Grinya_kiev

Introduction

The final time I wrote about Video games Workshop (OTCPK:GMWKF) was lower than a 12 months in the past; in that article I described the corporate’s enterprise mannequin and tried to elucidate in broad strokes the “magic” behind the Warhammer model. A 12 months later, nothing basic has modified in GW’s enterprise, however I assumed it is likely to be helpful to write down another article about this exceptional firm to speak about what has occurred within the final 12 months and to elaborate on some features that I needed to pass over final time.

If that is the primary time you might be listening to about Video games Workshop I recommend you atone for the earlier article after which proceed the in-depth dialogue with this one, since I shall be taking some issues without any consideration (e.g. what’s Warhammer) to keep away from pointless repetition.

Enterprise

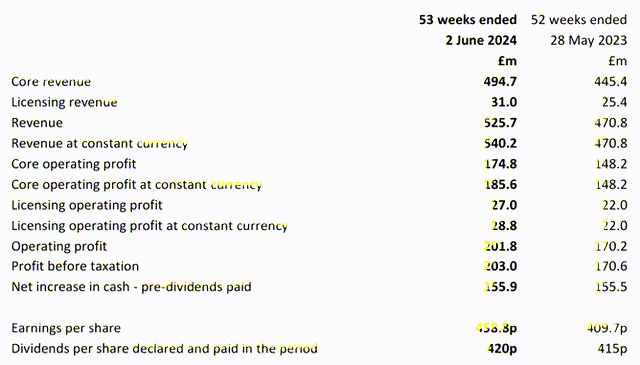

Annual Report FY24 (Video games Workshop Group)

Over the previous 12 months, GW’s income elevated by an excellent +11.7%, above analysts’ expectations, to £525.7 million (barely under what I had assumed in my finest case state of affairs). On earnings, GW additionally managed to shock analysts by attaining a PBT of £203 million, up 19% yoy. These outcomes stem from a superb efficiency of the Core phase and wonderful outcomes above expectations in Licensing Income (£31 million income, £27 million working revenue).

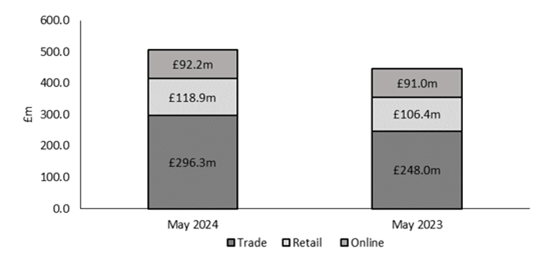

Annual Report FY24 (Video games Workshop Group)

Core Income elevated by 11.1% (+13.9% on a relentless foreign money foundation) to £494.7 million, primarily on account of development within the Commerce channel (third-party shops not operated by GW). Revenues from this channel in actual fact grew by 16.3%, boosted by an addition of about 700 shops bringing the full quantity to 7.200. Direct gross sales from the location remained just about flat in comparison with 2023, whereas the Retail phase grew by 8.6%.

-Retail:

In comparison with the others I believe the Retail gross sales channel deserves a extra in-depth evaluation. Once we discuss “Retail” we’re referring to Warhammer flagship shops run by Video games Workshop. Most of those shops are run by one particular person and have the first objective of attracting new followers. Inside these shops you’ll discover primarily “starter units,” that are appropriate for getting novices in control; they’re additionally a good way to satisfy different fanatics with whom you’ll be able to play video games, take part in tournaments, and even merely paint your personal miniatures collectively. Needless to say the shoppers who are likely to spend essentially the most are new gamers; in actual fact, the expense of constructing a brand new “military” can simply attain $1000 as much as $2000. These shops are subsequently vital to attracting new followers and constructing a neighborhood. Administration may be very cautious about capital allocation and over time has opened new shops the place they noticed match and closed those who didn’t meet their efficiency necessities.

