RobsonPL

Games Workshop (OTCPK:GMWKF) continues to perform well as a miniature company, but we think that the IP is heavily underutilised and will see donations of fans from other poorly handled franchises like Star Wars. We note that current efforts with Warhammer+ are highly lacking, with the product and content being below par in a few dimensions of quality, particularly in animation given the modern standard, and welcome that they have entered into some preliminary discussions with Amazon. However, Amazon has badly mishandled IPs in the past, at least relative to what would have been possible, and while a windfall could be expected for GW, which is starting from more limited monetisation of its IP with just Black Library and the miniatures themselves, we are very cautious of IP handling risks, as we believe that the general depression in swathes of the entertainment industry come down to this. In our opinion, the perverse need to “adapt material for modern audiences” will be a major issue for a property like Warhammer 40k, in particular, which relies very heavily on a dystopian grimdark setting with no faction being the good guys. Although, there’s no question that there is a very substantial opportunity for the 40k IP, as the lore and property are likely at this point to have a following that goes way beyond the tabletop hobby. For that reason, we think that while there are execution risks, the scope for the IP going far beyond the beloved tabletop game, which also we believe is faced by disruptive 3D printing risks which mount inexorably over time, as we focused on in previous coverage.

Brief Earnings Breakdown

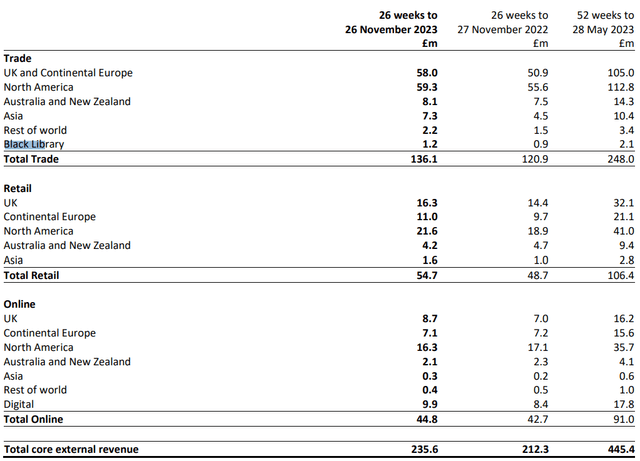

Core Revenue Breakdown (HY Report)

Let’s look at the more comprehensive revenue breakdown. Total trade revenue, which is revenue from selling GW products but not in GW stores, saw decent increases of a little over 12% for the HY report. Since these are not sales at GW stores, there is more of a skew towards products designed to recruit people into the hobby, so the bundles. More stores are stocking their stuff, with the number of outlets increasing by a little less than 10%. Some online revenue would be included in this segment as these retailers may be selling products online, but GW doesn’t have that breakdown and reports its own online sales only. Examples of retailers are hobby stores or other geek outlets that sell things like collectibles, cards and board games. C.C growth was 16%.

Retail similarly growing, with 81% of GW stores delivering store sales growth. This is another important avenue to recruit people to the hobby, and is a direct connection with the community of local players who engage with the hobby. Compared to independent retailers, there is more activity that actually gets people playing the game. Usually, there will be one of the recruitment bundles set up on a gaming table where players can give a go at rolling the dice and using all the measurement paraphernalia. Stores are similarly growing at rates of a little less than 10%, and overall C.C growth is 16%. Pricing continues to be an important lever of growth, where we can crudely estimate it’s about half of the push.

With the end of lockdowns and COVID-19, online revenues decelerated. This also includes Warhammer+ which has seen around a 50% increase in subscriber numbers, but remains low. There is not a lot of animated content on Warhammer+, and a lot of what is there is quite below standard, and only really enjoyable for hardcore fans. This initiative really isn’t going well in our opinion, and the standard that GW is putting out is substantially below fan-made projects, which got cracked down on and created quite a lot of bad-will.

Licensing revenue declined, but it’s really not a significant part of the mix as of yet at only 12.1 million GBP.

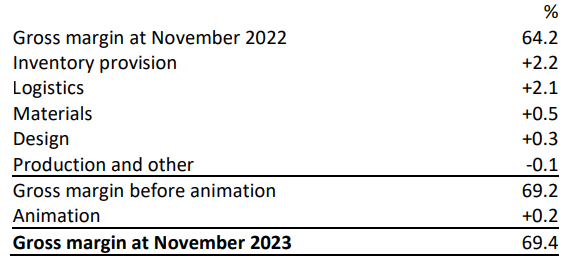

Gross margin improvement has been very substantial, with total cost of sales actually on the decline YoY in core revenues, which excludes licensing. About half of it is due to the reversal of an inventory provision, and the other half a reduction impact from logistics costs.

Gross Margin (HY Report)

Records in production have led to higher operating expenses. Replacing legacy systems, higher temporary worker headcount in manufacturing, as well as higher costs, associated with new warehousing facilities to process orders, and the general footprint is growing slightly across geographies, although new manufacturing equipment purchases have been avoided for now thanks to higher efficiency, but will likely be required in the near future as the company is contemplating new factories. Inflation had a role as well.

