 2020 and its track record is too short for us to assess its performance.

At the same time, after comparing it to other actively managed commodity ETFs, it does not present any attractive quality. Thus far, it doesn’t compete with similar options when it comes to either volatility, correlation, or returns.

For this reason, I think that investors should consider other options; recently, I reviewed COM and BCM, a commodity ETF and ETN, respectively, both of which are good options for a long-term horizon in my opinion.