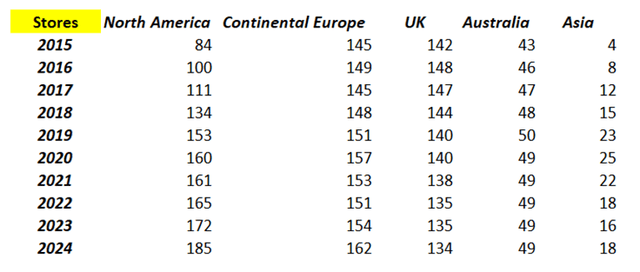

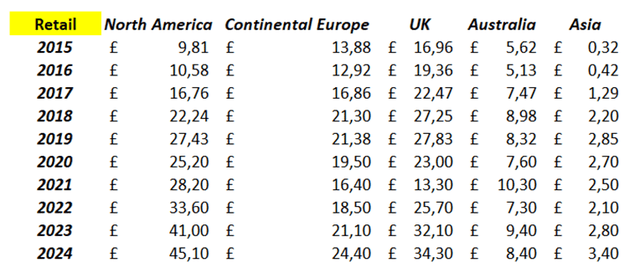

Within the following tables I’ve summarized the developments within the variety of shops, Retail phase gross sales, and common gross sales per retailer from 2015 to the current for every geographic space.

Notes to the monetary statements -Phase Data (Video games Workshop Group) Notes to the monetary statements -Phase Data (Video games Workshop Group) Notes to the monetary statements -Phase Data (Video games Workshop Group)

this information, we are able to get an concept of administration’s skill to allocate capital and handle these shops. Beginning with the UK for instance, we are able to see how within the face of a lower in shops (from 142 in 2015 to 134 in 2024), revenues have greater than doubled, bringing the typical income per retailer from £119,000 in 2015 to £256,000 in 2024.

The perfect performing geographic space is clearly North America, since 2015 we have now seen sturdy retailer enlargement and a CAGR of gross sales per retailer of about 8.5%, leading to Retail revenues which have greater than quadrupled in 9 years. Within the newest annual report, administration identified that they might determine to decelerate on opening new shops in North America to present the staff time to deal with the efficiency of present ones, whereas all the time retaining open the opportunity of reaching 200 shops quickly.

Australia and New Zeland is the geographical space that’s experiencing essentially the most difficulties, on account of organizational issues that they’re making an attempt to unravel. In distinction, Asia, with Japan and China, are performing very properly with Retail gross sales up 21.4 % yoy. This geographical space nonetheless accounts for a really small a part of GW’s gross sales, however additionally it is the market with essentially the most potential for development and growth.

Within the following picture you’ll be able to observe the burden of this gross sales channel in complete gross sales for every geographical space.

Notes to the monetary statements -Phase Data (Video games Workshop Group’s Annual Report FY24)

-Commerce:

As talked about earlier, Video games Workshop can presently rely on about 7200 multi-brand shops to have the ability to distribute its merchandise. The number of merchandise that may be present in these shops is far wider than within the Retail channel, whereas within the latter we primarily discover merchandise for brand new followers, within the former additionally it is attainable to purchase extra “superior” merchandise. In 2024 virtually 60 % of Core Income was realized by way of this gross sales channel, with 700 extra shops than in 2023 and revenues rising by about 19.5 % yoy.

It must be saved in thoughts that this calculation additionally contains gross sales made on-line by approved distributors (solely gross sales derived from Warhammer.com fall into the “On-line” channel). That mentioned, it’s clear that rising approved shops is a fast and efficient approach to attain followers and enhance potential clients. It isn’t unusual for even a few of these shops to carry Warhammer tournaments to deliver gamers collectively, and this can be a nice approach to preserve the neighborhood and keenness for the sport alive.

-Licensing Enterprise:

the Warhammer IP is content-rich and just about inexhaustible; the sport’s lore has been expanded yearly for almost 40 years, and content material and story creation is on the core of Video games Workshop’s technique. The Warhammer Studio staff has succeeded over time in creating unimaginable worlds and tales which have tens of millions of individuals hooked, and annually they proceed to broaden the horizons of what’s already an unlimited universe. Though GW’s core enterprise is promoting miniatures, not leveraging this wealth of content material to make video video games, sequence, or films is a waste, each for followers and shareholders.

As outlined within the annual report, the Warhammer Studio is the center of Video games Workshop, which, along with straight producing content material such because the Black Library books, animations, and different content material, is chargeable for managing and approving IP with licensing companions.