Consequently, operating profit is up 13%, a solid result.

Licensing Revenue

Licensing revenue is 12.1 million GBP, annualising to 24.2 million GBP for the FY, assuming no incremental growth. Releases like Darktide and before that, the Total War: Warhammer games are important for the IP business.

The history of videogame releases under the IP are actually a bright spot in terms of how the IP has been handled outside of Black Library and the minis. The new Space Marine game is coming out at some point this year, and the annualised sales could be quite a lot. Crudely, based on the sequel which will end up being less popular, there were 3.48 million purchases approximately one month after release. Assuming full price triple-A prices, and let’s say a 10% royalty, that could be really a lot of licensing income, maybe around 30 million GBP in the first 12 months if we use these figures and typical purchase distribution post release. That would be a more than quadrupling of current run-rates, of course, for just a year, but still great. But there are a lot of not worse Warhammer-IP games as well, so they haven’t been that great as stewards.

What’s coming next is the Amazon discussions.

As we announced on 18 December 2023, we have signed a contract with Amazon Content Services LLC for the prospective development by Amazon of Warhammer 40,000 universe into films and television series. We remain confident we will bring the worlds of Warhammer to the screen like you have never seen before. Games Workshop and Amazon will work together for a period of 12 months to agree creative guidelines for the films and television series to be developed by Amazon. The agreement will only proceed once the creative guidelines are mutually agreed between Games Workshop and Amazon.

The Licensing Business section in the PR

This is good news for GW investors. Warhammer+ is not doing the trick, they really aren’t managing to produce content that lives up to the IP, in our opinion, having sampled Hammer and Bolter. There isn’t enough content either to justify the current price (of the subscription, again in our opinion), and we have basically zero optimism in the venture despite the subscriber growth currently, which still constitutes a very marginal service. However, getting a series produced by another streaming service like Amazon is a much better idea, and in principle, it could actually work. However, Amazon has poorly handled other major IPs, despite the possibilities of easy and unimpeachable entertainment layups to make large franchises, and we feel it is possible this will happen with the Warhammer properties. We also mention the handling of the Astartes fan project, which they subsumed and then adjusted rather unnecessarily on visuals, and previous media projects like the Ultramarines movie, which was also poorly received and failed commercially. GW has poorly handled its own IP at times. It’s not clear that GW will not go for the cash grab, which would potentially cause some serious backlash and disappointment in the community, and more importantly, limit the ability of the company to create a sustainable entertainment franchise, which would be a game changer for the company.

Bottom Line

The minis business is a sustainable grower for the time being, and while there’s no guidance, it shouldn’t be too difficult to produce more growth, particularly with the latitude the company has in pricing which the markets continue to absorb easily, despite its magnitude. We should also note that we continue to have serious misgivings about the disruptive 3D printer risk, especially considering the high PEs above 20x. In the implied growth appreciation periods implied by those kinds of multiples, GW mini prices will continue to go up, and the cost of 3D printers, as well as their resolution, will become more competitive, and the hardcore base of fans will likely at least start supplementing their armies with 3D-printed models. While there is an appeal from the GW stores and the community element, the vast majority of the revenue comes from outside the stores (outside the retail segment), either online or from independent retailers who are unlikely to be hosting the community in their general shops. Also, the shops tend to be small, there isn’t that much capacity to hold a local community, so we feel that this element of the appeal will not be able to resist what will eventually become a clear economic argument for 3D printing.

Nonetheless, with actions being taken now to try to bring the Warhammer IP to the mainstream through Amazon, and monetise the deep lore outside of just the tabletop game, we do see a stronger buycase for the stock. If you compare GW’s valuations to IP rich peers, they are similarly valued in terms of multiples (looking at Disney (DIS) as a possible comp, and also Hasbro (HAS), maybe also Bandai Namco (OTCPK:NCBDF)), but they’ve made minimal headway thus far in making their IP mass-market, so the scope for growth is more substantial. Consider that the current revenue is at 24 million GBP, and could rise with upcoming game releases to maybe 50 million GBP, but the LotR deal with Amazon as a comp came with a price tag of $250 million for LotR and Hobbit rights. While Warhammer probably isn’t as proven in the entertainment sphere as LotR, anything in that order of magnitude will make a big difference for the company’s earnings and cash flow, whether lump sum or in some other structure. There are serious execution risks, where we’ve seen many pretty unfaithful adaptations that have failed to capture the spirit of the IPs, but a tag like $250 million could be just the beginning for how much money GW can get out of Warhammer in entertainment if they get it right. We think this is the upside case, as it’s so much more mass-market than a niche tabletop hobby, and will more than mitigate 3D printing risks. Nonetheless, we are not sure we are convinced enough yet to give it a clear buy, although there’s a lot of optionality here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.