Just_Super

Elevator Pitch

Ganfeng Lithium Group Co., Ltd. (OTCPK:GNENF) [1772:HK] shares are assigned a Hold investment rating.

I wrote about Ganfeng Lithium’s near-term woes pertaining to lithium price weakness and its vertical integration approach for the long run in my November 12, 2023 article. With the current update, I draw attention to GNENF’s recently disclosed profit warning and the company’s latest upstream expansion move.

The company’s recent profit warning was a negative surprise for the market as evidenced by the negative post-announcement share price performance. On the flip side, Ganfeng Lithium’s recent move to take a larger stake in a key mining asset suggests that its vertical integration plans are on track. Taking into consideration these developments, I have made the decision to maintain a Hold rating for Ganfeng Lithium.

Ganfeng Lithium shares can be traded on the Hong Kong market and the Over-The-Counter market. The mean daily trading values for the company’s Hong Kong-listed shares and OTC shares for the past 10 trading days were $13 million and $0.08 million, respectively as per S&P Capital IQ data. Ganfeng Lithium’s shares listed on the Hong Kong Stock Exchange can be bought or sold with US brokerages like Interactive Brokers.

GNENF Announces Profit Warning For Fiscal 2023

On January 30, 2024, Ganfeng Lithium issued a profit warning revealing that it expects to register a net income attributable to shareholders of RMB5.2 billion for full-year fiscal 2023 based on the mid-point of its “preliminary estimate.” This suggests that GNENF sees its net profit falling by -75% in FY 2023. GNENF’s full-year earnings projection of RMB5,200 million also implies that the company anticipates that it would have been in the red for the fourth quarter of the prior year with a net loss of -RMB810 million.

In the end-January profit warning announcement, Ganfeng Lithium noted that the lower “price of lithium salt products”, a greater drop in the selling price of products relative to the price contraction for “raw materials”, and “provisions for impairment on relevant assets” were the main reasons for the weak FY 2023 earnings.

I previously highlighted in my November 2023 write-up that “unfavorable demand and supply dynamics for the lithium market are expected to keep lithium prices depressed and Ganfeng Lithium’s financial performance is likely to remain weak in the very near term.” GNENF’s latest profit warning validates my earlier view of the lithium price outlook and the company’s short-term prospects.

Ganfeng Lithium’s OTC shares and Hong Kong-listed shares declined by -6.2% and -5.0% (source: S&P Capital IQ), respectively on January 31, 2024. This indicates that the company’s performance for Q4 2023 and full-year 2023 as per its profit warning was worse than what the market had hoped for.

It is highly probable that 2024 will still be a challenging year for GNENF, taking into account the outlook for the lithium market. Commodity data firm Fastmarkets has forecasted a +30% growth in the supply of lithium for this year. Also, energy research company Wood Mackenzie is of the opinion that “the destocking trend (for the lithium industry) will persist” in the current year as mentioned in its January 31, 2024 article. The current consensus FY 2024 financial estimates for Ganfeng Lithium taken from S&P Capital IQ point to the company recording lower revenue (-6.8%) and operating profit (-2.1%) for this fiscal year, which seems reasonable in light of the lithium market’s poor outlook.

Recent Upstream Expansion Move Is A Positive For The Company

In the previous section, I noted that GNENF’s raw material costs have contracted by a smaller degree as compared to the fall in the price of the company’s products sold, which was a factor that resulted in a lower FY 2023 profit for Ganfeng Lithium. Separately, I stressed in my November 12, 2023 article that GNENF “has the potential to improve its profitability and grow its earnings in the medium to long term by increasing the company’s degree of vertical integration.”

In other words, Ganfeng Lithium’s future earnings are likely to be less volatile, assuming that the company makes the right moves to become more vertically integrated. This explains why I have a favorable opinion of GNENF’s latest upstream expansion disclosure.

Earlier, the company published an announcement in the middle of January this year that it proposed to increase its stake in Mali Lithium from 55% to 60%. In the January 17, 2024 announcement, it is mentioned that Mali Lithium owns a “spodumene mine project in southern Mali” known as “Goulamina.”

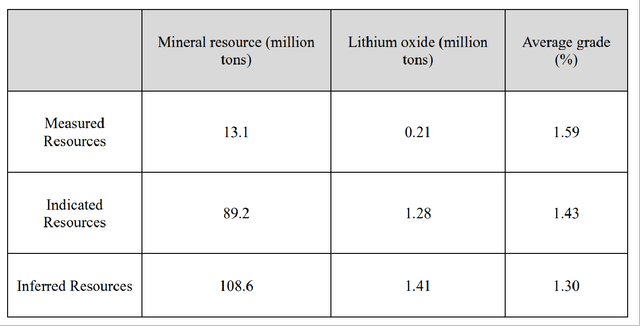

A Snapshot Of Goulamina’s Mining Reserves

Ganfeng Lithium’s January 17, 2024 Announcement

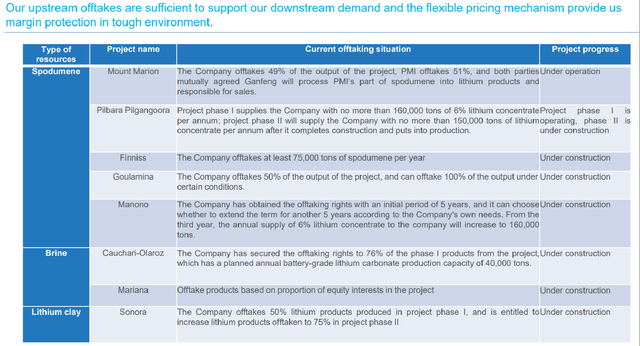

Ganfeng Lithium’s recent move to raise its equity interest in Mail Lithium (the company) and the Goulamina mine (the asset) is part of the company’s vertical integration plans to expand upstream and lock in the supply of key lithium raw materials as outlined in the chart presented below.

An Overview Of GNENF’s Upstream Lithium Raw Material Projects

Ganfeng Lithium’s Investor Presentation Slides

In specific terms, the market projects that Ganfeng Lithium’s operating margin can potentially expand from 16.7% for FY 2023 to 25.8% (source: S&P Capital IQ) in FY 2027. The analysts’ expectations of an improvement in operating profitability for GNENF are consistent with the company’s goal “to raise its ratio of self-sourced lithium raw materials to 70% in the long run” which I specifically mentioned in my November 2023 article.

It is reasonable to think that Ganfeng Lithium will continue to invest in existing and new assets for the future with the purpose of expanding upstream and increasing its degree of vertical integration. The most recent disclosure with respect to Mail Lithium and the Goulamina mine is a perfect example of the company’s long-term vertical integration strategy.

Closing Thoughts

A Hold rating for Ganfeng Lithium is still warranted. The 2024 outlook for the lithium market is unfavorable, which has negative read-throughs for the company’s financial performance this year. Looking beyond the short term, Ganfeng Lithium’s profitability prospects for the future are bright, taking into account the company’s vertical integration approach.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.