The settlement between Video games Workshop and Amazon to provide sequence, films, and merchandise on the Warhammer 40k universe has been recognized for a while now, there’s additionally an choice for Amazon to acquire the rights to the Warhammer Fantasy universe following the discharge of content material on Warhammer 40k. At the moment we have now no different information about this settlement, the one factor we all know is that the 2 corporations have till December 2024 to agree on inventive tips, the settlement can solely proceed if this section is profitable. For sure, how a lot of a constructive catalyst this settlement might be for Video games Workshop, not solely would it not usher in vital revenues from charges (within the final 12 months the working margin of this phase was 87%), however it might additionally make the Warhammer model even higher recognized and will deliver lots of people into the interest and preserve the passion of followers alive. We’ll simply have to attend a couple of months and see how the scenario evolves.

It is extremely latest information of the intense success achieved by the sport “Warhammer 40k: Area Marine 2”, developed by Saber Interactive and formally launched final September 9. Even earlier than the official launch date, the sport climbed the Steam charts, because of the opportunity of having early entry by buying a “premium” model of the sport. Inside 24 hours of launch, the sport had a document excessive of 225,690 simultaneous gamers on Steam, shattering the achievements of every other Warhammer recreation and exceeding all expectations. Writer Focus Entertainment reported on X on Sept. 10 that it had reached a document 2 million gamers. That is the seventh week it has been among the many high 100 best-selling video games on Steam and it’s presently nonetheless in first place.

Focus Leisure

If we think about that the bottom worth is $60 (the Gold Version and the Extremely Version that entitled early entry value $90 and $100, respectively), and taking away a 30% retained by the distribution platforms, we acquire a minimal income per copy bought of $45, multiplying it by 2 million we arrive at a income of not less than $90 million in a couple of days. As talked about, the sport has been an surprising success, has been highly regarded with players, and would appear to have all of the credentials to proceed to be related for a very long time, because of the presence of the web multiplayer mode.

This along with being nice information for GW’s upcoming outcomes, the place revenues from the licensing enterprise may simply exceed analysts’ expectations, can also be a superb catalyst for development within the coming years. Certainly, it has been 11 years for the reason that launch of the earlier chapter of the sport “Warhammer 40,000: Area Marine”, which was not an enormous success at launch however managed to carry out properly over time promoting 2.8 million copies. Paying attention to these excellent outcomes, nevertheless, it appears virtually a foregone conclusion {that a} third chapter of the story shall be printed sooner or later, and we most likely shouldn’t have to attend one other 11 years. As within the case of the Amazon sequence, these merchandise serve not solely to earn charges for Video games Workshop within the quick time period however extra importantly to deliver tens of millions of individuals nearer to the world of Warhammer.

Two different video games have been introduced in the course of the interval, the sequel to the PC and console technique recreation Mechanicus 2 and Talisman fifth Version. As profitable as the primary Mechanicus was for the kind of recreation, the numbers we are able to count on is not going to examine with these achieved by Area Marine 2.

To summarize, revenues from the Licensing phase are divided as follows: 70% console and PC video games, 15% cell, 15% different. Within the interval below evaluation revenues from the Licensing Enterprise have been significantly excessive on account of a excessive degree of assure earnings on multi-year contracts concluded within the second half of the 12 months (£17.6 million). Money obtained from licensees amounted to £25 million (£26.5 million in FY23). Lastly, the full licensing receivables stability was £28.3 million.

-Warhammer+:

Launched three years in the past, Warhammer+ is Video games Workshop’s subscription service to additional have interaction followers of the sport. Throughout the platform you’ll find unique animated reveals, tutorials (equivalent to how one can paint your personal miniatures) and far more. Of be aware is the chance for subscribers to get some advantages within the new recreation Area Marine 2 or to have the chance to purchase unique miniatures.

The subscription worth is £5.99 per 30 days or £49.99 per 12 months, and based on the most recent reported outcomes there are about 176,000 subscribers (136,000 in FY23). If we assume that everybody purchased the annual bundle, Warhammer+ gross sales in 2024 might have been round £8.8 million. It’s actually nonetheless a really marginal a part of the enterprise however additionally it is a good way to fund the Warhammer Studio enterprise. Because it takes time and the advantages supplied enhance, this service may develop into more and more related, though I do not assume it is going to be in a position to transfer the needle an excessive amount of.

Future Prospects

On this part I wish to speak in regards to the future growth prospects of Video games Workshop, beginning with essentially the most concrete and sure eventualities, after which concluding with a few of my very own speculations and concepts in regards to the long-term way forward for the corporate.

-Prime Video:

As mentioned earlier, essentially the most related catalyst in the mean time is the potential settlement with Amazon to provide sequence and movies in regards to the Warhammer 40k universe. Whereas within the earlier chapter I described the plain constructive results that the conclusion of this settlement may have, on this one I wish to deal with the opposite aspect of the coin and spotlight what are presently essentially the most related worries and attainable unfavourable results of a cancellation of the sequence.

In December 2022 it was introduced that Henry Cavill would function actor and producer on the Amazon adaptation of Warhammer 40k. It has now been virtually two years for the reason that announcement and there have been no main updates. In December 2023 Video games Workshop and Amazon got 12 months to agree on inventive tips, as we are actually a couple of months away from the deadline and there have nonetheless been no updates, rumors have begun to proliferate a couple of attainable cancellation of the sequence. These studies don’t come from official sources and are usually false or unfounded, stemming primarily from the absence of recent official bulletins and the approaching deadline. The 2 corporations should additionally agree on the kind of media for use; they have to really select whether or not it’s extra applicable to begin with a sequence, a film, or each. The profitable end result of this negotiation would deliver many advantages to each events, and I believe they wish to use on a regular basis they should make clear essentially the most related factors and make it possible for the eventual Amazon adaptation is trustworthy to the unique materials. The one factor we are able to do to attract conclusions is to attend for an official assertion.

That being mentioned, what could be the impression on Video games Workshop’s enterprise of any unfavourable end result of the deal? A serious development alternative would undoubtedly be wasted, however GW’s core enterprise would nonetheless stay in wonderful well being. In actual fact, we’re not speaking about an enormous advertising ploy essential to revive a dying model, as within the case of Mattel with Barbie. The Warhammer model is in full well being and increasing, even with out films or sequence to maintain development. Undoubtedly Warhammer followers could be disenchanted to not see on the display screen the primary reside motion adaptation of the tales and battles that for the second, they’ve solely examine in books or skilled on the gaming desk, however they actually wouldn’t hand over their ardour that in lots of instances has concerned them for many years.

Monish Pabrai’s phrases, from the ebook “The Dhandho Investor: The Low-Danger Worth Technique to Excessive Returns”, are wonderful to explain this case: “Heads I win; Tails I do not lose a lot.” With out an Amazon sequence or film, an enormous alternative for income development and income could be misplaced, however this could not really change something for the tens of millions of players and followers who’re presently captivated by the great world of Warhammer.

-Video video games:

I’ve already spent a number of traces in discussing the surprising success achieved by Area Marine 2, each when it comes to numbers and when it comes to fan scores and appreciation. Though it’s nonetheless too early to attract conclusions, it might appear to be a recreation that will stand the take a look at of time, because of the participating aggressive multiplayer mode that would presumably present longevity to the sport.

The success of Area Marine 2, along with bringing wonderful leads to the Licensing Enterprise to GW within the close to future, might encourage the builders to develop extra chapters of the story (there isn’t any scarcity of inventive materials to work with) and to launch them in a shorter time-frame than final time. Area Marine 2 was launched 11 years after the primary chapter, given the outcomes, I’d not be shocked if a 3rd and fourth chapter of the sport have been launched in the identical time-frame sooner or later. As an extra aspect impact of releasing extra video video games, we may see a rise in Warhammer+ subscribers, as this could supply unique advantages inside the varied video games.

-Geographical enlargement:

On this part I wish to reexamine Video games Workshop’s Core Enterprise and mirror on potential future developments in several geographic areas.

Notes to the monetary statements -Phase Data (Video games Workshop Group)

Within the picture you’ll be able to see the historic pattern (from 2015 to the current) of GW’s Core Income in several geographic areas. The corporate’s technique is to proceed geographic enlargement in each the Retail and Commerce channels. Administration may be very cautious and cautious about capital allocation for brand new direct retailer openings, so there isn’t any fastened goal of recent shops per 12 months but it surely all relies on market situations and alternatives glimpsed by administration.

Within the coming years I count on enlargement particularly in North America and Asia. Whereas North America is already a mature market, however with additional potential for development, Asia (significantly China and Japan) is a geographic space but to be actually penetrated, with equally nice potential for development. In December 2022, the primary Warhammer cafe retailer was opened in Tokyo, attaining appreciable success by enlisting many new followers.

Australia and New Zeland is the geographic space the place they’re experiencing main organizational issues. Within the newest annual report, CEO Kevin Rountree commented:

It may be busy in Australia within the subsequent few years as we improve their core monetary methods and relocate the entire staff to a brand new warehouse and workplace HQ too. Any IT options rolled out right here would be the globally chosen answer. These initiatives shall be a good problem; centrally run with the complete help of the UK based mostly staff with an appropriately resourced native implementation staff. My fingers are crossed – we are going to deploy extra sources, if wanted, to make sure they’re not crossed for too lengthy.

-Concepts for the Far Future:

On this quick paragraph I wish to attempt to describe a few of my concepts about what the long-term way forward for Video games Workshop’s enterprise is likely to be (by long-term I imply 10-15 years). I ought to level out that these are my private assumptions not supported by goal information, in order that they haven’t been taken under consideration on the analysis stage and aren’t related to my closing judgment of the standard of the corporate.

That being mentioned, I believe that sooner or later the corporate might create a brand new enterprise phase targeted on content material manufacturing (films or animated sequence). As of right this moment Warhammer Studio makes animated sequence accessible on Warhammer+, this enterprise phase nevertheless shouldn’t be very related in the mean time. As administration may be very cautious in capital allocation, to date it has not made sense to speculate massive quantities of capital within the creation of extra structured content material. Within the occasion that the take care of Amazon goes by way of and a Warhammer Cinematic Universe can then be created, administration may observe and consider the viewers response to this type of content material. Ought to there be quite a lot of curiosity (as is predicted), they may start to think about investing in content material produced straight by Warhammer Studio, to be distributed not solely on Warhammer+ but in addition in theaters or on different streaming platforms.

Making a sequence or film in regards to the Warhammer universe in the mean time is sort of a leap of religion; it’s anticipated to enchantment to many individuals (and it most likely will), however it’s nonetheless the primary time that this type of product has been tried and so there are not any goal benchmarks to depend on. A collaboration between Amazon and Video games Workshop may present a chance to set precedents that can be utilized by Warhammer Studios, in order that they’ll make investments massive sums in additional elaborate content material with extra confidence.

From the quantity of “ifs” I used within the earlier traces, you’ll be able to perceive the impossibility of utilizing these assumptions for affordable analysis and the need of the premise made firstly.

Valuation Replace

As talked about within the introduction, Video games Workshop’s fundamentals haven’t modified in a 12 months, this suggests that even the valuation shouldn’t be radically totally different to the earlier one. The difficulties in estimating future outcomes additionally stay; as a lot as I’m pretty satisfied that GW may have a vibrant future, it stays troublesome to chart a particular trajectory.

Within the earlier article I used a reduction fee of 12%, positively excessive, however justified by the excessive uncertainty in estimating future outcomes. Though the issue in estimating GW’s future has not diminished, after persevering with to review the corporate for a 12 months, I really feel far more assured within the extra optimistic assumptions I had made than the pessimistic ones. Because of this, I made a decision to make use of a decrease low cost fee within the new valuation.

Given the absence of leverage, we are able to approximate the WACC with the price of fairness. Utilizing the UK 10-year bond yield as risk-free fee, contemplating an fairness threat premium of 5.48% (I used the one estimated by Professor Damodaran) and a 3-year Beta of 1.13, we get a WACC barely under 10%. In my evaluations I want by no means to make use of a reduction fee under 10%, even when the WACC have been to be decrease. That is the minimal return I count on to get by investing in a single inventory. I think about it pointless to make use of decrease low cost charges, even when they have been to be justified by the formulation, if my aim was in actual fact to get 7-8% per 12 months I’d somewhat put money into a well-diversified index than take the danger of inventory selecting. Having closed this temporary parenthesis, on this case the WACC and my minimal required return match.

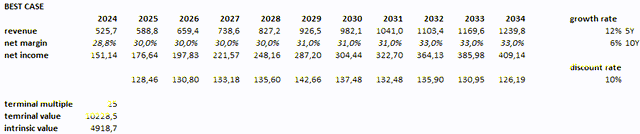

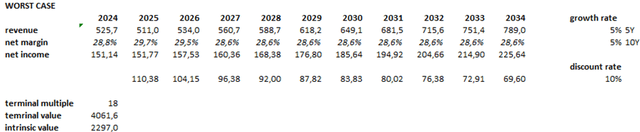

As you’ll be able to see from the photographs under, apart from updating the 2024 values with the corporate’s achievements, the remaining has remained the identical as a 12 months in the past, development charges, margins, and projected multiples. It’s because in comparison with a 12 months in the past apart from the surprising success of Area Marine 2, we have now no new related data accessible to have the ability to extra precisely estimate the way forward for Video games Workshop. In all probability solely after we might have information of the result of the take care of Amazon may we make new assumptions, however for that we have now to attend till December. Consequently, the one factor that has modified within the DCF is the low cost fee which has gone from 12% to 10% with the ensuing enhance in valuation.

Creator’s estimate Creator’s estimate Creator’s estimate

Within the base case state of affairs I don’t think about the main impression that the event of a Warhammer Cinematic Universe may need. I assumed continued income development in all geographic areas (larger development charges in North America and Asia than in different areas), in addition to a slight enchancment in margins on account of economies of scale and a rise in licensing income (video video games solely). In one of the best case state of affairs, alternatively, I thought of larger development charges within the occasion of a profitable end result of the Amazon deal. To conclude, the worst case state of affairs considers the idea that the Licensing Enterprise doesn’t develop significantly and consequently reasonable income development on account of a slight enhance in miniatures gross sales volumes and worth will increase according to inflation.

Then again, with regard to the extra “private” and fewer numerically demonstrable a part of the valuation, a 12 months later I imagine that the worst case state of affairs is far more unlikely to happen. With the developments which have taken place and the potential for future development described within the earlier paragraphs, I believe it’s unlikely that GW will be capable of develop its revenues by solely 5% per 12 months. I additionally imagine that the Licensing Enterprise can have a robust growth sooner or later, doubtlessly rising the corporate’s margins additional.If we subsequently think about the bottom and best-case eventualities as extra “affordable,” I really feel I can say that the corporate is presently accurately valued, based on the knowledge presently accessible. Within the case of a future realization of a Warhammer Cinematic Universe, present costs would possibly even supply a margin of security.

Conclusion

I hope I’ve succeeded in enriching the outline of Video games Workshop and the Warhammer universe, which I started with the earlier article made virtually a 12 months in the past. Video games Workshop is an distinctive firm with a novel model that’s extraordinarily troublesome to duplicate and is run by a superb administration staff, very competent in capital allocation and aligned with the pursuits of shareholders and followers of the sport.

I don’t presently personal shares in Video games Workshop, however I’m severely contemplating making an preliminary funding. What presently holds me again essentially the most from investing a good portion of my portfolio in GW are the identical doubts that held me again a 12 months in the past, that are the excessive problem of estimating future outcomes and the value. Extra exactly, the mix of those two elements. I are usually prepared to simply accept a excessive diploma of uncertainty, however the worth I pay have to be low sufficient to present me a big margin of security to bear the danger I’m exposing myself to.

Though I imagine the corporate is presently accurately valued, I don’t imagine the present worth gives an enough margin of security for my funding standards. Why then did I write that I plan to put money into it? As talked about, I imagine the present worth shouldn’t be too excessive, and being a enterprise of extraordinary high quality, maybe it’s smart so as to add it to the portfolio, ready for the bargains that the market gives once in a while to extend at decrease costs.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.